Blank Maryland Exclusion Template

Similar forms

The Maryland Exclusion Form serves a specific purpose in the realm of workers' compensation, allowing certain business officers or members to opt out of coverage. It shares similarities with several other legal documents that also deal with exemptions or waivers in various contexts. Here are four such documents:

- Workers' Compensation Waiver Form: Similar to the Maryland Exclusion Form, this document allows employees in specific roles to waive their rights to workers' compensation benefits. Both forms require signatures and must be submitted to relevant authorities, ensuring that the decision is documented and legally recognized.

- Liability Waiver Form: This form is often used in recreational or event settings, allowing participants to waive their right to sue for injuries sustained during activities. Like the Maryland Exclusion Form, it requires informed consent and acknowledgment of risks, emphasizing the importance of voluntary participation.

- Mobile Home Bill of Sale: This legal document is essential for the sale or transfer of ownership of a mobile home in New York. For those interested in creating or understanding this form, detailed information and templates can be found at PDF Templates Online.

- Release of Claims Form: This document is used when an individual agrees to relinquish their right to pursue legal action against another party. Similar to the Maryland Exclusion Form, it serves to protect certain entities from liability while ensuring that the individual understands the implications of their decision.

- Independent Contractor Agreement: This agreement outlines the terms under which a contractor operates, often including clauses that specify the lack of employer-employee relationships. Like the Maryland Exclusion Form, it clarifies the responsibilities and rights of the parties involved, particularly regarding insurance and liability.

Each of these documents plays a critical role in defining the relationship between parties and protecting their respective interests. Understanding their similarities can help individuals navigate their legal rights and responsibilities more effectively.

Maryland Exclusion - Usage Steps

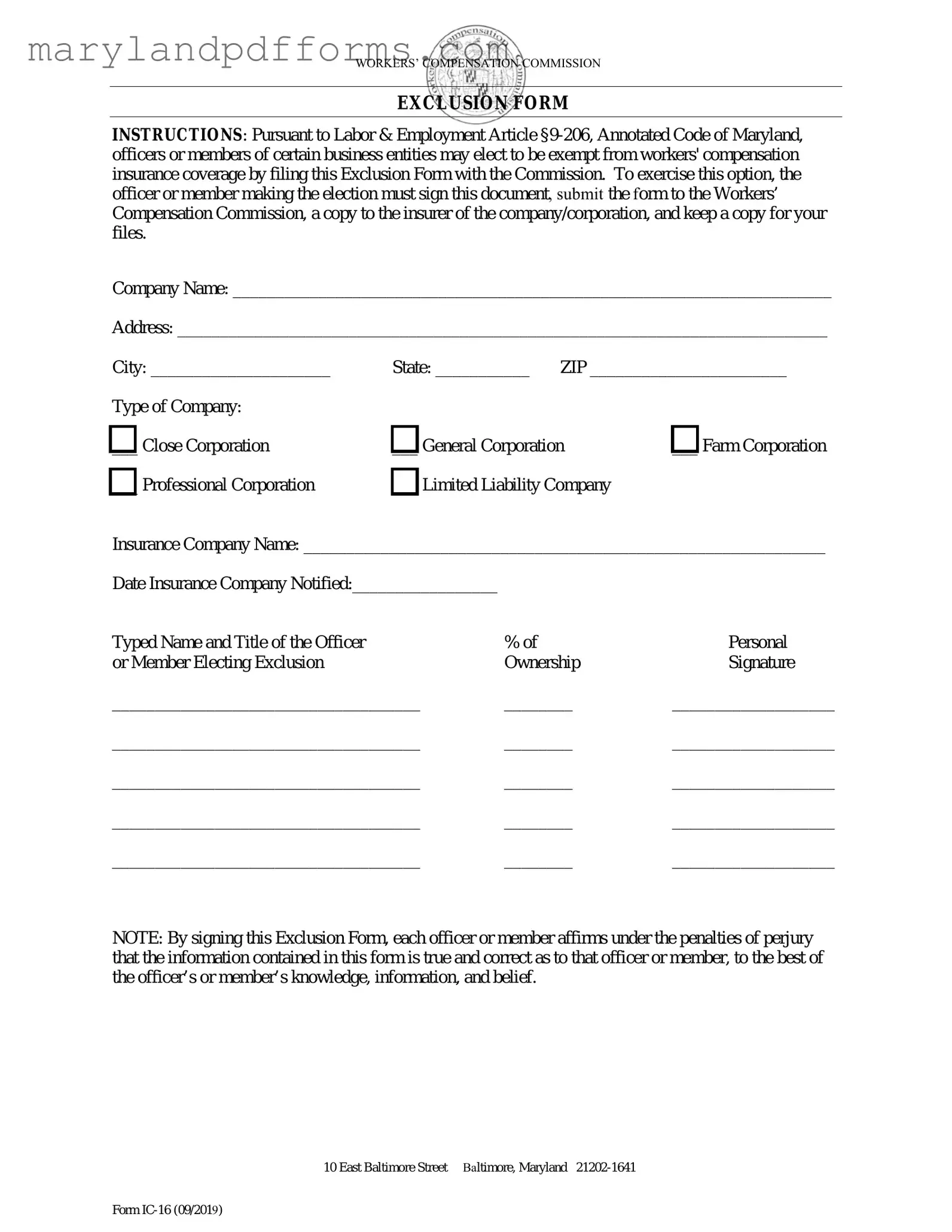

Completing the Maryland Exclusion form involves several straightforward steps. This process ensures that the appropriate parties are notified and that the necessary information is accurately recorded. Follow the steps below to successfully fill out the form.

- Obtain a copy of the Maryland Exclusion form.

- Fill in the Company Name at the top of the form.

- Provide the Address, City, State, and ZIP code of the company.

- Select the Type of Company by marking one of the options: Close Corporation, General Corporation, Farm Corporation, Professional Corporation, or Limited Liability Company.

- Enter the Insurance Company Name that covers the business.

- Indicate the Date Insurance Company Notified.

- Type the Name and Title of the officer or member electing exclusion.

- Each officer or member must sign the form, providing their Signature and the Percentage of Ownership next to their name.

- Make a copy of the completed form for your records.

- Submit the original form to the Workers’ Compensation Commission and send a copy to the insurer.

After completing these steps, ensure that all information is accurate and that the form is submitted in a timely manner. This will help maintain compliance with Maryland regulations regarding workers' compensation coverage.

Learn More on Maryland Exclusion

What is the Maryland Exclusion Form?

The Maryland Exclusion Form allows certain officers or members of business entities to opt out of workers' compensation insurance coverage. This is in accordance with Maryland law, specifically Labor & Employment Article §9-206.

Who is eligible to use the Maryland Exclusion Form?

Officers or members of specific business types can use this form. Eligible entities include:

- Close Corporations

- General Corporations

- Farm Corporations

- Professional Corporations

- Limited Liability Companies

How do I complete the Maryland Exclusion Form?

To complete the form, follow these steps:

- Fill in your company name and address.

- Select the type of company you represent.

- Provide the name of your insurance company.

- Sign the form and include your title and ownership percentage.

Where do I submit the Maryland Exclusion Form?

You must submit the completed form to the Workers’ Compensation Commission. Additionally, send a copy to your insurance company and keep a copy for your records.

What happens after I submit the form?

Once submitted, the Commission will process your request. If approved, you will be exempt from workers' compensation coverage as specified in the form.

Is there a penalty for providing false information on the form?

Yes, by signing the form, you affirm that the information is true and correct. Providing false information can lead to penalties under perjury laws.

Can I revoke my exclusion after submitting the form?

Yes, you can revoke your exclusion. However, you will need to notify the Workers’ Compensation Commission and your insurance company in writing to reinstate coverage.

What should I do if I have more questions about the form?

If you have additional questions, contact the Workers’ Compensation Commission directly. They can provide guidance and clarify any concerns you may have regarding the form or the process.

Additional PDF Forms

Maryland Income Tax Forms - Corporations must indicate if this is their first filing or if there has been a name or address change.

To ensure a seamless transfer process, both buyers and sellers should utilize the Colorado ATV Bill of Sale form, which can be found at https://coloradoformpdf.com/. This document not only clarifies the ownership transfer but also provides essential details necessary for ATV registration in Colorado.

What Does Futa Mean on My Paycheck - This report not only fulfills a legal requirement but also helps ensure proper unemployment support for employees.

Legal Partnership Vs Marriage - Documentation can include joint accounts or shared property ownership details.

Documents used along the form

The Maryland Exclusion form is a crucial document for certain business entities wishing to opt-out of workers' compensation insurance coverage. However, several other forms and documents often accompany it to ensure compliance and clarity in the process. Below is a list of these related documents, each serving a specific purpose.

- Workers' Compensation Insurance Policy: This document outlines the terms and coverage provided by the workers' compensation insurer. It is essential for businesses to understand what is covered and what is excluded.

- Certificate of Insurance: This certificate serves as proof that the business has an active workers' compensation insurance policy. It may be required by clients or regulatory bodies.

- Notice of Election to Exclude: Similar to the Exclusion Form, this notice is filed to formally inform the Workers' Compensation Commission of an officer's or member's decision to opt-out of coverage.

- Employer's First Report of Injury: This form is used to report any workplace injuries to the Workers' Compensation Commission. It is vital for documenting incidents, especially when coverage is in place.

- Claim for Compensation: Should an injury occur, this form is necessary for an employee to file a claim for compensation. It outlines the details of the injury and the benefits sought.

- ADP Pay Stub: This form provides employees with a summary of their earnings and deductions for a specific pay period, including crucial details like gross pay and taxes withheld, which can be further explored at topformsonline.com/adp-pay-stub.

- Independent Contractor Agreement: This agreement defines the relationship between a business and its independent contractors. It may specify that contractors are not covered under the business's workers' compensation insurance.

- Business Entity Registration Documents: These documents establish the legal status of the business entity, such as Articles of Incorporation or Organization, which may be required when submitting the Exclusion Form.

- Operating Agreement: For LLCs, this document outlines the management structure and operating procedures. It may include provisions regarding workers' compensation coverage and exclusions.

- Tax Identification Number (TIN) Application: This form is necessary for businesses to obtain a TIN from the IRS, which is often required when filing various forms, including the Exclusion Form.

- Annual Report: Many business entities are required to file annual reports with the state. This document may include information about insurance coverage and compliance with workers' compensation laws.

Understanding these related documents can help ensure that businesses navigate the complexities of workers' compensation regulations effectively. Proper documentation not only facilitates compliance but also protects both the business and its officers or members in the event of workplace incidents.

Key takeaways

Filling out the Maryland Exclusion Form is an important step for certain business entities wishing to opt out of workers' compensation insurance coverage. Here are some key takeaways to keep in mind:

- The form must be submitted to the Workers’ Compensation Commission.

- A copy of the completed form should also be sent to your company’s insurer.

- Keep a personal copy of the form for your records.

- Only specific business entities, such as close corporations and limited liability companies, can use this form.

- Each officer or member must sign the form to affirm their election of exclusion.

- When filling out the form, ensure that all information is accurate and complete.

- It is essential to notify your insurance company about this exclusion.

- The form includes a declaration under penalties of perjury, emphasizing the importance of honesty.

- Be mindful of the deadlines for submitting the form to avoid any potential issues.

- Consulting with a legal professional can provide clarity on the implications of opting out of coverage.

Misconceptions

Understanding the Maryland Exclusion Form is essential for business owners and officers who wish to opt out of workers' compensation insurance. However, several misconceptions surround this important document. Here are eight common misunderstandings:

- Only certain businesses can use the form. Many believe that only specific types of businesses can file the Maryland Exclusion Form. In reality, various business entities, including close corporations, general corporations, and limited liability companies, can utilize this option.

- Filing the form is optional for all officers. Some think that all officers automatically qualify for exemption without filing. However, to officially elect exclusion, officers must complete and submit the form to the Workers’ Compensation Commission.

- Once filed, the exclusion is permanent. There is a misconception that filing the Exclusion Form means the officer will always be exempt. In fact, the exclusion can be revoked, and officers may choose to opt back into coverage at any time.

- The form does not require notification to the insurer. Many believe that submitting the form to the Commission is sufficient. It is crucial to also notify the company’s insurer to ensure proper coverage adjustments.

- Only one signature is needed. Some individuals think that only the primary officer needs to sign the form. However, all officers or members electing exclusion must sign the document for it to be valid.

- The form can be submitted at any time. There is a misconception that the timing of submission is flexible. It is essential to file the form before the policy begins to ensure the exclusion is effective from the start of coverage.

- Completing the form is straightforward and requires no verification. Many underestimate the importance of accuracy. The form must be filled out correctly, as any misinformation could lead to penalties or denial of the exclusion.

- Once the form is submitted, no further action is needed. Some believe that after submitting the form, they can forget about it. In reality, it is important to keep a copy for personal records and to remain aware of any changes in the business structure or ownership that may affect the exclusion.

Understanding these misconceptions can help ensure that business owners make informed decisions regarding their workers' compensation coverage. Taking the time to properly complete and submit the Maryland Exclusion Form is crucial for protecting both the business and its officers.