Free Transfer-on-Death Deed Document for the State of Maryland

Similar forms

- Will: Both a Transfer-on-Death Deed and a will allow individuals to specify how their property will be distributed after death. However, a will goes through probate, while a Transfer-on-Death Deed does not.

- Living Trust: Like a Transfer-on-Death Deed, a living trust can help avoid probate. Both documents allow for the transfer of property outside of the probate process, but a living trust is more comprehensive in managing assets during a person's lifetime.

- Beneficiary Designation: Similar to a Transfer-on-Death Deed, beneficiary designations are used for financial accounts and insurance policies to directly transfer assets upon death, bypassing probate.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows co-owners to automatically inherit each other’s share upon death, akin to how a Transfer-on-Death Deed functions for designated beneficiaries.

- Payable-on-Death (POD) Accounts: POD accounts allow individuals to name beneficiaries who receive the funds directly upon the account holder's death, similar to how a Transfer-on-Death Deed designates heirs for real estate.

- Transfer-on-Death (TOD) Registration: This is often used for securities and allows for the direct transfer of ownership upon death, mirroring the function of a Transfer-on-Death Deed for real property.

- Life Estate Deed: A life estate deed allows someone to live in a property until death, after which it transfers to another party, much like the Transfer-on-Death Deed transfers property upon death.

- Family Limited Partnership: This arrangement can facilitate the transfer of family-owned assets while providing some control during the owner's lifetime, similar to the intent behind a Transfer-on-Death Deed.

- Health Care Proxy: While primarily focused on medical decisions, a health care proxy can complement a Transfer-on-Death Deed by ensuring that a person’s wishes regarding their health care are respected, aligning with their property transfer wishes.

Maryland Transfer-on-Death Deed - Usage Steps

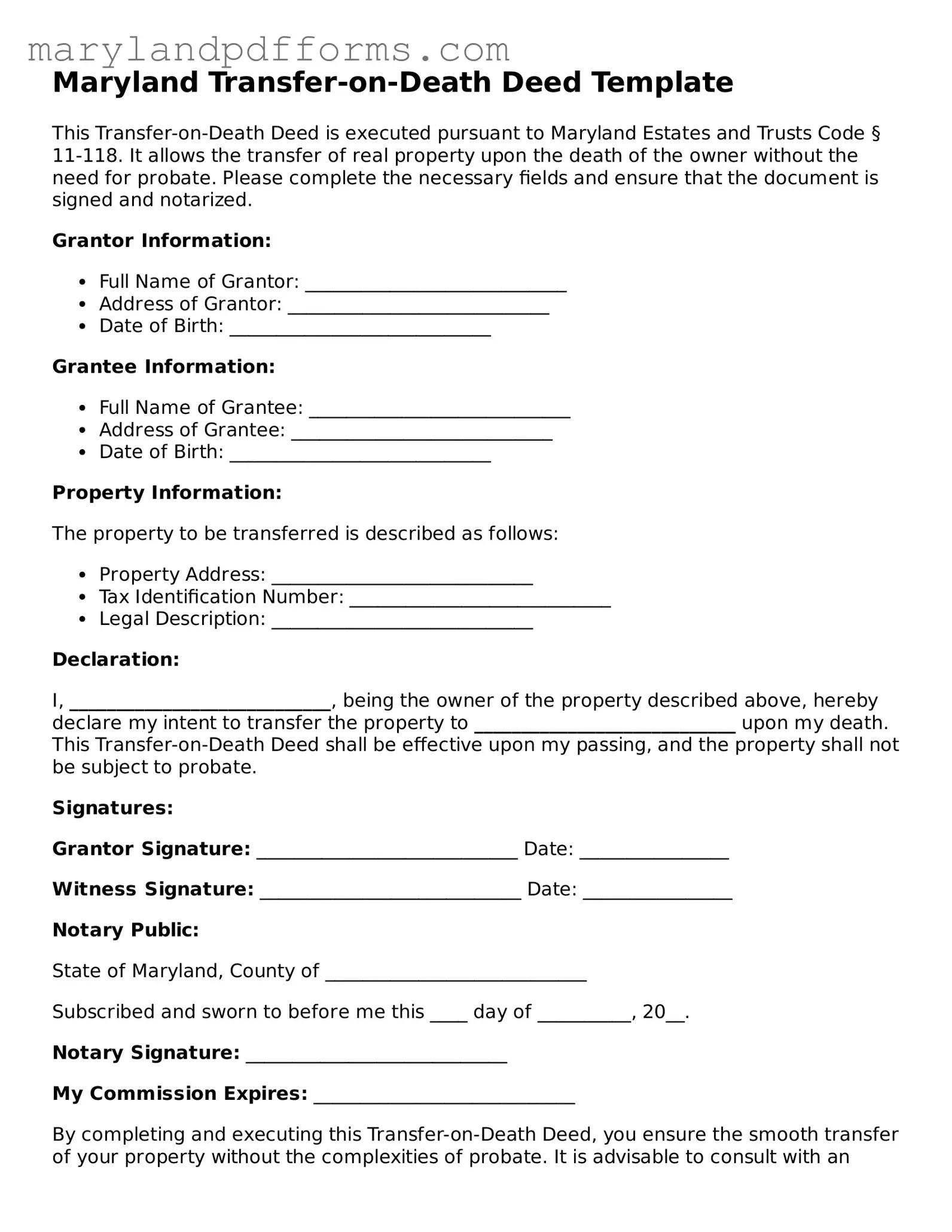

After obtaining the Maryland Transfer-on-Death Deed form, you will need to complete it accurately to ensure it reflects your intentions regarding the transfer of property. This process involves gathering necessary information and carefully filling out each section of the form. Below are the steps to guide you through completing the deed.

- Begin by downloading the Maryland Transfer-on-Death Deed form from the official state website or obtaining a physical copy from a legal office.

- At the top of the form, fill in your name as the current property owner. Ensure that your name is spelled correctly and matches the name on the property title.

- Next, provide the address of the property you wish to transfer. Include the complete street address, city, and zip code.

- In the designated section, enter the name of the individual(s) you intend to transfer the property to. This should include their full names and any relevant identifying information.

- If there are multiple beneficiaries, indicate how the property should be divided among them. Specify whether it will be shared equally or in specific proportions.

- Include a description of the property. This may involve referencing the legal description found in the current deed or property records.

- Next, sign and date the form in the appropriate section. Your signature must be witnessed to ensure its validity.

- Have your signature notarized by a licensed notary public. This step is crucial as it verifies your identity and the authenticity of the document.

- Finally, file the completed and notarized Transfer-on-Death Deed with the local land records office in the county where the property is located. Be sure to keep a copy for your records.

Following these steps will help ensure that the form is completed correctly and filed appropriately. This careful approach can provide peace of mind regarding the future of your property and its intended beneficiaries.

Learn More on Maryland Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Maryland?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This deed enables property owners to bypass the probate process, which can be lengthy and costly. The owner retains full control of the property during their lifetime and can sell or modify the property as they see fit.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Maryland can use a Transfer-on-Death Deed. This includes homeowners and property investors. However, it’s important to note that the deed must be properly executed and recorded to be effective. The property owner must be of sound mind and legal age to create this document.

How do I create a Transfer-on-Death Deed?

Creating a Transfer-on-Death Deed involves several steps:

- Obtain the appropriate form from a reliable source, such as the Maryland State Department of Assessments and Taxation.

- Fill out the form with accurate information, including the property description and the beneficiary’s details.

- Sign the deed in the presence of a notary public.

- Record the deed with the local land records office in the county where the property is located.

It’s advisable to consult with an attorney to ensure that the deed is completed correctly and meets all legal requirements.

What happens to the property after the owner's death?

Upon the death of the property owner, the designated beneficiary automatically receives ownership of the property without the need for probate. This transfer occurs immediately, simplifying the process and allowing the beneficiary to manage or sell the property without delay.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your lifetime. To do this, you must create a new deed that either designates a different beneficiary or explicitly revokes the previous deed. It is crucial to record the new or revocation deed with the local land records office to ensure that your wishes are legally recognized.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. However, the beneficiary may be responsible for property taxes after the transfer occurs. Additionally, it’s important to consider potential capital gains taxes when the property is sold. Consulting a tax professional can provide clarity on individual circumstances.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed is specifically designed for real estate. It cannot be used for personal property, bank accounts, or other assets. For those assets, different estate planning tools, such as wills or trusts, may be more appropriate.

What if I have multiple beneficiaries?

If you wish to designate multiple beneficiaries for your property, you can do so within the Transfer-on-Death Deed. It’s important to clearly specify how the property will be divided among them. For example, you can state that each beneficiary receives an equal share or outline specific percentages. Clear language helps prevent disputes later on.

Discover Other Forms for Maryland

Molst Form Md - Regularly reviewing the implications and stipulations of the DNR ensures it aligns with a patient’s evolving healthcare goals.

How to Get a Cease and Desist Order - Can be tailored to fit specific situations or concerns.

Homeschool Maryland - Submitting a well-crafted Letter of Intent can establish trust between the family and local educational authorities.

Documents used along the form

The Maryland Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. This deed simplifies the transfer process and can help avoid delays and costs associated with probate proceedings. However, several other forms and documents are often used in conjunction with this deed to ensure a smooth transition of property ownership.

- Last Will and Testament: This legal document outlines how a person's assets, including real estate, should be distributed after their death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to designate beneficiaries who will receive the assets directly upon the account holder's death, avoiding probate.

- Power of Attorney: This document grants another person the authority to act on behalf of the property owner in legal and financial matters, which can include signing the Transfer-on-Death Deed if the owner is unable to do so.

- Affidavit of Heirship: This document may be used to establish the identity of heirs when a property owner passes away without a will, providing clarity on who has the right to inherit the property.

- Residential Lease Agreement: This legal document is crucial for landlords and tenants to define their rental relationship clearly. For those interested in templates, PDF Templates Online offers resources that can assist in creating a comprehensive agreement.

- Deed of Trust: This legal instrument can be used to secure a loan with real estate as collateral. It may be relevant if the property is encumbered by a mortgage that needs to be addressed during the transfer process.

- Quitclaim Deed: This form is used to transfer ownership interest in a property without warranties. It can be useful if the owner wishes to transfer property to a beneficiary while still alive, complementing the Transfer-on-Death Deed.

Utilizing these documents in conjunction with the Maryland Transfer-on-Death Deed can help ensure that property is transferred according to the owner's wishes and that all legal requirements are met. It is advisable to consult with a legal professional to navigate these forms effectively and to ensure that all aspects of the transfer process are handled properly.

Key takeaways

Filling out and using the Maryland Transfer-on-Death Deed form can be a straightforward process, but it’s essential to understand the key aspects involved. Here are some important takeaways:

- Eligibility: Only individuals can create a Transfer-on-Death Deed. This means that entities like corporations or trusts cannot use this form.

- Property Types: The deed can only be used for real estate, such as residential properties, land, or commercial buildings.

- Revocability: You can revoke the Transfer-on-Death Deed at any time before your death. This allows for flexibility in your estate planning.

- Signature Requirement: The deed must be signed by the owner in the presence of a notary public. This ensures that the document is legally valid.

- Filing: After signing, the deed must be recorded in the local land records office where the property is located. This step is crucial for the deed to take effect.

- Beneficiary Designation: You can name one or more beneficiaries in the deed. Make sure their full legal names are included to avoid confusion.

- Impact on Taxes: The property will not be included in your estate for tax purposes, which can provide tax benefits for your heirs.

- No Immediate Transfer: The property does not transfer to the beneficiary until the owner's death. Until then, the owner retains full control over the property.

- Consultation Recommended: It’s wise to consult with a legal professional to ensure that the deed aligns with your overall estate plan and complies with Maryland laws.

Misconceptions

Here are nine common misconceptions about the Maryland Transfer-on-Death Deed form:

- It avoids probate completely. While a Transfer-on-Death Deed allows property to pass directly to beneficiaries, other assets may still require probate.

- It is only for real estate. This deed specifically applies to real property, not personal property or other types of assets.

- It can be revoked at any time without notice. Although revocation is possible, it must be done formally and recorded to be effective.

- All heirs must agree to the deed. A Transfer-on-Death Deed can be executed by the property owner alone, without needing consent from heirs.

- It is the same as a will. A Transfer-on-Death Deed is not a will; it operates differently and has specific requirements.

- It has no tax implications. Beneficiaries may still face tax consequences when they inherit property through this deed.

- It is only for married couples. Anyone can use a Transfer-on-Death Deed, regardless of marital status.

- It guarantees the property will go to the named beneficiary. If the beneficiary predeceases the owner, the property may not transfer as intended.

- It eliminates the need for estate planning. This deed is just one tool and should be part of a broader estate planning strategy.