Blank Maryland Sales Use Tax 202 Template

Similar forms

The Maryland Sales and Use Tax 202 form shares similarities with several other tax-related documents. Below are four such documents and their connections to the 202 form:

- IRS Form 1040: This is the standard individual income tax return form. Like the 202 form, it requires personal information, including the taxpayer's name and identification number, ensuring accurate processing of tax obligations.

- Texas Operating Agreement form: This form is crucial for establishing the governance framework of an LLC, similar to how tax forms require specific information for compliance. For more details, visit https://texasdocuments.net/printable-operating-agreement-form/.

- Maryland Business Personal Property Return (Form 1): This form is used to report personal property owned by businesses. Similar to the 202 form, it necessitates detailed business information and must be filed with the Maryland Comptroller's office, ensuring compliance with state tax regulations.

- Sales Tax Exemption Certificate: This document is used by purchasers to claim an exemption from sales tax on certain purchases. Both the exemption certificate and the 202 form require specific identifying information, such as the purchaser's name and address, to validate the transaction.

- IRS Form 941: This form is used to report payroll taxes withheld from employees. Like the 202 form, it requires the employer's identification number and must be filed regularly to maintain compliance with tax laws.

Maryland Sales Use Tax 202 - Usage Steps

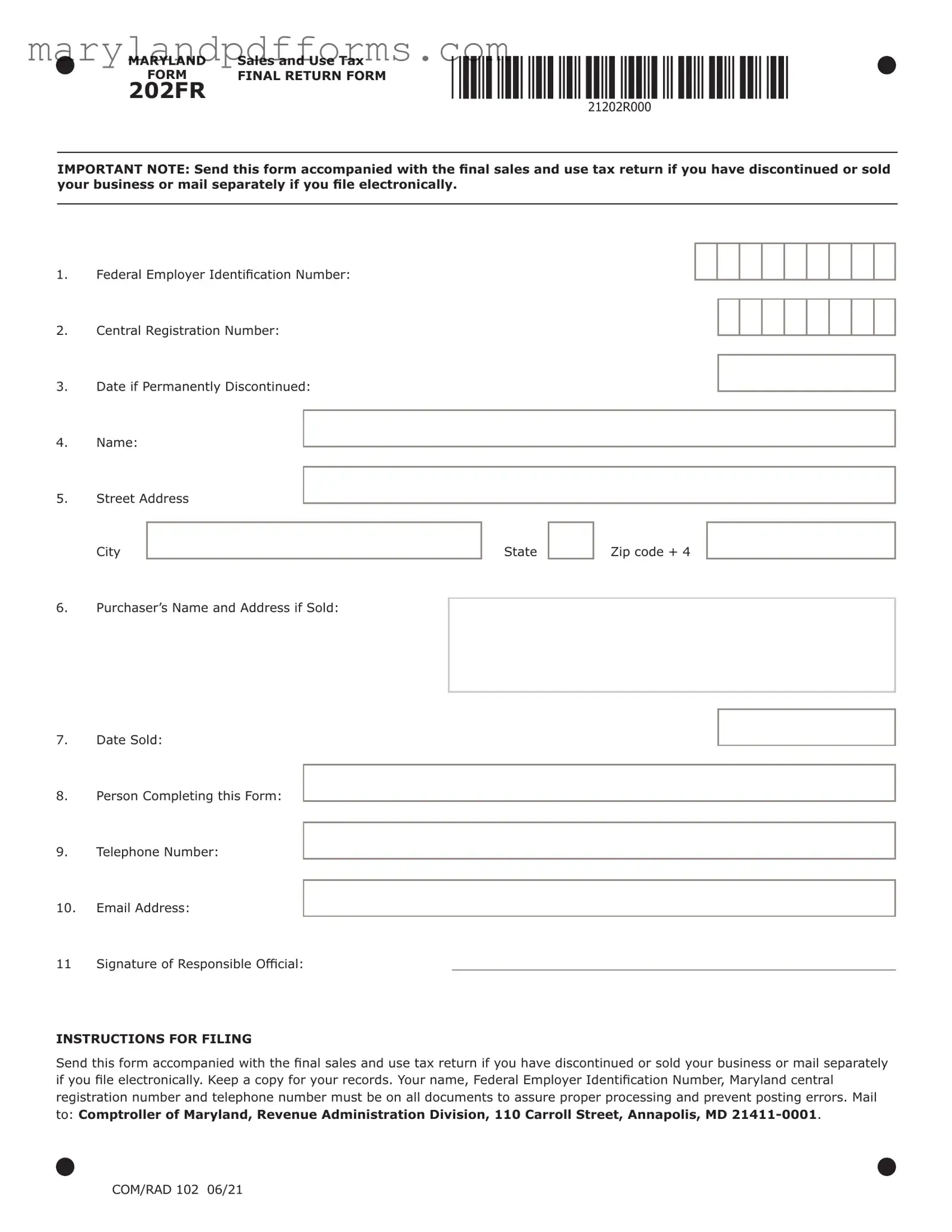

Filling out the Maryland Sales Use Tax 202 form is a straightforward process. This form is essential for those who have discontinued or sold their business. By following these steps, you can ensure that you complete the form accurately and submit it properly.

- Gather Your Information: Collect your Federal Employer Identification Number (FEIN) and Central Registration Number (CRN). You will also need your business name, address, and contact information.

- Complete the Form: Start filling out the form with the following details:

- 1. Federal Employer Identification Number

- 2. Central Registration Number

- 3. Date if Permanently Discontinued

- 4. Name of the business

- 5. Street Address, City, State, and Zip code + 4

- 6. Purchaser’s Name and Address if sold

- 7. Date Sold

- 8. Name of the person completing the form

- 9. Telephone Number

- 10. Email Address

- 11. Signature of Responsible Official

- Double-Check Your Entries: Review all the information you provided. Ensure that your name, FEIN, CRN, and telephone number are correct on all documents.

- Prepare for Submission: Make a copy of the completed form for your records. This is important in case you need to reference it later.

- Mail the Form: Send the completed form along with the final sales and use tax return to the following address:

- Comptroller of Maryland

- Revenue Administration Division

- 110 Carroll Street

- Annapolis, MD 21411-0001

After you have mailed the form, keep an eye out for any correspondence from the Comptroller's office. They may reach out if there are any issues or if additional information is needed. Staying organized and proactive will help ensure a smooth process.

Learn More on Maryland Sales Use Tax 202

What is the purpose of the Maryland Sales and Use Tax 202 form?

The Maryland Sales and Use Tax 202 form serves as a final return for businesses that have either discontinued operations or sold their business. This form is essential for ensuring that all sales and use tax obligations are settled before closing down or transferring ownership. By submitting this form, businesses can provide the necessary information to the state, confirming that they have fulfilled their tax responsibilities.

How should I submit the Maryland Sales and Use Tax 202 form?

When submitting the Maryland Sales and Use Tax 202 form, it is important to follow specific instructions to ensure proper processing. If you are discontinuing or selling your business, you should send this form along with your final sales and use tax return. Alternatively, if you are filing electronically, you may mail the form separately. Always keep a copy for your records. Be sure to include your name, Federal Employer Identification Number, Maryland Central Registration Number, and telephone number on all documents to avoid any posting errors.

What information is required on the form?

The Maryland Sales and Use Tax 202 form requires several pieces of information to be filled out accurately. Here is a list of the key details you need to provide:

- Federal Employer Identification Number

- Central Registration Number

- Date of Permanently Discontinued Operations

- Your Name

- Street Address and City

- Purchaser’s Name and Address (if applicable)

- Date Sold (if applicable)

- Name of the Person Completing the Form

- Telephone Number

- Email Address

- Signature of Responsible Official

Providing accurate information is crucial for ensuring that your submission is processed without delays.

Where should I send the completed form?

Once you have completed the Maryland Sales and Use Tax 202 form, you should mail it to the following address:

Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001.

Make sure to send it to the correct department to facilitate proper processing of your final return. Keeping a copy for your records is also advisable.

Additional PDF Forms

Maryland Dc 70 - The form collects essential contact information from all parties involved.

For those looking to understand the nuances, a California Marital Separation Agreement is crucial in managing the separation process effectively. You can find a customizable option for your needs at accessible California Marital Separation Agreement templates.

Maryland W-4 - The local tax rates vary based on your residence.

Documents used along the form

The Maryland Sales and Use Tax 202 form is essential for businesses that have ceased operations or sold their assets. However, it is often accompanied by other important documents that help ensure a smooth transition and compliance with state regulations. Below is a list of additional forms and documents that are frequently used in conjunction with the Sales and Use Tax 202 form.

- Final Sales and Use Tax Return: This document summarizes the total sales and use tax collected during the final reporting period. It is crucial for accurately reporting any outstanding tax obligations before the business officially closes.

- Business Discontinuation Notice: This notice informs the Maryland Comptroller's office about the permanent discontinuation of business activities. It helps update state records and ensures that the business is no longer liable for future tax filings.

- Motorcycle Bill of Sale: This document is essential for protecting both parties in a motorcycle transaction. For more information, refer to PDF Templates Online.

- Asset Transfer Agreement: If a business is sold, this agreement outlines the terms and conditions of the asset transfer. It is vital for clarifying ownership and responsibilities related to tax obligations on the sold assets.

- Certificate of Good Standing: This document verifies that the business is compliant with all state regulations and has fulfilled its tax obligations. It may be required by potential buyers or creditors during the sale process.

By understanding these additional forms and their purposes, businesses can navigate the process of closing or selling more effectively. Ensuring that all necessary documents are filed accurately helps prevent future complications and supports compliance with Maryland tax laws.

Key takeaways

Filling out the Maryland Sales Use Tax 202 form can seem daunting, but understanding its key components can simplify the process. Here are some important takeaways to keep in mind:

- Purpose of the Form: This form is specifically for businesses that have discontinued operations or sold their business.

- Accompanying Documents: Always send this form along with your final sales and use tax return. If you file electronically, you can mail it separately.

- Essential Information: Include your Federal Employer Identification Number and Maryland Central Registration Number. These are crucial for proper processing.

- Contact Details: Provide your name, telephone number, and email address. This helps the authorities reach you if there are any questions.

- Signature Requirement: Don’t forget to include the signature of the responsible official. This validates the form.

- Retention of Records: Keep a copy of the completed form for your records. This is important for future reference.

- Mailing Address: Send the form to the Comptroller of Maryland at the specified address in Annapolis.

- Discontinuation Date: Clearly indicate the date your business was permanently discontinued or sold. This information is vital.

- Purchaser Information: If applicable, include the purchaser’s name and address. This helps in tracking the transfer of business.

- Attention to Detail: Ensure all fields are filled out accurately to prevent delays or posting errors.

By keeping these takeaways in mind, you can navigate the Maryland Sales Use Tax 202 form with greater ease and confidence.

Misconceptions

Here are four common misconceptions about the Maryland Sales and Use Tax 202 form:

- It is only for businesses that have permanently closed. Many believe this form is only necessary for businesses that have shut down. In reality, it is also required when a business is sold. Proper filing ensures that all tax obligations are settled.

- You can file the form without a final sales and use tax return. Some think they can submit the 202 form independently. However, it must be accompanied by the final sales and use tax return if the business has discontinued operations.

- The form can be submitted electronically without any additional steps. There is a misconception that electronic filing eliminates the need for mailing the form. If you file electronically, you must send the 202 form separately to ensure proper processing.

- Only the owner needs to sign the form. It is often assumed that only the business owner is responsible for signing. In fact, the signature of a responsible official is required, which may include other authorized personnel.

Understanding these points will help ensure compliance and proper processing of your tax obligations in Maryland.