Blank Maryland Cof 85 Template

Similar forms

The Maryland Cof 85 form is a financial reporting document specifically designed for organizations that do not file Form 990. It shares similarities with several other financial forms used by nonprofit organizations. Below is a list of documents that are comparable to the Cof 85 form, along with a brief explanation of how they are similar:

- Form 990: This is the standard annual reporting form for most tax-exempt organizations. Like the Cof 85, it requires detailed financial information, including revenue, expenses, and changes in net assets.

- Form 990-EZ: A shorter version of Form 990, this form is used by smaller organizations. It, too, focuses on financial activities and requires similar types of financial disclosures as the Cof 85.

- Form 990-N (e-Postcard): This form is for very small tax-exempt organizations. While it is much simpler, it still captures essential information about revenue and activities, paralleling the basic reporting purpose of the Cof 85.

- Form 1023: This application for tax-exempt status requires organizations to provide financial projections and a detailed description of their activities. The financial transparency needed here is akin to what is required in the Cof 85.

- Form 990-PF: Used by private foundations, this form requires detailed financial information, including revenue and expenses, similar to the Cof 85's requirements for reporting on finances.

- Arizona Hold Harmless Agreement: This document is crucial for protecting parties from liability during specific activities, similar to how financial forms, like the Cof 85, ensure accountability. To learn more about this agreement, visit Templates Online.

- State Charitable Organization Registration Forms: Many states require nonprofits to register and provide financial information. These forms often ask for similar financial disclosures as the Cof 85, ensuring transparency in fundraising activities.

- Financial Statements (compiled or audited): Nonprofits often prepare financial statements that summarize their financial position. These statements provide a comprehensive view of revenue and expenses, aligning with the reporting objectives of the Cof 85.

Each of these forms and documents serves to ensure that organizations maintain transparency and accountability regarding their financial activities, similar to the Maryland Cof 85 form.

Maryland Cof 85 - Usage Steps

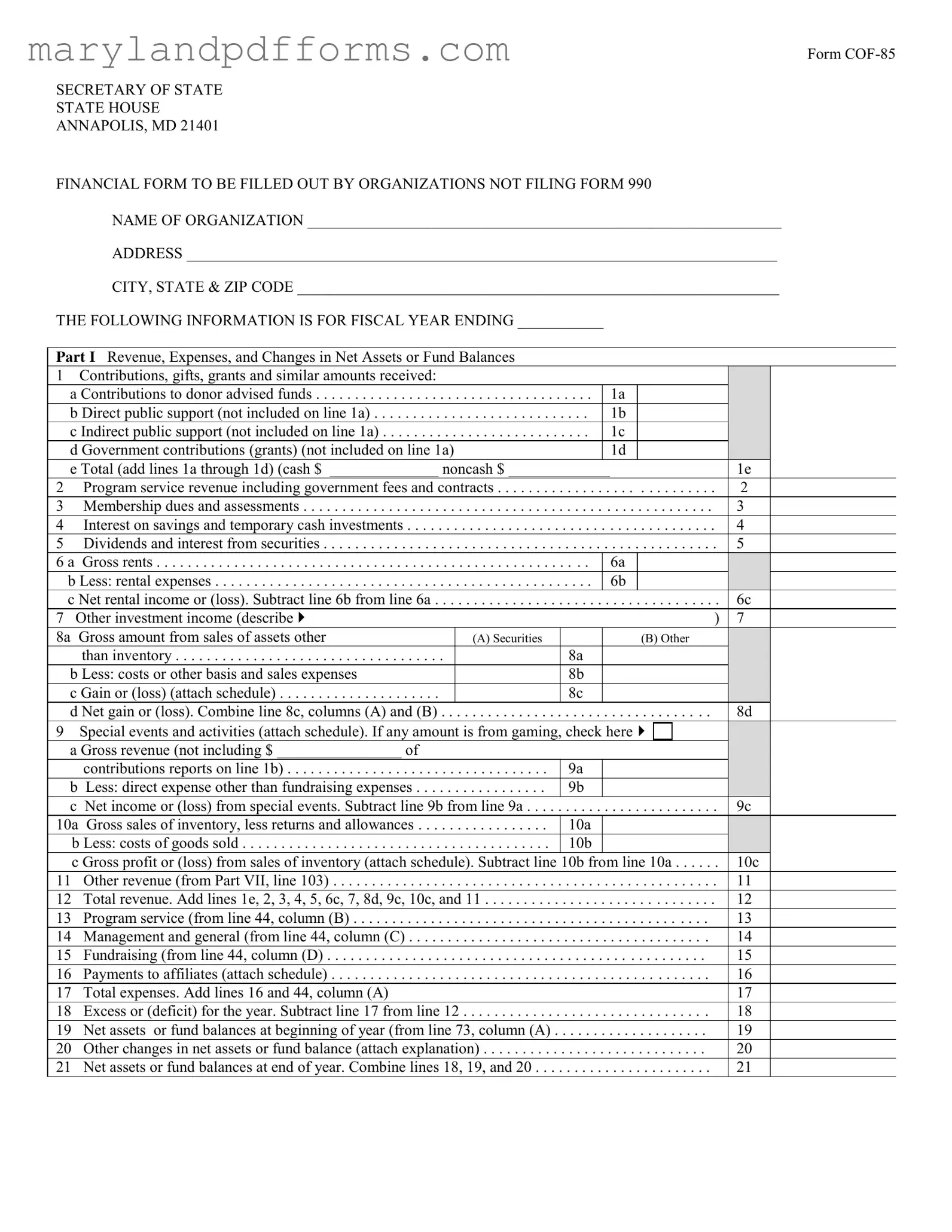

Completing the Maryland Cof 85 form is an important step for organizations that do not file Form 990. This form requires detailed financial information for the fiscal year ending date you specify. After filling out the form, it should be submitted to the Secretary of State in Annapolis, Maryland, as part of your compliance with state regulations.

- Organization Information: Write the name of your organization at the top of the form. Fill in the address, including city, state, and ZIP code.

- Fiscal Year End: Indicate the fiscal year ending date in the designated space.

- Part I - Revenue: Complete the revenue section. Start with contributions, gifts, grants, and similar amounts received. Break these down into categories such as direct public support and government contributions. Add them up for the total revenue.

- Program Service Revenue: Report any revenue from program services, including government fees and contracts. Fill in the amounts for membership dues, interest, and dividends as applicable.

- Other Income: Include any other sources of income, such as rental income and special events. Ensure you calculate the net income or loss for each source.

- Total Revenue: Add all sources of revenue to find the total revenue for the year.

- Part II - Functional Expenses: Report total expenses by category, including grants, salaries, and professional fees. Make sure to separate program services, management and general expenses, and fundraising expenses.

- Part III - Program Services: List each program service provided by your organization. For each service, describe the outputs and the total expenses associated with it.

- Part IV - Revenue and Other Revenue: Fill in the program service revenue and any other revenue. Total these amounts accordingly.

- Part V - Balance Sheets: Complete the balance sheet section, detailing assets, liabilities, and fund balances. This includes cash, accounts receivable, and any liabilities owed.

- Part VI - Officers, Directors & Trustees: List all officers, directors, and trustees, including their titles and average compensation.

- Part VII - Compensation: Report the compensation of the five highest-paid individuals for professional services, noting the type of service provided.

- Final Declaration: Sign and date the form, including the name and title of the officer completing the report. Ensure that the declaration is filled out accurately.

After completing these steps, review the form for accuracy. Once verified, submit it to the appropriate state office to ensure compliance with Maryland regulations.

Learn More on Maryland Cof 85

What is the Maryland COF-85 form?

The Maryland COF-85 form is a financial reporting document that organizations, which do not file Form 990, must complete. It provides a detailed overview of the organization’s revenue, expenses, and changes in net assets or fund balances for a specified fiscal year. This form is essential for maintaining transparency and accountability in financial reporting.

Who needs to file the COF-85 form?

Organizations that are exempt from filing Form 990, typically smaller non-profits or those with less than $25,000 in gross receipts, are required to file the COF-85 form. This includes charities, foundations, and other non-profit entities operating in Maryland. It is crucial for these organizations to comply with state regulations regarding financial disclosures.

What information is required on the COF-85 form?

The COF-85 form requires various financial details, including:

- Total contributions, gifts, and grants received.

- Program service revenue and membership dues.

- Expenses related to program services, management, and fundraising.

- Net assets or fund balances at the beginning and end of the fiscal year.

- Details about officers, directors, and trustees.

Each section is designed to provide a comprehensive view of the organization's financial health.

When is the COF-85 form due?

The COF-85 form is generally due on the 15th day of the 5th month following the end of the organization’s fiscal year. For organizations with a fiscal year ending December 31, the form would be due by May 15 of the following year. It is important to adhere to this deadline to avoid penalties.

How can an organization submit the COF-85 form?

Organizations can submit the COF-85 form either by mail or electronically, depending on the state’s current submission guidelines. If submitting by mail, ensure that all required documents are included and sent to the address specified on the form. For electronic submissions, follow the instructions provided on the Maryland Secretary of State's website.

What happens if an organization fails to file the COF-85 form?

Failure to file the COF-85 form can result in penalties, including fines and potential loss of tax-exempt status. Additionally, non-compliance may affect the organization’s credibility and ability to receive funding or donations. It is essential for organizations to stay compliant with filing requirements to maintain their operational status.

Can the COF-85 form be amended after submission?

Yes, if an organization discovers an error or needs to update information after submitting the COF-85 form, it can file an amendment. This typically involves submitting a corrected version of the form along with an explanation of the changes. It is advisable to address any discrepancies promptly to ensure accurate records.

Where can organizations find assistance with completing the COF-85 form?

Organizations can seek assistance from various sources, including accounting professionals, legal advisors, or non-profit support organizations. Additionally, the Maryland Secretary of State’s office provides resources and guidance on completing the COF-85 form. It is beneficial to utilize these resources to ensure accurate and compliant submissions.

Additional PDF Forms

Maryland Uniform Credentialing - It ensures that all necessary personal and professional information is correctly captured.

Must Appear in Court - You can find the citation number printed below the bar code on the citation form.

For those looking to navigate the eviction process in Texas effectively, it's crucial to utilize the proper documentation, such as the Notice to Quit form. You can find the necessary resources to assist you in this process at texasdocuments.net/printable-notice-to-quit-form, ensuring you meet all legal requirements and maintain a smooth transition for all parties involved.

What Does Futa Mean on My Paycheck - This report is a critical part of maintaining good standing with the Maryland Department of Labor.

Documents used along the form

The Maryland Cof 85 form is a financial document that organizations must complete when they do not file Form 990. Alongside this form, several other documents are often required to provide a comprehensive view of an organization's financial health and operational activities. Below is a list of these documents, each serving a specific purpose.

- Form 990: This is the annual information return required by the IRS for tax-exempt organizations. It provides detailed information about the organization's finances, governance, and activities.

- Balance Sheet: This document summarizes an organization’s assets, liabilities, and net assets at a specific point in time. It helps stakeholders understand the financial position of the organization.

- New York Motorcycle Bill of Sale: This form serves as a crucial document during the sale or transfer of ownership of a motorcycle, ensuring both parties are protected under the law. For more information, visit PDF Templates Online.

- Statement of Functional Expenses: This statement breaks down the expenses incurred by the organization into categories such as program services, management, and fundraising. It provides insight into how funds are utilized.

- Schedule of Program Services: This schedule details the specific programs offered by the organization, including the costs associated with each program and the outcomes achieved. It highlights the organization’s impact.

- List of Officers, Directors, and Trustees: This document lists the individuals in key leadership roles within the organization. It includes their titles and compensation, which is essential for transparency.

- Conflict of Interest Policy: This policy outlines how the organization manages conflicts of interest among its board members and staff. It is crucial for maintaining ethical governance.

These documents collectively provide a clearer picture of an organization’s financial and operational status, ensuring compliance and promoting transparency with stakeholders.

Key takeaways

Filling out and using the Maryland Cof 85 form requires careful attention to detail. Here are some key takeaways to consider:

- Accurate Reporting: Ensure all financial information is accurately reported, including contributions, revenue, and expenses. This helps maintain transparency and compliance.

- Understand the Structure: Familiarize yourself with the form's sections, including revenue, expenses, and program services. Each part serves a specific purpose in detailing your organization’s financial activities.

- Documentation: Attach any necessary schedules or explanations as required. This includes detailing grants and other financial activities to provide clarity.

- Review and Sign: Before submission, review the completed form for errors. The officer's signature is essential, affirming the accuracy of the information provided.

Misconceptions

Here are nine common misconceptions about the Maryland Cof 85 form:

- Only large organizations need to file the Cof 85 form. This is incorrect. Any organization that does not file Form 990 must submit the Cof 85 form, regardless of size.

- The Cof 85 form is only for non-profits. In reality, any organization that meets the criteria and does not file Form 990 is required to complete this form, including certain for-profit entities.

- Filing the Cof 85 form is optional. This is a misconception. If your organization qualifies, you must file the form to comply with Maryland state regulations.

- All financial information must be disclosed in detail. While the form requires financial data, it does not necessitate exhaustive detail. Summary information is often sufficient.

- You can submit the Cof 85 form anytime during the year. The form must be filed by a specific deadline, usually aligned with the end of your fiscal year. Missing this deadline can lead to penalties.

- The Cof 85 form is the same as Form 990. These forms serve different purposes. Form 990 is more comprehensive and is required for larger organizations, while the Cof 85 is a simpler alternative for those not filing 990.

- There are no penalties for late submission. This is false. Late filings can result in fines or other penalties, so it is crucial to submit on time.

- Once filed, the Cof 85 form does not need to be updated. Organizations must update their information annually, reflecting any changes in finances or structure.

- Only financial professionals can fill out the Cof 85 form. This is not true. While financial knowledge is helpful, anyone can complete the form as long as they have access to the necessary information.