Free Operating Agreement Document for the State of Maryland

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the rules and procedures for managing a corporation. They define roles, responsibilities, and the decision-making process within the organization.

- Partnership Agreement: This document governs the relationships between partners in a business. Like an Operating Agreement, it specifies each partner's contributions, rights, and obligations.

- Shareholder Agreement: This agreement is used by corporations to manage the relationship between shareholders. It addresses voting rights, share transfers, and other important governance issues, similar to how an Operating Agreement manages member relations.

- LLC Membership Certificate: This document serves as proof of ownership in an LLC. While the Operating Agreement details the operational aspects, the membership certificate confirms individual ownership interests.

- Business Plan: A business plan outlines the strategy and goals of a company. Although it is more focused on future planning, it complements the Operating Agreement by providing a roadmap for the business's direction.

- Employment Agreement: This document sets the terms of employment for individuals within a business. It shares similarities with an Operating Agreement by outlining roles and responsibilities but is more focused on employee relations.

- Motorcycle Bill of Sale: This form is essential for documenting the transfer of motorcycle ownership in New York, ensuring legality and clarity in the transaction process. For comprehensive templates, visit PDF Templates Online.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared between parties. Like an Operating Agreement, it establishes clear expectations and obligations, albeit in the context of confidentiality.

- Indemnification Agreement: This document outlines the circumstances under which one party will compensate another for certain damages or losses. It parallels the Operating Agreement in that it defines responsibilities and protections for members.

- Asset Purchase Agreement: Used when acquiring assets from another business, this agreement details the terms of the transaction. It is similar to an Operating Agreement in that it specifies rights and responsibilities related to ownership and management.

Maryland Operating Agreement - Usage Steps

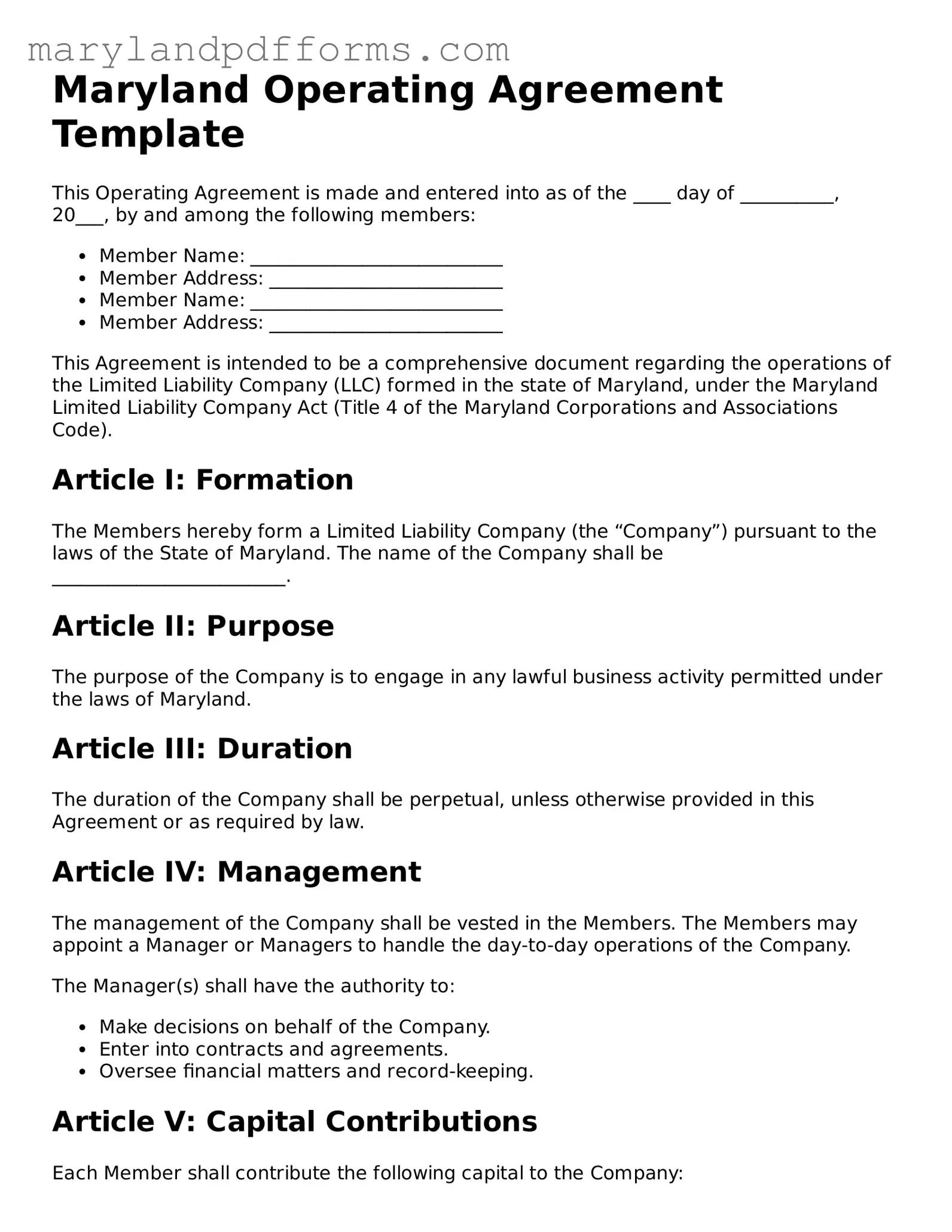

After you gather the necessary information, you can begin filling out the Maryland Operating Agreement form. This document is essential for outlining the structure and management of your business. Follow these steps to ensure you complete the form accurately.

- Begin with the name of your LLC. Write the full legal name as registered with the state.

- Next, provide the principal office address. This should be the main location where your business operates.

- List the names and addresses of all members. Include each member's full name and their corresponding address.

- Specify the management structure of the LLC. Indicate whether it will be managed by members or appointed managers.

- Outline the purpose of your LLC. Describe the nature of your business activities in a few sentences.

- Detail the contributions of each member. Include any cash, property, or services that members will contribute to the LLC.

- Explain the distribution of profits and losses. Clearly state how profits and losses will be shared among members.

- Include provisions for adding or removing members. Describe the process for admitting new members or for the withdrawal of existing ones.

- Sign and date the document. Ensure all members sign the agreement to validate it.

Once you have completed the form, keep a copy for your records. You may need to refer to it later as your business evolves.

Learn More on Maryland Operating Agreement

What is a Maryland Operating Agreement?

A Maryland Operating Agreement is a legal document that outlines the internal management structure and operating procedures of a limited liability company (LLC) in Maryland. It serves as a foundational blueprint for how the business will be run, detailing the roles and responsibilities of members, decision-making processes, and how profits and losses will be distributed. While not required by law, having an Operating Agreement is highly recommended to prevent misunderstandings and disputes among members.

Why should I create an Operating Agreement for my LLC?

Creating an Operating Agreement is essential for several reasons:

- Clarifies Roles: It defines the roles and responsibilities of each member, ensuring everyone understands their contributions.

- Prevents Disputes: By outlining procedures for decision-making and conflict resolution, it can help avoid disputes down the line.

- Legal Protection: An Operating Agreement can help maintain your LLC's limited liability status, protecting personal assets from business debts.

- Customizes Operations: It allows members to tailor the management structure and operational procedures to fit their unique needs.

What should be included in a Maryland Operating Agreement?

A comprehensive Maryland Operating Agreement typically includes the following key components:

- Company Information: Name, principal address, and purpose of the LLC.

- Member Details: Names and addresses of all members, along with their ownership percentages.

- Management Structure: Whether the LLC will be member-managed or manager-managed, and the powers of each.

- Voting Rights: Procedures for voting on important matters, including the percentage of votes needed for decisions.

- Profit Distribution: How profits and losses will be allocated among members.

- Amendment Procedures: How the Operating Agreement can be modified in the future.

Do I need a lawyer to draft my Operating Agreement?

While it is not mandatory to hire a lawyer to draft your Operating Agreement, consulting with one can provide significant benefits. A lawyer can ensure that the document complies with Maryland laws and addresses specific needs unique to your business. If your LLC has multiple members or complex operations, professional guidance can help prevent potential pitfalls and ensure all members are adequately protected.

How do I file my Operating Agreement with the state?

Interestingly, you do not need to file your Operating Agreement with the state of Maryland. Instead, this document is kept internally among the members of the LLC. It is crucial, however, to maintain a copy of the Operating Agreement with your business records, as it may be required for banking purposes, legal disputes, or when applying for licenses and permits.

Can I change my Operating Agreement after it has been created?

Yes, you can modify your Operating Agreement after it has been established. The process for making changes should be outlined in the original document. Typically, amendments require a vote from the members, and the changes should be documented in writing. This ensures that all members are aware of the new terms and agree to them, maintaining clarity and cohesion within the LLC.

Discover Other Forms for Maryland

Maryland Excise Tax - Many states require a Bill of Sale for registering a newly purchased motorcycle.

When completing a transaction, it is essential to utilize a Bill of Sale form to ensure all details are documented clearly. For those in Colorado, you can find a reliable template at https://coloradoformpdf.com/, which will help you to efficiently outline the essential elements of the sale, providing protection and clarity for both the seller and buyer throughout the process.

Maryland Atv Laws - A straightforward way to document the sale of your off-road vehicle.

Title Mobile Home - Enhances the overall transaction experience with clear documentation.

Documents used along the form

When forming a Limited Liability Company (LLC) in Maryland, the Operating Agreement is a crucial document. However, several other forms and documents are often used in conjunction with it to ensure compliance with state laws and to establish clear guidelines for the operation of the business. Below is a list of essential documents that may be needed alongside the Maryland Operating Agreement.

- Articles of Organization: This is the foundational document that officially creates your LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Member Information Form: This document collects details about each member of the LLC, including their contributions and ownership percentages. It helps clarify roles within the company.

- ADP Pay Stub: Understanding the components of the topformsonline.com/adp-pay-stub/ form is essential for employees to manage their finances accurately, as it summarizes their earnings and deductions for a specific pay period.

- Bylaws: While not required for LLCs, bylaws can outline the internal management structure and procedures of the company. They serve as a guide for decision-making and governance.

- Initial Resolution: This document records the decisions made by the members at the formation of the LLC, such as appointing officers or approving the Operating Agreement.

- Employer Identification Number (EIN) Application: This form is needed to obtain an EIN from the IRS, which is essential for tax purposes and hiring employees.

- Business License Application: Depending on your business type and location, you may need to apply for specific licenses or permits to legally operate your LLC.

- Operating Agreement Amendments: If changes occur in the future, amendments to the Operating Agreement are necessary to reflect new agreements among members or changes in business structure.

- Membership Certificates: These certificates can be issued to members as proof of their ownership interest in the LLC, providing a tangible representation of their stake in the company.

- Annual Reports: Maryland requires LLCs to file annual reports to maintain good standing. This document updates the state on the LLC's status and any changes in membership or management.

Utilizing these documents in conjunction with the Maryland Operating Agreement will help ensure that your LLC operates smoothly and remains compliant with state regulations. Always consider consulting with a professional to tailor these documents to your specific business needs.

Key takeaways

When filling out and using the Maryland Operating Agreement form, it is essential to keep several key points in mind. Here are ten important takeaways:

- Understand the Purpose: An Operating Agreement outlines the management structure and operating procedures of your LLC. It serves as a crucial document for both members and potential investors.

- Member Information: Clearly list all members of the LLC, including their names and addresses. This information is vital for legal identification.

- Ownership Percentages: Specify each member's ownership percentage. This detail is critical for profit distribution and decision-making authority.

- Management Structure: Decide if the LLC will be member-managed or manager-managed. This choice impacts how daily operations are conducted.

- Voting Rights: Define the voting rights of each member. This should correlate with ownership percentages unless otherwise agreed upon.

- Profit and Loss Distribution: Outline how profits and losses will be shared among members. This can differ from ownership percentages if agreed upon.

- Meetings: Establish guidelines for regular meetings, including frequency and notification procedures. Consistent communication is key to effective management.

- Amendments: Include a process for amending the Operating Agreement. Flexibility is necessary as the business evolves.

- Dispute Resolution: Outline how disputes among members will be resolved. Consider mediation or arbitration to avoid lengthy legal battles.

- Compliance: Ensure that the Operating Agreement complies with Maryland state laws. Regularly review the document to stay aligned with any legal changes.

By following these takeaways, you can create a comprehensive and functional Operating Agreement that meets the needs of your LLC.

Misconceptions

When it comes to the Maryland Operating Agreement form, there are several misconceptions that can lead to confusion. Understanding these myths can help ensure that business owners are making informed decisions. Here are four common misconceptions:

- It’s only necessary for large businesses. Many people believe that operating agreements are only for big companies. In reality, even small businesses or single-member LLCs can benefit from having a clear operating agreement. It outlines the structure and management of the business, which can prevent misunderstandings later on.

- Operating agreements are required by law. Some individuals think that having an operating agreement is a legal requirement in Maryland. While it’s not mandatory, having one is highly recommended. It provides clarity and can protect the interests of the members involved.

- Once it’s created, it can’t be changed. Another misconception is that an operating agreement is set in stone. In fact, these agreements can be amended as the business grows and changes. Regular reviews and updates ensure that the agreement remains relevant and effective.

- All operating agreements are the same. Many assume that there is a one-size-fits-all template for operating agreements. However, each agreement should be tailored to fit the specific needs and goals of the business. Customization is key to addressing unique circumstances and requirements.

By addressing these misconceptions, business owners can better navigate the complexities of their operating agreements and set their ventures up for success.