Free Quitclaim Deed Document for the State of Maryland

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and the right to sell it. Unlike a quitclaim deed, it offers protection against future claims.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property and assures that the property has not been sold to someone else. However, it does not provide the same level of protection as a warranty deed.

- Special Purpose Deed: This type of deed is used for specific purposes, such as a transfer between family members or in divorce settlements. It functions similarly to a quitclaim deed in that it transfers interest without warranties.

- Deed of Trust: This document secures a loan by transferring property to a trustee until the debt is paid. While it serves a different purpose, it involves property transfer similar to a quitclaim deed.

- Life Estate Deed: This deed allows a person to retain rights to a property during their lifetime while transferring ownership to another party upon their death. It shares the aspect of transferring interest in property without warranties.

- Affidavit of Title: This document is often used in conjunction with a quitclaim deed to affirm that the seller has clear title to the property. It provides a declaration of ownership without guaranteeing it.

- Transfer on Death Deed: This deed allows property owners to designate a beneficiary who will receive the property upon their death. It is similar to a quitclaim deed in that it transfers interest without immediate effect.

- Bill of Sale: While primarily used for personal property, a bill of sale transfers ownership from one party to another. It shares the basic function of transferring interest, though it is not specific to real estate.

- Power of Attorney: This document grants someone the authority to act on behalf of another in legal matters, including property transfers. It can facilitate a quitclaim deed process but serves a broader purpose.

Maryland Quitclaim Deed - Usage Steps

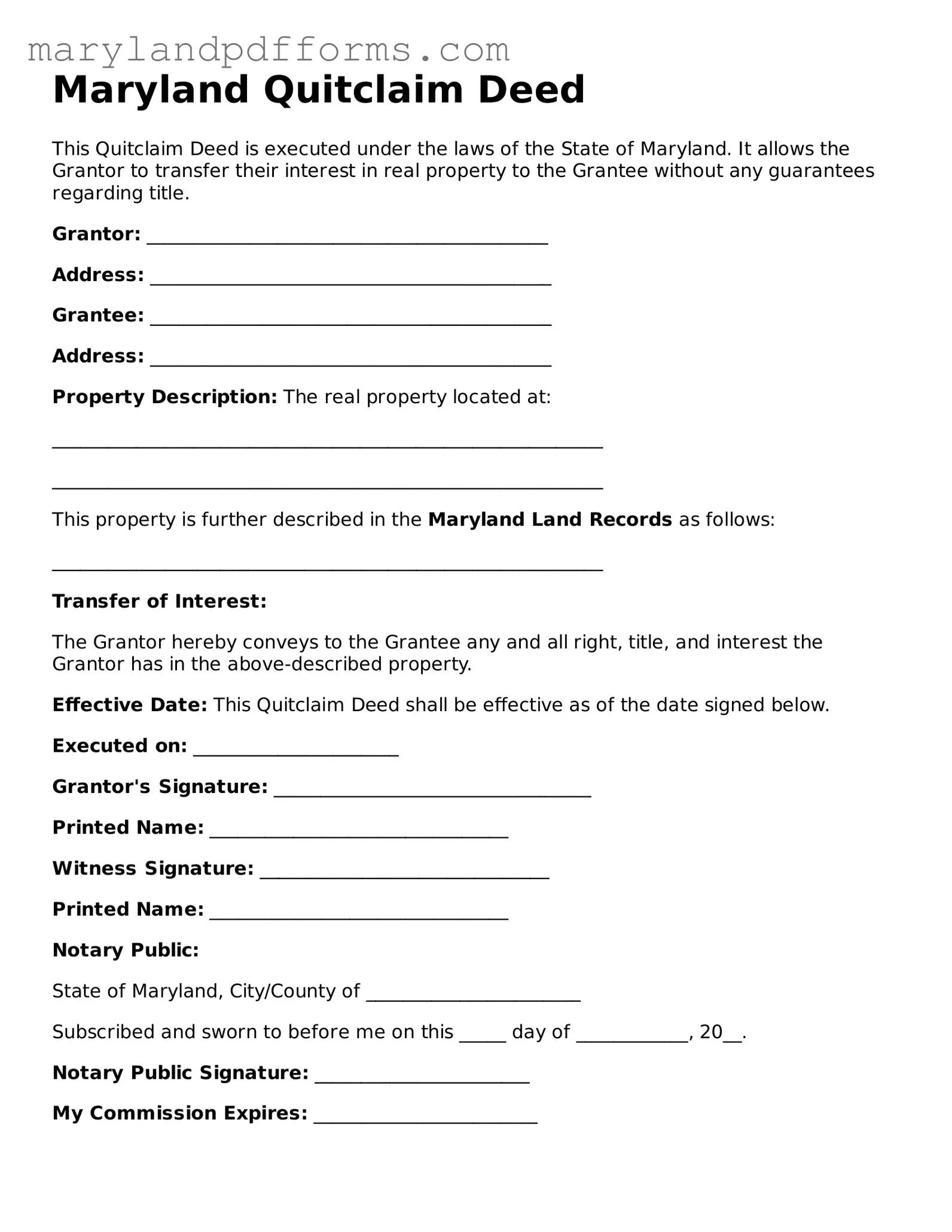

Once you have your Maryland Quitclaim Deed form ready, it’s time to fill it out. This process involves providing specific details about the property and the parties involved. Make sure to have all necessary information at hand to ensure a smooth completion.

- Begin by entering the date at the top of the form.

- In the section labeled "Grantor," write the name of the person or entity transferring the property. Ensure that the name matches official documents.

- Next, in the "Grantee" section, fill in the name of the person or entity receiving the property.

- Provide the complete address of the Grantee, including city, state, and ZIP code.

- Describe the property being transferred. Include the address and any legal descriptions available. This may involve referencing a previous deed or property records.

- Check the box that indicates whether the property is residential or commercial, if applicable.

- Sign the form in the designated area. The Grantor must sign it in the presence of a notary public.

- Have the notary public sign and seal the document to verify the authenticity of the signature.

- Finally, make copies of the completed deed for your records before submitting it to the appropriate county office for recording.

After filling out the form, you’ll need to file it with your local county office. This step is crucial to ensure the transfer is legally recognized. Keep a copy for your personal records as well.

Learn More on Maryland Quitclaim Deed

What is a Maryland Quitclaim Deed?

A Maryland Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. This type of deed does not guarantee that the property title is clear or free of liens. Instead, it simply conveys whatever interest the grantor has in the property, if any. It's often used between family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

Consider using a Quitclaim Deed in the following situations:

- Transferring property between family members, such as during a divorce or inheritance.

- Adding or removing a spouse from the property title.

- Clearing up title issues, such as correcting a name or removing a deceased person's name.

Keep in mind that while a Quitclaim Deed is simple, it may not be the best option for all transactions, especially if the buyer is not familiar with the property history.

How do I complete a Maryland Quitclaim Deed?

To complete a Quitclaim Deed in Maryland, follow these steps:

- Gather necessary information, including the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a legal description of the property, which can typically be found on the property tax bill or in the previous deed.

- Fill out the Quitclaim Deed form accurately. Ensure all details are correct to avoid issues later.

- Sign the document in the presence of a notary public to make it legally binding.

- File the completed deed with the local land records office to officially record the transfer.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. The key difference lies in the level of protection offered. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such assurances. It simply transfers whatever interest the grantor may have. For this reason, buyers should exercise caution and consider a Warranty Deed for more secure transactions.

Discover Other Forms for Maryland

Power of Attorney Form Maryland - This form can be essential for individuals with aging parents or other family members needing assistance.

In addition to understanding the management structure of an LLC, it is important for business owners to have access to reliable resources when preparing important documents. For those looking to create or refine their operating agreements, utilizing tools from PDF Templates Online can simplify the process and ensure compliance with New York regulations.

Rental Application Form Maryland Pdf - Required to provide personal information for renting.

Documents used along the form

The Maryland Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another. When executing this deed, several other forms and documents may be required to ensure a smooth transaction. Below is a list of documents commonly used alongside the Quitclaim Deed in Maryland.

- Property Transfer Tax Form: This form is used to report the transfer of real property and calculate any applicable transfer taxes due at the time of the sale.

- Title Search Report: A title search report provides information about the property's ownership history, liens, and any other claims against the property, ensuring the seller has the right to transfer ownership.

- Settlement Statement: This document outlines all financial aspects of the property transaction, including the sale price, closing costs, and any credits or debits for both the buyer and seller.

- Affidavit of Consideration: This affidavit declares the amount of consideration exchanged in the transaction, which is essential for tax purposes and verifying the legitimacy of the transfer.

- Power of Attorney: If the seller cannot be present to sign the Quitclaim Deed, a Power of Attorney allows another individual to act on their behalf, facilitating the transfer process.

- Notice of Intent to Foreclose: In cases where the property is in foreclosure, this document informs the relevant parties of the lender's intent to foreclose on the property.

- Deed of Trust: This document secures a loan with the property as collateral. It outlines the terms of the loan and the rights of the lender in the event of default.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide information about the association's rules, regulations, and any fees associated with the property.

- Property Disclosure Statement: This statement requires the seller to disclose known issues or defects with the property, ensuring the buyer is fully informed before completing the transaction.

Each of these documents plays a vital role in the property transfer process in Maryland. Understanding their purpose can help ensure that all legal requirements are met and that the transaction proceeds smoothly.

Key takeaways

When filling out and using the Maryland Quitclaim Deed form, it is essential to understand several key aspects to ensure the process goes smoothly. Below are important takeaways to consider:

- The Quitclaim Deed transfers ownership of property without guaranteeing that the title is free of claims or liens.

- Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified on the form.

- It is important to include a legal description of the property. This description should be detailed enough to identify the property precisely.

- The form must be signed by the grantor in the presence of a notary public to be legally valid.

- Consider recording the Quitclaim Deed with the local land records office to provide public notice of the property transfer.

- There may be fees associated with recording the deed, so check with the local office for specific costs.

- It is advisable to consult with a legal professional if there are any concerns regarding the property title or the implications of the transfer.

- Ensure that all parties involved understand the implications of a Quitclaim Deed, especially regarding potential liabilities.

- Keep a copy of the executed Quitclaim Deed for personal records after it has been recorded.

Misconceptions

When dealing with real estate transactions in Maryland, the Quitclaim Deed form can often lead to confusion. Here are ten common misconceptions about this important document:

- Quitclaim Deeds Transfer Ownership Completely. Many believe that a quitclaim deed transfers full ownership of a property. However, it only conveys whatever interest the grantor has at the time of signing. If the grantor has no ownership interest, the recipient gains nothing.

- Quitclaim Deeds Are Only for Family Transfers. While it is true that these deeds are frequently used among family members, they can also be used in various situations, including sales between unrelated parties or to clear up title issues.

- Quitclaim Deeds Provide Title Insurance. This is a misunderstanding. A quitclaim deed does not guarantee that the title is free of liens or encumbrances. Title insurance is a separate product that protects against such issues.

- Quitclaim Deeds Are Irrevocable. Some people think that once a quitclaim deed is executed, it cannot be undone. In fact, if both parties agree, a quitclaim deed can be revoked or modified.

- Only Lawyers Can Prepare Quitclaim Deeds. While legal assistance can be helpful, individuals can also prepare their own quitclaim deeds, provided they follow state requirements and guidelines.

- Quitclaim Deeds Are Always Quick and Easy. Although the process can be straightforward, complications may arise, especially if there are disputes over ownership or if the property has liens.

- Quitclaim Deeds Do Not Require Notarization. In Maryland, a quitclaim deed must be notarized to be valid. This step is crucial for the document to be legally recognized.

- Quitclaim Deeds Are the Same as Warranty Deeds. This is a significant misconception. A warranty deed provides a guarantee that the grantor holds clear title to the property, while a quitclaim deed makes no such assurances.

- Quitclaim Deeds Are Only for Real Estate. While they are most commonly used for real estate transactions, quitclaim deeds can also be used to transfer other types of property, such as vehicles or personal belongings.

- All Quitclaim Deeds Are the Same. Not all quitclaim deeds are identical. Variations can exist based on specific circumstances, such as the type of property being transferred or the relationship between the parties involved.

Understanding these misconceptions can help you navigate the process of using a quitclaim deed in Maryland more effectively. Always consider seeking advice if you have questions or concerns regarding your specific situation.