Blank Maryland State Claim Template

Similar forms

- Insurance Claim Form: Similar to the Maryland State Claim form, an insurance claim form is used to request reimbursement for medical expenses from an insurance company. Both require detailed patient information and documentation of services rendered.

- Residential Lease Agreement Form: The PDF Templates Online provides essential resources for drafting lease agreements, ensuring both landlords and tenants have clear expectations and legal protections in place.

- Medicare Claim Form: This form is utilized to file claims for medical services covered by Medicare. Like the Maryland State Claim form, it requires patient details, treatment descriptions, and proof of services received.

- Health Savings Account (HSA) Claim Form: Individuals use this form to withdraw funds from their HSA for qualified medical expenses. Both forms require itemized bills and details about the services provided.

- Workers' Compensation Claim Form: This document is submitted to claim benefits for work-related injuries. It shares similarities with the Maryland State Claim form in that it asks for details about the injury, treatment, and related expenses.

- Auto Accident Claim Form: Used to seek compensation for medical expenses resulting from an automobile accident, this form requires similar information about the accident and medical treatment, akin to the Maryland State Claim form.

- Flexible Spending Account (FSA) Claim Form: This form is used to request reimbursement for eligible medical expenses from an FSA. Both forms require detailed information about the patient and the services for which reimbursement is sought.

- Supplemental Insurance Claim Form: This form is submitted to secondary insurance providers to cover costs not paid by primary insurance. It mirrors the Maryland State Claim form in its need for comprehensive patient and treatment information.

Maryland State Claim - Usage Steps

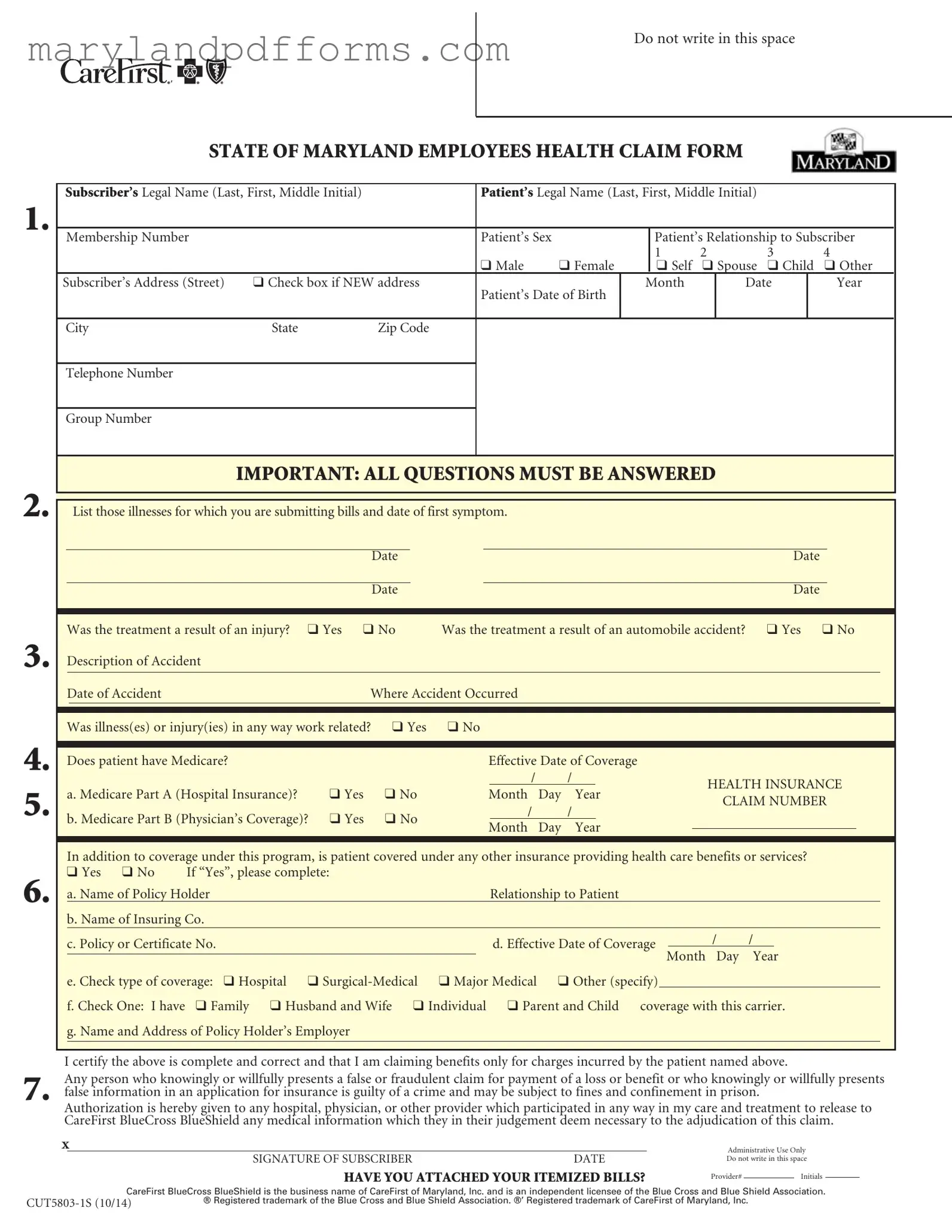

Completing the Maryland State Claim form is a crucial step in ensuring that your health care expenses are reimbursed. After filling out this form, you will submit it along with any necessary documentation to the appropriate address. It is important to provide accurate information to avoid delays in processing your claim.

- Subscriber's Legal Name: Enter your last name, first name, and middle initial.

- Patient's Legal Name: Provide the patient's last name, first name, and middle initial.

- Membership Number: Fill in your membership number as it appears on your health insurance card.

- Patient's Sex: Check the appropriate box for male or female.

- Patient's Relationship to Subscriber: Indicate whether the patient is yourself, a spouse, child, or other.

- Subscriber's Address: Write your street address. If you have a new address, check the box provided.

- Patient's Date of Birth: Enter the patient's birth date in the format of month, date, and year.

- City, State, Zip Code: Fill in your city, state, and zip code.

- Telephone Number: Provide a contact number.

- Group Number: Enter your group number if applicable.

- List of Illnesses: Specify the illnesses for which you are submitting bills along with the date of the first symptom.

- Injury Treatment: Indicate whether the treatment was due to an injury by checking 'Yes' or 'No.'

- Automobile Accident: Indicate if the treatment was a result of an automobile accident.

- Description of Accident: Provide details about the accident, including the date and location.

- Work-Related Illness/Injury: State if the illness or injury was work-related.

- Medicare Coverage: Indicate if the patient has Medicare and provide the effective date of coverage.

- Other Insurance: If the patient has other insurance, complete the additional information requested, including the policy holder's name and relationship to the patient.

- Certification: Sign and date the form to certify that the information provided is complete and correct.

- Attach Bills: Ensure you have attached itemized bills for the services provided.

Learn More on Maryland State Claim

What is the purpose of the Maryland State Claim form?

The Maryland State Claim form is designed for members of the State Employees Health Plan to submit claims for health care services received. This includes claims for services rendered by non-participating providers, as participating providers typically bill CareFirst BlueCross BlueShield directly. The form ensures that all necessary information is collected for processing the claim efficiently.

What information is required to complete the claim form?

To complete the claim form, the following information must be provided:

- Subscriber’s and patient’s legal names

- Membership number and group number

- Patient’s date of birth and sex

- Details about the illness or injury, including dates of symptoms

- Information regarding any other insurance coverage

- Itemized bills from the provider

All questions on the form must be answered to avoid delays in processing.

What types of bills need to be submitted with the claim form?

When submitting a claim, it is essential to attach itemized bills that include:

- Provider’s full name, degree, address, and phone number

- Patient’s full name and descriptions of services provided

- The date each service was rendered

- The provider’s diagnosis or the patient’s chief complaint

- The total amount charged for each service

Additionally, any bills in a foreign language must be translated into English, and foreign currency should be converted to U.S. dollars.

What should I do if I have other insurance coverage?

If the patient has other insurance coverage, including Medicare, it is important to submit a copy of the payment statement from that insurance carrier along with the claim. This statement may be referred to as an “Explanation of Benefits” or “Summary of Benefits.” Providing this information helps ensure that the claim is processed accurately and promptly.

How can I ensure my claim is processed without delays?

To avoid delays in processing your claim, ensure the following:

- All sections of the claim form are accurately completed.

- Itemized bills are included and meet the specified requirements.

- Only one claim form is submitted per patient.

- Any required pre-authorizations are obtained, especially for specific therapies.

Keeping a copy of your submitted claim and bills for your records is also advisable.

Additional PDF Forms

Maryland Charitable Registration - A declaration statement is included to affirm the accuracy of the information reported.

Requirements for Open Work Permit in Canada - A valid Maryland driver’s license is an acceptable form of identification.

Documents used along the form

When filing a claim with the Maryland State Employees Health Claim Form, there are several other documents that may be necessary to support your claim. These documents can provide additional information and ensure that your claim is processed smoothly. Below is a list of common forms and documents you might encounter.

- Itemized Bills: These bills must be detailed and include the provider's name, services rendered, and the amount charged. They are essential for verifying the costs associated with your treatment.

- Explanation of Benefits (EOB): If another insurance carrier is involved, this document outlines what services were covered, how much was paid, and what remains your responsibility. It is crucial for coordinating benefits.

- Letter of Medical Necessity: This letter, typically from your physician, explains why a particular treatment or service is essential for your health. It supports claims for durable medical equipment or specialized treatments.

- Claim Appeal Letter: If a claim is denied, this letter can be used to formally request a review of the decision. It should include details about the claim and reasons for the appeal.

- Proof of Coverage: This document confirms your insurance coverage at the time of treatment. It can be a policy document or a letter from your insurance provider.

- Accident Report: If your treatment is due to an accident, a report detailing the incident can be important. This document provides context and supports claims related to injuries.

- Authorization Forms: If your treatment required prior approval from your insurance provider, these forms demonstrate that the necessary authorizations were obtained.

- Medicare Documents: If you are covered by Medicare, providing documents related to your Medicare coverage can be necessary, especially if Medicare is the primary payer.

- Provider’s Signature: A signature from your healthcare provider on the bill or claim form can validate the services rendered and is often required for processing.

- Patient Consent Form: This form gives permission for your medical information to be shared with your insurance provider, ensuring compliance with privacy regulations.

Having these documents ready can make the claims process more efficient and help ensure that you receive the benefits to which you are entitled. Always keep copies of everything you submit for your records.

Key takeaways

When filling out the Maryland State Claim form, keep the following key points in mind:

- Complete All Sections: Ensure every question on the form is answered. Incomplete forms may delay processing.

- Use One Form Per Patient: Each patient should have their own claim form. This helps keep claims organized and reduces confusion.

- Attach Itemized Bills: Include itemized bills from the provider. These should detail services rendered, dates, and charges.

- Translation and Currency Conversion: If bills are in a foreign language or currency, translate them to English and convert to U.S. dollars.

- Medicare Information: If the patient has Medicare, indicate this on the form and attach relevant payment statements.

- Accurate Descriptions: Provide clear descriptions of services, including diagnosis and any additional required information for specific services.

- Keep Copies: Always retain copies of the claim form and all bills for your records.

- Signature Required: The subscriber must sign the form, certifying the information is correct and complete.

By following these guidelines, you can ensure a smoother claims process. If you have questions, don't hesitate to reach out to CareFirst BlueCross BlueShield for assistance.

Misconceptions

Understanding the Maryland State Claim form is essential for ensuring that your healthcare claims are processed smoothly. However, several misconceptions can lead to confusion. Here are seven common myths about the form, along with clarifications to help you navigate the process effectively.

- Misconception 1: Only certain types of medical services can be claimed.

- Misconception 2: You don’t need to provide itemized bills.

- Misconception 3: The form can be filled out incorrectly without consequences.

- Misconception 4: Claims can be submitted without any supporting documents.

- Misconception 5: You can use one claim form for multiple patients.

- Misconception 6: You don’t need to keep copies of your submissions.

- Misconception 7: Claims will be processed automatically if submitted online.

This is not true. You can submit claims for various medical services, including visits to non-participating providers, as long as you provide the necessary documentation.

In fact, itemized bills are crucial. They must include details like the provider's information, services rendered, and the amount charged for each service.

Accuracy is key. Incorrect or incomplete information can delay your claim or even result in denial. Always double-check your entries.

This is a common misunderstanding. You must attach all relevant documents, including itemized bills and any necessary explanations from other insurance carriers.

Each patient requires a separate claim form. Using one form for multiple patients can lead to processing errors.

It’s wise to keep copies of all bills and the claim form for your records. This can be helpful if there are any disputes or follow-up questions.

While online submissions can expedite the process, they still require complete and accurate information. Manual review may still be necessary.

By debunking these misconceptions, you can approach the Maryland State Claim form with confidence, ensuring that your claims are submitted correctly and efficiently.