Blank Maryland Ntbw Template

Similar forms

- Loan Estimate Form: Similar to the Maryland Ntbw form, the Loan Estimate provides borrowers with key details about the costs associated with a mortgage. It outlines the loan terms, estimated monthly payments, and closing costs, helping borrowers understand their financial obligations.

- Good Faith Estimate: This document offers an estimate of the closing costs and loan terms for borrowers. Like the Ntbw form, it aims to ensure that borrowers are aware of the financial implications of their mortgage options.

- Closing Disclosure: The Closing Disclosure is provided to borrowers before finalizing a mortgage. It details the final terms of the loan, including costs and fees, similar to how the Ntbw form emphasizes the importance of understanding loan terms and benefits.

- Mortgage Application: The mortgage application collects essential information from borrowers. It shares a purpose with the Ntbw form in that both documents require transparency regarding the borrower’s financial situation and the terms of the loan.

- Borrower’s Certification and Authorization: This document allows lenders to verify the information provided by borrowers. It parallels the Ntbw form in confirming that borrowers understand and agree to the terms of their mortgage.

- Affidavit of Borrower: This affidavit serves as a sworn statement by the borrower regarding their financial status and intentions. It is similar to the Ntbw form in that it requires borrowers to affirm their understanding of the mortgage terms.

- Debt-to-Income Ratio Worksheet: This worksheet helps assess a borrower’s ability to manage monthly payments. Like the Ntbw form, it emphasizes the importance of evaluating personal financial circumstances when considering a new loan.

Maryland Ntbw - Usage Steps

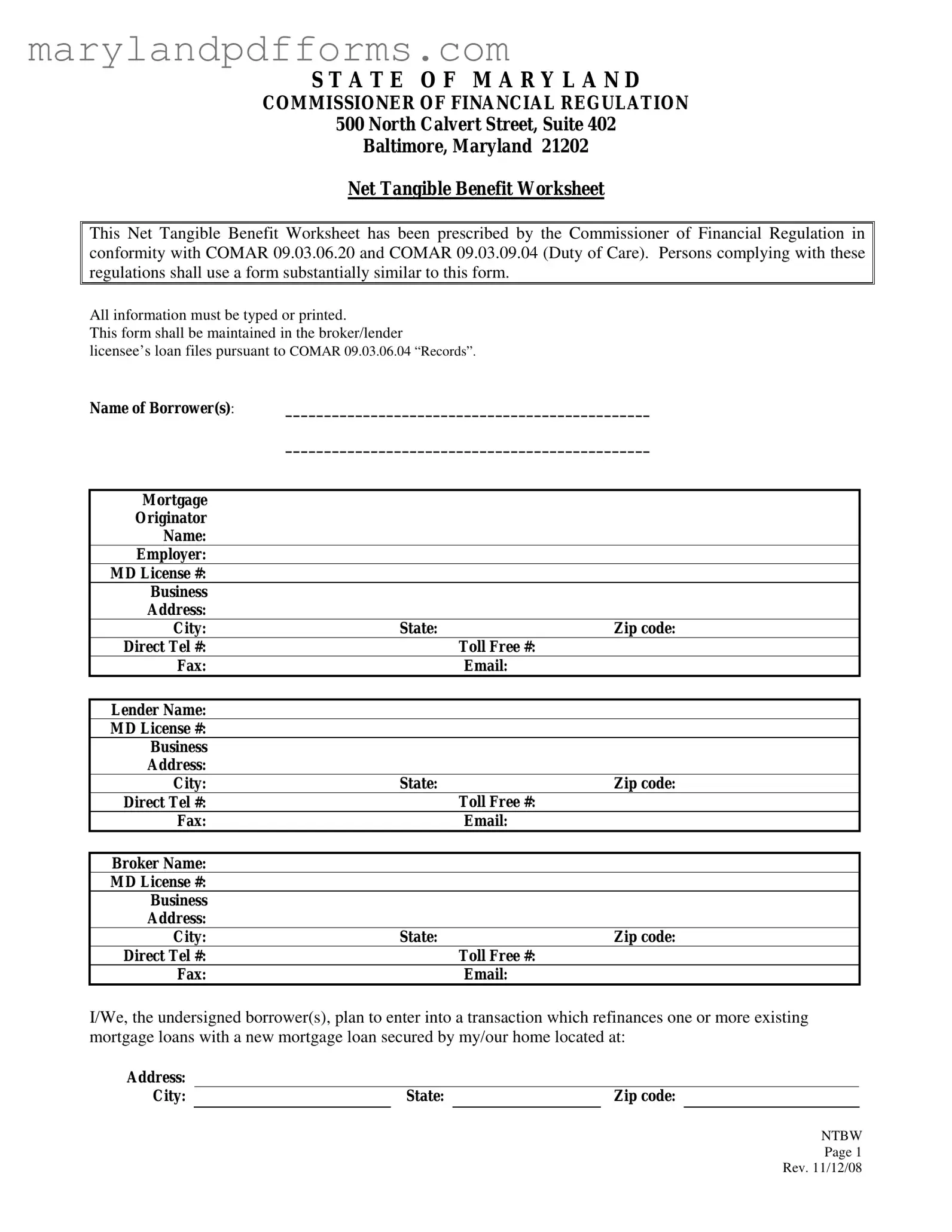

Completing the Maryland Net Tangible Benefit Worksheet is essential for borrowers looking to refinance their existing mortgage loans. This form requires accurate information about the borrowers, the mortgage originator, lender, and broker involved in the transaction. Follow these steps carefully to ensure all necessary details are provided.

- Begin by entering the Name of Borrower(s) at the top of the form. Ensure that all names are clearly printed or typed.

- Fill in the Mortgage Originator Name, Employer, and MD License # in the designated fields.

- Provide the Business Address, City, State, and Zip code for the mortgage originator.

- Enter the Direct Tel #, Toll Free #, Fax, and Email for the mortgage originator.

- Next, fill in the Lender Name and MD License #.

- Complete the Business Address, City, State, and Zip code for the lender.

- Provide the Direct Tel #, Toll Free #, Fax, and Email for the lender.

- Now, enter the Broker Name and MD License #.

- Fill in the Business Address, City, State, and Zip code for the broker.

- Provide the Direct Tel #, Toll Free #, Fax, and Email for the broker.

- In the section regarding the property, enter the Address, City, and Zip code of the home being refinanced.

- Review the acknowledgments and initial any benefits that apply to you. Each borrower should initial the benefits that are relevant.

- Consider the terms of both the existing and new loans, and confirm that you believe the new loan provides a net benefit.

- Finally, each borrower should sign and date the form at the bottom.

Learn More on Maryland Ntbw

What is the purpose of the Maryland Net Tangible Benefit Worksheet?

The Maryland Net Tangible Benefit Worksheet is designed to ensure that borrowers understand the benefits of refinancing their existing mortgage loans. It is a requirement set by the Commissioner of Financial Regulation, ensuring compliance with specific regulations. The form helps borrowers evaluate whether the new loan offers a tangible benefit compared to their current mortgage terms. By filling out this worksheet, borrowers can clarify the costs and potential advantages of refinancing.

Who is required to use the Net Tangible Benefit Worksheet?

Any broker or lender involved in the refinancing process in Maryland must utilize the Net Tangible Benefit Worksheet. This requirement is part of the regulations outlined in COMAR (Code of Maryland Regulations). The form must be maintained in the loan files of the broker or lender and should be completed accurately to ensure compliance with state regulations.

What information is needed to complete the worksheet?

To complete the Maryland Net Tangible Benefit Worksheet, borrowers will need to provide various pieces of information, including:

- Name of the borrower(s)

- Mortgage originator's details, including name, employer, and contact information

- Lender's information, including name and contact details

- Broker's information, if applicable

- Details about the property being refinanced

Additionally, borrowers must acknowledge their understanding of the costs and terms associated with the new loan and indicate the specific benefits they expect to gain from refinancing.

What are some examples of tangible benefits that can be identified on the worksheet?

Borrowers can identify various tangible benefits on the worksheet. Some common examples include:

- Obtaining a lower interest rate

- Reducing monthly payments

- Switching from an adjustable-rate mortgage to a fixed-rate mortgage

- Eliminating features like negative amortization or balloon payments

- Consolidating existing loans into a new mortgage

- Avoiding foreclosure

Each borrower should review the list carefully and initial any benefits that apply to their situation. This helps ensure that the refinancing decision is informed and beneficial.

Additional PDF Forms

Baltimore Gun Laws - The score sheet reinforces accountability among handgun permit applicants.

Maryland Late Filing Penalty - Do not send cash with Form 500D when making your payment.

Documents used along the form

When working with the Maryland Net Tangible Benefit Worksheet (NTBW), several other forms and documents often accompany it. These documents help ensure that all necessary information is collected and that the refinancing process is clear and compliant with regulations.

- Loan Estimate (LE): This document provides borrowers with important details about the mortgage loan they are considering. It outlines the estimated interest rate, monthly payments, and total closing costs. The Loan Estimate must be provided to borrowers within three business days of their application.

- Residential Lease Agreement: Understanding the legal framework of renting is crucial for both landlords and tenants. A well-structured PDF Templates Online can provide essential guidance and templates to ensure compliance with local laws and protect the interests of all parties involved.

- Closing Disclosure (CD): The Closing Disclosure is given to borrowers at least three days before closing on a mortgage loan. It includes final details about the loan terms, closing costs, and the total amount the borrower will need to pay at closing. This document ensures that borrowers have a clear understanding of their financial obligations.

- Borrower’s Certification and Authorization: This form is signed by the borrower to confirm their identity and authorize the lender to access their credit report and other necessary information. It is essential for verifying the borrower’s financial status and eligibility for the loan.

- Good Faith Estimate (GFE): Although less common now due to the introduction of the Loan Estimate, the Good Faith Estimate may still be used in some cases. It provides an estimate of the costs associated with the loan and helps borrowers compare offers from different lenders.

These documents work together to facilitate a smooth refinancing process. They ensure that borrowers are well-informed about their options and obligations, promoting transparency and understanding in the mortgage lending process.

Key takeaways

Filling out and using the Maryland Net Tangible Benefit (NTBW) form is an important step for borrowers considering refinancing their mortgage loans. Here are some key takeaways to keep in mind:

- The NTBW form is required by the Maryland Commissioner of Financial Regulation and follows specific regulations.

- All information on the form must be typed or printed clearly to ensure accuracy.

- This form must be kept in the loan files of the broker or lender, as mandated by Maryland regulations.

- Borrowers must acknowledge their understanding of the costs and terms associated with the new loan.

- Each borrower should indicate which benefits apply to them by initialing the relevant sections on the form.

- Benefits may include obtaining a lower interest rate or monthly payment, changing loan types, and avoiding foreclosure.

- Borrowers should evaluate both existing and new loan terms to ensure the new loan provides a tangible benefit.

- By signing the form, borrowers certify that they have read and understood the information provided.

Misconceptions

Understanding the Maryland Net Tangible Benefit (NTBW) form is essential for borrowers and lenders alike. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- The NTBW form is optional. Many people believe that using the NTBW form is not mandatory. In reality, the form is required by the Commissioner of Financial Regulation to ensure that borrowers understand the tangible benefits of refinancing.

- All lenders use the same version of the NTBW form. Some assume that every lender will provide the same NTBW form. However, while the form must be similar, each lender may have slight variations tailored to their specific processes.

- Completing the NTBW form guarantees loan approval. There is a misconception that filling out the NTBW form automatically leads to loan approval. This is not the case; the form is simply a tool to help assess the benefits of refinancing, and approval depends on various factors.

- Only first-time borrowers need to fill out the NTBW form. Some believe that only first-time borrowers are required to complete this form. In truth, anyone refinancing an existing mortgage must fill it out, regardless of their borrowing history.

- The NTBW form is only for fixed-rate loans. It is a common misconception that the NTBW form applies only to fixed-rate mortgage loans. In reality, it is relevant for all types of loans, including adjustable-rate mortgages, as long as they involve refinancing.

By clarifying these misconceptions, borrowers can better navigate the refinancing process and make informed decisions about their mortgage options.