Blank Maryland Dhr Template

Similar forms

The Maryland Department of Human Resources (DHR) form is a crucial document for individuals applying for Long-Term Care Medical Assistance. Several other documents serve similar purposes in terms of collecting personal and financial information for assistance programs. Below are four documents that share similarities with the Maryland DHR form:

- Medicaid Application Form: This form is used nationwide to determine eligibility for Medicaid benefits. Like the Maryland DHR form, it requires detailed financial information, including income, assets, and expenses, to assess an applicant's need for assistance.

- Supplemental Nutrition Assistance Program (SNAP) Application: This application is designed to evaluate eligibility for food assistance. Similar to the DHR form, it collects personal information, income details, and household composition to determine eligibility for benefits.

- Social Security Administration (SSA) Benefits Application: Individuals seeking Social Security benefits must complete this application. It also requires personal identification, income, and asset information, paralleling the requirements found in the Maryland DHR form.

- Temporary Assistance for Needy Families (TANF) Application: This form is used to apply for cash assistance under the TANF program. It shares the same focus on financial documentation and personal information to evaluate eligibility, akin to the DHR form.

Maryland Dhr - Usage Steps

Filling out the Maryland DHR form requires careful attention to detail. It is essential to ensure that all required information is accurate and complete. After submitting the application, it will be reviewed by the appropriate department, and any additional documentation may be requested. Timely submission is important, so it is advisable to gather as many documents as possible before starting.

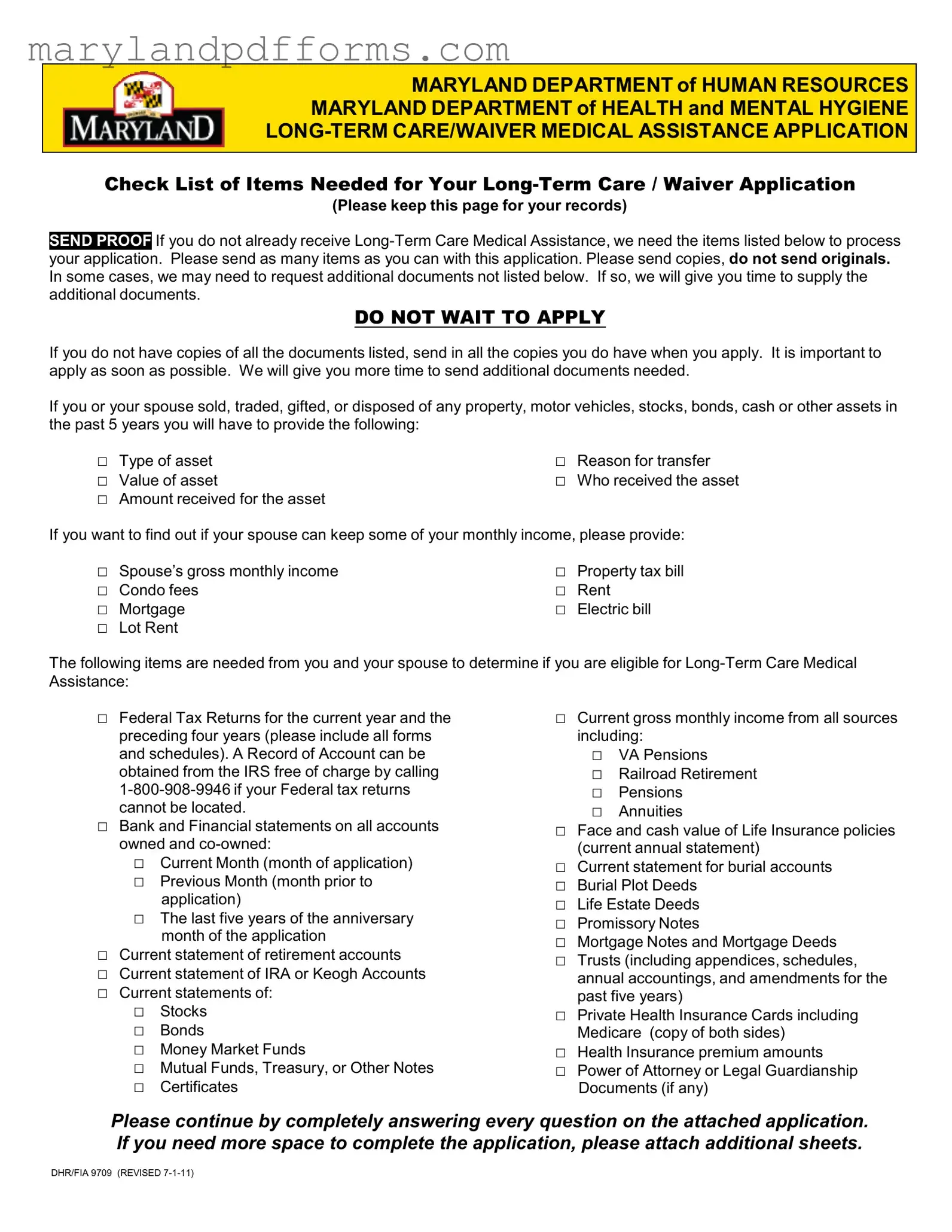

- Gather all necessary documents listed in the checklist, including proof of income, assets, and any previous assistance received.

- Make copies of all documents. Do not send original documents.

- Complete the application form, starting with the benefit selection section. Indicate whether you are applying for Long-Term Care Waiver and if you need assistance for past medical bills.

- Fill out the applicant information section. Provide your last name, first name, middle name, Social Security number, date of birth, gender, and ethnicity if you choose to disclose it.

- Answer questions about your residency status in Maryland and your marital status.

- If applicable, complete the immigration status section with the required details and proof.

- Provide your current address or the address of the long-term care facility where you reside.

- List previous addresses for the past five years, indicating whether you or your spouse owned each home.

- Designate an authorized representative if you wish for someone else to assist with your application.

- Review the completed application for accuracy and completeness.

- Submit the application along with the copies of required documents to the local department.

Learn More on Maryland Dhr

What is the Maryland DHR Form?

The Maryland DHR Form is an application used to apply for Long-Term Care and Waiver Medical Assistance. This form is essential for individuals seeking financial support for long-term care services. It collects vital information about the applicant's financial status, medical needs, and personal details to determine eligibility for assistance.

What documents do I need to submit with the application?

When applying, it’s crucial to include several documents to support your application. Here’s a checklist of items you should gather:

- Federal Tax Returns for the current year and the past four years.

- Bank and financial statements for all accounts owned or co-owned.

- Current gross monthly income documentation from all sources.

- Proof of any property transfers made in the last five years.

- Health insurance information, including Medicare cards.

Remember, it's best to send copies, not originals, and if you don’t have all the documents ready, submit what you can. You can provide the rest later.

How do I know if I am eligible for Long-Term Care Medical Assistance?

Eligibility for Long-Term Care Medical Assistance is determined based on several factors, including:

- Your income and assets, which must fall below certain limits.

- Your medical needs, which must require long-term care services.

- Any transfers of assets made in the past five years, which may affect eligibility.

Completing the application accurately and providing all requested documentation will help ensure a smooth review process.

What if I need help completing the application?

If you find the application process overwhelming, you're not alone. Many resources are available to assist you. Consider reaching out to:

- Your local Department of Social Services for guidance.

- Family members or friends who have experience with the process.

- Community organizations that specialize in helping individuals with medical assistance applications.

Don’t hesitate to ask for help; it's a crucial step in ensuring you receive the assistance you need.

How long does it take to process the application?

The processing time for the Maryland DHR Form can vary based on several factors, including the completeness of your application and the volume of applications being processed. Generally, you can expect to receive a decision within 30 to 90 days. If additional documents are needed, the processing may take longer. It’s always a good idea to follow up with your case manager to check on the status of your application.

Additional PDF Forms

Maryland State Police Accident Report - Document any towing information relevant to the vehicles.

Modification of Sentence - Defendants have the right to seek modifications based on their circumstances.

Maryland State Tax Forms - Fiduciaries need to ensure proper calculations to minimize errors in tax reporting.

Documents used along the form

The Maryland Department of Human Resources (DHR) form is an essential document for individuals seeking Long-Term Care or Waiver Medical Assistance. When submitting this form, applicants often need to provide additional documentation to support their application. Below is a list of other forms and documents that are commonly required alongside the Maryland DHR form.

- Federal Tax Returns: Applicants must submit their Federal Tax Returns for the current year and the previous four years. This includes all forms and schedules. If the returns cannot be located, a Record of Account can be obtained from the IRS.

- Bank and Financial Statements: Current and previous month bank statements for all accounts owned or co-owned are necessary. Additionally, statements from retirement accounts, stocks, bonds, and other financial assets must be included.

- Proof of Income: Documentation of current gross monthly income from all sources, such as pensions, annuities, and life insurance policies, is required. This helps determine eligibility for assistance.

- Operating Agreement: A crucial step for LLCs is having a solid Operating Agreement in place. This document outlines management structure and operational guidelines, ensuring clarity and efficiency in business operations. For assistance with creating one, check out PDF Templates Online.

- Power of Attorney or Guardianship Documents: If applicable, any existing Power of Attorney or legal guardianship documents must be provided. These documents clarify who has the authority to make decisions on behalf of the applicant.

Each of these documents plays a critical role in the application process for Long-Term Care Medical Assistance in Maryland. Ensuring that all required documents are included can facilitate a smoother review and approval process.

Key takeaways

Filling out the Maryland DHR form for Long-Term Care/Waiver Medical Assistance requires attention to detail. Here are key takeaways to ensure a smooth application process:

- Submit Copies: Always send copies of documents, not originals. This protects your important papers.

- Apply Promptly: Do not delay your application. Submit what you have and provide additional documents later.

- Document Transfers: If you transferred any assets in the past five years, you must provide details about each transfer.

- Income Information: Include your spouse's gross monthly income and relevant expenses to assess eligibility.

- Tax Returns: Provide federal tax returns for the current year and the previous four years, including all forms and schedules.

- Bank Statements: Submit recent bank statements along with financial statements for all accounts owned or co-owned.

- Comprehensive Income: List all sources of income, including pensions, annuities, and life insurance values.

- Health Insurance Details: Include copies of health insurance cards and information about premiums.

- Complete the Application: Answer every question fully. If you need more space, attach additional sheets as necessary.

- Authorized Representatives: If someone is helping you with your application, provide their details in the designated section.

Following these guidelines will enhance the likelihood of a successful application. Be thorough and organized in your submissions.

Misconceptions

Misconceptions about the Maryland DHR form can lead to confusion and delays in the application process. Here are nine common misconceptions:

- All documents must be submitted at once. Many believe they need to gather every document before applying. In reality, it’s better to apply as soon as possible and submit additional documents later.

- Only original documents are accepted. Some think they must send original documents. However, copies are sufficient and preferred for the application process.

- Eligibility is based solely on income. Many assume that only income matters. In fact, a variety of factors, including assets and household composition, are considered.

- Previous financial transactions are irrelevant. Some applicants think past asset transfers do not matter. However, any sales or gifts made in the last five years must be disclosed.

- Application processing is instantaneous. A common belief is that applications are processed immediately. In truth, it can take time to review and verify all submitted information.

- Providing personal information is optional. Some applicants feel they can skip questions about race or ethnicity. While it’s optional, providing this information can help ensure compliance with federal laws.

- Medical assistance is only for the elderly. Many think that only seniors qualify for long-term care assistance. However, individuals of all ages with qualifying needs can apply.

- Receiving assistance from another state disqualifies you. Some believe that receiving medical assistance from another state automatically disqualifies them. This is not always the case, as eligibility can vary.

- Applying guarantees approval. Lastly, many think that submitting the application ensures they will receive assistance. Approval depends on meeting specific eligibility criteria.

Understanding these misconceptions can help individuals navigate the Maryland DHR application process more effectively.