Blank Maryland Sheet Template

Similar forms

- Property Deed: Similar to the Maryland Sheet form, a property deed serves as a legal document that transfers ownership of real estate from one party to another. It includes essential details such as the names of the grantor and grantee, property description, and any terms of the transfer.

- Mortgage Application: Like the Maryland Sheet form, a mortgage application collects critical information for financing property transactions. It requires details about the property, the buyer’s financial status, and the terms of the mortgage, ensuring that all parties are informed and compliant.

- Title Insurance Policy: This document is similar in that it protects against potential disputes over property ownership. It requires detailed property information and ensures that the title is clear, much like the Maryland Sheet form’s focus on accurate property and grantor/grantee details.

- Settlement Statement: Also known as a closing statement, this document outlines all financial transactions involved in a property sale. It parallels the Maryland Sheet form by itemizing fees, taxes, and any adjustments, providing a comprehensive overview of the financial aspects of the transaction.

Maryland Sheet - Usage Steps

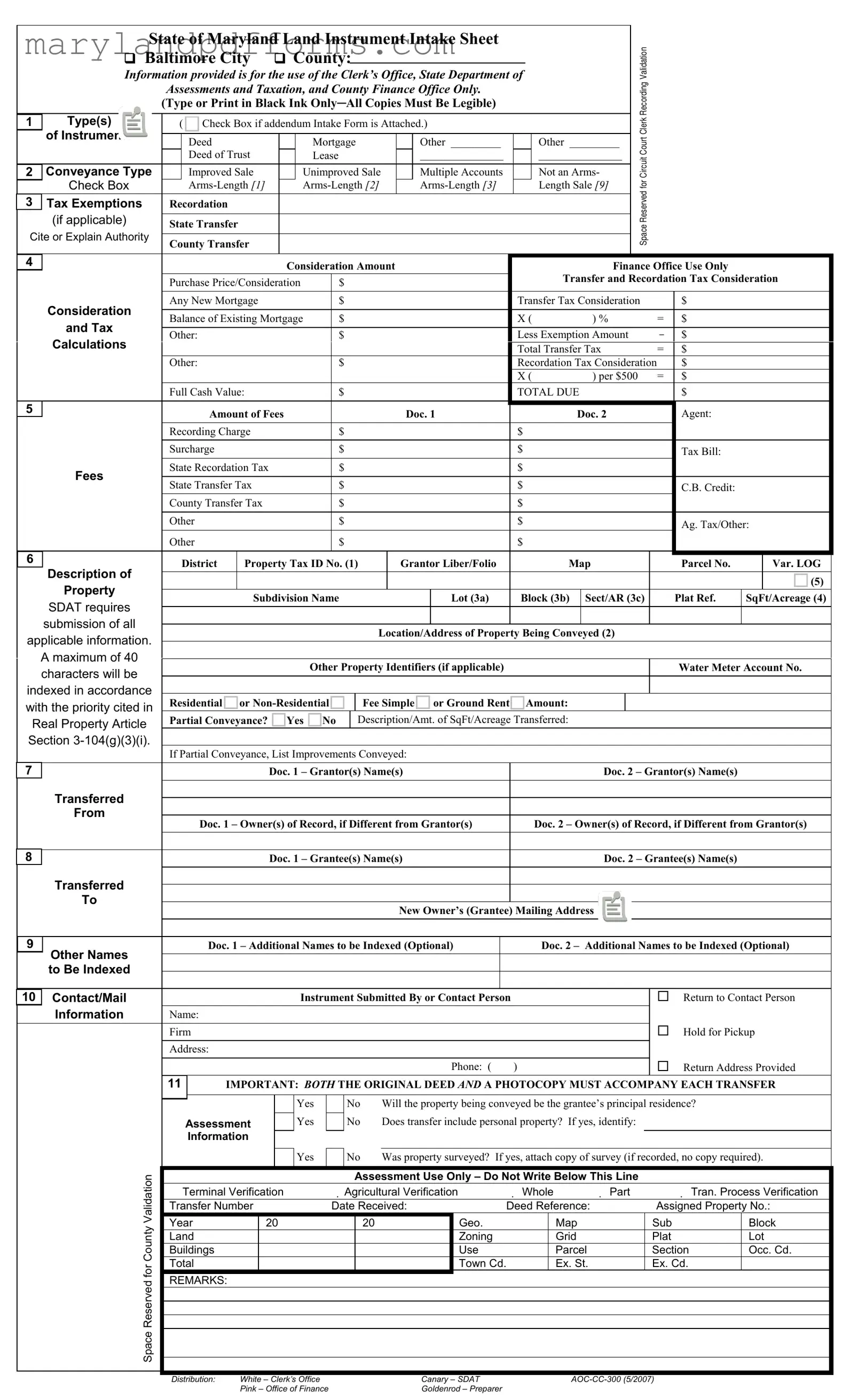

Filling out the Maryland Sheet form requires careful attention to detail to ensure all necessary information is accurately captured. This process involves providing specific data about the property, the parties involved, and any applicable fees or taxes. Once the form is completed, it will be submitted to the appropriate offices for processing.

- Begin by writing the name of the County at the top of the form.

- In the Clerk section, indicate the type of instrument you are submitting by checking the appropriate box (e.g., Deed, Mortgage, etc.). If you have an addendum, check the box for the Intake Form.

- For the Conveyance Type, select whether the sale is Improved, Unimproved, or Multiple Accounts. Check the box if it is an Arms-Length Sale.

- In the Tax Exemptions section, fill in any applicable exemptions and provide the necessary citation or explanation.

- Enter the Consideration Amount, including the purchase price, any new mortgage, and existing mortgage balances. Calculate and fill in the total transfer tax and recordation tax.

- List the Amount of Fees for each document, including recording charges, surcharges, and any state or county taxes.

- Provide a Description of District Property, including the Tax ID Number, property location, and any relevant identifiers.

- Complete the Grantor(s) and Grantee(s) sections by entering the names and mailing addresses of all parties involved.

- Fill in any Other Names that need to be indexed, if applicable.

- Provide Contact/Mail Instrument Submitted By information, including the name, firm, address, and phone number.

- Indicate whether the original deed and a photocopy are included, and answer the questions regarding the property’s principal residence status, personal property, and survey status.

Learn More on Maryland Sheet

What is the Maryland Sheet form?

The Maryland Sheet form, also known as the Land Instrument Intake Sheet, is a document used for recording various types of property transactions in Maryland. It is primarily utilized by the Clerk’s Office, the State Department of Assessments and Taxation, and the County Finance Office. This form collects essential information regarding the transaction, including the type of instrument being recorded, property details, and tax considerations.

Who needs to fill out the Maryland Sheet form?

Any individual or entity involved in a property transaction in Maryland must complete the Maryland Sheet form. This includes sellers, buyers, and their representatives. If you are transferring property through a deed, mortgage, or other legal instruments, this form is required to ensure proper recording and assessment.

What information is required on the form?

The Maryland Sheet form requires several key pieces of information, including:

- Type of instrument (e.g., deed, mortgage)

- Conveyance type (e.g., improved sale, unimproved sale)

- Consideration amount (purchase price)

- Property details (address, tax ID number, etc.)

- Names of grantors and grantees

- Contact information for the person submitting the form

It is crucial to provide accurate and complete information to avoid delays in processing.

What are the fees associated with the Maryland Sheet form?

Fees vary depending on the type of transaction and the amount of consideration. The form outlines various charges, including:

- Recording charges

- State recordation tax

- County transfer tax

- Other applicable fees

All fees must be calculated and included on the form to ensure proper processing.

Is it necessary to submit both the original deed and a photocopy?

Yes, both the original deed and a photocopy must accompany each transfer when submitting the Maryland Sheet form. This requirement ensures that there is a record for both the Clerk’s Office and the submitting party.

What happens if the form is filled out incorrectly?

If the Maryland Sheet form is filled out incorrectly, it may lead to delays in processing the property transfer. In some cases, the form may be rejected, requiring resubmission with the correct information. To avoid complications, double-check all entries for accuracy before submission.

Can I obtain assistance with filling out the Maryland Sheet form?

Yes, assistance is available for completing the Maryland Sheet form. Many local real estate professionals, such as attorneys and title companies, can provide guidance. Additionally, the Clerk’s Office may offer resources or staff to help with questions regarding the form.

Additional PDF Forms

Mountains in Maryland - The form helps you navigate your choices concerning retirement funds.

Court Forms - Submission of the Intake Sheet helps to ensure compliance with state recording requirements.

Md Business Tax - The form addresses both resident and non-resident members of the entity.

Documents used along the form

The Maryland Sheet form is an essential document used in real estate transactions within the state of Maryland. However, it is often accompanied by other forms and documents that help facilitate the process. Below is a list of some commonly used documents that may be required along with the Maryland Sheet form.

- Deed: This legal document transfers ownership of property from one party to another. It outlines the details of the transaction, including the names of the grantor and grantee, and must be signed and notarized.

- Mortgage Agreement: This document outlines the terms of the loan taken out to purchase the property. It includes details such as the loan amount, interest rate, repayment schedule, and the consequences of default.

- Deed of Trust: Similar to a mortgage, this document involves a third party (the trustee) holding the property title until the loan is repaid. It protects the lender’s interest while allowing the borrower to use the property.

- Residential Lease Agreement: This crucial document sets the terms between a landlord and tenant, ensuring both parties understand their responsibilities and rights, similar to the PDF Templates Online for legal leases.

- Transfer Tax Form: This form is used to calculate the transfer tax due on the sale of the property. It includes information about the purchase price and any exemptions that may apply.

- Property Disclosure Statement: Sellers are often required to provide this document, which discloses any known issues with the property. It helps buyers make informed decisions and protects sellers from future liability.

- Settlement Statement: This document outlines all financial details related to the closing of the property transaction. It includes costs, fees, and the final amounts due from both the buyer and seller.

Having these documents prepared and ready can streamline the process and ensure that all necessary information is accurately recorded. It’s important to consult with a qualified professional to make sure everything is in order before proceeding with your real estate transaction.

Key takeaways

When filling out and using the Maryland Sheet form, keep the following key points in mind:

- Legibility is crucial. Use black ink and ensure all copies are clear and easy to read.

- Specify the type of instrument. Clearly indicate whether you are recording a deed, mortgage, or another type of document.

- Indicate conveyance type. Choose from options like improved sale, unimproved sale, or arms-length transactions.

- Provide accurate consideration amounts. This includes the purchase price and any mortgages involved.

- Include property details. Fill in the property tax ID, location, and any relevant identifiers to avoid processing delays.

- Attach required documents. Always submit both the original deed and a photocopy with your form.

- Understand tax implications. Be aware of transfer and recordation taxes that may apply to your transaction.

By following these guidelines, you can ensure a smoother process when submitting the Maryland Sheet form.

Misconceptions

Understanding the Maryland Sheet form is crucial for anyone involved in real estate transactions in Maryland. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- It is only for deeds. Many believe the Maryland Sheet form is solely for recording deeds. In reality, it is used for various instruments, including mortgages, leases, and court documents.

- Legibility is not important. Some think that legibility does not matter as long as the information is provided. However, all copies must be legible, as this is essential for processing by the Clerk’s Office and other agencies.

- Only one consideration amount is needed. A common misconception is that only the purchase price needs to be reported. The form requires multiple consideration amounts, including any new or existing mortgages and transfer tax considerations.

- Tax exemptions are automatic. Many assume that tax exemptions apply without any action. In fact, specific exemptions must be indicated on the form and may require additional documentation.

- All properties must be surveyed. Some individuals believe that a survey is mandatory for all transactions. While surveys can be beneficial, they are only required if specified, such as for certain types of transfers.

- Only the buyer needs to sign. There is a misconception that only the grantee's signature is necessary. Both grantors and grantees must provide their signatures for the transaction to be valid.

- The form can be submitted without a photocopy. Some think that submitting the original deed alone is sufficient. However, it is important to include a photocopy of the original deed with each transfer.

By clarifying these misconceptions, individuals can better navigate the Maryland Sheet form and ensure a smoother transaction process.