Blank Maryland New Hire Template

Similar forms

- W-4 Form: Similar to the Maryland New Hire form, the W-4 form collects employee information for tax withholding purposes. Both require personal details like name, address, and Social Security Number.

- I-9 Form: The I-9 form verifies an employee's eligibility to work in the U.S. It also requires personal information, including the employee's name and Social Security Number, similar to the Maryland New Hire form.

- ADP Pay Stub: The ADP Pay Stub form provides a detailed summary of an employee's earnings and deductions for a specific pay period. It includes essential information such as gross pay, net pay, and taxes withheld, which is crucial for financial management. For more details, visit https://topformsonline.com/adp-pay-stub.

- State New Hire Reporting Forms: Many states have their own new hire reporting forms. Like the Maryland New Hire form, these documents collect similar information about the employer and employee for tracking and compliance purposes.

- Employment Application: An employment application gathers information about a candidate's work history and qualifications. Both the application and the Maryland New Hire form require personal details and may ask about previous employment.

- Payroll Information Form: This form collects details necessary for payroll processing, including salary and tax information. It is similar to the Maryland New Hire form, which also asks for salary details.

- Health Insurance Enrollment Form: This form is used to enroll employees in health benefits. Like the Maryland New Hire form, it collects personal information and may inquire about employee eligibility for benefits.

- Direct Deposit Authorization Form: This document allows employees to authorize direct deposit of their paychecks. Both forms require personal banking information and employee identification.

- Employee Handbook Acknowledgment: This form confirms that employees have received and understood the company’s policies. It shares similarities with the Maryland New Hire form in that it collects employee signatures and personal information.

- Tax Credit Forms (like the W-2): These forms are used to report employee earnings and tax withholdings. They share the need for accurate employee information, such as Social Security Numbers and names, similar to the Maryland New Hire form.

Maryland New Hire - Usage Steps

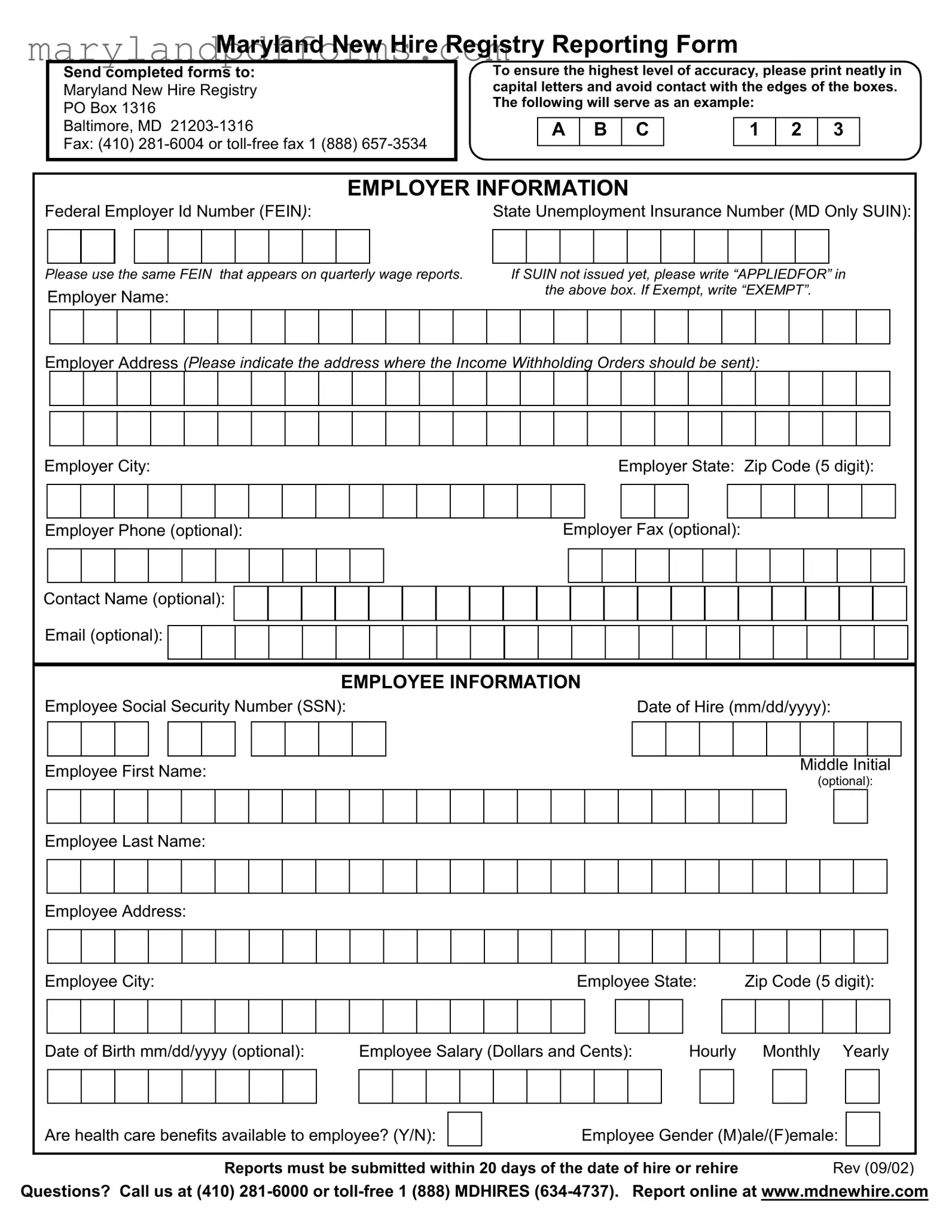

After completing the Maryland New Hire form, send it to the Maryland New Hire Registry at the specified address or via fax. Ensure that you provide accurate information to avoid delays. Below are the steps to fill out the form correctly.

- Begin with the Employer Information section.

- Enter the Federal Employer Id Number (FEIN). Use the same FEIN from your quarterly wage reports.

- If applicable, input the State Unemployment Insurance Number (MD Only SUIN). If you haven't received one, write “APPLIEDFOR”. If exempt, write “EXEMPT”.

- Fill in the Employer Name.

- Provide the Employer Address, where income withholding orders should be sent.

- Enter the Employer City, Employer State, and Zip Code (5 digits).

- Optionally, add the Employer Phone and Employer Fax.

- If desired, include a Contact Name and Email.

- Next, move to the Employee Information section.

- Input the Employee Social Security Number (SSN).

- Fill in the Date of Hire in mm/dd/yyyy format.

- Provide the Employee First Name, Middle Initial (optional), and Employee Last Name.

- Enter the Employee Address.

- Fill in the Employee City, Employee State, and Zip Code (5 digits).

- Optionally, include the Date of Birth in mm/dd/yyyy format.

- Indicate the Employee Salary in Dollars and Cents, and specify if it is Hourly, Monthly, or Yearly.

- State whether health care benefits are available to the employee by marking Y for Yes or N for No.

- Finally, indicate the Employee Gender by selecting M for Male or F for Female.

Ensure that the form is filled out neatly in capital letters and avoid touching the edges of the boxes. After completing the form, submit it within 20 days of the employee's hire or rehire date.

Learn More on Maryland New Hire

What is the Maryland New Hire form?

The Maryland New Hire form is a document that employers in Maryland are required to complete when they hire a new employee. This form helps the state keep track of new hires for various purposes, including child support enforcement and unemployment insurance. It collects essential information about both the employer and the employee, ensuring that all necessary details are recorded accurately.

How do I submit the Maryland New Hire form?

You can submit the completed Maryland New Hire form in several ways. You may send it by mail to the Maryland New Hire Registry at PO Box 1316, Baltimore, MD 21203-1316. Alternatively, you can fax the form to (410) 281-6004 or use the toll-free fax number at 1 (888) 657-3534. Ensure that you send the form within 20 days of the employee's hire date to comply with state regulations.

What information is required on the form?

The Maryland New Hire form requires specific information from both the employer and the employee. For the employer, you will need to provide:

- Federal Employer Identification Number (FEIN)

- State Unemployment Insurance Number (if applicable)

- Employer name and address

- Contact details (optional)

For the employee, the form requires:

- Social Security Number (SSN)

- Date of hire

- Employee's name and address

- Date of birth (optional)

- Salary information

- Gender

It is important to fill out the form neatly and accurately to avoid any issues.

What happens if I miss the submission deadline?

If you do not submit the Maryland New Hire form within 20 days of hiring or rehiring an employee, you may face penalties. The state may impose fines, and failure to comply could affect your business's standing. It is advisable to set reminders or establish a process to ensure timely submissions.

Can I report new hires online?

Yes, you can report new hires online through the Maryland New Hire Registry website at www.mdnewhire.com. This option may be more convenient, allowing you to complete the process quickly and efficiently. Online reporting can help ensure that your submission is received promptly and accurately.

Where can I get help if I have questions about the form?

If you have any questions regarding the Maryland New Hire form, you can call the Maryland New Hire Registry at (410) 281-6000 or the toll-free number at 1 (888) MDHIRES (634-4737). They can provide assistance and clarify any doubts you may have about completing the form or the submission process.

Additional PDF Forms

How Much Back Child Support Is a Felony in Maryland - Legal guidance is advisable when completing this form to ensure all necessary elements are included.

To further clarify the details of the transaction, utilizing a reliable resource like PDF Templates Online can streamline the process of completing the New York Motorcycle Bill of Sale form, ensuring that all necessary information is accurately documented and providing peace of mind for both parties involved.

Form Mw506nrs - Individuals and various business entities can file the MW506AE application.

Documents used along the form

The Maryland New Hire form is a crucial document for employers in Maryland, serving as a means to report new hires to the state. Along with this form, several other documents may be required to ensure compliance with employment laws and regulations. Below is a list of commonly used forms that complement the Maryland New Hire form.

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. It ensures that the correct amount of federal income tax is withheld from their paychecks.

- I-9 Form: The Employment Eligibility Verification form is necessary for verifying the identity and employment authorization of individuals hired for employment in the United States.

- Marital Separation Agreement: For those navigating separation, our comprehensive Marital Separation Agreement resources provide essential guidance on legal obligations.

- Maryland Employee Withholding Exemption Certificate: This document allows employees to claim exemptions from state income tax withholding if they meet specific criteria.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their wages directly into their bank accounts, ensuring timely payment.

- Employee Handbook Acknowledgment: This form confirms that employees have received and understood the company’s employee handbook, which outlines policies and procedures.

- Health Insurance Enrollment Form: If health benefits are offered, this form is used by employees to enroll in health insurance plans provided by the employer.

- Emergency Contact Form: This document allows employees to provide important contact information in case of an emergency, ensuring that the employer can reach someone on their behalf.

Employers should ensure that all relevant forms are completed accurately and submitted in a timely manner. This helps maintain compliance with state and federal regulations while fostering a supportive work environment.

Key takeaways

Filling out the Maryland New Hire form is an important process for employers. Here are some key takeaways to keep in mind:

- Submission Timeline: Reports must be submitted within 20 days of the employee's date of hire or rehire.

- Accurate Information: Ensure that all information is printed neatly in capital letters. Avoid contact with the edges of the boxes to maintain clarity.

- Employer Identification: Use the same Federal Employer Identification Number (FEIN) that appears on quarterly wage reports. If a State Unemployment Insurance Number (SUIN) is not issued, write “APPLIEDFOR” in the designated box.

- Contact Details: Include the employer's address where income withholding orders should be sent. Providing optional contact information can facilitate communication.

- Employee Information: Collect complete details about the employee, including their Social Security Number, date of hire, and salary structure.

- Health Care Benefits: Indicate whether health care benefits are available to the employee by answering yes or no.

For any questions or assistance, employers can reach out to the Maryland New Hire Registry at the provided phone numbers or visit the official website.

Misconceptions

- Misconception 1: The Maryland New Hire form is only for full-time employees.

- Misconception 2: Employers can submit the form at any time after hiring.

- Misconception 3: The form does not require accurate information.

- Misconception 4: Only the employee's Social Security Number is necessary.

- Misconception 5: The form can be submitted online without any verification.

- Misconception 6: The New Hire Registry is only for tracking employment.

- Misconception 7: The form can be faxed without confirmation.

This form is required for all new hires, regardless of their employment status. Whether an employee is part-time, full-time, or temporary, the form must be completed and submitted.

It is essential to submit the form within 20 days of the employee's hire or rehire date. Delays can lead to penalties for the employer.

Accuracy is crucial. Employers must ensure that all information is correct and clearly printed to avoid issues with processing.

While the employee's Social Security Number is important, the form also requires various other details, such as the employer's information and the employee's salary.

Even when submitting online, employers should verify all entered information for accuracy. Mistakes can delay processing and lead to complications.

The registry helps in various ways, including ensuring compliance with child support laws. It plays a significant role in supporting state and federal programs.

After faxing the form, it is wise to confirm receipt. This step helps ensure that the submission was successful and that there are no issues with processing.