Blank Maryland Sales And Use Tax Resale Certificate Template

Similar forms

-

Uniform Commercial Code (UCC) Exemption Certificate: This document allows buyers to purchase goods without paying sales tax, similar to the Maryland Sales and Use Tax Resale Certificate. Both forms certify that the items are intended for resale or incorporation into other products.

-

Sales Tax Exemption Certificate: Used in various states, this certificate exempts buyers from sales tax on purchases made for specific exempt purposes. Like the Maryland certificate, it requires the buyer to state the intended use of the purchased items.

-

Manufacturing Exemption Certificate: This document is issued to manufacturers to purchase machinery and materials without sales tax. It shares similarities with the Maryland form, as both are designed for entities that will use the items in the production of goods for sale.

-

Resale Certificate in Other States: Many states have their own versions of resale certificates. These documents function similarly to the Maryland form, allowing businesses to buy goods tax-free when they intend to resell them.

Maryland Sales And Use Tax Resale Certificate - Usage Steps

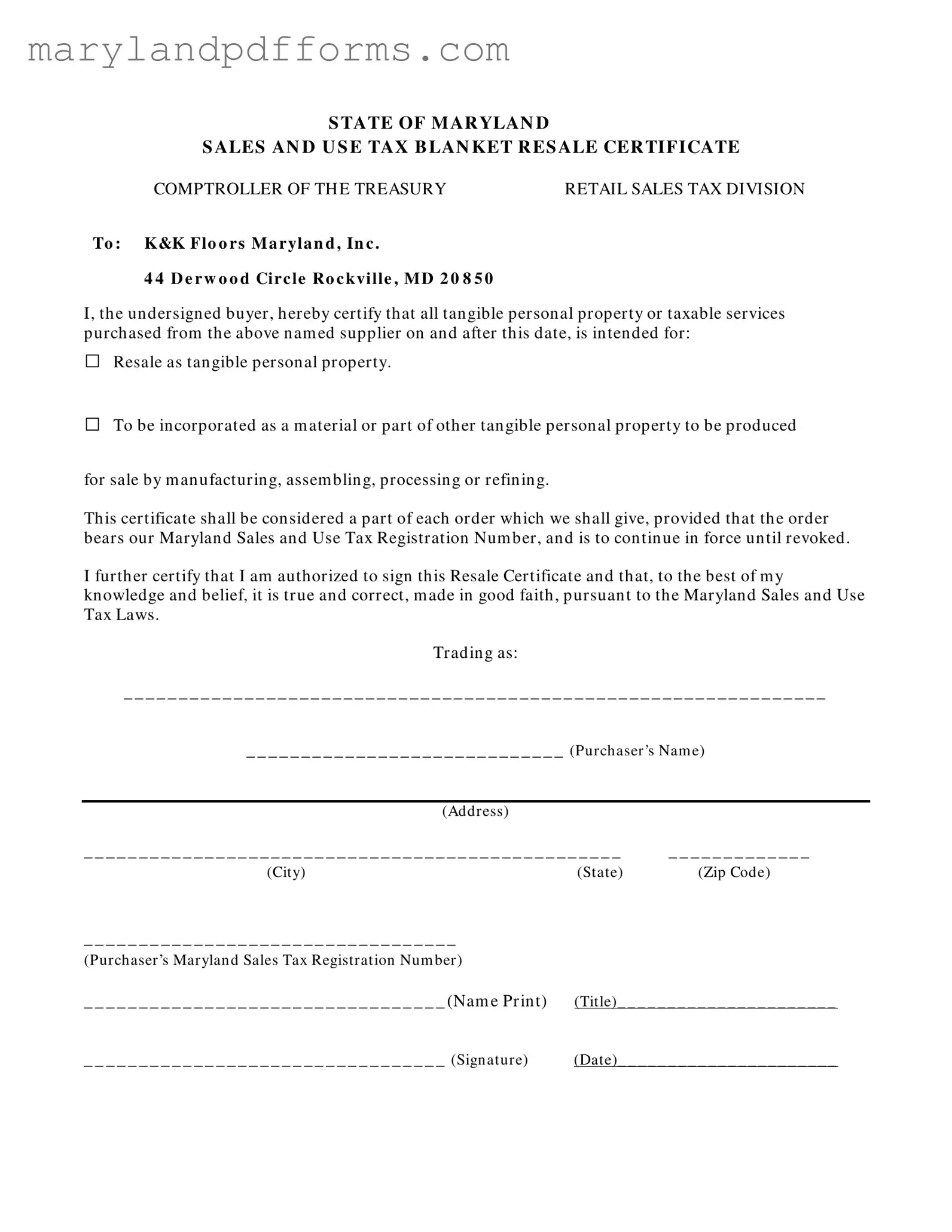

Filling out the Maryland Sales and Use Tax Resale Certificate is straightforward. This form allows buyers to certify that they intend to resell the tangible personal property or taxable services they purchase. Follow these steps to complete the form correctly.

- Provide the Supplier's Information: Write the name and address of the supplier, K&K Floors Maryland, Inc., including the street address, city, state, and zip code.

- Identify Yourself: Fill in your name as the purchaser in the designated space.

- Enter Your Address: Complete your address, including the street, city, state, and zip code.

- Include Your Maryland Sales Tax Registration Number: Write your Maryland Sales Tax Registration Number in the specified area.

- Check the Appropriate Box: Indicate whether the purchase is for resale as tangible personal property or to be incorporated into other tangible personal property for production.

- Print Your Name and Title: In the provided fields, print your name and your title within the organization.

- Sign and Date the Form: Sign your name and include the date of signing in the designated spaces.

Once you have completed the form, keep a copy for your records. You will then submit it to the supplier as part of your purchase transaction.

Learn More on Maryland Sales And Use Tax Resale Certificate

What is the Maryland Sales and Use Tax Resale Certificate?

The Maryland Sales and Use Tax Resale Certificate is a document that allows businesses to purchase tangible personal property or taxable services without paying sales tax, provided that these items are intended for resale. This certificate is used when making purchases from suppliers, ensuring that tax is not charged at the time of sale.

Who can use the Resale Certificate?

Only businesses that are registered with the Maryland Sales and Use Tax can use this certificate. The purchaser must have a valid Maryland Sales Tax Registration Number and must certify that the items purchased are for resale or for incorporation into other products intended for sale.

How do I fill out the Resale Certificate?

To complete the certificate, follow these steps:

- Provide the name and address of the supplier.

- Indicate the purpose of the purchase by checking the appropriate box (resale or incorporation).

- Fill in your business name, address, and Maryland Sales Tax Registration Number.

- Sign and date the certificate, including your title.

Ensure all information is accurate and complete to avoid issues with tax compliance.

Is the Resale Certificate valid indefinitely?

The certificate remains valid until it is revoked. However, it must be presented with each order, and the order should include the purchaser's Maryland Sales Tax Registration Number. It is advisable to review the certificate periodically to ensure that the information is still accurate.

What happens if I misuse the Resale Certificate?

Misuse of the Resale Certificate can lead to serious consequences, including penalties and interest on unpaid sales tax. If a business uses the certificate to purchase items not intended for resale, they may be held liable for the tax that should have been collected at the time of sale.

Can I use the Resale Certificate for online purchases?

Yes, businesses can use the Maryland Sales and Use Tax Resale Certificate for online purchases. When making an online order, the purchaser should provide the certificate to the seller, ensuring that the seller recognizes the certificate as valid for tax-exempt purchases.

Where can I obtain the Resale Certificate form?

The Maryland Sales and Use Tax Resale Certificate can typically be obtained from the Maryland Comptroller's website or directly from the Retail Sales Tax Division. It may also be available through various business resource centers and tax professionals.

What should I do if I lose my Resale Certificate?

If the Resale Certificate is lost, it is recommended to complete a new certificate. Ensure that the new certificate contains all the required information and is signed and dated. Keep a copy for your records and provide the new certificate to suppliers as needed.

Additional PDF Forms

Maryland Personal Property Tax - Report your business financials for both the beginning and end of the period.

For those looking to establish clear terms in their rental relationships, the PDF Templates Online provides valuable resources, including the New York Residential Lease Agreement, ensuring that both landlords and tenants can maintain a fair and transparent agreement while minimizing conflict and misunderstandings.

Addendum Meaning in Real Estate - This addendum is a vital document that addresses various legal, environmental, and financial considerations in real estate sales.

Haccp Plan Example - The HACCP plan helps ensure food safety in Maryland food establishments.

Documents used along the form

The Maryland Sales and Use Tax Resale Certificate is a key document for businesses purchasing goods for resale. However, several other forms and documents often accompany it to ensure compliance with tax regulations and streamline transactions. Below are some commonly used forms that may be relevant.

- Maryland Sales and Use Tax Registration Application: This form is necessary for businesses to register with the Maryland Comptroller’s office. It allows businesses to collect sales tax on taxable sales and provides them with a unique registration number, which is crucial for completing the resale certificate.

- Maryland Sales and Use Tax Return: Businesses must file this return periodically to report the sales tax they have collected and remit it to the state. It provides an overview of taxable sales and ensures that the business is compliant with tax obligations.

- Exempt Use Certificate: This document is used when a purchaser claims an exemption from sales tax for certain purchases. It’s essential for buyers who qualify for tax exemptions and need to provide proof to their suppliers.

- Supplier's Invoice: An invoice from the supplier details the items purchased, their prices, and any applicable taxes. It serves as a record of the transaction and is often required for accounting and tax reporting purposes.

Understanding these documents and their purposes can help ensure smooth transactions and compliance with Maryland tax laws. Keeping accurate records and using the right forms will make managing sales tax responsibilities much easier for businesses.

Key takeaways

Filling out and using the Maryland Sales and Use Tax Resale Certificate form can be straightforward if you keep a few key points in mind. Here are some important takeaways to consider:

- Purpose of the Certificate: This form certifies that the buyer intends to purchase tangible personal property or taxable services for resale, not for personal use.

- Correct Supplier Information: Always ensure that the supplier’s name and address are accurately filled in. This helps avoid any confusion during transactions.

- Buyer’s Information: Provide complete details about the purchaser, including name, address, and Maryland Sales Tax Registration Number. Incomplete information may render the certificate invalid.

- Intended Use: Clearly indicate whether the items are for resale or will be incorporated into other products. This distinction is crucial for tax purposes.

- Signature Requirement: The form must be signed by someone authorized to do so on behalf of the purchasing entity. This adds a layer of accountability.

- Validity of the Certificate: The certificate remains valid until it is revoked. Make sure to keep track of any changes in your business status that may affect its validity.

- Record Keeping: Retain copies of all resale certificates for your records. This can be helpful in case of audits or disputes with the tax authorities.

- Good Faith Certification: The signer certifies that the information provided is true and correct to the best of their knowledge. Providing false information can lead to penalties.

Understanding these key points can help streamline the process of using the Maryland Sales and Use Tax Resale Certificate form and ensure compliance with state tax laws.

Misconceptions

Misconceptions about the Maryland Sales and Use Tax Resale Certificate can lead to confusion. Here are eight common misunderstandings:

- Only retailers can use the certificate. Many believe that only retail businesses can utilize the resale certificate. In reality, any business purchasing items for resale, including wholesalers and manufacturers, can use it.

- The certificate must be renewed annually. Some think they need to renew the resale certificate each year. However, it remains valid until it is revoked, as long as the buyer continues to use it in good faith.

- It covers all purchases without limitation. A common misconception is that the resale certificate applies to all purchases. It only applies to items intended for resale or incorporation into products for sale.

- It is not necessary to provide a registration number. Many assume that they can submit the certificate without their Maryland Sales Tax Registration Number. This number is crucial for the certificate to be valid.

- Only physical goods can be purchased using the certificate. Some believe the certificate is only for tangible personal property. However, it can also apply to taxable services that are intended for resale.

- There are no consequences for misuse. A misconception exists that there are no penalties for misusing the certificate. In fact, misuse can lead to fines and back taxes owed.

- It can be used for personal purchases. Some individuals think they can use the resale certificate for personal purchases. This is incorrect; the certificate is strictly for business-related transactions.

- Verbal agreements are sufficient. Many believe that a verbal agreement with a supplier is enough to use the resale certificate. Written documentation is necessary to ensure clarity and compliance.

Understanding these misconceptions can help businesses navigate the Maryland Sales and Use Tax Resale Certificate more effectively.