Blank Maryland Cra Template

Similar forms

- Maryland Sales and Use Tax License: Like the CRA form, this document is essential for businesses that sell taxable goods or services in Maryland. It requires similar information regarding the business's legal structure and owner details.

- Maryland Employer Withholding Tax Registration: This form registers employers for withholding taxes from employee wages. It shares the need for the Federal Employer Identification Number (FEIN) and information about the business's ownership structure.

- New York Operating Agreement: Understanding the PDF Templates Online is essential for ensuring that your LLC in New York adheres to the necessary regulations and operates smoothly.

- Maryland Unemployment Insurance Registration: This document is necessary for businesses that employ workers. It collects similar data about the business and its employees, including the number of employees and the date wages were first paid.

- Maryland Alcohol Tax License Application: Businesses involved in the sale or distribution of alcohol must complete this application. It requires information about the business and its ownership, paralleling the CRA form's requirements.

- Maryland Tobacco Tax License Application: Similar to the alcohol tax license, this application is required for businesses selling tobacco products. It also gathers essential business information, including ownership details.

- Maryland Motor Fuel Tax License Application: This form is for businesses involved in the sale or distribution of motor fuels. It requires data about the business and its operations, much like the CRA form.

- Maryland Transient Vendor License Application: This document is needed for vendors selling goods temporarily in Maryland. It requests similar information about the business's ownership and operations as the CRA form.

Maryland Cra - Usage Steps

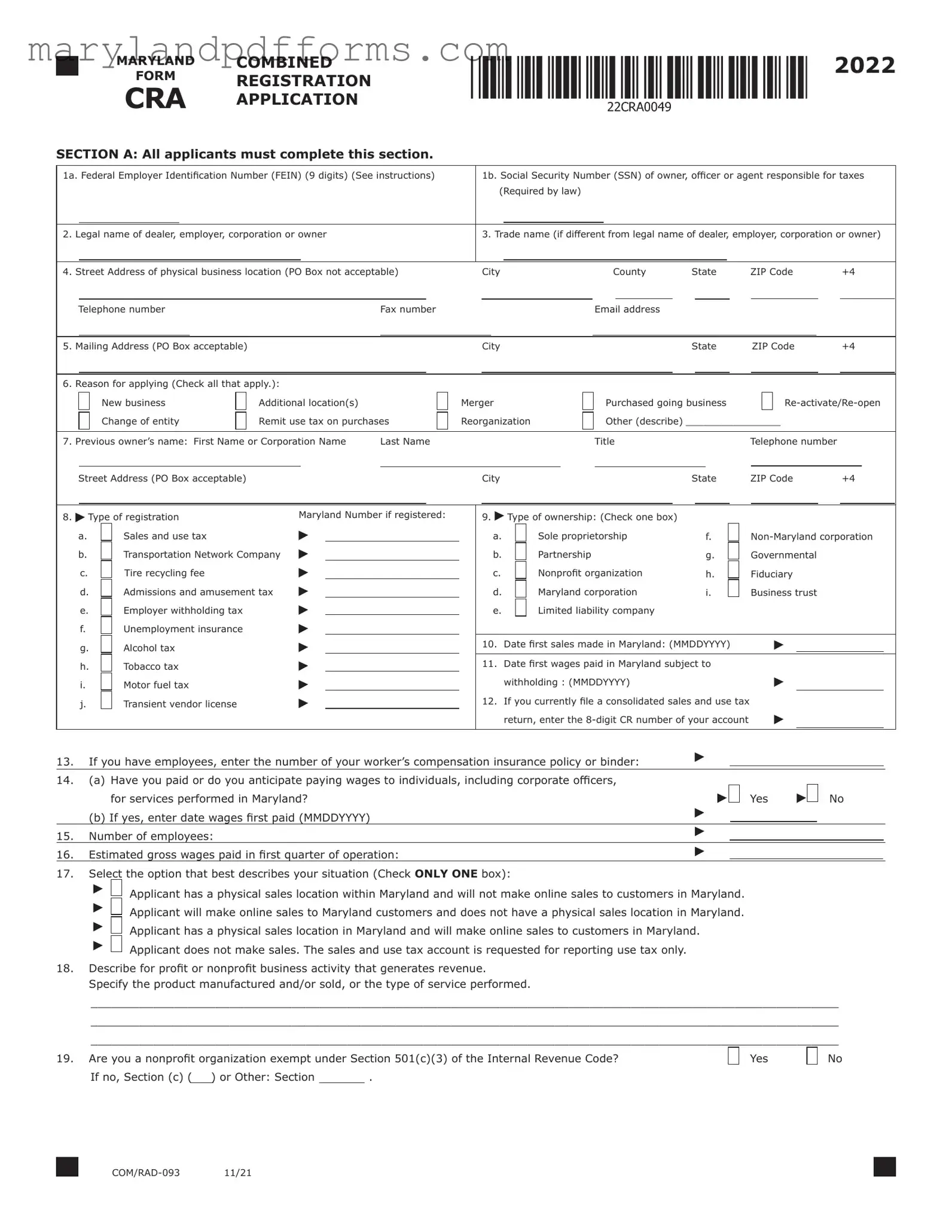

Filling out the Maryland CRA form involves several steps to ensure all necessary information is provided. Completing this form accurately is essential for proper registration. Follow these steps carefully to complete the application.

- Enter your Federal Employer Identification Number (FEIN). This number is nine digits long and is required for most businesses.

- Provide the Social Security Number (SSN) of the owner, officer, or agent responsible for taxes.

- Fill in the legal name of your business, corporation, or owner.

- If applicable, enter the trade name of your business, which may differ from the legal name.

- Complete the physical business location address. A PO Box is not acceptable here.

- Provide your mailing address. A PO Box is acceptable for this section.

- Select the reasons for applying by checking all that apply, such as new business or additional locations.

- Input the previous owner’s name and contact information if applicable.

- Indicate the type of registration you are seeking and provide the Maryland number if registered.

- Check the type of ownership that applies to your business.

- Provide the date when the first sales were made in Maryland.

- Enter the date when the first wages were paid in Maryland.

- If you file a consolidated sales and use tax return, include the 8-digit CR number of your account.

- List the number of employees you currently have.

- Answer whether you anticipate paying wages to individuals for services performed in Maryland.

- Describe the business activity that generates revenue.

- Indicate whether your business has only one physical location in Maryland.

- Identify the owners, partners, or corporate officers by providing their names, titles, and contact information.

- Complete Section B if registering for an unemployment insurance account, answering all relevant questions.

- Fill out Section C if engaging in activities related to alcohol or tobacco tax licenses.

- Complete Section D if you plan to sell or transport fuels in Maryland.

- Check if you would like to receive paper coupons for tax filing.

- Sign and date the application in Section F, ensuring all required information is accurate.

After completing the form, double-check all entries for accuracy. Make sure to detach the instruction sheet and mail the application to the specified address. This will help ensure that your application is processed without delay.

Learn More on Maryland Cra

What is the Maryland CRA Form?

The Maryland CRA Form is a registration application used by businesses to register for various tax accounts in the state of Maryland. This includes sales and use tax, unemployment insurance, and other specific taxes related to certain industries. Completing this form is essential for compliance with state tax laws.

Who needs to fill out the CRA Form?

Any individual or business entity looking to operate in Maryland and engage in taxable activities must complete the CRA Form. This includes sole proprietors, partnerships, corporations, and nonprofit organizations. If you plan to hire employees or sell taxable goods or services, you will need to register.

What information is required on the CRA Form?

The form requires various details, including:

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

- Legal name and trade name of the business

- Physical and mailing addresses

- Type of business ownership

- Reason for applying

- Details about previous ownership, if applicable

Make sure to provide accurate information to avoid delays in processing.

How do I submit the CRA Form?

You can submit the completed CRA Form by mailing it to the Central Registration office of the Comptroller of Maryland. Ensure that you include all necessary sections and signatures. Alternatively, you can register online at the Maryland Comptroller's website.

What happens after I submit the CRA Form?

Once submitted, the Comptroller’s office will review your application. If everything is in order, you will receive confirmation of your registration and any necessary account numbers. If there are issues, they will contact you for clarification or additional information.

Can I apply for multiple tax accounts using the CRA Form?

Yes, the CRA Form allows you to apply for multiple tax accounts in one submission. You can check the boxes for all relevant taxes you wish to register for, such as sales and use tax, unemployment insurance, and others.

Is there a fee associated with submitting the CRA Form?

There is no fee for submitting the CRA Form itself. However, depending on the type of business and the taxes you are registering for, there may be fees associated with specific licenses or permits that are required after registration.

What if I need to make changes to my registration later?

If you need to update any information after your initial registration, you can do so by contacting the Comptroller’s office. They will provide guidance on how to submit changes, which may involve filling out additional forms.

Are there any deadlines for submitting the CRA Form?

While there are no specific deadlines for submitting the CRA Form, it is advisable to complete it as soon as you begin your business operations in Maryland. Timely registration helps ensure compliance with state tax laws and avoids potential penalties.

Where can I find assistance if I have questions about the CRA Form?

If you have questions, you can contact the Comptroller’s office directly. They have resources available to assist you with the CRA Form and any other registration-related inquiries. Additionally, their website offers helpful information and guidance.

Additional PDF Forms

Requirements for Open Work Permit in Canada - Acceptable documents for proof include a birth certificate.

How Long Does Insurance Last After You Quit - This form supports your pursuit of necessary healthcare beyond your employment.

For LLCs in Texas, it's crucial to have a solid foundation for governance, and one way to achieve this is by utilizing the Texas Operating Agreement form to clearly outline the roles and responsibilities of each member. This form is not only vital for operational clarity but also works to protect the interests of all members involved. To access this important document, visit https://texasdocuments.net/printable-operating-agreement-form and begin the process of establishing a well-structured management framework.

What Is a Certificate of Compliance Maryland - Submission of the form indicates a formal request for exclusion from coverage.

Documents used along the form

When navigating the business landscape in Maryland, completing the Maryland Combined Registration Application (CRA) form is just one step. Several other forms and documents may be required to ensure compliance with state regulations. Understanding these documents can help streamline your registration process and set your business up for success.

- Sales and Use Tax License: This license is necessary for businesses that sell tangible personal property or taxable services in Maryland. It allows you to collect sales tax from customers and remit it to the state.

- Employer Withholding Tax Account: If your business has employees, you must register for an employer withholding tax account. This account is used to withhold state income taxes from employee wages.

- Unemployment Insurance Registration: Employers in Maryland are required to register for unemployment insurance. This provides coverage for employees who may become unemployed and need financial assistance.

- Tire Recycling Fee Account: If your business sells tires, you must register for this account to comply with the state’s tire recycling fee regulations, which help fund environmental initiatives.

- Transient Vendor License: This license is required for businesses that make sales at temporary locations, such as fairs or flea markets. It ensures that vendors comply with sales tax regulations.

- Medical Power of Attorney: To ensure your healthcare preferences are respected, consider our essential Medical Power of Attorney form resources for detailed guidance on appointing a trusted decision-maker.

- Alcohol Tax License: If your business involves the sale or distribution of alcoholic beverages, you must obtain this license. Additional registration with the appropriate division may be necessary.

- Tobacco Tax License: Similar to the alcohol license, this document is essential for businesses involved in the sale of tobacco products. It ensures compliance with state tax laws.

- Local Business Licenses: Depending on your business location, you may need to obtain specific licenses from your local jurisdiction. These licenses vary by county and city, so it's important to check local regulations.

By familiarizing yourself with these documents, you can navigate the registration process with confidence. Each form plays a crucial role in ensuring your business operates legally and efficiently within Maryland. Always consult with local authorities or professionals if you have questions about specific requirements for your business type.

Key takeaways

Filling out the Maryland Combined Registration Application (CRA) form is an essential step for businesses operating in the state. Here are some key takeaways to keep in mind:

- Complete All Sections: Ensure that every section of the form is filled out accurately. Incomplete applications will be returned, which can delay your registration process.

- Provide Correct Identification Numbers: Enter your Federal Employer Identification Number (FEIN) and the Social Security Number (SSN) of the responsible individual. These numbers are crucial for tax purposes.

- Legal and Trade Names: Clearly state both the legal name of your business and any trade name you may use. This helps in establishing your business identity.

- Mailing Addresses: Provide both your physical business location and a mailing address. Note that a P.O. Box is acceptable for the mailing address but not for the physical location.

- Specify Your Business Type: Indicate the type of registration you are seeking, such as sales and use tax, unemployment insurance, or alcohol tax license. Different registrations may have different requirements.

- Ownership Structure: Clearly identify the type of ownership of your business, whether it’s a sole proprietorship, partnership, corporation, or another structure. This information affects your tax obligations.

- Employee Information: If you have employees, you must provide information about wages and workers' compensation insurance. This is essential for compliance with state regulations.

- Follow Up on Additional Requirements: Depending on your business type, you may need to contact other agencies for additional licenses or registrations. Be proactive in ensuring all legal requirements are met.

By keeping these points in mind, you can navigate the registration process more smoothly and ensure compliance with Maryland's business regulations.

Misconceptions

1. The CRA form is only for new businesses. This is incorrect. The Maryland CRA form can also be used for existing businesses that are expanding, merging, or changing ownership. It serves multiple purposes beyond just new registrations.

2. You need a Federal Employer Identification Number (FEIN) to apply. While having a FEIN is necessary for most businesses, sole proprietorships without employees do not require one. In such cases, the owner's Social Security Number can suffice.

3. The mailing address must be the same as the physical location. This is a misconception. While the physical business location must be provided, the mailing address can be a P.O. Box. This allows for flexibility in receiving correspondence.

4. You cannot apply for multiple tax accounts at once. This is false. The CRA form allows applicants to register for various tax accounts simultaneously, including sales tax, unemployment insurance, and others, making the process more efficient.

5. All businesses must have a physical location in Maryland. Not necessarily. Businesses that operate online without a physical presence in Maryland can still register using the CRA form. They must indicate their sales model accurately on the application.