Blank Real Estate Sales Agreement In Maryland Template

Similar forms

- Purchase Agreement: Similar to the Real Estate Sales Agreement, a Purchase Agreement outlines the terms of a real estate transaction, including the property description, purchase price, and closing details. Both documents serve to protect the interests of buyers and sellers in a real estate deal.

- Lease Agreement: A Lease Agreement, like the Real Estate Sales Agreement, defines the terms of occupancy for a property. While the former is for rental arrangements, both documents detail the responsibilities of parties involved and the conditions for property use.

- Option to Purchase Agreement: This document gives a buyer the right to purchase a property at a later date. It shares similarities with the Real Estate Sales Agreement in that it specifies terms such as price and duration, but it does not require an immediate sale.

- Operating Agreement: The Texas Operating Agreement is crucial for any LLC in Texas, as it outlines the management structure and operational procedures. This document guarantees that all members understand their rights and responsibilities, facilitating effective decision-making. For more details, visit texasdocuments.net/printable-operating-agreement-form/.

- Listing Agreement: A Listing Agreement is a contract between a property owner and a real estate agent. Like the Real Estate Sales Agreement, it outlines terms and conditions, but it focuses on the representation of the seller in the market rather than the sale itself.

Real Estate Sales Agreement In Maryland - Usage Steps

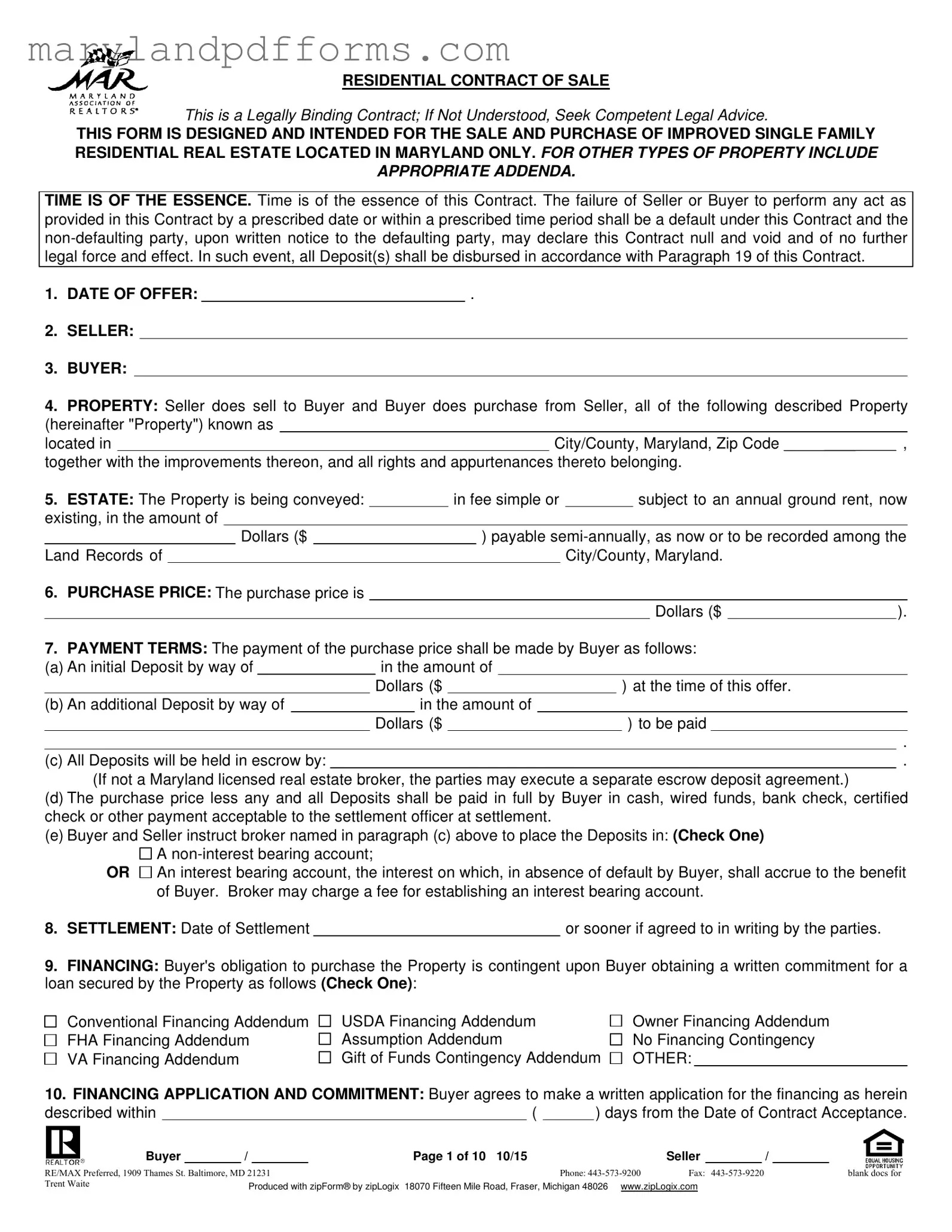

Filling out the Real Estate Sales Agreement in Maryland requires attention to detail and accuracy. This document serves as a formal agreement between the buyer and seller regarding the sale of residential property. Below are the steps to complete the form correctly.

- Date of Offer: Enter the date you are making the offer.

- Seller Information: Fill in the name of the seller.

- Buyer Information: Fill in the name of the buyer.

- Property Description: Provide the full address of the property, including city, county, and zip code.

- Estate Type: Specify whether the property is being sold in fee simple or subject to an annual ground rent, and indicate the amount.

- Purchase Price: State the total purchase price of the property.

- Payment Terms: Outline the payment structure, including the initial deposit amount and any additional deposits. Specify how the deposits will be held and the method of payment at settlement.

- Settlement Date: Indicate the proposed date for settlement.

- Financing Contingency: Check the appropriate financing option that applies to the buyer.

- Financing Application: State the number of days the buyer has to apply for financing.

- Home Inspection: Indicate if the buyer will conduct a home inspection and whether any addenda are attached.

- Inclusions/Exclusions: List any personal property included in the sale and any items excluded.

- Lead-Based Paint Disclosure: Ensure the buyer initials to acknowledge understanding of lead-based paint regulations if applicable.

- Addenda/Disclosures: Check any applicable addenda that are attached to the contract.

- Wood Destroying Insect Inspection: Indicate if an inspection will be conducted and outline responsibilities for treatment if necessary.

- Deposit Instructions: Specify how the deposit will be handled and any conditions for its return.

- Deed and Title: Clarify the conditions under which the seller will convey the property title.

- Condition of Property: Note the condition the property will be in at settlement.

- Settlement Costs: Acknowledge that the buyer will be responsible for all settlement-related costs.

- Signatures: Ensure that both parties sign and date the agreement.

After completing the form, it is crucial to review all entries for accuracy. Both parties should retain copies of the signed agreement for their records. If any questions arise, consulting a legal professional is advisable to ensure compliance with all applicable laws and regulations.

Learn More on Real Estate Sales Agreement In Maryland

What is a Real Estate Sales Agreement in Maryland?

A Real Estate Sales Agreement in Maryland is a legally binding contract between a buyer and a seller for the purchase of residential real estate. It outlines the terms of the sale, including the purchase price, payment terms, property details, and conditions for closing the transaction. This form is specifically designed for improved single-family residential properties located in Maryland.

What are the key components of this agreement?

The key components of the Real Estate Sales Agreement include:

- Date of Offer: The date when the offer is made.

- Seller and Buyer Information: Names and contact details of both parties.

- Property Description: Details about the property being sold.

- Purchase Price: The agreed-upon price for the property.

- Payment Terms: How the buyer will pay, including deposits and settlement details.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

What happens if the buyer or seller fails to meet the contract terms?

If either party fails to perform as outlined in the contract by the specified deadlines, it constitutes a default. The non-defaulting party may declare the contract null and void by providing written notice to the defaulting party. In such cases, any deposits will be handled according to the contract's deposit provisions.

Can the buyer conduct inspections on the property?

Yes, the buyer has the right to conduct inspections on the property. This includes home inspections and environmental inspections. The buyer must notify the seller of their intention to include inspection contingencies in an addendum to the contract. The buyer is responsible for the costs associated with these inspections.

What is the significance of the deposit in the agreement?

The deposit is a sum of money that the buyer puts down as a show of good faith. It is held in escrow until the transaction is completed. If the sale goes through, the deposit is applied to the purchase price. If the contract is terminated due to a default by either party, the deposit will be disbursed according to the terms outlined in the agreement.

What are the financing options available to the buyer?

The buyer's obligation to purchase the property may depend on securing financing. The agreement allows the buyer to select from various financing options, including conventional loans, FHA, VA, USDA loans, or other financing methods. The buyer must apply for financing within a specified period after the contract is accepted.

What should buyers know about lead-based paint disclosures?

Under federal law, sellers must disclose any known lead-based paint hazards if the property was built before 1978. The seller must provide a lead-based paint disclosure form to the buyer. Buyers should be aware that failing to provide this information can result in legal penalties for the seller.

Additional PDF Forms

Md Business Tax - Specific lines on the form are dedicated to listing partners’ or members’ information.

Referral Request Form - Submitting this form does not guarantee payment; eligibility and plan provisions apply.

In addition to providing a solid foundation for the management structure of an LLC, the New York Operating Agreement form can be obtained from various resources, including PDF Templates Online, which offers practical templates to help business owners create an agreement tailored to their specific needs and ensure compliance with state regulations.

Md 510 Instructions 2023 - Form 510E is essential for entities wanting to manage their tax return due dates effectively.

Documents used along the form

The Real Estate Sales Agreement in Maryland serves as a foundational document in real estate transactions. However, several additional forms and documents are commonly utilized alongside it to ensure a smooth and legally compliant process. Each of these documents plays a vital role in protecting the interests of both buyers and sellers, addressing specific aspects of the transaction. Below is a list of such documents, along with brief descriptions of their purposes.

- Lead-Based Paint Disclosure: This document is required for homes built before 1978, as they may contain lead-based paint hazards. Sellers must disclose any known lead-based paint issues to buyers, ensuring they are informed about potential risks before completing the sale.

- Financing Addendum: This addendum outlines the specific financing terms agreed upon by the buyer and seller. It details the type of financing the buyer will use, such as conventional, FHA, or VA loans, and sets forth any conditions related to obtaining financing.

- Divorce Settlement Agreement: This document is essential for spouses to formalize the terms of their divorce, including asset division and custody arrangements, to avoid future disputes. For more information, visit https://coloradoformpdf.com.

- Home Inspection Contingency Addendum: This addendum allows the buyer to conduct a home inspection within a specified time frame. It provides the buyer the right to negotiate repairs or withdraw from the contract if significant issues are discovered during the inspection.

- Property Disclosure Statement: This document requires the seller to disclose any known defects or issues with the property. It serves to inform the buyer about the property's condition and any potential problems that could affect its value or livability.

Utilizing these additional forms and documents alongside the Real Estate Sales Agreement helps ensure that all parties involved are well-informed and protected throughout the transaction process. By addressing various aspects of the sale, these documents contribute to a smoother, more transparent real estate experience.

Key takeaways

- Understand the Purpose: The Real Estate Sales Agreement in Maryland is specifically designed for the sale and purchase of improved single-family residential real estate in Maryland. Ensure this is the right form for your transaction.

- Time Sensitivity: Time is crucial in this contract. Missing deadlines can lead to defaults, so stay organized and adhere to all timelines outlined in the agreement.

- Deposit Details: The agreement requires a deposit, which must be held in escrow. Familiarize yourself with the terms regarding how and when this deposit is to be made and disbursed.

- Financing Contingencies: If financing is needed, be aware of the contingencies that must be met, including obtaining a loan commitment within a specified timeframe.

- Inspections: Buyers have the right to conduct home and environmental inspections. If you wish to include these contingencies, ensure they are documented in an addendum.

- Condition of Property: The property is sold "as is," meaning the seller is not obligated to make repairs. Inspect the property thoroughly before finalizing the agreement.

- Legal Compliance: Ensure compliance with all state and federal regulations, including those related to lead-based paint, especially for homes built before 1978.

Misconceptions

When dealing with the Real Estate Sales Agreement in Maryland, several misconceptions can arise. Understanding these misconceptions can help both buyers and sellers navigate the process more effectively.

- Misconception 1: The agreement is only for cash transactions.

- Misconception 2: The property is sold "as is" without any recourse.

- Misconception 3: The seller is responsible for all repairs before settlement.

- Misconception 4: The agreement does not require legal advice.

Many believe that the Real Estate Sales Agreement is applicable only to cash purchases. In reality, this agreement accommodates various financing options, including conventional loans, FHA, VA, and USDA financing. Buyers can select the financing method that best suits their needs, and the agreement outlines the necessary contingencies for obtaining financing.

While the agreement states that the property is sold "as is," this does not mean that buyers have no rights. Buyers are encouraged to conduct home inspections and can negotiate repairs or adjustments based on the findings. The agreement allows for contingencies related to inspections, ensuring that buyers can address any significant issues before finalizing the sale.

It is a common belief that sellers must complete all repairs before settlement. However, the agreement specifies that the seller is only responsible for repairs related to specific contingencies, such as those found during inspections. If the cost of repairs exceeds a certain percentage of the purchase price, the seller may have options to cancel the contract or negotiate further with the buyer.

Some individuals think they can navigate the Real Estate Sales Agreement without legal counsel. This is a risky assumption. The agreement is legally binding, and its complexities can lead to misunderstandings. It is advisable for both parties to seek competent legal advice to ensure that they fully understand their rights and obligations under the contract.