Free Small Estate Affidavit Document for the State of Maryland

Similar forms

-

Will: A will outlines how a person's assets should be distributed after their death. Like a Small Estate Affidavit, it serves to clarify the wishes of the deceased.

-

Trust: A trust can manage assets during a person's lifetime and after death. Similar to a Small Estate Affidavit, it provides a clear plan for asset distribution.

-

Letters of Administration: This document is issued by a court to appoint someone to manage a deceased person's estate. It functions similarly by granting authority to handle estate matters.

-

Probate Petition: A probate petition initiates the legal process of distributing a deceased person's estate. Both documents aim to facilitate the transfer of assets.

-

Affidavit of Heirship: This document identifies the heirs of a deceased person. It serves a similar purpose by establishing who is entitled to the estate.

-

Deed of Distribution: A deed of distribution transfers property from an estate to its heirs. Like the Small Estate Affidavit, it formalizes the transfer of ownership.

-

Notice to Quit: This form is crucial for landlords to formally inform tenants of their need to vacate the premises. For detailed guidance on this document, visit texasdocuments.net/printable-notice-to-quit-form.

-

Power of Attorney: A power of attorney allows someone to act on another's behalf. While it is used during a person's lifetime, it can relate to estate management like the Small Estate Affidavit.

-

Certificate of Death: This document confirms the death of an individual. It is often required alongside a Small Estate Affidavit to validate the estate's claims.

-

Estate Inventory: An estate inventory lists all assets of a deceased person. It complements the Small Estate Affidavit by detailing what is being distributed.

-

Final Accounting: This document summarizes the financial activities of an estate. It is similar in that it provides transparency regarding asset distribution.

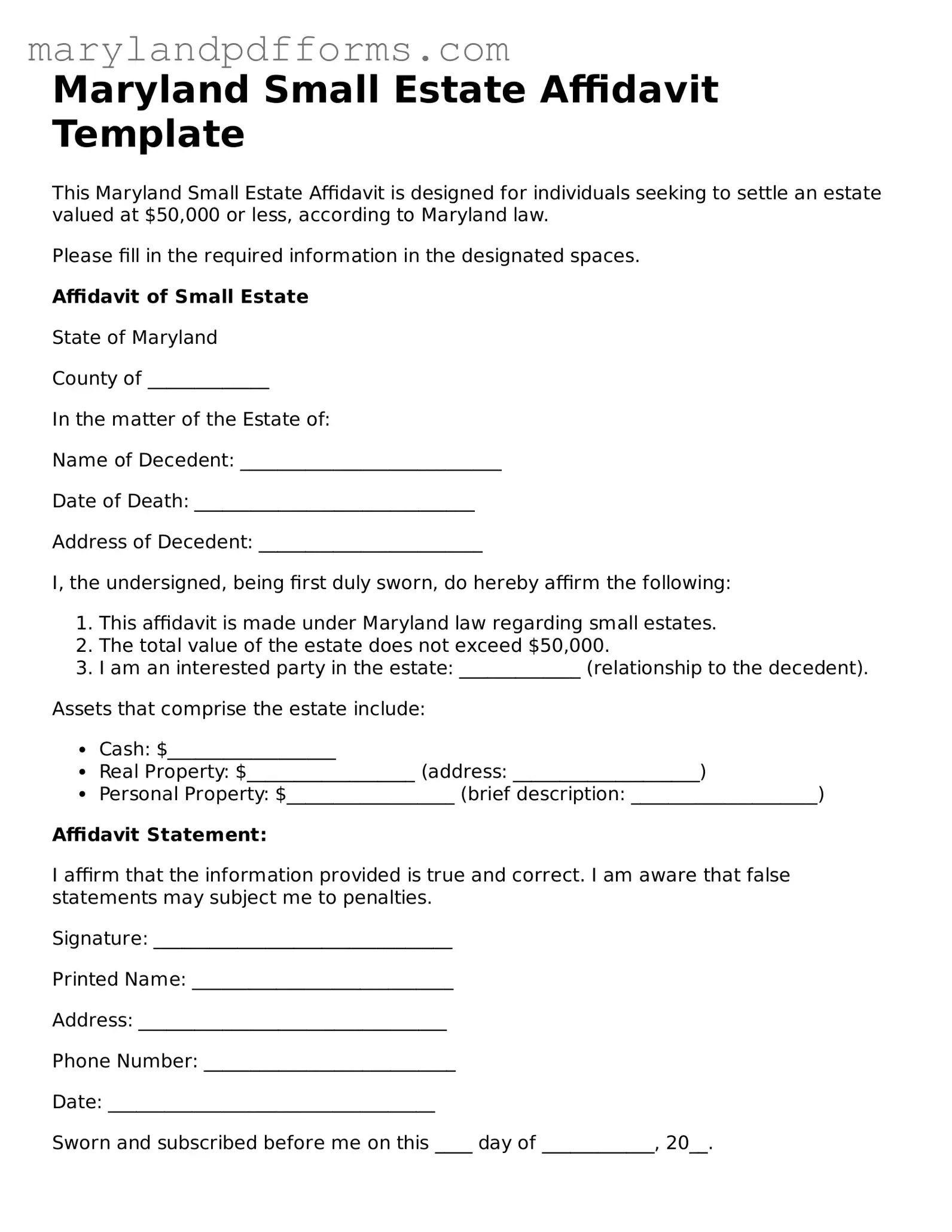

Maryland Small Estate Affidavit - Usage Steps

Once you have gathered all the necessary documents and information, you can begin filling out the Maryland Small Estate Affidavit form. This form is a critical step in settling a small estate, and completing it accurately is essential to ensure a smooth process. Below are the steps to guide you through filling out the form.

- Begin by entering the decedent's full name at the top of the form.

- Next, provide the date of the decedent's death. This should be the exact date as stated on the death certificate.

- In the following section, list the address of the decedent. Ensure this is their last known residence.

- Indicate whether the decedent left a will. If there is a will, you will need to attach a copy to the affidavit.

- Fill in the names and addresses of all heirs. Include their relationship to the decedent.

- State the total value of the estate. This should include all assets that are part of the estate.

- Sign and date the affidavit at the bottom. Make sure to do this in front of a notary public.

- Finally, make copies of the completed form for your records and for any heirs involved.

After completing the form, you will need to file it with the appropriate court in Maryland. This will initiate the process of settling the estate, allowing you to move forward with distributing the assets to the heirs.

Learn More on Maryland Small Estate Affidavit

What is a Maryland Small Estate Affidavit?

The Maryland Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the lengthy and often costly probate process. This form can be used when the total value of the estate is below a certain threshold, which is currently set at $50,000 for personal property and $100,000 for real property. By using this affidavit, heirs can claim the deceased's assets more quickly and efficiently.

Who is eligible to use the Small Estate Affidavit?

To qualify for the Small Estate Affidavit, the following conditions must be met:

- The total value of the estate must be below the specified limits ($50,000 for personal property and $100,000 for real property).

- The deceased must have passed away without a will (intestate) or left a will that does not require formal probate.

- The person filing the affidavit must be an eligible heir or a person entitled to inherit under Maryland law.

How do I complete the Small Estate Affidavit?

Completing the Small Estate Affidavit involves several steps:

- Gather necessary information about the deceased, including their full name, date of death, and details about their assets.

- Obtain the Small Estate Affidavit form from the Maryland State Court website or your local court.

- Fill out the form accurately, ensuring all required information is included.

- Sign the affidavit in front of a notary public, as notarization is required for the document to be valid.

What assets can be claimed using the Small Estate Affidavit?

The Small Estate Affidavit can be used to claim various types of assets, including:

- Bank accounts

- Personal property such as vehicles, jewelry, and furniture

- Stocks and bonds

- Real estate, provided it falls within the value limits

However, certain assets, such as those held in a trust or life insurance policies with designated beneficiaries, may not be included in the affidavit process.

Is there a deadline for filing the Small Estate Affidavit?

While there is no strict deadline for filing the Small Estate Affidavit, it is advisable to do so as soon as possible after the death of the individual. Delaying the process can complicate matters and may lead to issues with asset distribution. Additionally, creditors may have a limited time to make claims against the estate, so prompt action can help protect the interests of the heirs.

Can I seek legal assistance when filing the Small Estate Affidavit?

Yes, seeking legal assistance is often a wise decision when dealing with estate matters. An attorney can help ensure that the Small Estate Affidavit is completed accurately and in compliance with Maryland law. They can also provide guidance on any specific circumstances that may arise, such as disputes among heirs or the need for additional documentation. While legal fees may be an added expense, the benefits of having professional support can outweigh the costs, especially in complex situations.

Discover Other Forms for Maryland

Maryland Durable Power of Attorney Form - This form is different from a regular power of attorney because it remains valid after incapacitation.

The Arizona Transfer-on-Death Deed form is a valuable tool for estate planning, allowing property owners to transfer their real estate directly to a beneficiary upon their death, thereby avoiding probate court. This streamlined process not only honors the owner's final wishes but also simplifies the transition of property ownership. For those looking to utilize this form effectively, you can see the form to ensure all details are correctly completed.

Affidavit of Service - In some instances, it may also include the server's contact information.

Documents used along the form

When navigating the process of settling a small estate in Maryland, several documents may accompany the Maryland Small Estate Affidavit. Each of these documents plays a crucial role in ensuring that the estate is managed and distributed according to the deceased's wishes and state law. Below is a list of commonly used forms that often accompany the Small Estate Affidavit.

- Death Certificate: This official document certifies the death of the individual and is essential for initiating the estate settlement process. It provides proof of death to financial institutions and other entities involved in the estate.

- Will: If the deceased left a will, it is important to include it with the Small Estate Affidavit. The will outlines the deceased's wishes regarding the distribution of their assets and may impact how the estate is settled.

- Inventory of Assets: This document lists all the assets owned by the deceased at the time of their passing. It helps in establishing the value of the estate and ensures that all assets are accounted for during distribution.

- Articles of Incorporation: This foundational document is essential for legally establishing a corporation in Colorado, detailing critical information such as the corporation's name and purpose. More information can be found at coloradoformpdf.com/.

- Affidavit of Heirship: In cases where the deceased did not leave a will, this affidavit may be used to establish the rightful heirs. It provides a sworn statement regarding the relationships of the heirs to the deceased.

Understanding these documents can help streamline the process of settling a small estate. By being prepared with the necessary forms, individuals can honor their loved one's legacy while ensuring compliance with legal requirements.

Key takeaways

Filling out and using the Maryland Small Estate Affidavit form can be a straightforward process, but understanding the key aspects is essential for effective estate management. Here are some important takeaways to keep in mind:

- Eligibility Criteria: The Small Estate Affidavit is typically used when the total value of the deceased person's estate is under a certain threshold, which is currently set at $50,000 for personal property and $100,000 for real property.

- Who Can Use It: Only certain individuals, such as the surviving spouse, children, or other heirs, can file the affidavit. It's important to ensure you have the legal right to do so.

- Required Information: The form requires basic information about the deceased, including their name, date of death, and details of their assets. Gather all necessary documentation before you start.

- Notarization: The affidavit must be signed in front of a notary public. This step is crucial as it adds a layer of authenticity to the document.

- Filing with the Court: After completing the affidavit, it must be filed with the appropriate Maryland court. This step is necessary to legally transfer the assets to the rightful heirs.

- Potential Complications: If there are disputes among heirs or if the estate exceeds the small estate limits, complications may arise. Understanding your rights and responsibilities can help navigate these challenges.

By keeping these points in mind, you can approach the Maryland Small Estate Affidavit process with confidence and clarity.

Misconceptions

Understanding the Maryland Small Estate Affidavit can help simplify the process of settling a small estate. However, several misconceptions often lead to confusion. Here’s a list of ten common misunderstandings about this form:

- Only estates under $50,000 qualify. Many believe that only estates valued at $50,000 or less can use the Small Estate Affidavit. In reality, the limit is $50,000 for personal property, but other assets may not count toward this total.

- All heirs must agree to use the affidavit. Some think that all heirs need to agree before using the Small Estate Affidavit. While it’s best to have consensus, it is not a strict requirement.

- The affidavit can be used for real estate. Many assume that the Small Estate Affidavit can be used to transfer real estate. However, it is only applicable for personal property, not real property.

- You must hire a lawyer to complete it. There’s a belief that legal assistance is necessary to fill out the affidavit. In fact, many people can complete it on their own without legal help.

- It takes a long time to process. Some think that the Small Estate Affidavit process is lengthy. In many cases, it can be processed quickly, often within a few weeks.

- You need a court hearing. A common misconception is that a court hearing is required. The Small Estate Affidavit allows for a more straightforward process without the need for a hearing.

- Only one affidavit can be filed. Many believe that only one Small Estate Affidavit can be filed per estate. In reality, multiple affidavits can be filed if there are different heirs or assets.

- All debts must be paid before filing. Some think that all debts of the deceased must be settled before using the affidavit. While debts should be addressed, it is not a requirement to pay all debts before filing.

- It is the same as a will. Many confuse the Small Estate Affidavit with a will. They serve different purposes; the affidavit is used for settling estates without a will or for small estates.

- It is only for residents of Maryland. Some believe that only Maryland residents can use the Small Estate Affidavit. However, it can also be used by non-residents if the estate has assets located in Maryland.

By clearing up these misconceptions, individuals can navigate the Small Estate Affidavit process with greater confidence and ease.