Free Promissory Note Document for the State of Maryland

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it often includes additional clauses regarding collateral and default conditions.

- Mortgage: A mortgage is a specific type of loan document that secures a loan against real estate. Similar to a promissory note, it requires the borrower to repay the loan, but it also involves the property as collateral.

- Personal Guarantee: This document holds an individual personally responsible for a business's debt. It resembles a promissory note in that it establishes an obligation to pay, but it often pertains to business loans rather than personal ones.

- Installment Agreement: An installment agreement allows for payments to be made over time. Like a promissory note, it specifies amounts due and payment schedules, but it may cover the purchase of goods or services rather than just a loan.

- Credit Agreement: This document outlines the terms under which credit is extended to a borrower. It shares similarities with a promissory note by detailing repayment terms but typically involves revolving credit rather than a fixed loan.

- Security Agreement: A security agreement provides collateral for a loan. While a promissory note focuses on the promise to pay, a security agreement specifies what assets back that promise.

- Debt Acknowledgment: This document confirms the existence of a debt between parties. It is similar to a promissory note in that it recognizes an obligation, but it may lack the detailed repayment terms found in a note.

- Lease Agreement: A lease agreement outlines the terms for renting property. While it primarily focuses on rental payments, it shares the structure of outlining payment terms and obligations like a promissory note does.

- Forbearance Agreement: This document allows a borrower to temporarily reduce or suspend payments. It relates to a promissory note by addressing repayment terms but often includes specific conditions for the forbearance period.

- Trailer Bill of Sale: The New York Trailer Bill of Sale form is essential for transferring ownership of a trailer, providing crucial details of the transaction to protect both parties. For more information, visit PDF Templates Online.

- Settlement Agreement: A settlement agreement resolves a dispute, often involving a payment. Similar to a promissory note, it establishes an obligation to pay, but it usually results from negotiations rather than a straightforward loan.

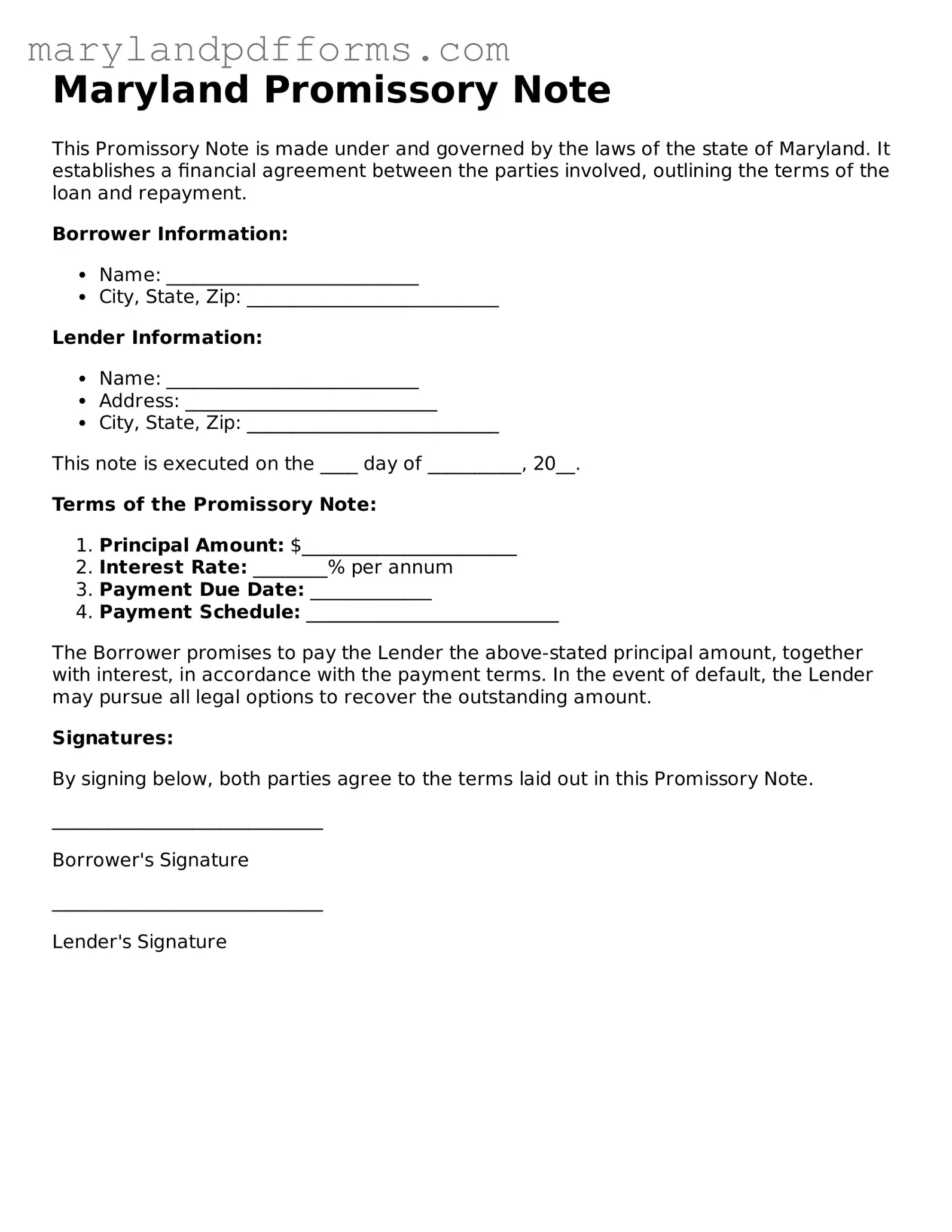

Maryland Promissory Note - Usage Steps

Once you have the Maryland Promissory Note form in front of you, it is essential to complete it accurately. This ensures that both parties understand their obligations. Follow the steps below to fill out the form correctly.

- Start with the date. Write the date when the note is being executed at the top of the form.

- Identify the borrower. Enter the full legal name and address of the person or entity borrowing the money.

- Identify the lender. Write the full legal name and address of the person or entity lending the money.

- Specify the principal amount. Clearly state the total amount of money being borrowed in both numerical and written form.

- Detail the interest rate. Indicate the interest rate that will apply to the loan, if any. Ensure it is expressed as an annual percentage rate.

- Outline the payment terms. Describe how and when the borrower will repay the loan. Include the payment schedule and any grace periods.

- Include any late fees. If applicable, specify any penalties for late payments.

- Provide collateral details. If the loan is secured by collateral, describe the collateral in detail.

- Signatures are next. Both the borrower and lender must sign and date the form. If there are witnesses or a notary, include their signatures as well.

After completing the form, ensure that all information is accurate and legible. Keep a copy for your records and provide a copy to the other party involved.

Learn More on Maryland Promissory Note

What is a Maryland Promissory Note?

A Maryland Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It specifies the amount borrowed, the interest rate, repayment schedule, and any other terms agreed upon by both parties. This document serves as a written record of the debt and is enforceable in court if necessary.

When should I use a Promissory Note?

You should consider using a Promissory Note whenever you lend or borrow money, whether it’s for personal loans, business transactions, or real estate purchases. This document provides clarity and security for both parties involved, helping to prevent misunderstandings and disputes about repayment terms.

What are the key components of a Maryland Promissory Note?

A comprehensive Promissory Note typically includes the following components:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Schedule: Details on when payments are due, including the frequency (monthly, quarterly, etc.).

- Maturity Date: The date by which the loan must be fully repaid.

- Signatures: Both the borrower and lender must sign the document to make it legally binding.

Do I need to have the Promissory Note notarized?

While notarization is not strictly required for a Promissory Note to be valid in Maryland, it is highly recommended. Having the document notarized adds an extra layer of security and helps verify the identities of the parties involved. This can be especially important if legal disputes arise later.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the Promissory Note, the lender has the right to take legal action. This may include filing a lawsuit to recover the owed amount. The Promissory Note serves as evidence in court, making it easier for the lender to prove the debt and seek repayment.

Can I modify a Promissory Note after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to create a written amendment that outlines the modifications and have both parties sign it. This ensures that all changes are documented and legally enforceable.

Where can I obtain a Maryland Promissory Note form?

You can find a Maryland Promissory Note form through various sources, including online legal document providers, local legal offices, or financial institutions. It’s important to ensure that the form you choose complies with Maryland laws and meets your specific needs.

Discover Other Forms for Maryland

Affidavit of Service - This form can be used in various legal situations, including divorces and lawsuits.

Md Assessment and Taxation - Defines the corporation's approach to ethical business practices.

Documents used along the form

When entering into a loan agreement, a Maryland Promissory Note is a crucial document that outlines the terms of repayment. However, it is often accompanied by other important forms and documents that help clarify the agreement and protect the interests of both parties involved. Below is a list of some common forms that are frequently used alongside the Maryland Promissory Note.

- Loan Agreement: This document details the specific terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a comprehensive outline of the expectations and obligations of both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, a security agreement is necessary. This document specifies the assets that back the loan and outlines the lender's rights in case of default. It provides clarity on what can be seized if the borrower fails to repay.

- Disclosure Statement: Lenders often provide a disclosure statement that outlines the total cost of the loan, including fees, interest rates, and any other charges. This document ensures transparency and helps borrowers understand the full financial implications of their agreement.

- Personal Guarantee: In some cases, a personal guarantee may be required, especially for business loans. This document holds an individual personally responsible for the debt if the borrowing entity defaults. It adds an extra layer of security for the lender.

Understanding these accompanying documents can enhance your grasp of the lending process and ensure that all parties are on the same page. Each form plays a vital role in establishing a clear and enforceable agreement, fostering a sense of trust and accountability between the lender and borrower.

Key takeaways

When filling out and using the Maryland Promissory Note form, several important considerations should be kept in mind.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender to avoid confusion.

- Specify the Loan Amount: Indicate the exact amount of money being borrowed to ensure clarity in repayment obligations.

- Outline the Interest Rate: Include the interest rate, if applicable, to define the cost of borrowing. Ensure it complies with Maryland’s usury laws.

- Set the Repayment Terms: Detail the repayment schedule, including due dates and payment amounts, to establish a clear timeline.

- Include Default Terms: Specify what constitutes a default and the consequences, which may include late fees or acceleration of the loan.

- Signatures Required: Ensure that both parties sign and date the document to validate the agreement and make it legally binding.

Misconceptions

Understanding the Maryland Promissory Note form is crucial for both lenders and borrowers. However, several misconceptions often arise. Here are seven common misunderstandings:

- All Promissory Notes Are the Same: Many believe that all promissory notes follow a universal format. In reality, each state has its own requirements and nuances, making the Maryland version distinct.

- A Promissory Note Must Be Notarized: Some think that notarization is mandatory for a promissory note to be valid. In Maryland, notarization is not a requirement, although it can provide additional legal protection.

- Only Written Notes Are Valid: There's a misconception that only handwritten or printed notes hold legal weight. However, electronic promissory notes can also be enforceable under Maryland law, provided they meet certain criteria.

- Interest Rates Are Unlimited: Some borrowers assume that lenders can charge any interest rate they desire. Maryland law does impose limits on interest rates to protect consumers from predatory lending practices.

- Defaulting on a Promissory Note Has No Consequences: Many individuals think that failing to repay a promissory note will not lead to serious repercussions. In truth, defaulting can result in legal action and damage to one’s credit score.

- Promissory Notes Are Only for Large Loans: There's a belief that promissory notes are only necessary for significant amounts of money. However, they can be used for any loan amount, regardless of size.

- Once Signed, a Promissory Note Cannot Be Changed: Some assume that the terms of a promissory note are set in stone once signed. Modifications can be made if both parties agree to the changes and document them properly.

Being aware of these misconceptions can help individuals navigate the process of creating or signing a promissory note in Maryland more effectively.