Blank Resale Certificate Maryland Template

Similar forms

- Sales Tax Exemption Certificate: This document allows buyers to purchase items without paying sales tax. It is similar to the Resale Certificate as both are used to certify that the buyer intends to use the purchased items for resale or exempt purposes.

- Wholesale Certificate: A wholesale certificate is issued to businesses that buy goods for resale. Like the Resale Certificate, it confirms that the buyer is not the end consumer and intends to sell the products to others.

- Marital Separation Agreement: If you are navigating your separation, consider using the comprehensive Marital Separation Agreement resources to ensure clarity on your rights and obligations.

- Certificate of Exemption: This certificate is used by organizations that qualify for tax exemptions. Similar to the Resale Certificate, it verifies that the buyer is exempt from sales tax due to their specific status or purpose.

- Purchase Order: A purchase order outlines the details of a transaction between a buyer and a seller. While it serves a different function, it often accompanies a Resale Certificate to indicate that the goods are intended for resale.

Resale Certificate Maryland - Usage Steps

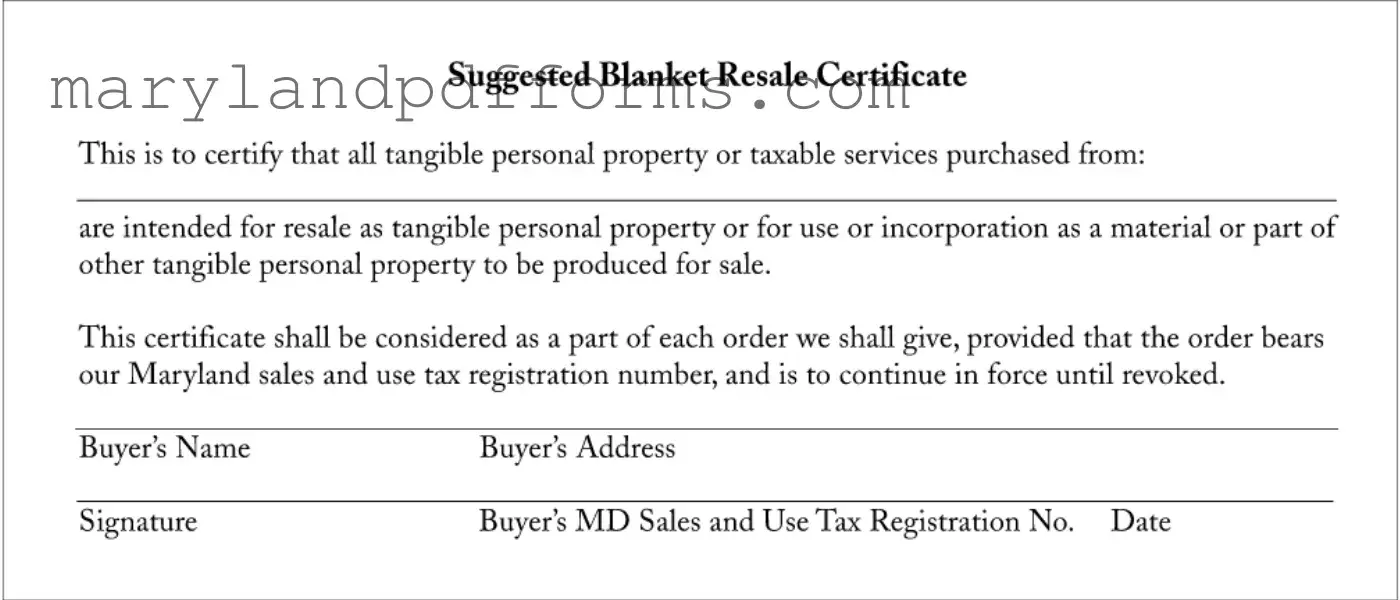

After gathering the necessary information, you can proceed to fill out the Resale Certificate Maryland form. This form certifies that the items being purchased are intended for resale. Ensure that all information is accurate to avoid any issues during the resale process.

- Begin by entering the Buyer's Name in the designated field.

- Provide the Buyer's Address in the appropriate section.

- Fill in the Buyer's MD Sales and Use Tax Registration No. to confirm your registration status.

- Sign the form where indicated to validate the certificate.

- Enter the Date on which you are completing the form.

Once the form is completed, it should be submitted along with your purchase orders. Keep a copy for your records, as it may be required for future transactions.

Learn More on Resale Certificate Maryland

What is a Resale Certificate in Maryland?

A Resale Certificate in Maryland is a document that allows businesses to purchase goods without paying sales tax. It certifies that the items are intended for resale or for use in creating other products for sale. This certificate helps streamline the purchasing process for retailers and wholesalers.

Who can use a Resale Certificate?

Any business that is registered for sales and use tax in Maryland can use a Resale Certificate. This includes retailers, wholesalers, and manufacturers who plan to resell the items they purchase. To qualify, the business must have a valid Maryland sales and use tax registration number.

How do I obtain a Resale Certificate?

To obtain a Resale Certificate, you need to complete the suggested blanket resale certificate form. This form requires you to provide your business name, address, Maryland sales and use tax registration number, and a signature. You can usually find the form on the Maryland Comptroller's website or through your tax professional.

What information is required on the Resale Certificate?

The Resale Certificate must include the following information:

- Buyer's name

- Buyer's address

- Buyer's Maryland sales and use tax registration number

- Date of issuance

- Signature of the buyer

Does a Resale Certificate expire?

The Resale Certificate does not have a specific expiration date. It remains valid as long as the buyer's sales and use tax registration is active. However, it can be revoked at any time by the buyer or if the buyer's registration status changes.

Can I use a Resale Certificate for all purchases?

No, a Resale Certificate can only be used for purchases intended for resale or for use in creating other products for sale. It cannot be used for personal purchases or for items that will not be resold.

What happens if I misuse a Resale Certificate?

Misusing a Resale Certificate can lead to penalties, including fines and back taxes owed. If a business uses the certificate for non-qualifying purchases, they may be held responsible for paying the sales tax on those items, along with any applicable penalties.

How should I present the Resale Certificate to my supplier?

When making a purchase, present the completed Resale Certificate to your supplier at the time of sale. Ensure that the order includes your Maryland sales and use tax registration number. This will help the supplier verify that the purchase is exempt from sales tax.

Where can I find more information about Resale Certificates in Maryland?

For more information about Resale Certificates, visit the Maryland Comptroller's website. They provide resources and guidance on sales tax regulations, including how to properly use a Resale Certificate.

Additional PDF Forms

Mdnewhire - Record the date of hire in the format mm/dd/yyyy for consistency.

The New York Operating Agreement form is a crucial legal document that outlines the management structure and operational guidelines of a limited liability company (LLC) in New York. This form helps define the rights and responsibilities of its members, ensuring clarity in the business's day-to-day operations. For those looking to create this document, resources such as PDF Templates Online can provide valuable assistance in navigating its components, helping business owners enhance their LLC's effectiveness.

Court Forms - To prevent processing issues, review the completed Intake Sheet thoroughly before submission.

Documents used along the form

When engaging in resale transactions in Maryland, several forms and documents may accompany the Resale Certificate. Each of these documents plays a crucial role in ensuring compliance with tax regulations and facilitating smooth business operations. Below is a list of commonly used forms that you might encounter.

- Sales Tax Registration Certificate: This document proves that a business is registered to collect sales tax in Maryland. It includes the business's registration number and must be presented when making tax-exempt purchases.

- Purchase Order: A purchase order is a document issued by a buyer to a seller, indicating the types, quantities, and agreed prices for products or services. It helps in tracking orders and ensuring that both parties are on the same page regarding the transaction.

- Exemption Certificate: This form is used by buyers to claim exemption from sales tax for certain purchases. It provides details about the buyer's exemption status and must be completed accurately to avoid tax liabilities.

- Invoice: An invoice is a detailed bill provided by the seller to the buyer, outlining the products or services sold, their prices, and any applicable taxes. It serves as a record of the transaction and is important for both accounting and tax purposes.

- Hold Harmless Agreement: This document protects parties from liability during certain activities, such as events and construction projects, ensuring that one party agrees not to hold the other responsible for specified risks. For more information on creating this agreement, visit Templates Online.

- Resale Certificate for Other States: If a business operates in multiple states, it may need to use resale certificates specific to those states. These documents certify that purchases are intended for resale, adhering to the tax regulations of each state.

- Tax Exempt Status Documentation: Some organizations, like non-profits, may have tax-exempt status. This documentation proves that the organization is exempt from sales tax and is often required when making purchases without incurring tax.

Understanding these documents and their purposes can help streamline your business transactions and ensure compliance with Maryland's sales tax regulations. Always keep thorough records and consult with a tax professional if you have questions about specific forms or requirements.

Key takeaways

When using the Resale Certificate Maryland form, keep these key points in mind:

- Purpose of the Certificate: The form certifies that items purchased are intended for resale or as part of other products for sale.

- Registration Requirement: Ensure that your order includes your Maryland sales and use tax registration number for the certificate to be valid.

- Continuity: The certificate remains effective until it is revoked, covering all future orders unless stated otherwise.

- Accurate Information: Fill in all required fields, including the buyer’s name, address, and signature, to avoid issues.

- Revocation: Be aware that you can revoke the certificate at any time, but you must notify the seller to ensure they are aware.

Misconceptions

Understanding the Resale Certificate in Maryland can be tricky. Here are some common misconceptions that often arise:

- Anyone can use a resale certificate. Only businesses with a valid Maryland sales and use tax registration number can utilize this form.

- A resale certificate exempts all purchases from tax. It only applies to items intended for resale, not for personal use or consumption.

- Resale certificates are permanent. They remain in effect until revoked, but they must be updated if the buyer’s information changes.

- All items purchased with a resale certificate are tax-free. Only tangible personal property or taxable services intended for resale qualify for exemption.

- Only physical goods can be purchased with a resale certificate. Taxable services can also be included, as long as they are intended for resale.

- Resale certificates are only for retailers. Manufacturers and wholesalers can also use them when buying materials for production.

- There’s no need to keep records of resale certificates. Businesses should maintain copies for their records to support their tax-exempt purchases.

- Using a resale certificate is the same as filing a tax return. They serve different purposes; one is for exemption on purchases, while the other is for reporting sales.

- Resale certificates are only valid in Maryland. They are specific to Maryland, but other states have similar forms with different rules.

Being informed about these misconceptions can help businesses navigate the resale process more effectively.