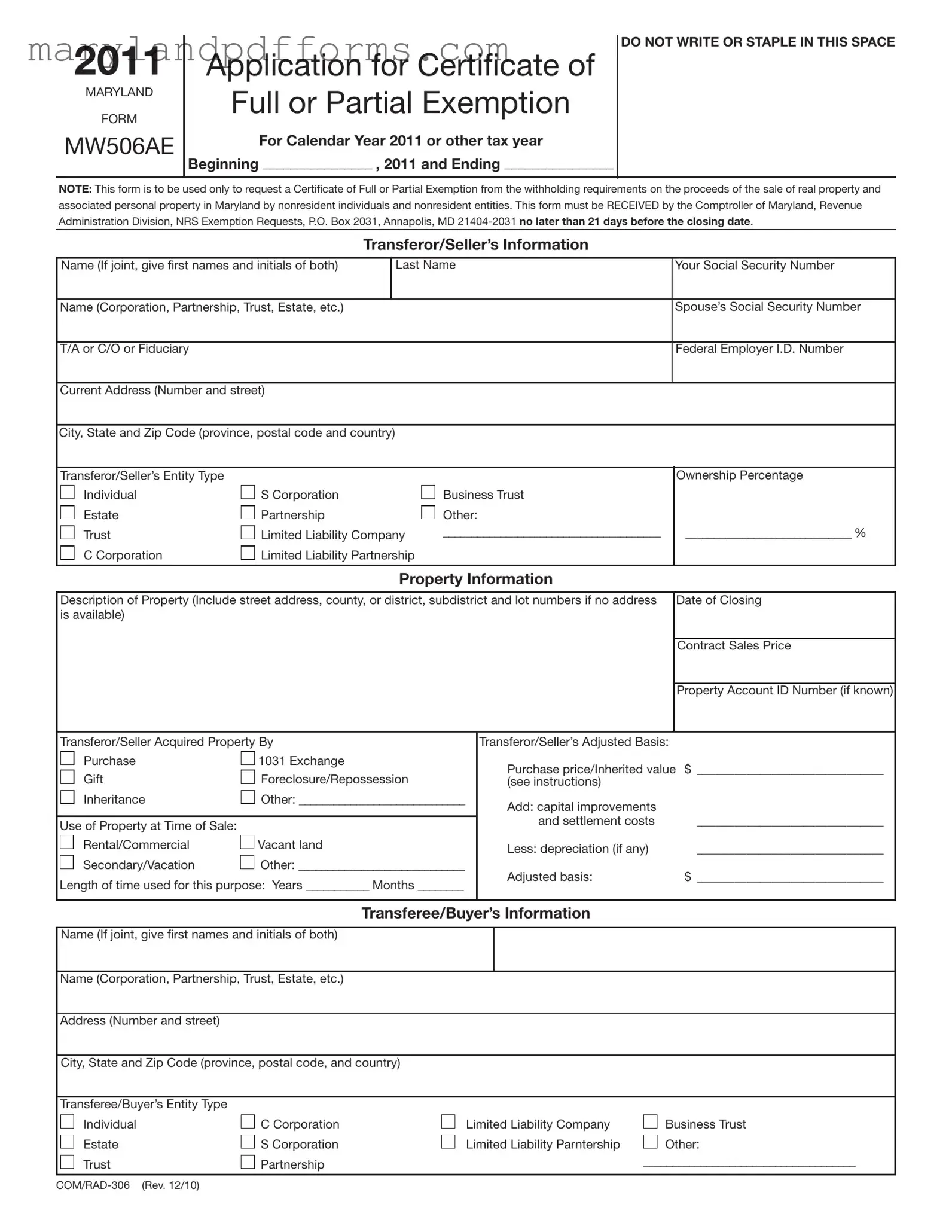

Blank Maryland Mw506Ae Template

Similar forms

The Maryland MW506AE form is a specific application for a Certificate of Full or Partial Exemption from withholding requirements on the sale of real property by nonresident individuals and entities. Several other documents serve similar purposes in different contexts. Here’s a comparison of the MW506AE with nine other related forms:

- IRS Form 8288: This form is used by buyers of U.S. real property interests from foreign sellers to report and pay withholding tax. Like the MW506AE, it addresses tax withholding but focuses on transactions involving foreign sellers.

- IRS Form 1099-S: This form reports proceeds from real estate transactions. It is similar to the MW506AE in that it relates to the sale of property, but it is used primarily for reporting purposes rather than for exemption applications.

- IRS Form 8821: This form is a Tax Information Authorization. While it does not directly relate to property sales, it allows a designated person to receive tax information, which can be useful in managing tax implications of property transactions.

- IRS Form 1040: This is the standard individual income tax return form. It is related because it includes reporting of capital gains from property sales, which may tie back to the exemptions claimed on the MW506AE.

- IRS Form 4562: This form is used to claim depreciation on property. It is relevant as it helps establish the adjusted basis for property, similar to the calculations required on the MW506AE.

- California Living Will Form: To ensure your medical preferences are honored, consider preparing a comprehensive Living Will document that outlines your healthcare wishes during critical times.

- Maryland Form 502: This is the Maryland income tax return for individuals. It relates to the MW506AE as both forms deal with income tax implications, particularly for nonresidents.

- Maryland Form 503: This form is for nonresident income tax returns. It is similar in that it addresses the tax responsibilities of nonresidents, much like the MW506AE does for property sales.

- Maryland Form 1: This is the application for a Maryland Sales and Use Tax Exemption Certificate. While focused on sales tax, it shares the purpose of seeking exemption from tax obligations.

- IRS Form 8822: This form is used to change an address with the IRS. Though not directly related to property sales, maintaining accurate records is crucial for tax matters, including those involving the MW506AE.

Each of these documents serves a unique purpose, yet they all connect to tax obligations and exemptions in various ways, particularly in the context of property transactions and reporting requirements.

Maryland Mw506Ae - Usage Steps

Filling out the Maryland MW506AE form is an important step for nonresident individuals and entities looking to request a certificate of full or partial exemption from withholding requirements on the sale of real property in Maryland. Ensure that you have all necessary information and documentation ready before starting the process. Following these steps will help you complete the form accurately and submit it on time.

- Obtain the Maryland MW506AE form from the official Maryland tax website or other reliable sources.

- Fill in the calendar year for which you are applying at the top of the form.

- Provide the transferor/seller’s information, including the full name, Social Security number (or Federal Employer Identification Number), and current address.

- Indicate the entity type of the transferor/seller and the ownership percentage of the property.

- Describe the property being sold, including the address and any relevant identification numbers.

- Enter the contract sales price and the date of closing for the sale.

- Complete the section regarding how the transferor/seller acquired the property and its adjusted basis, including any capital improvements or depreciation.

- Provide information about the transferee/buyer, including their name, address, and entity type.

- Check the appropriate box to indicate the reason for requesting a full or partial exemption from withholding.

- Calculate the amount subject to tax withholding by subtracting the adjusted basis from the contract sales price.

- Enter the applicable tax rate based on whether the transferor/seller is an individual or a business entity.

- Calculate the total amount of tax to be withheld at closing by multiplying the amount subject to tax withholding by the tax rate.

- Sign and date the form, ensuring that all signatures are provided where necessary.

- Mail the completed form and any required documentation to the Comptroller of Maryland at the specified address.

After submitting the form, it is crucial to wait for the Comptroller’s decision regarding your application. Remember, the completed form must be received at least 21 days before the closing date to ensure timely processing. If you have any questions or need assistance, consider reaching out to the Comptroller’s office or consulting additional resources available online.

Learn More on Maryland Mw506Ae

What is the purpose of the Maryland MW506AE form?

The Maryland MW506AE form is used to apply for a Certificate of Full or Partial Exemption from withholding requirements on the sale of real property and associated personal property in Maryland. This applies specifically to nonresident individuals and nonresident entities. Completing this form allows the seller to request exemption from tax withholding on the proceeds from the sale.

Who is eligible to file the MW506AE form?

Eligible filers include nonresident individuals, fiduciaries, C corporations, S corporations, limited liability companies, and partnerships. If the transferors or sellers are married and filing a joint Maryland income tax return, they must still submit separate MW506AE forms for each individual. It is crucial to ensure that the completed form is submitted on time to avoid any issues.

What is the deadline for submitting the MW506AE form?

The completed MW506AE form must be received by the Comptroller of Maryland no later than 21 days before the closing date of the sale. This deadline is critical to ensure that the application is processed in time and that the seller receives the appropriate exemption certificate.

What information is required on the MW506AE form?

The form requires detailed information, including:

- Transferor/Seller’s name, Social Security number, and address.

- Property information, including description, contract sales price, and property account ID number.

- Reason for exemption, which must be supported by appropriate documentation.

- Calculation of tax to be withheld, if applicable.

Providing accurate and complete information is essential for the approval of the exemption request.

What documentation is needed to support the exemption request?

Documentation varies based on the reason for the exemption. Common requirements include:

- For a principal residence transfer, provide a copy of the contract of sale or HUD-1 settlement sheet.

- For tax-free exchanges, include a letter from the qualified intermediary.

- If the transfer is of inherited property, submit a copy of the death certificate.

It is crucial to attach all necessary documentation to avoid delays or denial of the exemption request.

How is the tax to be withheld calculated on the MW506AE form?

To calculate the tax to be withheld, follow these steps:

- Determine the amount subject to tax withholding by subtracting the adjusted basis from the contract sales price.

- Identify the applicable tax rate: 8.25% for business entities or 6.75% for individuals.

- Multiply the amount subject to tax by the tax rate to find the total tax to be withheld at closing.

This calculation must be completed for the application to be considered valid, especially if requesting a partial exemption.

Additional PDF Forms

Maryland Late Filing Penalty - Track due dates diligently to ensure adherence to Maryland’s tax scheduling.

Completing the Colorado Articles of Incorporation form is essential for any business aspiring to operate legally in Colorado, and additional resources can be found at coloradoformpdf.com, which provides guidance on filling out this crucial document accurately.

Modification of Sentence - The form needs to be clearly filled out to avoid delays in processing.

Documents used along the form

The Maryland MW506AE form is essential for nonresident individuals and entities seeking a Certificate of Full or Partial Exemption from withholding requirements on real property sales. However, several other forms and documents often accompany this application to ensure a smooth process. Here’s a brief overview of those documents:

- Form MW506: This is the general withholding tax return form for Maryland. It reports the amount of tax withheld from the sale of real property and is crucial for compliance.

- Form 2848: This is the Power of Attorney and Declaration of Representative form. It allows someone else to act on behalf of the taxpayer in tax matters, which can be helpful during the exemption application process.

- Texas Notice to Quit Form: This legal document is crucial for landlords wishing to instruct tenants to vacate the property. For more information, visit texasdocuments.net/printable-notice-to-quit-form/.

- HUD-1 Settlement Statement: This document outlines all the costs associated with the sale of real estate. It is often required to support claims for exemptions based on settlement expenses.

- Death Certificate: If the property is inherited, a death certificate is necessary to validate the transfer of property within six months of the owner's passing.

- Tax Exempt Status Documentation: For transfers involving tax-exempt entities, proof of tax-exempt status from the IRS is required to support the exemption claim.

- Agreement of Sale: This document details the terms of the property sale. It can provide necessary context for the exemption request and is often required for tax-free exchanges.

- Notarized Affidavit: In some cases, a notarized affidavit may be needed to confirm the details of the transaction, especially for transfers involving partnerships or tax-free reorganizations.

- Partnership Agreement: If the transfer involves a partnership, this document outlines the terms of the partnership and can clarify the nature of the transaction.

- Certificate of Good Standing: This document verifies that a business entity is authorized to operate in Maryland. It may be required for nonresident entities involved in the transaction.

Submitting these documents alongside the MW506AE form can streamline the process and help ensure that all necessary information is available for the Comptroller's review. Being thorough and prepared can make a significant difference in the outcome of your exemption request.

Key takeaways

The Maryland MW506AE form is essential for nonresident individuals and entities seeking a certificate of full or partial exemption from withholding requirements on real property sales. Here are six key takeaways to consider when filling out and using this form:

- Timeliness is Crucial: Submit the completed MW506AE form to the Comptroller of Maryland at least 21 days before the closing date to ensure timely processing.

- Accurate Information is Key: Provide complete and correct details about the transferor/seller, including names, addresses, and identification numbers. This helps avoid delays in processing.

- Understand Your Eligibility: Familiarize yourself with the reasons for exemption listed on the form. Ensure that you check the appropriate box and provide any required documentation to support your claim.

- Calculate Tax Withholding Properly: If applying for a partial exemption, accurately calculate the amount subject to tax withholding. This calculation is critical and must be included for the application to be valid.

- Documentation is Essential: Attach all necessary documents that support your exemption request. This may include contracts, settlement sheets, and proof of property acquisition.

- Final Decisions are Binding: Be aware that the Comptroller’s decision regarding the issuance or denial of the exemption certificate is final and not subject to appeal. Ensure all information is accurate to avoid complications.

Misconceptions

Misconceptions about the Maryland MW506AE form can lead to confusion and potentially costly mistakes. Here are ten common misconceptions along with clarifications to ensure a better understanding of the form and its requirements.

- 1. The MW506AE form is only for Maryland residents. This form is specifically designed for nonresident individuals and entities selling real property in Maryland. Residents do not need to use this form.

- 2. You can submit the form at any time before closing. The form must be received by the Comptroller of Maryland at least 21 days before the closing date. Late submissions may not be processed in time.

- 3. All property sales require the MW506AE form. The form is only necessary if the seller is a nonresident. Maryland residents do not need to file this form.

- 4. You can skip providing documentation for exemptions. Each reason for requesting an exemption requires specific documentation. Failing to provide this can result in denial of the exemption.

- 5. The form is only for residential property sales. The MW506AE form applies to both residential and commercial properties, as long as the seller is a nonresident.

- 6. You can use the form for any tax year. The MW506AE form is specific to the tax year indicated on the form. Ensure you are using the correct version for the year of the sale.

- 7. The form guarantees an exemption from withholding. Submitting the form does not guarantee an exemption. The Comptroller will review the application and determine if the exemption is granted.

- 8. Only one form is needed for joint sellers. If the sellers are married and filing jointly, only one form is required. However, if there are multiple sellers not married to each other, a separate form is needed for each.

- 9. You can file the form electronically. Currently, the MW506AE form must be mailed to the Comptroller of Maryland. Electronic filing is not available.

- 10. You do not need to sign the form if someone else prepares it. The form must be signed by the transferor/seller, regardless of who prepares it. This signature confirms the accuracy of the information provided.

Understanding these misconceptions can help ensure compliance and a smoother transaction process when dealing with property sales in Maryland.