Blank Maryland W4 Template

Similar forms

- IRS Form W-4: This form is used by employees to indicate their tax situation to their employer. Like the Maryland W4, it helps determine the amount of federal income tax to withhold from paychecks.

- Virginia Form VA-4: Similar to the Maryland W4, this form is used by Virginia employees to claim exemptions and determine state tax withholding.

- Pennsylvania Form REV-419: This document allows Pennsylvania employees to claim exemptions from state withholding. It serves a similar purpose as the Maryland W4 for residents of Pennsylvania working in Maryland.

- New Jersey Form W-4: This form is used by New Jersey employees to report their tax situation. It is similar to the Maryland W4 in that it helps employers calculate state tax withholding.

- California Form DE 4: Employees in California use this form to claim personal allowances and exemptions for state withholding. Its function parallels that of the Maryland W4.

- Massachusetts Form M-4: This document allows Massachusetts employees to claim exemptions from state income tax withholding, similar to the Maryland W4.

- Illinois Form IL-W-4: Employees in Illinois use this form to indicate their withholding allowances, much like the Maryland W4 does for Maryland residents.

- Texas Form W-4: Although Texas does not have a state income tax, this form is used for federal withholding. It serves a similar role as the Maryland W4 in managing tax withholdings.

- Florida Form W-4: Like Texas, Florida does not have a state income tax, but this form is used for federal tax purposes. It reflects similar principles as the Maryland W4.

Maryland W4 - Usage Steps

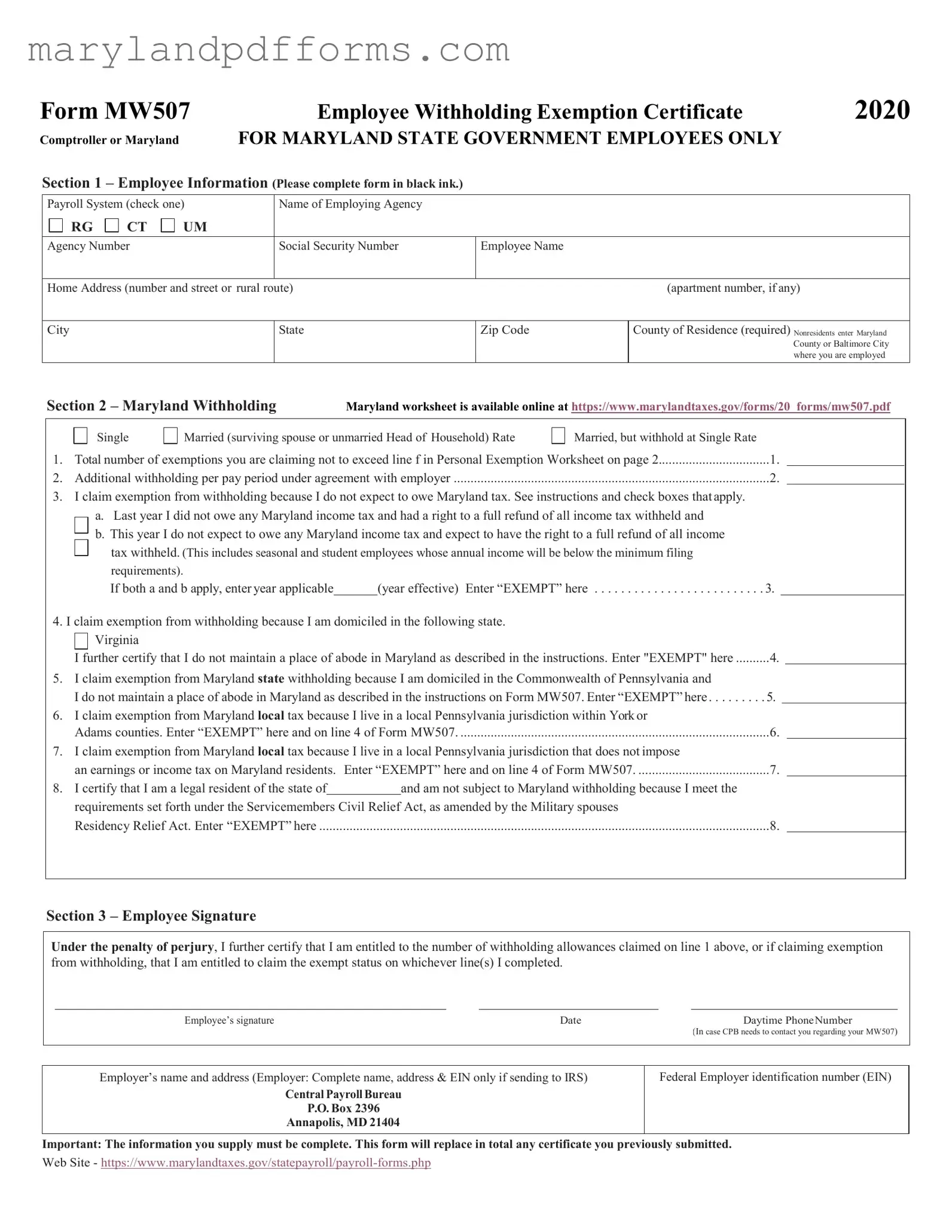

Completing the Maryland W4 form, also known as Form MW507, is essential for ensuring that the correct amount of state income tax is withheld from your paycheck. After filling out the form, submit it to your employer, who will use the information to adjust your withholding accordingly. Follow these steps to accurately fill out the form.

- Begin by writing your employee information in Section 1. Use black ink to fill in your name, Social Security number, home address, and the county where you reside. If you are a nonresident, indicate the Maryland county or Baltimore City where you are employed.

- In Section 2, select your marital status by checking the appropriate box: Single, Married (surviving spouse or unmarried Head of Household), or Married but withholding at the Single Rate.

- Enter the total number of exemptions you are claiming on line 1. Ensure this does not exceed the limit specified in the Personal Exemption Worksheet.

- If applicable, provide any additional withholding amount per pay period as agreed with your employer on line 2.

- If you believe you qualify for an exemption from withholding, check the relevant boxes and provide the necessary information as indicated in lines 3 through 8. Be sure to enter "EXEMPT" where required.

- In Section 3, sign and date the form. This confirms that the information you provided is accurate and that you are entitled to the exemptions claimed.

- Finally, include your daytime phone number in case your employer needs to contact you regarding the form.

Once completed, hand the form to your employer. They will process it and adjust your tax withholding based on the information provided. For further assistance or to access the form online, visit the Maryland State Government's tax website.

Learn More on Maryland W4

-

What is the Maryland W4 form?

The Maryland W4 form, officially known as Form MW507, is an Employee Withholding Exemption Certificate. It is used by employees in Maryland to determine the amount of state income tax withholding from their paychecks.

-

Who needs to fill out the Maryland W4 form?

Any employee working in Maryland must complete the Maryland W4 form if they want to claim exemptions from state tax withholding or if they wish to adjust their withholding allowances. This includes both residents and non-residents employed in Maryland.

-

How do I complete the Maryland W4 form?

To complete the form, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your marital status and the number of exemptions you are claiming.

- If applicable, check the boxes for any exemptions you qualify for.

- Sign and date the form before submitting it to your employer.

-

What if I am exempt from Maryland withholding?

If you believe you are exempt from Maryland withholding, you must indicate this on the form. You should check the appropriate boxes and provide the necessary information to support your claim for exemption.

-

Can I change my exemptions later?

Yes, you can change your exemptions at any time. Simply complete a new Maryland W4 form and submit it to your employer. This will replace any previous forms you submitted.

-

What happens if I don’t submit a Maryland W4 form?

If you do not submit a Maryland W4 form, your employer will withhold taxes at the default rate. This may result in higher withholding than necessary, which could affect your take-home pay.

-

Where can I find the Maryland W4 form?

You can download the Maryland W4 form from the Maryland Comptroller's website. The direct link to the form is here .

-

What should I do if I have questions about the form?

If you have questions about completing the Maryland W4 form, you should contact your employer's payroll department. They can provide guidance specific to your situation.

-

Is the Maryland W4 form the same as the federal W4 form?

No, the Maryland W4 form is specific to Maryland state taxes, while the federal W4 form is used for federal income tax withholding. Both forms serve similar purposes but are used for different tax jurisdictions.

-

How often should I review my Maryland W4 form?

It is advisable to review your Maryland W4 form whenever you experience a significant life change, such as marriage, divorce, or a change in income. Regular reviews ensure that your withholding aligns with your current tax situation.

Additional PDF Forms

Tax Id Number Lookup Maryland - The application inquires about the reason for applying; multiple options can be selected.

Statement of Charges Maryland - This form can lead to the criminal charges being pressed against the accused.

Documents used along the form

When filling out the Maryland W4 form, also known as the MW507, several other forms and documents may be needed to ensure accurate tax withholding. These documents help clarify your tax situation and provide necessary information to your employer. Here are some common forms that often accompany the Maryland W4:

- Federal W-4 Form: This is the federal version of the withholding allowance certificate. It helps employers determine how much federal income tax to withhold from your paycheck. Completing this form is essential for federal tax purposes.

- Personal Exemption Worksheet: This worksheet assists you in calculating the number of exemptions you can claim on your Maryland W4. It ensures that you do not withhold too much or too little tax based on your personal situation.

- Maryland MW507A: This form is used for employees who claim exemption from Maryland withholding. It provides additional information about your residency status and tax obligations, particularly for those living in neighboring states.

- State Tax Return: Your previous year’s Maryland state tax return can help you determine your current withholding needs. It shows your tax liability and whether you received a refund or owed money, which can guide your decisions on exemptions.

- Residential Lease Agreement: Familiarity with the PDF Templates Online can provide essential insights into the terms and conditions between landlords and tenants, helping to prevent disputes in rental situations.

- Proof of Residency: If you are claiming exemption from Maryland taxes due to residency in another state, you may need to provide documentation proving your residency. This can include utility bills, lease agreements, or other official documents.

Understanding these forms can simplify the tax withholding process and ensure that you comply with state and federal regulations. Taking the time to gather the necessary documents can save you from potential issues down the line.

Key takeaways

When filling out and using the Maryland W4 form, also known as Form MW507, it is essential to understand its purpose and requirements. Here are seven key takeaways:

- Personal Information: Ensure that all personal information, including your name, address, and Social Security number, is accurately completed. Use black ink for clarity.

- Exemptions: You can claim a certain number of exemptions, but it should not exceed the limit specified in the Personal Exemption Worksheet. This worksheet is available online for reference.

- Additional Withholding: If you and your employer agree on additional withholding, specify that amount in the appropriate section of the form.

- Exemption Claims: You may claim exemption from withholding if you did not owe Maryland tax last year and do not expect to owe this year. Make sure to check the relevant boxes and provide the applicable year.

- Domicile Considerations: If you reside in another state, such as Virginia or Pennsylvania, and do not maintain a place of abode in Maryland, you can claim exemption from Maryland withholding. Clearly indicate your state of domicile.

- Signature Requirement: The form must be signed by the employee under penalty of perjury, confirming the accuracy of the information provided and the entitlement to the claimed exemptions.

- Employer Information: If submitting the form to the IRS, your employer must provide their name, address, and Employer Identification Number (EIN). Ensure this information is complete to avoid processing delays.

By following these guidelines, employees can effectively complete the Maryland W4 form, ensuring compliance with state tax regulations.

Misconceptions

- Misconception 1: The Maryland W4 form is the same as the federal W4 form.

- Misconception 2: Only Maryland residents need to fill out the MW507 form.

- Misconception 3: If I claim exemptions on the MW507, I will never owe taxes.

- Misconception 4: The number of exemptions claimed on the MW507 directly affects my take-home pay.

- Misconception 5: Once I submit the MW507, I cannot change my exemptions.

- Misconception 6: The MW507 form is only for full-time employees.

This is incorrect. The Maryland W4 form, known as MW507, is specifically for state income tax withholding. While both forms serve similar purposes, they are distinct and tailored to their respective tax jurisdictions.

This is misleading. Nonresidents who work in Maryland and earn income are also required to complete the MW507 form for withholding purposes. They must indicate their county of employment and any applicable exemptions.

This is a common misunderstanding. Claiming exemptions means you believe you will not owe state taxes for the year. However, if your income changes or you do not meet the exemption criteria, you may still owe taxes when you file your return.

While the number of exemptions does influence the amount withheld from your paycheck, it does not directly correlate with your overall tax liability. It's essential to accurately assess your tax situation to avoid under-withholding.

This is false. You can update your MW507 form at any time during the year if your personal or financial situation changes. It is advisable to do so to ensure proper withholding.

This misconception overlooks the fact that part-time employees, seasonal workers, and even students earning income in Maryland must also complete the MW507 form. Any individual earning taxable income in the state should ensure compliance.