Blank Maryland Frorm 510 Template

Similar forms

Form 1065: This is the U.S. Return of Partnership Income. Like Form 510, it reports income, deductions, gains, and losses from partnerships. Both forms require details about partners and their shares of income.

Form 1120S: This is the U.S. Income Tax Return for an S Corporation. Similar to Form 510, it is used to report income, deductions, and credits for S Corporations, focusing on the distribution of income to shareholders.

Form 990: This is the Return of Organization Exempt from Income Tax. While it serves a different purpose, both Form 990 and Form 510 require detailed information about the organization’s income and activities, particularly for tax compliance.

Form 1040: This is the U.S. Individual Income Tax Return. While Form 1040 is for individuals, both forms require reporting of income and deductions, and they ultimately affect the tax obligations of the individuals involved.

Form 5471: This is the Information Return of U.S. Persons With Respect to Certain Foreign Corporations. Like Form 510, it requires detailed reporting of ownership and income distribution, particularly for U.S. persons involved with foreign entities.

Form 8865: This is the Return of U.S. Persons With Respect to Certain Foreign Partnerships. Similar to Form 510, it focuses on the reporting of income and distributions from foreign partnerships to U.S. partners.

Form 1066: This is the U.S. Income Tax Return for Real Estate Mortgage Investment Conduits. Both forms require reporting of income and distributions, emphasizing the flow of income to investors.

Form 1041: This is the U.S. Income Tax Return for Estates and Trusts. Both Form 510 and Form 1041 deal with the allocation of income and tax responsibilities among beneficiaries or partners.

Texas Operating Agreement Form: This is a crucial document for LLCs in Texas, specifying the management framework and operational guidelines necessary for member governance. For more information and to fill out the form, visit https://texasdocuments.net/printable-operating-agreement-form/.

Form 990-T: This is the Exempt Organization Business Income Tax Return. Similar to Form 510, it is used by tax-exempt organizations to report unrelated business income and calculate tax owed.

Form 1120: This is the U.S. Corporation Income Tax Return. While it applies to C Corporations, both forms require reporting of income and deductions, impacting the overall tax responsibilities of the entities.

Maryland Frorm 510 - Usage Steps

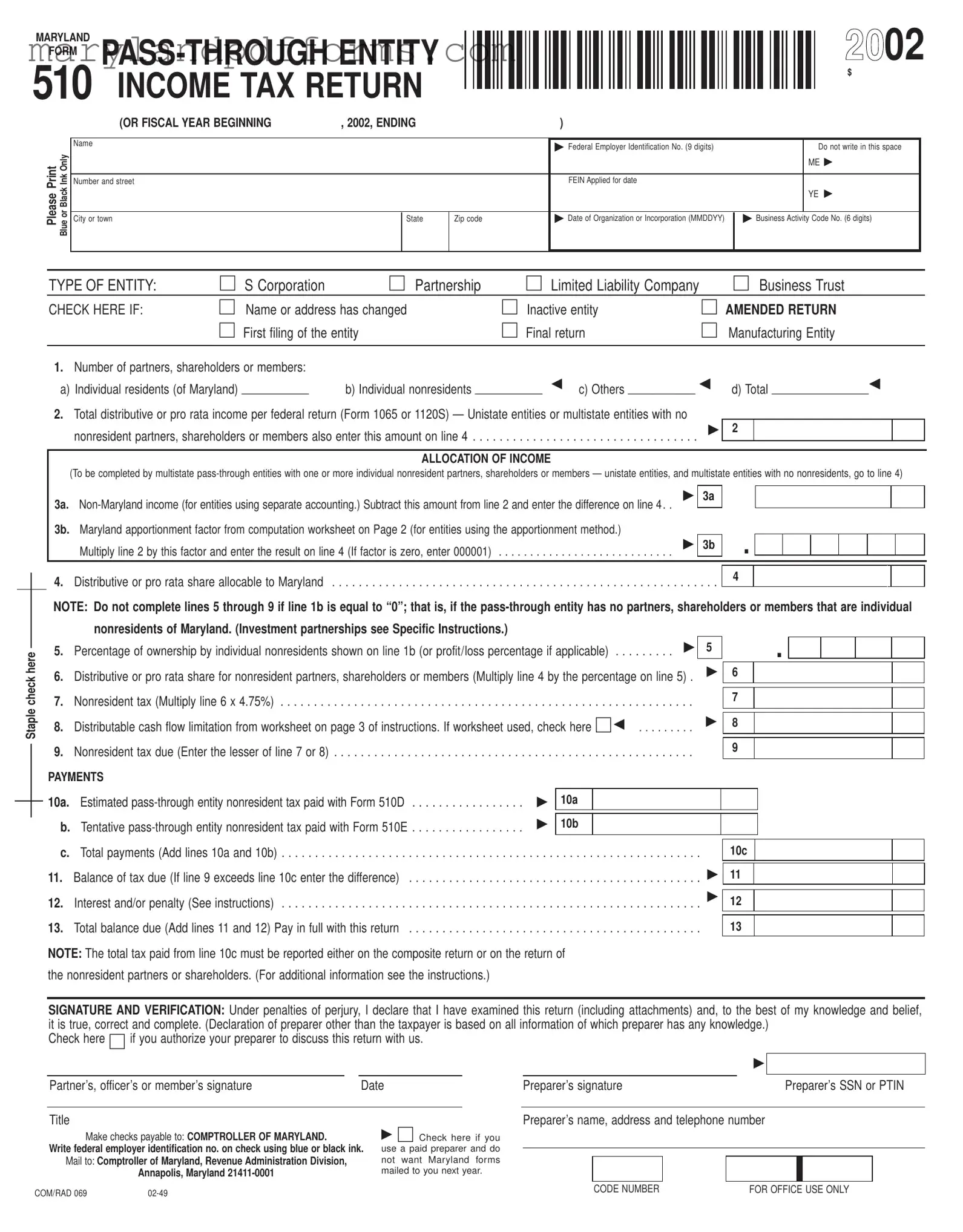

Filling out the Maryland Form 510 is a crucial step for pass-through entities to report their income and tax obligations. This process involves providing specific information about the entity, its owners, and the income generated. Following the steps below will help ensure that the form is completed accurately.

- Obtain the Form: Download the Maryland Form 510 from the Maryland Comptroller's website or acquire a physical copy.

- Fill in Basic Information: At the top of the form, enter the name of the entity and the Federal Employer Identification Number (FEIN). Also, provide the entity’s address, including city, state, and zip code.

- Indicate the Date of Organization: Write the date of organization or incorporation in the specified format (MMDDYY).

- Business Activity Code: Enter the 6-digit business activity code that corresponds to the entity's primary business activity.

- Select the Type of Entity: Check the box that identifies the type of entity: S Corporation, Partnership, Limited Liability Company, or Business Trust.

- Check Relevant Boxes: Indicate if there have been any changes to the name or address, if the entity is inactive, or if this is an amended or final return.

- Provide Ownership Information: Fill in the number of partners, shareholders, or members, distinguishing between Maryland residents and non-residents.

- Report Total Income: Enter the total distributive or pro-rata income as reported on the federal return (Form 1065 or 1120S).

- Complete Income Allocation: If applicable, fill out the allocation of income section, including non-Maryland income and Maryland apportionment factors.

- Calculate Nonresident Tax: Follow the prompts to calculate the nonresident tax due based on the distributive share for nonresident partners or shareholders.

- Detail Payments: Report any estimated tax payments made with Form 510D and tentative payments made with Form 510E. Calculate the total payments.

- Determine Balance Due: If the tax due exceeds the total payments, calculate the balance of tax due.

- Sign and Date the Form: The partner, officer, or member must sign and date the form, verifying the accuracy of the information provided.

- Mail the Form: Send the completed form and any payments to the Comptroller of Maryland, ensuring that the FEIN is noted on the check.

After completing these steps, review the form for accuracy before submitting it. This careful approach will help ensure compliance with Maryland tax regulations and avoid potential issues down the line.

Learn More on Maryland Frorm 510

What is the Maryland Form 510?

The Maryland Form 510 is an income tax return specifically designed for pass-through entities, such as S Corporations, Partnerships, Limited Liability Companies, and Business Trusts. This form is used to report income, deductions, and tax liabilities for these entities operating in Maryland. It allows for the distribution of income to partners, shareholders, or members, and ensures compliance with state tax laws.

Who needs to file the Maryland Form 510?

Any pass-through entity that has partners, shareholders, or members, including individual nonresidents of Maryland, must file this form. This includes entities that are either based in Maryland or have income sourced from Maryland. If the entity has no nonresident partners, shareholders, or members, certain sections of the form may not need to be completed.

What information is required to complete the Form 510?

To complete the Form 510, the following information is typically required:

- Name and Federal Employer Identification Number (FEIN) of the entity.

- Address and business activity code.

- Number of partners, shareholders, or members, including residents and nonresidents.

- Total distributive or pro rata income as reported on federal returns (Form 1065 or 1120S).

- Details on income allocation, especially for multistate entities.

Additional information may include payment details, tax due, and signatures for verification.

What are the deadlines for filing Form 510?

The Maryland Form 510 is generally due on the 15th day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Extensions may be available, but they must be requested in advance.

How is tax calculated on the Form 510?

Tax for nonresident partners, shareholders, or members is calculated based on their distributive or pro rata share of the entity's income allocable to Maryland. This amount is then multiplied by the nonresident tax rate of 4.75%. It's important to ensure accurate reporting to avoid penalties or interest on underpayments.

Where should the completed Form 510 be sent?

Completed Maryland Form 510 should be mailed to the Comptroller of Maryland, Revenue Administration Division, at Annapolis, Maryland 21411-0001. If using a paid preparer, ensure that the preparer's information is included on the form. Payments should be made out to the Comptroller of Maryland, with the FEIN noted on the check.

Additional PDF Forms

Md Estate Forms - The Maryland 504E form allows fiduciaries to request an extension for filing fiduciary income tax returns.

The Colorado Divorce Settlement Agreement form is a crucial legal document that helps in preventing misunderstandings between spouses by clearly detailing the agreed terms regarding the division of assets, liabilities, child custody, and other pertinent matters during a divorce. For those looking for a reliable source to access this form, coloradoformpdf.com/ is an excellent resource that aligns with Colorado's legal requirements, ensuring that all aspects are addressed appropriately.

Maryland Confidential Morbidity Report - It clarifies that laboratory facilities should use a different reporting form.

Documents used along the form

The Maryland Form 510 is essential for pass-through entities to report their income tax. However, there are several other forms and documents that are often used alongside it. These documents help clarify various aspects of the entity's financial situation and ensure compliance with tax regulations. Here’s a brief overview of some of the most common forms and documents associated with the Maryland Form 510.

- Maryland Form 510D: This form is used to report estimated nonresident tax payments made by the pass-through entity. It helps ensure that the entity meets its tax obligations throughout the year.

- Maryland Form 510E: This is a tentative return for pass-through entity nonresident taxes. It allows entities to estimate their tax liability and make payments accordingly.

- Maryland Form 500: This is the corporate income tax return for businesses. If a pass-through entity has corporate income, it may need to file this form in addition to Form 510.

- Maryland Form 502: This is the individual income tax return. Nonresident partners or shareholders may need to file this form to report their share of income from the pass-through entity.

- Maryland Form 1065: This is the federal partnership return. It provides details about the entity's income, deductions, and credits, which are then used to complete the Maryland Form 510.

- New York Operating Agreement: This legal document is essential for defining the structure and operational guidelines of an LLC in New York, ensuring clarity among members regarding their roles and responsibilities. For those interested in templates, visit PDF Templates Online.

- Maryland Form 1120S: This form is for S corporations to report their income. Similar to Form 1065, it provides necessary information for completing the Maryland Form 510.

- Maryland Apportionment Factor Worksheet: This worksheet helps determine how much income is taxable in Maryland for multistate entities. It is crucial for accurately completing the allocation of income section on Form 510.

- Partnership Agreement: This document outlines the terms and conditions of the partnership. It can provide important context for income distribution and ownership percentages reported on Form 510.

Understanding these forms and documents can greatly simplify the process of filing taxes for pass-through entities in Maryland. Each form serves a specific purpose and contributes to a comprehensive understanding of the entity's tax obligations. By ensuring all relevant documents are in order, entities can avoid potential issues with tax compliance.

Key takeaways

Understanding the Maryland Form 510 is crucial for pass-through entities such as S Corporations, Partnerships, and Limited Liability Companies. Here are some key takeaways to keep in mind:

- The form must be filled out accurately, including the Federal Employer Identification Number (FEIN) and the business activity code.

- Entities with nonresident partners, shareholders, or members need to complete the income allocation section to determine the tax owed to Maryland.

- Be mindful of deadlines and ensure that all payments are made on time to avoid penalties and interest.

- Keep thorough records, as the form requires detailed information about income, ownership percentages, and tax payments.

Misconceptions

Misconception 1: The Maryland Form 510 is only for S Corporations.

This form is applicable to various entities, including partnerships, limited liability companies, and business trusts. It is not limited to just S Corporations.

Misconception 2: Only Maryland residents need to file this form.

Nonresident partners, shareholders, or members also need to be considered. If your entity has nonresidents, you must complete the form accordingly.

Misconception 3: You can ignore the form if your entity has no nonresident members.

If your entity has no nonresident partners, you still need to complete certain lines. Specifically, you should not complete lines 5 through 9, but other sections may still require attention.

Misconception 4: The form is only for entities with income.

Even if your entity is inactive or has no income, you may still need to file the form. Indicate your entity's status appropriately.

Misconception 5: You don’t need to report payments made in advance.

Misconception 6: The form can be submitted without any supporting documents.

Misconception 7: The apportionment factor is the same for all entities.

Misconception 8: Filing an amended return is unnecessary if you made a mistake.

Misconception 9: You can use any ink color to fill out the form.