Free Real Estate Purchase Agreement Document for the State of Maryland

Similar forms

- Lease Agreement: This document outlines the terms under which a tenant can occupy a property. Like a purchase agreement, it specifies the duration, payment terms, and responsibilities of both parties.

- Sales Contract: Similar to a real estate purchase agreement, a sales contract is used in various transactions. It details the terms of sale for goods or services, including price and delivery conditions.

- Option Agreement: This document gives a buyer the right, but not the obligation, to purchase a property within a specified time frame. It shares similarities in outlining terms and conditions like a purchase agreement.

- Motorcycle Bill of Sale: This form is essential for documenting the sale or transfer of a motorcycle. Similar to other agreements, it outlines important details about the transaction, ensuring both parties are legally protected. You can find a useful resource at PDF Templates Online.

- Listing Agreement: This is a contract between a property owner and a real estate agent. It outlines the agent's responsibilities and the terms of the property sale, similar to how a purchase agreement details the buyer and seller's obligations.

- Buyer’s Agency Agreement: This document establishes a relationship between a buyer and their real estate agent. It includes terms of representation and compensation, akin to the agreements found in a purchase contract.

- Title Agreement: This document addresses the ownership rights of a property. It is similar to a purchase agreement in that it ensures the buyer is aware of any claims or liens against the property.

- Escrow Agreement: This agreement involves a third party holding funds during a transaction. Like a purchase agreement, it outlines the conditions under which the funds will be released, ensuring both parties are protected.

- Disclosure Statement: This document informs buyers about the condition of a property. It is similar to a purchase agreement in that it provides essential information that influences a buyer's decision.

Maryland Real Estate Purchase Agreement - Usage Steps

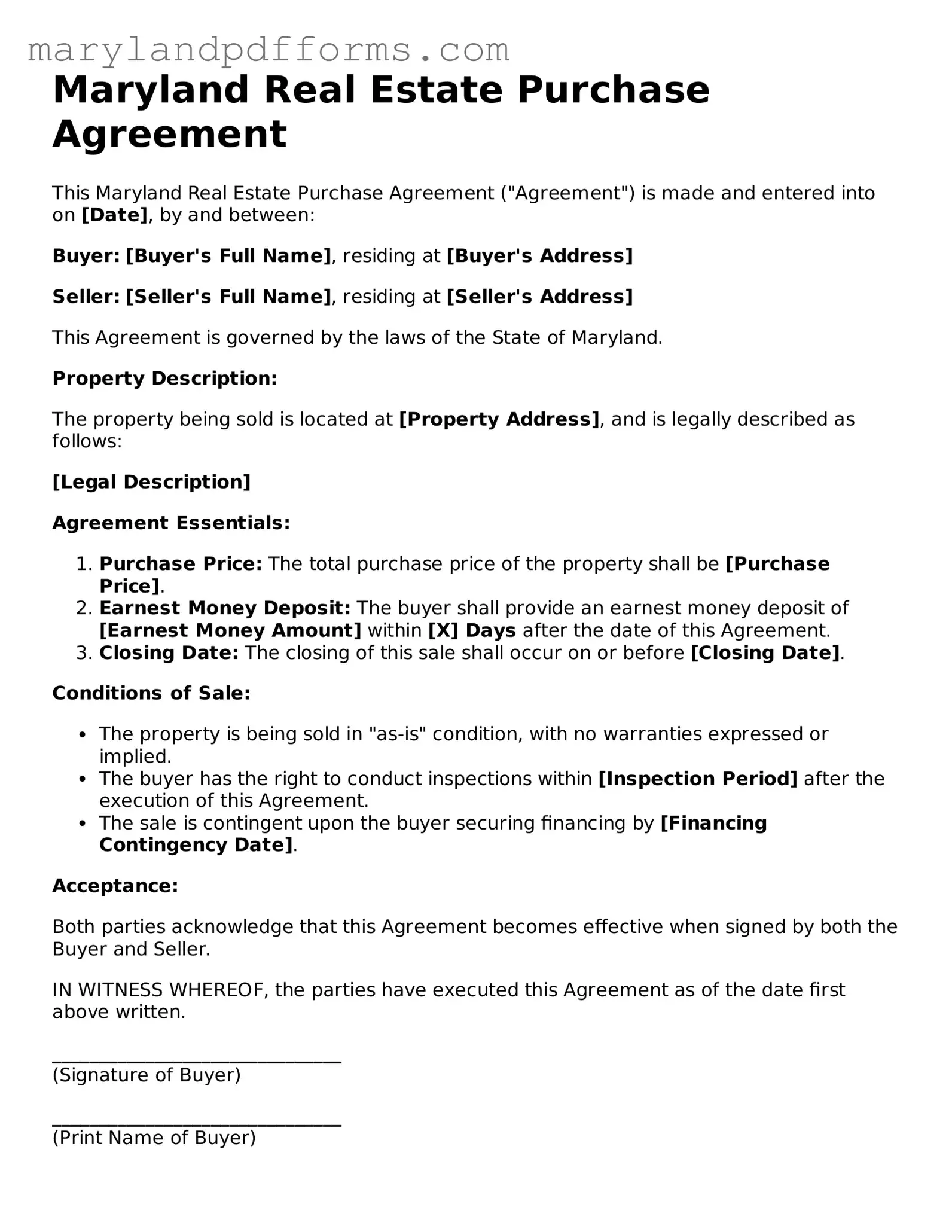

Once you have the Maryland Real Estate Purchase Agreement form in hand, you can begin the process of filling it out. This form is essential for formalizing the terms of a real estate transaction between the buyer and the seller. Follow these steps to ensure that you complete the form accurately.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the buyer and the seller in the designated sections.

- Provide the legal description of the property being sold. This information can typically be found on the property deed or tax records.

- Specify the purchase price of the property. Ensure that this figure is clearly stated and accurate.

- Outline the terms of the deposit, including the amount and the due date.

- Indicate the financing terms, if applicable. This includes details about any loans or mortgages involved in the purchase.

- Include any contingencies, such as home inspections or financing approvals, that must be met for the sale to proceed.

- Provide the closing date and any relevant information about the closing process.

- Have both parties sign and date the agreement at the bottom of the form.

- Make copies of the completed form for both the buyer and the seller for their records.

Learn More on Maryland Real Estate Purchase Agreement

What is a Maryland Real Estate Purchase Agreement?

The Maryland Real Estate Purchase Agreement is a legally binding document used when buying or selling property in Maryland. It outlines the terms and conditions of the sale, including the purchase price, financing details, and any contingencies. This agreement protects both the buyer and seller by clearly defining their rights and responsibilities during the transaction.

What should be included in the agreement?

A comprehensive Maryland Real Estate Purchase Agreement should include the following key elements:

- Identification of the parties involved (buyer and seller)

- Description of the property being sold

- Purchase price and payment terms

- Contingencies (e.g., financing, inspections)

- Closing date and possession details

- Disclosures and any warranties

Including these elements ensures clarity and reduces the risk of misunderstandings.

Can I modify the agreement?

Yes, the Maryland Real Estate Purchase Agreement can be modified. However, any changes must be agreed upon by both parties and documented in writing. It is advisable to consult with a real estate attorney or agent to ensure that modifications comply with Maryland law and do not inadvertently affect the validity of the agreement.

What happens if one party breaches the agreement?

If one party breaches the agreement, the other party may have several options. They can seek to enforce the contract, request specific performance (forcing the breaching party to fulfill their obligations), or pursue damages for any losses incurred. Legal action may be necessary, and consulting with an attorney is recommended to understand the best course of action.

Is an attorney required to complete this agreement?

While it is not legally required to have an attorney to complete a Maryland Real Estate Purchase Agreement, it is highly advisable. An attorney can provide guidance, ensure compliance with state laws, and help protect your interests. Real estate transactions can be complex, and having professional assistance can prevent costly mistakes.

How is the agreement executed?

The agreement is executed when both the buyer and seller sign the document. After signing, it is essential to provide copies to all parties involved. The agreement may also need to be notarized, depending on specific requirements. Once executed, the agreement becomes legally binding.

What should I do after signing the agreement?

After signing the Maryland Real Estate Purchase Agreement, the following steps should be taken:

- Ensure all parties have received signed copies.

- Complete any contingencies, such as inspections or securing financing.

- Prepare for the closing process, including reviewing closing documents.

- Communicate regularly with your real estate agent or attorney.

Staying organized and proactive will help facilitate a smooth transaction.

Discover Other Forms for Maryland

Bill of Sale Maryland - Includes a description of the item being sold for clarity.

In addition to the information provided about the Arizona Hold Harmless Agreement, it is essential to consider utilizing resources that can aid in drafting such documents effectively. For instance, visiting Templates Online can offer valuable templates and guidance to ensure that all legal requirements are met and the agreement is tailored to specific needs.

Sell Car in Maryland - The document enables buyers to verify the vehicle is not stolen or encumbered by legal issues.

Living Will Maryland Pdf - With a Living Will, you can outline your wishes on artificial nutrition and hydration.

Documents used along the form

When engaging in a real estate transaction in Maryland, several important documents accompany the Real Estate Purchase Agreement. Each of these forms serves a specific purpose and plays a critical role in ensuring a smooth transaction. Understanding these documents can help you navigate the process with confidence.

- Property Disclosure Statement: This document requires the seller to disclose known issues with the property. It helps buyers make informed decisions by revealing any potential problems.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about the risks of lead-based paint. It is a crucial step in protecting the health of future occupants.

- Financing Addendum: If the buyer is obtaining financing, this document outlines the terms of the loan. It specifies details such as the loan type and any contingencies related to financing.

- Home Inspection Contingency: This form allows buyers to have the property inspected before finalizing the purchase. It provides an opportunity to negotiate repairs or reconsider the offer based on inspection findings.

- California Loan Agreement Form: To secure your financing needs, explore our thorough California loan agreement options that define clear terms and conditions for your borrowing experience.

- Title Commitment: This document is issued by a title company and outlines the legal status of the property. It ensures that the title is clear and that there are no claims against it.

- Settlement Statement (HUD-1): This form details all the financial aspects of the transaction, including closing costs. It provides transparency and helps both parties understand the financial obligations involved.

- Power of Attorney: If a party cannot be present at closing, a power of attorney allows someone else to sign documents on their behalf. This ensures that the transaction can proceed smoothly.

- Affidavit of Title: This sworn statement confirms the seller’s ownership of the property and that there are no outstanding claims or liens. It protects the buyer from potential legal issues after the sale.

- Closing Disclosure: Required by federal law, this document provides a detailed breakdown of the final loan terms and closing costs. Buyers must receive this form at least three days before closing to review it thoroughly.

Each of these documents is essential in the real estate process, and understanding their significance can greatly benefit both buyers and sellers. Properly preparing and reviewing these forms ensures a smoother transaction and helps avoid potential pitfalls down the road.

Key takeaways

When dealing with the Maryland Real Estate Purchase Agreement, it’s essential to understand the key aspects of this important document. Here are some takeaways to keep in mind:

- Ensure all parties involved in the transaction are clearly identified. This includes full names and contact information.

- Specify the property address accurately. Include any relevant details about the property to avoid confusion.

- Outline the purchase price and any earnest money deposit. This shows the buyer's commitment to the transaction.

- Include contingencies. Common contingencies might involve financing, inspections, or the sale of another property.

- Set a timeline for closing. This helps both parties stay on track and manage expectations.

- Be clear about what is included in the sale. This might cover appliances, fixtures, and other personal property.

- Review any disclosures required by Maryland law. Sellers must disclose certain information about the property.

- Make sure to include the signatures of all parties. This is crucial for the agreement to be legally binding.

- Consider consulting a real estate attorney. They can provide valuable insights and help avoid potential pitfalls.

- Keep a copy of the signed agreement for your records. This will be important for future reference.

By paying attention to these key points, you can navigate the Maryland Real Estate Purchase Agreement with confidence.

Misconceptions

Understanding the Maryland Real Estate Purchase Agreement form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are nine common misconceptions, along with clarifications:

-

The form is only for residential properties.

This is incorrect. The Maryland Real Estate Purchase Agreement can be used for both residential and commercial properties.

-

It is a legally binding contract immediately upon signing.

While the agreement becomes binding once signed by both parties, it may still be contingent on certain conditions being met.

-

All terms are negotiable.

While many terms can be negotiated, some aspects, such as state laws and regulations, must be adhered to and cannot be changed.

-

Once signed, the buyer cannot back out.

Buyers may have the right to back out under specific conditions, such as failing to secure financing or unsatisfactory inspection results.

-

The agreement does not require a deposit.

A deposit, often referred to as earnest money, is typically required to demonstrate the buyer's serious intent to purchase.

-

Only real estate agents can fill out the form.

While agents often assist in completing the form, buyers and sellers can also fill it out themselves, provided they understand the terms.

-

It is the same as a lease agreement.

A purchase agreement outlines the terms of buying a property, while a lease agreement pertains to renting it.

-

All contingencies are automatically included.

Contingencies must be explicitly stated in the agreement; they are not automatically included.

-

The form is the same across all states.

Each state has its own specific requirements and forms, including Maryland, which has unique provisions and regulations.

Being aware of these misconceptions can help individuals navigate the real estate transaction process more effectively.