Blank Maryland Tax 766 Template

Similar forms

- Form W-4: Similar to the Maryland Tax 766 form, Form W-4 is used by employees to indicate their federal income tax withholding preferences. Both forms allow individuals to specify the number of allowances and any additional amount they wish to have withheld from their payments.

- Form W-4P: This form is specifically for pension and annuity payments, allowing recipients to elect federal tax withholding. Like the Maryland Tax 766, it requires the designation of allowances and provides options for additional withholding.

- Form 1099-R: This document reports distributions from pensions and annuities, including the total amount withheld for federal taxes. It complements the Maryland Tax 766 by providing a summary of the withholding choices made by the retiree throughout the year.

- Form 1040-ES: This form is used for estimated tax payments. Similar to the Maryland Tax 766, it addresses tax obligations for individuals who may not have sufficient withholding from their pensions or other income sources.

- Form 4852: This is a substitute for Form W-2 or 1099-R when those forms are not received. It serves a similar purpose in reporting income and withholding, ensuring taxpayers can accurately report their income, including pension payments.

- Form 1040: The standard individual income tax return form, which summarizes all income, including pensions. It relates to the Maryland Tax 766 as both deal with tax obligations and reporting for individuals receiving retirement income.

- Form 8888: This form allows individuals to allocate their tax refund to multiple accounts. While it serves a different purpose, it is similar in that it involves managing tax-related financial decisions, much like the Maryland Tax 766 manages withholding preferences.

- Form 8606: This form is used to report nondeductible contributions to traditional IRAs. It relates to the Maryland Tax 766 in that both forms deal with retirement accounts and the tax implications of withdrawals or distributions.

Maryland Tax 766 - Usage Steps

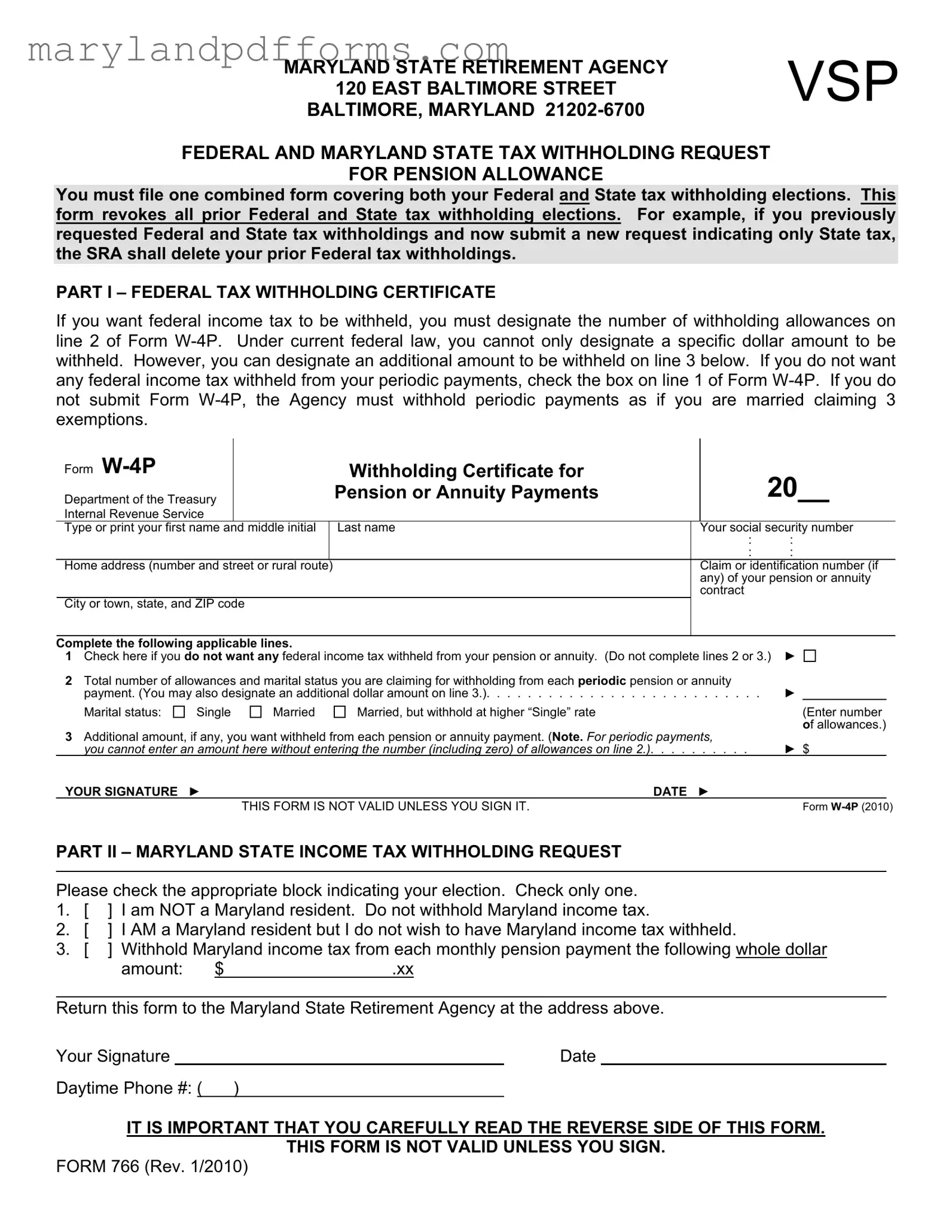

Completing the Maryland Tax 766 form is essential for managing your federal and state tax withholding on pension payments. Follow these steps carefully to ensure accurate submission.

- Obtain the Maryland Tax 766 form from the Maryland State Retirement Agency's website or by contacting their office.

- Begin with Part I – Federal Tax Withholding Certificate. Fill in your first name, middle initial, last name, and Social Security number at the top of the form.

- Provide your home address, including the street number, city or town, state, and ZIP code.

- If applicable, enter your claim or identification number for your pension or annuity contract.

- On line 1, check the box if you do not want any federal income tax withheld from your pension payments. If you check this box, skip lines 2 and 3.

- If you want federal income tax withheld, enter the total number of allowances you are claiming on line 2. Indicate your marital status by checking the appropriate box (Single, Married, or Married but withholding at a higher “Single” rate).

- If you wish to designate an additional amount to be withheld, enter that amount on line 3.

- Sign and date the form at the bottom of Part I. Remember, the form is not valid without your signature.

- Move to Part II – Maryland State Income Tax Withholding Request. Check only one box to indicate your tax withholding preference:

- I am NOT a Maryland resident and do not want Maryland income tax withheld.

- I AM a Maryland resident but do not wish to have Maryland income tax withheld.

- Withhold Maryland income tax from each monthly pension payment for a specified whole dollar amount.

- Sign and date this section as well. Include your daytime phone number for any follow-up communication.

- Return the completed form to the Maryland State Retirement Agency at the address provided on the form.

After submitting the form, it will be processed by the Maryland State Retirement Agency. Ensure you keep a copy for your records. If your tax situation changes, you can file a new request to adjust your withholding preferences at any time.

Learn More on Maryland Tax 766

What is the Maryland Tax 766 form used for?

The Maryland Tax 766 form is a combined request for federal and state tax withholding related to pension allowances. It allows retirees to specify how much tax they want withheld from their pension payments. By submitting this form, retirees can revoke any previous withholding elections they made for both federal and state taxes.

Who needs to complete the Maryland Tax 766 form?

Any retiree receiving pension payments from the Maryland State Retirement and Pension System should complete the Maryland Tax 766 form. This includes individuals who want to adjust their federal or Maryland state tax withholding or those who wish to opt out of withholding altogether. It is essential for ensuring that the correct amount of taxes is withheld from pension payments.

How do I fill out the federal tax withholding section of the form?

In Part I of the form, you will need to complete the Federal Tax Withholding Certificate (Form W-4P). Here’s how to do it:

- Check the box if you do not want any federal income tax withheld.

- Indicate the number of allowances you are claiming on line 2 and specify your marital status.

- If you want an additional amount withheld, enter that amount on line 3.

Make sure to sign and date the form at the bottom. If you do not submit this form, federal taxes will be withheld as if you are married claiming three exemptions.

Can I change my withholding elections after submitting the form?

Yes, you can change your withholding elections at any time by submitting a new Maryland Tax 766 form. Any new submission will revoke previous elections, so it’s important to ensure that your new choices are clearly indicated. Keep in mind that your new elections will remain in effect until you decide to change them again.

What happens if I do not submit the Maryland Tax 766 form?

If you do not submit the Maryland Tax 766 form, the Maryland State Retirement Agency is required to withhold taxes as if you are married and claiming three exemptions. This could result in higher withholding than you might prefer. Additionally, you may miss the opportunity to tailor your withholding to better fit your financial situation.

Where should I send the completed Maryland Tax 766 form?

Once you have completed the Maryland Tax 766 form, return it to the Maryland State Retirement Agency at the following address:

- Maryland State Retirement Agency

- 120 East Baltimore Street

- Baltimore, Maryland 21202-6700

Make sure to keep a copy for your records before sending it off.

Additional PDF Forms

Maryland Snap Redetermination Form - Responding to all questions thoroughly helps prevent delays in approval for medical assistance.

Mdnewhire - An optional middle initial can be included for clarity on the employee's identity.

Documents used along the form

The Maryland Tax 766 form is used to request federal and state tax withholding for pension allowances. Several other forms and documents are commonly used in conjunction with this form to ensure accurate tax reporting and compliance. Below is a list of these related documents.

- Form W-4P: This form is the Withholding Certificate for Pension or Annuity Payments. It allows retirees to indicate how much federal income tax should be withheld from their pension payments. The retiree can choose the number of allowances or specify an additional amount to be withheld.

- Form 1040-ES: This is the Estimated Tax for Individuals form. It is used by individuals who need to make estimated tax payments throughout the year. Retirees may use this form if they expect to owe tax and do not have enough tax withheld from their pension.

- Form 1099-R: This form reports distributions from pensions, annuities, retirement plans, and other similar sources. By January 31 of the following year, retirees receive this form showing the total pension payments received and the amount of federal tax withheld.

- New York Residential Lease Agreement: Essential for any landlord or tenant, this legal document outlines terms and responsibilities to avoid disputes. For more information on this important form, visit PDF Templates Online.

- Form W-8BEN: This form is used by foreign individuals to certify their foreign status for U.S. tax withholding purposes. Foreign retirees may need to submit this form to ensure the correct withholding rate applies to their pension payments.

These forms and documents help ensure that retirees meet their tax obligations while receiving their pension benefits. It is important to complete them accurately and submit them in a timely manner to avoid potential penalties or issues with tax compliance.

Key takeaways

Here are some important points to keep in mind when filling out and using the Maryland Tax 766 form:

- Combined Form: You must complete one form for both Federal and Maryland state tax withholding elections. Submitting a new request cancels any prior elections.

- Federal Tax Withholding: You can choose to have federal income tax withheld by indicating the number of allowances on Form W-4P. If you prefer no withholding, simply check the designated box.

- Maryland State Tax Withholding: As a Maryland resident, you have options. You can opt out of withholding or specify a dollar amount to be deducted from your pension payments.

- Signature Required: Make sure to sign the form. It is not valid without your signature.

- Changes to Elections: You can change or revoke your withholding choices at any time by submitting a new form.

- Seek Assistance: If you need help, contact the Internal Revenue Service or a tax consultant. The Maryland State Retirement Agency cannot assist with tax return preparation.

Misconceptions

Understanding the Maryland Tax 766 form can be challenging. Here are eight common misconceptions that may lead to confusion:

- It only applies to Maryland residents. Many believe the form is only for Maryland residents. In fact, non-residents can also use the form to request withholding exemptions.

- Filing the form is optional. Some retirees think they can ignore the form. However, if they do not file it, the agency will withhold taxes as if they are married claiming three exemptions.

- Only federal taxes are withheld. There is a misconception that only federal taxes are relevant. Both federal and Maryland state taxes can be withheld based on the elections made on the form.

- Once submitted, the elections are permanent. Many retirees assume their choices remain unchanged forever. In reality, they can revoke or change their elections at any time by submitting a new form.

- The form is only for pension payments. Some individuals think the form applies only to pension payments. It also applies to annuity payments and other retirement distributions.

- Only specific dollar amounts can be withheld. There is a belief that individuals can only choose a fixed dollar amount. However, they can also designate the number of allowances and request additional amounts to be withheld.

- There are no penalties for insufficient withholding. Many retirees are unaware that failing to withhold enough taxes can result in penalties. It is important to monitor withholding to avoid unexpected tax liabilities.

- Help is available from the Maryland State Retirement Agency. Some individuals think they can get tax advice from the agency. However, the agency cannot assist with tax return preparation or provide tax advice.

Clarifying these misconceptions can help retirees make informed decisions regarding their tax withholding choices.