Blank Maryland Net Tangible Benefit Worksheet Template

Similar forms

The Maryland Net Tangible Benefit Worksheet serves a specific purpose in the mortgage refinancing process. Several other documents share similarities in their function and structure. Here’s a list of ten such documents:

- Loan Estimate Form: This form provides borrowers with a summary of key loan terms, projected payments, and closing costs. Like the Net Tangible Benefit Worksheet, it aims to ensure borrowers understand their financial commitments.

- Closing Disclosure: This document outlines the final details of the mortgage loan, including the loan terms, monthly payments, and closing costs. Both documents help borrowers make informed decisions about their loans.

- Good Faith Estimate: This form gives borrowers an estimate of the costs they will incur when obtaining a mortgage. Similar to the Net Tangible Benefit Worksheet, it focuses on transparency and understanding of financial implications.

- Borrower Certification and Authorization: This document requires borrowers to certify their identity and authorize the lender to obtain necessary information. Both forms emphasize the importance of borrower acknowledgment in the lending process.

- Lease Agreement: A New York Lease Agreement form is crucial for ensuring clarity between landlords and tenants regarding rental terms. Familiarize yourself with this document to avoid ambiguities and consider utilizing resources like PDF Templates Online for templates to aid in the agreement process.

- Loan Application (1003): The standard mortgage application collects essential borrower information. Like the Net Tangible Benefit Worksheet, it serves as a foundational document in the loan process.

- Debt-to-Income Ratio Calculation Form: This form helps lenders assess a borrower’s ability to repay the loan. It is similar in that it evaluates the borrower’s financial situation to determine loan suitability.

- Mortgage Disclosure Improvement Act (MDIA) Notice: This notice informs borrowers about their rights and the timeline for receiving disclosures. It parallels the Net Tangible Benefit Worksheet in promoting borrower awareness.

- Truth in Lending Act (TILA) Disclosure: This disclosure provides important information about the cost of credit, including the annual percentage rate (APR). Both documents aim to ensure borrowers are well-informed.

- Home Loan Toolkit: This guide offers practical advice for homebuyers and borrowers. It shares a similar goal of educating borrowers about their options and responsibilities.

- Refinance Agreement: This document outlines the terms of the refinancing process. Like the Net Tangible Benefit Worksheet, it focuses on the benefits and obligations associated with the new loan.

Maryland Net Tangible Benefit Worksheet - Usage Steps

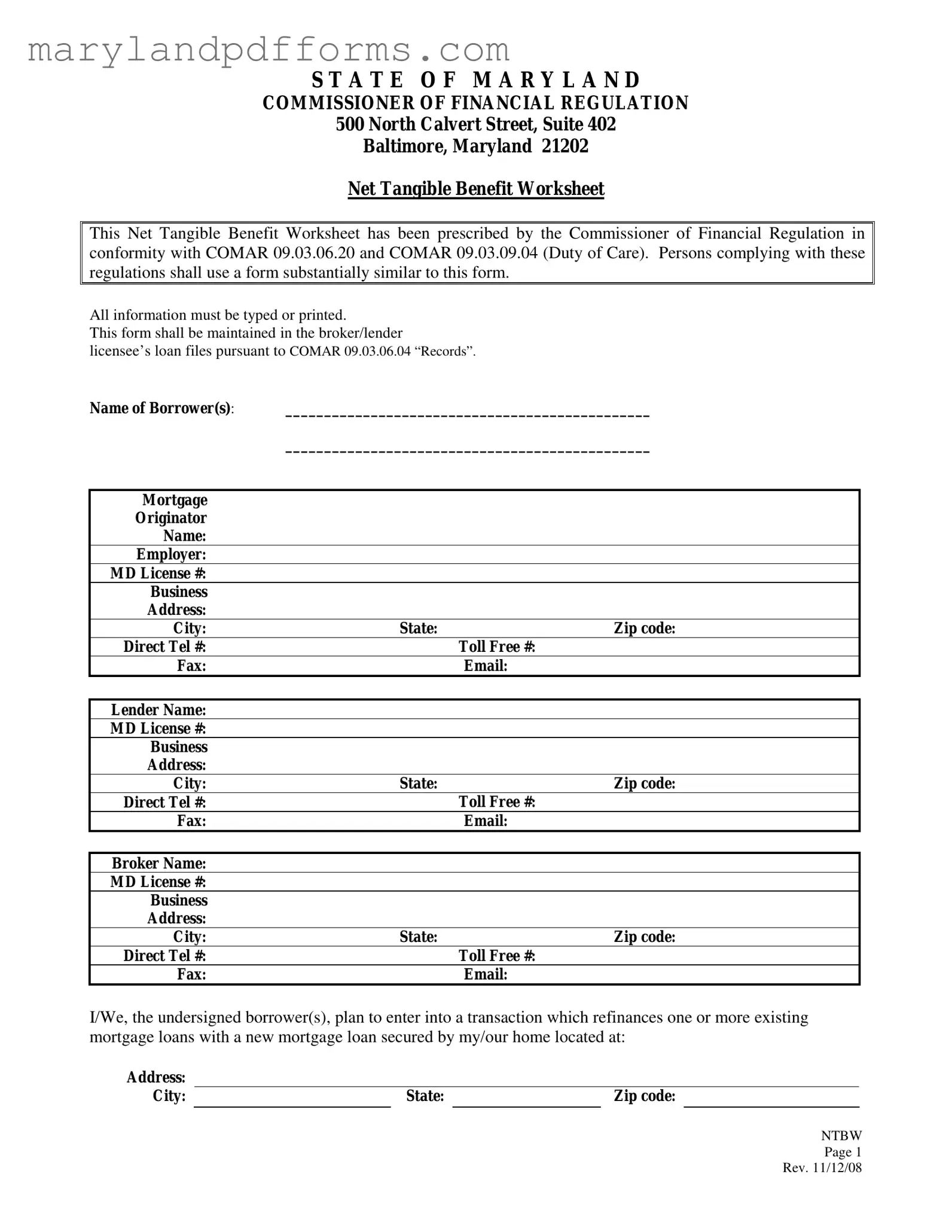

Completing the Maryland Net Tangible Benefit Worksheet is essential for ensuring compliance with state regulations. This process requires attention to detail and accurate information. Follow the steps below to fill out the form correctly.

- Begin by entering the Name of Borrower(s) in the designated space at the top of the form.

- Fill in the Mortgage Originator Name and their Employer information, including the MD License #.

- Provide the Business Address, City, State, and Zip code for the mortgage originator.

- Enter the Direct Tel #, Toll Free #, Fax, and Email of the mortgage originator.

- Repeat the same process for the Lender Name, including their MD License # and contact details.

- Next, fill out the Broker Name along with their MD License # and contact information.

- Indicate the property address where the refinancing will occur by filling in the Address, City, and Zip code.

- Review the acknowledgment section. Ensure you understand the costs associated with the new loan and the potential changes in terms.

- Each borrower should initial next to the benefits that apply to their situation. Options include obtaining a lower interest rate, changing from an adjustable to a fixed rate, or consolidating existing loans.

- Consider all terms of both the existing and new loans, along with personal circumstances, to confirm the overall benefits.

- Finally, both borrowers must sign and date the form in the designated areas at the bottom.

Learn More on Maryland Net Tangible Benefit Worksheet

What is the purpose of the Maryland Net Tangible Benefit Worksheet?

The Maryland Net Tangible Benefit Worksheet is designed to ensure that borrowers receive a clear understanding of the benefits associated with refinancing their mortgage loans. It is a requirement under Maryland regulations that lenders provide this form to demonstrate that the new loan offers a tangible benefit compared to the existing loan. The worksheet helps both the borrower and the lender assess the financial advantages of the new mortgage, taking into account various factors such as interest rates, monthly payments, and loan terms.

Who needs to complete the Net Tangible Benefit Worksheet?

Both borrowers and lenders are involved in the completion of the Net Tangible Benefit Worksheet. Borrowers must provide their personal information, including names and contact details, as well as the specifics of their existing mortgage and the new loan they are considering. Lenders, including mortgage originators and brokers, are responsible for ensuring that this form is filled out accurately and kept on file as part of the loan documentation. It is essential for compliance with Maryland's financial regulations.

What information is required on the worksheet?

The worksheet requires several key pieces of information, including:

- Names and contact details of the borrower(s)

- Details of the mortgage originator and lender, including their Maryland license numbers

- The address of the property being refinanced

- A list of potential benefits the borrower may receive from the new loan, which the borrower must initial

Additionally, the borrower must acknowledge their understanding of the costs associated with the new loan and confirm that they believe it provides a net tangible benefit.

What are some examples of net tangible benefits listed on the form?

The worksheet outlines several benefits that borrowers may experience by refinancing their mortgage. Some examples include:

- Obtaining a lower interest rate

- Reducing monthly payments

- Switching from an adjustable-rate mortgage to a fixed-rate mortgage

- Eliminating private mortgage insurance

- Consolidating other loans into a new mortgage

These benefits help borrowers evaluate whether refinancing is the right decision for their financial situation. Each borrower should consider their unique circumstances when assessing the advantages of a new loan.

Additional PDF Forms

Maryland Credentialing Application - Remember, incomplete applications will be returned, so double-check your entries.

To ensure safety and transparency, it is crucial to understand the details surrounding the California Release of Liability form, as outlined in resources like https://holdharmlessletter.com, which provides valuable insights into how this document can protect individuals and organizations during high-risk activities.

Is Maryland State Income Tax Currently Being Withheld From Your Pay? - Any errors in reporting can lead to adjustments or inquiries from the Maryland tax authorities.

Documents used along the form

The Maryland Net Tangible Benefit Worksheet is an essential document used in refinancing transactions. However, several other forms and documents often accompany it to ensure compliance and transparency in the lending process. Below is a list of these documents, each serving a specific purpose in the refinancing process.

- Loan Estimate: This document provides borrowers with important details about the mortgage loan, including estimated interest rates, monthly payments, and closing costs. It helps borrowers understand the financial implications of their loan options.

- Closing Disclosure: Issued at least three days before closing, this document outlines the final terms and costs of the mortgage. It ensures that borrowers are fully informed about the financial aspects of their loan before finalizing the transaction.

- Borrower's Affidavit: This sworn statement confirms the borrower's identity and financial situation. It may include information about income, debts, and other relevant financial details that lenders need to assess risk.

- Independent Contractor Agreement: To establish clear working terms, download the essential Independent Contractor Agreement template for your needs.

- Title Insurance Policy: This document protects the lender and borrower from potential claims against the property title. It ensures that the property is free from liens or other issues that could affect ownership.

- Income Verification Documents: These documents, such as pay stubs or tax returns, are used to verify the borrower's income. Lenders require this information to assess the borrower's ability to repay the loan.

These documents work together to create a comprehensive picture of the refinancing process, ensuring that borrowers are well-informed and protected. Understanding each of these forms can help borrowers navigate their refinancing journey more effectively.

Key takeaways

Here are key takeaways regarding the Maryland Net Tangible Benefit Worksheet:

- The worksheet is designed to ensure compliance with Maryland's financial regulations.

- It must be filled out completely, with all information typed or printed clearly.

- Borrowers should understand the costs and terms associated with the new loan compared to existing loans.

- Each borrower must initial any benefits that apply to their refinancing situation.

- Benefits can include lower interest rates, lower monthly payments, or changes in loan features.

- Borrowers must consider their personal circumstances when evaluating the new loan's benefits.

- The completed worksheet should be kept in the lender’s loan files as required by regulations.

Misconceptions

Misconceptions about the Maryland Net Tangible Benefit Worksheet can lead to confusion among borrowers. Here are four common misunderstandings:

- The worksheet is optional. Many people believe that using the Net Tangible Benefit Worksheet is not mandatory. In reality, it is prescribed by the Commissioner of Financial Regulation and must be used by lenders to ensure compliance with state regulations.

- All loans automatically qualify for benefits. Some borrowers think that refinancing will always result in a tangible net benefit. However, each situation is unique. Borrowers must evaluate the terms of both their existing and new loans to determine if the new loan truly offers a benefit.

- The worksheet guarantees a lower payment. There is a misconception that completing the worksheet will guarantee a lower monthly payment. While the worksheet helps assess potential benefits, it does not ensure that the new loan will be cheaper. Market conditions and individual financial situations play significant roles.

- Only interest rates matter. Many borrowers focus solely on interest rates when considering refinancing. The worksheet emphasizes that other factors, such as loan duration and closing costs, also significantly impact the overall benefit of a new loan.

Understanding these misconceptions can help borrowers make informed decisions about refinancing their mortgages.