Blank Maryland Rtc 60 Template

Similar forms

- Maryland Form 502: This is the Maryland Resident Income Tax Return. Like the RTC-60, it requires personal information and income details to determine tax liability. Both forms help Maryland residents assess their financial standing for potential benefits or credits.

- New York Mobile Home Bill of Sale: This legal document is pivotal for the ownership transfer of mobile homes in New York. It ensures compliance with state regulations and preserves the rights of both parties involved in the transaction. For templates and more information, check out PDF Templates Online.

- Maryland Form 502CR: This form is used for claiming the Maryland Earned Income Tax Credit. Similar to the RTC-60, it aims to provide financial relief to eligible residents based on income and family size. Both forms require documentation of income and dependents.

- Federal Form 1040: This is the U.S. Individual Income Tax Return. While the RTC-60 focuses on renters, both forms assess income and require personal information. They are essential for determining tax obligations and eligibility for various credits.

- Maryland Form 1: This is the Maryland Non-Resident Income Tax Return. It shares similarities with the RTC-60 in that both require income reporting and personal details. However, Form 1 is for non-residents, while the RTC-60 is specifically for renters in Maryland.

- HUD Form 50058: This form is used for reporting information on individuals receiving housing assistance. Like the RTC-60, it collects income and household information to determine eligibility for benefits, focusing on housing needs.

- Maryland Form 15: This is the Application for a Property Tax Credit. Similar to the RTC-60, it is designed to assist residents with financial relief based on specific criteria, including income and residency status.

Maryland Rtc 60 - Usage Steps

Completing the Maryland RTC-60 form is an essential step for eligible renters seeking financial assistance through the Renters' Tax Credit program. After filling out this form, it will be submitted to the Maryland Department of Assessments and Taxation for review. The information provided will help determine eligibility based on specific criteria such as income, rent paid, and household composition.

- Begin with your personal details. Fill in your last name, first name, and middle initial in the designated fields.

- Provide your Social Security Number and birth date.

- Enter your daytime telephone number and check the appropriate box for your title (Mr., Mrs., Ms.).

- List your spouse's or co-tenant's full name, along with their Social Security Number and birth date.

- Fill in your present address, including apartment number, city, county, and zip code.

- If your address changed in 2015, provide the previous address, including city, county, and zip code.

- Indicate if your mailing address differs from your present address and provide that information if necessary.

- Answer whether you resided in public housing in 2015 by checking "Yes" or "No."

- State your marital status by checking the appropriate box and providing the date if applicable.

- Describe your rented residence by checking the correct option (Apartment, House, Mobile Home, or Other).

- Indicate your applicant status by checking the relevant box (Age 60 or Over, Totally Disabled, Surviving Spouse, or Under Age 60 with Dependent Child).

- Provide the name and address of the management company or landlord to whom you paid rent for at least six months in 2015.

- If applicable, enter the name and address of your current management company or landlord.

- State whether you rent from a relative and, if so, attach a photocopy of your lease.

- List all household residents who lived with you in 2015, including their names, birth dates, Social Security numbers, whether they are your dependents, and their relationship to you.

- Indicate if you or your spouse filed a Federal Income Tax Return for 2015 and attach a copy of the return if applicable.

- Detail all sources of income for 2015 in the provided sections, ensuring you attach proof of all income.

- Enter the total rent you paid in Maryland for 2015, breaking it down by month.

- Indicate whether you receive any rent subsidy and provide details if applicable.

- Check which utilities or services were included in your monthly rent, or indicate if none were included.

- Sign the declaration under penalties of perjury, confirming the accuracy of the information provided.

- Have your spouse or co-tenant sign if applicable.

Once the form is completed, it should be returned to the Maryland Department of Assessments and Taxation. It is advisable to keep a copy for your records. If any additional information is needed, the department may reach out to you for clarification. Remember, the filing deadline is September 1, 2016.

Learn More on Maryland Rtc 60

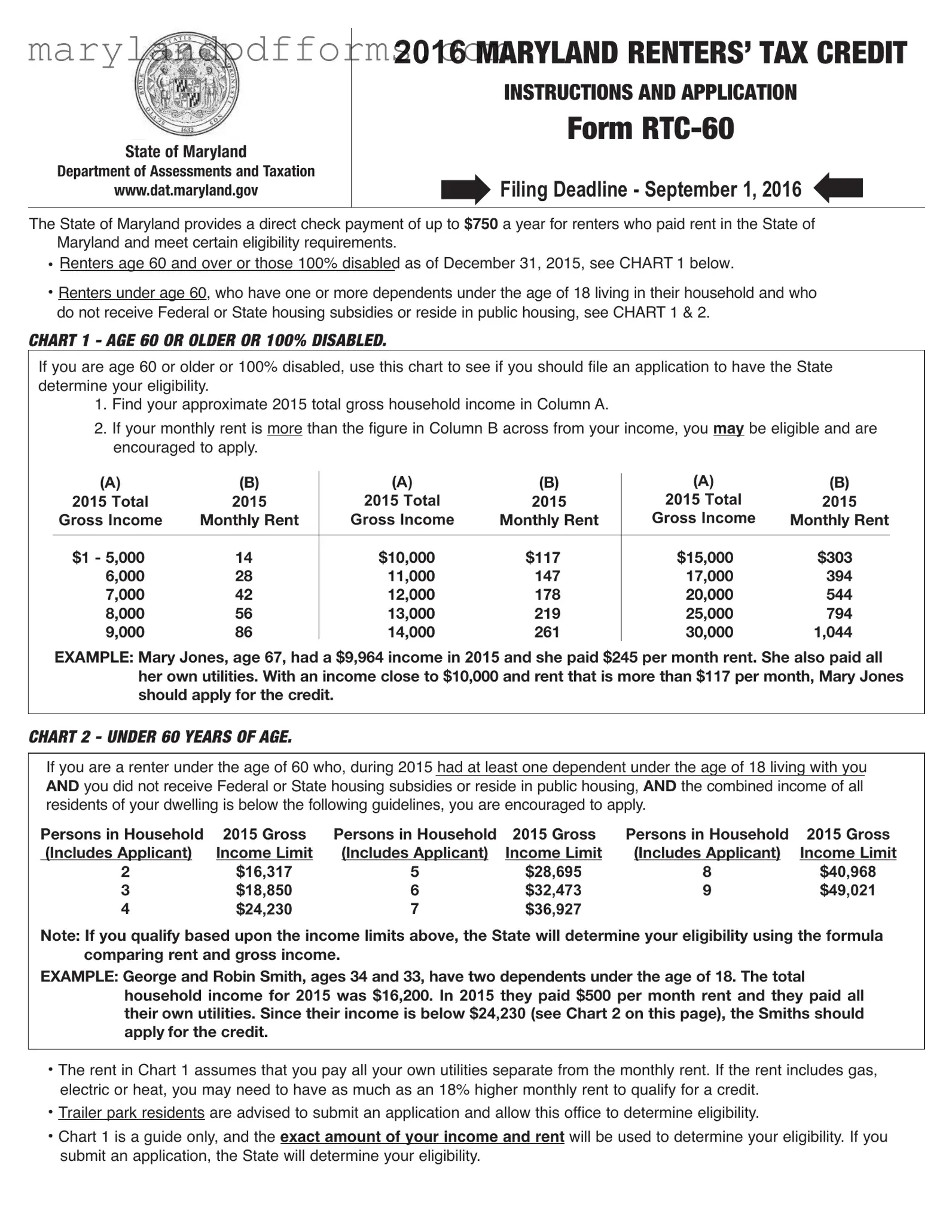

- If you are 60 years old or older or 100% disabled as of December 31, 2015, you may qualify.

- If you are under 60, you must have at least one dependent under the age of 18 living with you, not receive any Federal or State housing subsidies, and have a total gross income below certain limits.

- For 2 people, the income limit is $16,317.

- For 3 people, it is $18,850.

- For 4 people, it is $24,230.

- For larger households, the limits increase accordingly.

- A copy of your lease or rental agreement.

- Proof of income, such as tax returns or pay stubs.

- For applicants under 60 with dependents, you must submit copies of the child’s Social Security card and birth certificate.

What is the Maryland RTC 60 form?

The Maryland RTC 60 form is an application for the Renters’ Tax Credit. This program provides financial assistance to eligible renters in Maryland. If you qualify, you can receive a direct payment of up to $750 a year to help offset your rent costs.

Who is eligible to apply for the Renters’ Tax Credit?

Eligibility depends on several factors:

What are the income limits for eligibility?

Income limits vary based on the number of people in your household. For example:

Check the full chart in the RTC 60 form for all limits.

What documents do I need to submit with my application?

You will need to provide several documents, including:

When is the application deadline?

The deadline to submit the RTC 60 form is September 1, 2016. Make sure to file before this date to be considered for the credit.

What if I live in a trailer park?

If you live in a trailer park, you are still encouraged to apply. The State will assess your eligibility based on your income and rent paid, even if you live in a mobile home.

What happens after I submit my application?

Once you submit your application, it will be processed in the order received. If additional information is needed, the Department may reach out to you. If your application is approved, you will receive the tax credit payment directly.

Additional PDF Forms

Maryland Corporate Tax Rate - The Department ID number is critical for the proper processing of the form by the state.

Landlords seeking to initiate the eviction process should familiarize themselves with the Texas Notice to Quit form, as it serves as a critical step in ensuring proper legal protocol is followed; for detailed guidance and to obtain the form, visit texasdocuments.net/printable-notice-to-quit-form/.

Md Form 502 - Descriptive details about the individual, such as driver's license number, are included.

Documents used along the form

The Maryland Renters’ Tax Credit Program is designed to assist eligible renters by providing financial relief through a direct payment. Alongside the RTC-60 form, several other documents may be necessary to ensure a smooth application process. Below are some common forms and documents that applicants often need to submit or reference when applying for the renters’ tax credit.

- Proof of Income Documentation: This may include copies of pay stubs, tax returns, or Social Security benefit statements. These documents help verify the total gross income reported on the RTC-60 form and ensure that applicants meet the income eligibility requirements.

- Lease Agreement: A copy of the lease or rental agreement is required to demonstrate the applicant's legal obligation to pay rent. This document should clearly outline the terms of the rental arrangement, including the monthly rent amount and the duration of the lease.

- Hold Harmless Agreement: This legal document, particularly the Arizona Hold Harmless Agreement, is often necessary to ensure that one party is not held liable for damages during activities related to the rental process. For more information, you can refer to Templates Online.

- Proof of Dependents: For applicants under age 60 with dependents, documentation such as a child’s birth certificate or Social Security card may be necessary. This proof is essential to confirm eligibility based on the presence of dependents in the household.

- Death Certificate (if applicable): If the applicant is a surviving spouse, a death certificate of the deceased spouse must be submitted. This document verifies the applicant's status and eligibility under the program.

- Public Assistance Documentation: If applicable, a copy of the AIMS Public Assistance letter is needed to confirm the benefits received. This information helps establish the financial situation of the applicant and their eligibility for the tax credit.

Gathering these documents can facilitate the application process and increase the likelihood of a successful outcome. It is advisable to review all requirements carefully and ensure that all necessary information is submitted by the filing deadline.

Key takeaways

Key Takeaways for the Maryland RTC 60 Form:

- The filing deadline for the RTC 60 form is September 1, 2016.

- Renters who qualify may receive up to $750 annually.

- Eligibility includes renters aged 60 or older, or those who are 100% disabled.

- Renters under 60 must have dependents under 18 and meet specific income criteria.

- Applicants must provide proof of rent paid and a valid lease agreement.

- The dwelling must be the applicant's principal residence for at least six months in 2015.

- All household income must be reported, including non-taxable income sources.

- Utilities included in rent may affect eligibility; higher rent may be required to qualify.

- Applications are processed in the order received, so timely submission is crucial.

Misconceptions

Understanding the Maryland RTC 60 form can be challenging, and several misconceptions often arise regarding its purpose and requirements. Below is a list of common misunderstandings along with clarifications to help individuals navigate the application process more effectively.

- Only seniors can apply. Many believe that only individuals aged 60 and older are eligible for the Renters’ Tax Credit. However, renters under 60 with dependents may also qualify if they meet specific income and housing criteria.

- Income from all sources is exempt. Some applicants think that only taxable income counts towards eligibility. In reality, all sources of income, including nontaxable ones like Social Security benefits, must be reported.

- Renters living in public housing can apply. It is a common misconception that those residing in public housing can receive the credit. However, individuals who live in public housing or receive housing subsidies are ineligible for this program.

- Utilities are always included in the rent calculation. Many people assume that their rent includes utilities. The form specifies that if utilities are included, applicants may need to adjust their reported rent to qualify for the credit.

- Proof of income is not necessary. Some individuals believe that they can apply without providing proof of their income. In fact, applicants must submit documentation to verify their income and may be asked for additional information after submission.

- The application deadline is flexible. There is a misconception that the application can be submitted at any time. The deadline is firm, and applications must be submitted by September 1 of the filing year.

- Only the primary applicant's income matters. Many assume that only the income of the primary applicant is considered. However, the combined income of all household members is taken into account when determining eligibility.

- Once approved, the credit is guaranteed every year. Some believe that if they qualify one year, they will automatically qualify in subsequent years. Each application must be submitted annually, and eligibility is reassessed each time.

- All renters qualify if they meet income limits. While income limits are a key factor, applicants must also meet other requirements, such as having a bona fide lease and not receiving housing subsidies, to qualify for the credit.

Addressing these misconceptions can help potential applicants better understand their eligibility and the requirements of the Maryland RTC 60 form, ultimately leading to a smoother application process.