Blank Maryland Domestic Partnership Template

Similar forms

The Maryland Domestic Partnership form shares similarities with several other documents that also establish legal relationships, rights, and responsibilities among individuals. Below is a list of nine such documents, along with explanations of how they relate to the Maryland Domestic Partnership form.

- Marriage Certificate: Like the Domestic Partnership form, a marriage certificate legally recognizes the relationship between two individuals. Both documents require proof of a committed relationship and may involve similar criteria regarding age and legal capacity.

- Civil Union Agreement: This document is akin to a Domestic Partnership, as it provides legal recognition to couples who may not wish to marry. Both agreements typically involve mutual support and shared responsibilities.

- Living Will: For those planning ahead, a thorough Living Will document guide ensures your medical preferences are respected when you can't voice them.

- Power of Attorney: A Power of Attorney grants one individual the authority to act on behalf of another in legal matters. Similar to the Domestic Partnership form, it often requires proof of a close, trusting relationship and can include provisions for health care decisions.

- Health Care Proxy: This document allows a person to make medical decisions on behalf of another. Like the Domestic Partnership form, it emphasizes the importance of mutual support and trust in a relationship, particularly regarding health care decisions.

- Joint Lease Agreement: A joint lease establishes a shared living arrangement between two parties. It parallels the Domestic Partnership form in that it requires both individuals to demonstrate a commitment to living together, often as a sign of financial interdependence.

- Tax Dependent Affidavit: This document allows individuals to claim someone as a dependent for tax purposes. Similar to the Domestic Partnership form, it requires proof of support and shared residence, reinforcing the financial interdependence aspect.

- Adoption Papers: Adoption documents formalize the legal relationship between a parent and a child. Like the Domestic Partnership form, they require proof of commitment and support, especially when adding dependents to health benefits.

- Beneficiary Designation Forms: These forms designate individuals to receive benefits upon one’s death. They share similarities with the Domestic Partnership form in that they establish a recognized relationship for the purpose of benefits distribution.

- Shared Utility Bills: Utility bills in both names serve as proof of a shared residence. This requirement is similar to the Domestic Partnership form, which also necessitates documentation that confirms cohabitation.

Maryland Domestic Partnership - Usage Steps

After completing the Maryland Domestic Partnership form, you will need to submit it to the appropriate department for processing. Ensure that all required documentation is attached to support your claims. This will help in verifying your relationship and any dependents you wish to include under your coverage.

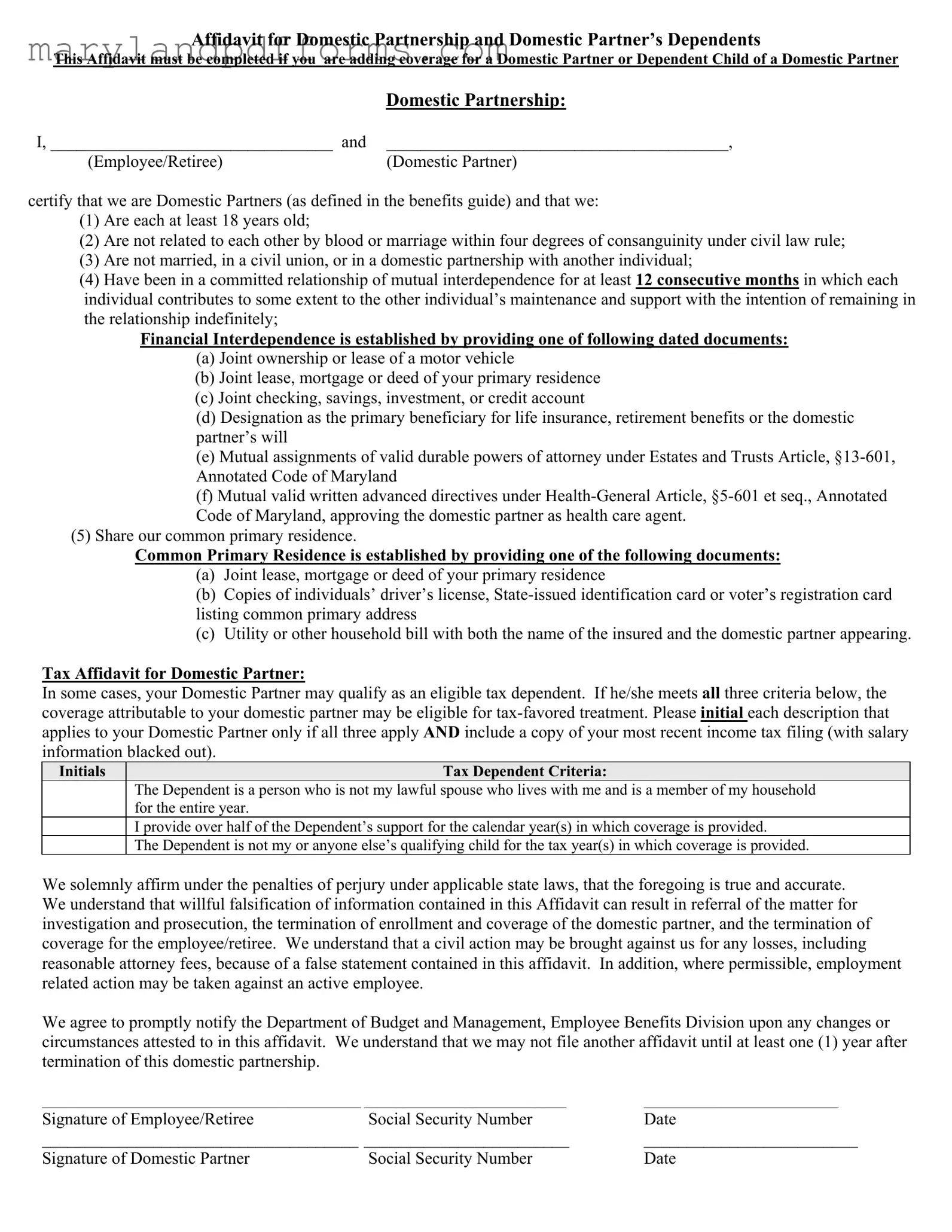

- Obtain the Form: Download the Maryland Domestic Partnership form from the official state website or request a physical copy from your employer's human resources department.

- Fill in Personal Information: Write the names of both partners, including the employee/retiree and the domestic partner, in the designated spaces at the top of the form.

- Certify Your Relationship: Confirm that both partners meet the criteria for a domestic partnership by checking the boxes next to each statement, ensuring you understand each requirement.

- Provide Financial Interdependence Documentation: Choose one of the listed options to demonstrate financial interdependence, and attach the corresponding dated document.

- Establish Common Primary Residence: Indicate how you share a primary residence by selecting one of the provided options and including the necessary documentation.

- Complete the Tax Affidavit: If applicable, initial the boxes that apply to your domestic partner's tax-dependent status and attach a copy of your most recent income tax filing with salary information redacted.

- Sign the Affidavit: Both partners must sign and date the affidavit at the bottom of the form, ensuring that all information is accurate.

- Fill Out Dependent Information: If you are adding dependents, provide their names, dates of birth, and social security numbers as required.

- Initial Required Documentation for Dependents: For each dependent, initial the appropriate boxes indicating their relationship and provide the necessary supporting documents.

- Submit the Form: Once completed, submit the form along with any required documentation to your employer’s human resources department or the designated office.

Learn More on Maryland Domestic Partnership

What is the Maryland Domestic Partnership form?

The Maryland Domestic Partnership form is a legal document that allows individuals in a committed relationship to certify their partnership status. It is used to enroll a domestic partner in health benefits and may also include dependents of the domestic partner. This form requires both parties to affirm their relationship and provide necessary documentation to establish eligibility.

Who is eligible to complete the Domestic Partnership form?

To be eligible, both individuals must be at least 18 years old and not related by blood or marriage within four degrees of consanguinity. They must not be married or in another domestic partnership. Additionally, they should have been in a committed relationship for at least 12 consecutive months, demonstrating mutual support and financial interdependence.

What documentation is required to establish financial interdependence?

To prove financial interdependence, one of the following documents must be provided:

- Joint ownership or lease of a motor vehicle

- Joint lease, mortgage, or deed of the primary residence

- Joint bank accounts or credit accounts

- Designation as the primary beneficiary on life insurance or retirement benefits

- Mutual assignments of durable powers of attorney

- Mutual valid written advance directives approving the partner as a health care agent

How can we establish a common primary residence?

Common primary residence can be established by providing one of the following documents:

- Joint lease, mortgage, or deed of the primary residence

- Driver’s licenses or state-issued IDs showing the same address

- Utility bills or household bills with both names appearing

What are the tax implications for a Domestic Partner?

If certain criteria are met, a domestic partner may qualify as an eligible tax dependent. The criteria include living with the employee for the entire year, receiving over half of their support from the employee, and not being someone else's qualifying child. It's essential to initial each applicable criterion on the form and provide a copy of the most recent income tax filing.

What happens if false information is provided on the affidavit?

Providing false information on the affidavit can lead to severe consequences, including termination of enrollment and coverage for the domestic partner. It may also result in legal action for any losses incurred due to the false statement, including attorney fees. Employment-related actions may be taken against active employees as well.

Can the Domestic Partnership form be filed again after termination?

No, once a domestic partnership is terminated, a new affidavit cannot be filed until at least one year has passed since the termination date. This rule ensures that the partnership status is legitimate and not filed in quick succession.

What documentation is needed for dependents of the Domestic Partner?

To add a dependent of a domestic partner, specific documentation is required based on the relationship. This may include:

- Official state birth certificates for biological or adopted children

- Adoption papers for adopted children

- Proof of residency for legal wards

- Marriage certificates for step-children

It's crucial to provide accurate documentation to ensure eligibility for health benefits coverage.

What is the Sole Support Affirmation?

The Sole Support Affirmation is a declaration that confirms the domestic partner provides sole financial support for a dependent child who is not a biological or adopted child. This affirmation must be signed to validate the dependent's eligibility for health benefits.

Additional PDF Forms

How Much Back Child Support Is a Felony in Maryland - Timely submission of this petition can expedite judicial intervention in cases of violation.

For more information on how to properly complete the Texas Notice to Quit form, visit texasdocuments.net/printable-notice-to-quit-form to access a printable version that can help streamline the process for landlords and tenants alike.

Unclaimed Property Maryland Claim Form - Provide the Patient’s date of birth.

Documents used along the form

When entering into a domestic partnership in Maryland, several important forms and documents accompany the Maryland Domestic Partnership form. These documents help establish the relationship, clarify financial responsibilities, and ensure that both partners understand their rights and obligations. Below is a list of commonly used forms that may be required in conjunction with the Maryland Domestic Partnership form.

- Affidavit for Domestic Partnership and Domestic Partner’s Dependents: This form certifies the existence of a domestic partnership and outlines the criteria necessary for both partners to be recognized as such, including age, relationship status, and financial interdependence.

- Tax Affidavit for Domestic Partner: This affidavit is necessary if one partner qualifies as a tax dependent. It requires specific criteria to be met, ensuring that the domestic partner can be included for tax-favored treatment.

- Dependent Tax Affidavit for Domestic Partner’s Dependents: This document is used to add a dependent child of the domestic partner to health benefits. It includes relationship verification and eligibility criteria for coverage.

- Joint Lease or Mortgage Agreement: This document serves as proof of shared residence, showing that both partners live together in a common primary residence.

- Mobile Home Bill of Sale: This essential document facilitates the transfer of ownership of a mobile home in New York, providing protection for both parties involved in the transaction. For more information, you can visit PDF Templates Online.

- Utility Bills: Recent utility bills that display both partners’ names and the same address can be used to establish shared residency, further validating the domestic partnership.

- Health Care Power of Attorney: This legal document designates one partner as the health care agent for the other, ensuring that they can make medical decisions on behalf of their partner if necessary.

- Beneficiary Designation Forms: These forms allow partners to name each other as beneficiaries for life insurance policies or retirement accounts, reinforcing their financial interdependence.

- Advanced Directives: These documents specify a partner’s wishes regarding medical treatment and care, ensuring that both partners are aware of and respect each other’s health care preferences.

Understanding these documents is crucial for anyone considering a domestic partnership in Maryland. Each form plays a significant role in protecting the rights and responsibilities of both partners, helping to create a strong foundation for their shared life together. By ensuring that all necessary paperwork is completed accurately, partners can focus on nurturing their relationship rather than worrying about legal complexities.

Key takeaways

The Maryland Domestic Partnership form is essential for employees or retirees seeking to add a domestic partner or their dependent child to health benefits coverage.

Both partners must certify that they are at least 18 years old and not related by blood or marriage within four degrees.

Partners must confirm that they are not currently married, in a civil union, or in another domestic partnership.

A committed relationship of mutual interdependence lasting at least 12 consecutive months is required.

Financial interdependence can be demonstrated through various documents, such as joint ownership of property or shared financial accounts.

To establish a common primary residence, partners must provide documentation like joint leases or utility bills showing the same address.

Domestic partners may qualify as tax dependents if specific criteria are met, including support and residency requirements.

Falsifying information on the affidavit can lead to severe consequences, including legal action and termination of coverage.

Changes in circumstances must be reported to the Department of Budget and Management to maintain compliance with the partnership agreement.

Misconceptions

Misconceptions about the Maryland Domestic Partnership form can lead to confusion and misapplication of the law. Here are seven common misconceptions, along with clarifications:

- Domestic partners must be married first. Many believe that domestic partners need to be married to qualify for benefits. However, the form explicitly states that applicants must not be married or in another domestic partnership.

- Only same-sex couples can register as domestic partners. This is not true. The Maryland Domestic Partnership law applies to both same-sex and opposite-sex couples, as long as they meet the specified criteria.

- Financial interdependence can be proven through any financial document. Some think that any financial document suffices to demonstrate financial interdependence. In reality, specific types of documents, such as joint leases or beneficiary designations, are required.

- There is no minimum duration for the relationship. A common misconception is that couples can register immediately. The form requires that partners have been in a committed relationship for at least 12 consecutive months.

- All dependents qualify for health benefits under the partnership. Many assume that any child of a domestic partner is automatically eligible for health benefits. Eligibility is contingent on meeting specific criteria outlined in the form.

- Once registered, partners can file affidavits as often as they like. Some individuals believe they can file multiple affidavits. However, the form states that a new affidavit cannot be submitted until at least one year after the termination of the partnership.

- Falsifying information on the form has no serious consequences. This is a dangerous misconception. The form clearly outlines that willful falsification can lead to severe penalties, including termination of benefits and potential legal action.