Blank Maryland 746 Template

Similar forms

- IRS Form 5329: This form is similar in that it addresses tax implications related to retirement distributions. Like the Maryland 746 form, it requires individuals to acknowledge their understanding of tax responsibilities when taking early withdrawals from retirement accounts.

- 401(k) Plan Distribution Notice: This document serves to inform participants of their options regarding distributions from their 401(k) plans. Similar to the Maryland 746 form, it includes essential information about tax consequences and the choice to roll over funds to another retirement account.

- Notice of Special Tax Treatment: This notice provides details on the tax treatment of certain retirement plan distributions. It parallels the Maryland 746 form by ensuring that individuals are aware of their choices and the potential tax ramifications before making a distribution decision.

- Articles of Incorporation: The Colorado Articles of Incorporation form is essential for legally establishing a corporation in Colorado. It requires details about the corporation's name, structure, and purpose, and must be filed with the Colorado Secretary of State. More information can be found at https://coloradoformpdf.com.

- Retirement Plan Rollover Form: This form is used to facilitate the rollover of retirement funds from one account to another. Like the Maryland 746 form, it requires individuals to make an affirmative choice about how they wish to manage their retirement funds and acknowledges their understanding of the process involved.

Maryland 746 - Usage Steps

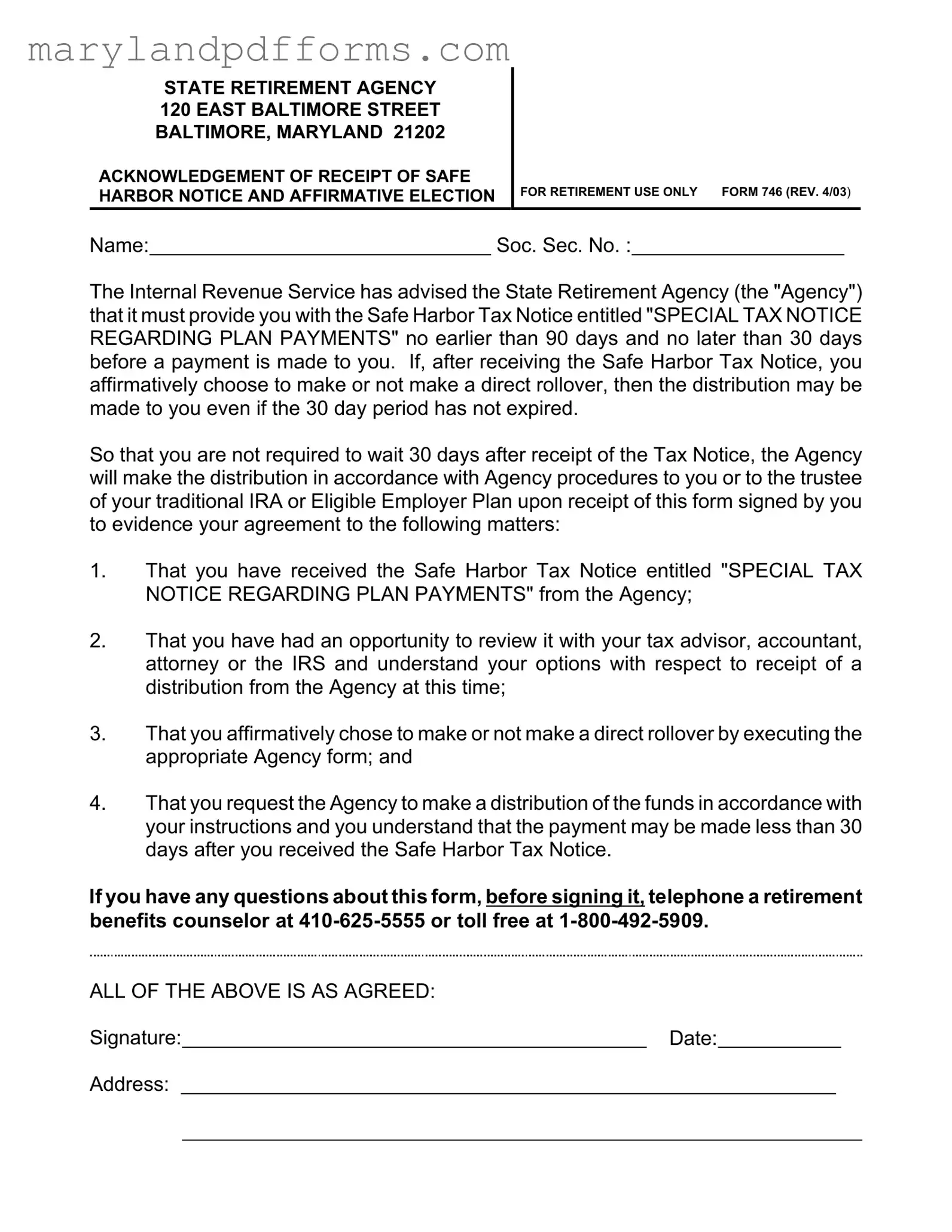

Completing the Maryland 746 form is a straightforward process. This form is necessary to acknowledge the receipt of the Safe Harbor Tax Notice and to indicate your election regarding retirement distributions. Follow the steps carefully to ensure that all required information is accurately provided.

- Obtain the Maryland 746 form. You can find it on the State Retirement Agency's website or request a copy from their office.

- In the first section, enter your Name as it appears on your official documents.

- Next, provide your Social Security Number in the designated field.

- Read the Safe Harbor Tax Notice carefully. Ensure you understand your options regarding the distribution of your retirement funds.

- Consult with a tax advisor, accountant, or attorney if needed, to clarify any questions regarding your choices.

- Indicate your choice regarding a direct rollover by completing the appropriate section of the form.

- Sign the form to confirm your agreement with the statements provided. Make sure to include the date of your signature.

- Lastly, fill in your current Address where you can be reached.

After completing the form, submit it to the State Retirement Agency. Ensure that you keep a copy for your records. If you have any questions or need assistance, do not hesitate to contact a retirement benefits counselor at the provided phone numbers.

Learn More on Maryland 746

What is the Maryland 746 form?

The Maryland 746 form is an acknowledgment of receipt of the Safe Harbor Tax Notice and an affirmative election for retirement distributions. It is used by individuals who are about to receive a payment from the State Retirement Agency, allowing them to confirm their understanding of tax implications and their distribution options.

Why do I need to complete the Maryland 746 form?

Completing the Maryland 746 form is essential for confirming that you have received the Safe Harbor Tax Notice. This form ensures that you understand your options regarding direct rollovers and distributions. It also allows the Agency to process your payment without waiting the full 30-day period after you receive the tax notice.

What is the Safe Harbor Tax Notice?

The Safe Harbor Tax Notice, titled "SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS," provides important information about the tax implications of receiving a distribution from your retirement plan. It outlines your options for rolling over funds and the potential tax consequences of each choice.

What happens if I do not complete the Maryland 746 form?

If you do not complete the Maryland 746 form, the State Retirement Agency may not be able to process your distribution request. You might have to wait for the full 30-day period after receiving the Safe Harbor Tax Notice before any payment can be made, which could delay access to your funds.

Can I consult with a tax advisor before signing the form?

Yes, you are encouraged to review the Safe Harbor Tax Notice with a tax advisor, accountant, or attorney. Understanding your options is crucial, and consulting with a professional can help you make an informed decision regarding your retirement distribution.

How do I submit the Maryland 746 form?

After completing and signing the Maryland 746 form, you should submit it to the State Retirement Agency. Ensure that you include your signature and date, as well as any other required information, to avoid processing delays.

Where can I get help if I have questions about the Maryland 746 form?

If you have questions about the Maryland 746 form or the distribution process, you can contact a retirement benefits counselor at the State Retirement Agency. Call 410-625-5555 or toll-free at 1-800-492-5909 for assistance.

Additional PDF Forms

What Is a Certificate of Compliance Maryland - It affirms a legal understanding of the responsibilities of waiving coverage.

State of Maryland Insurance - Understand charges applicable for different types of lenses.

It is crucial for individuals involved in the sale of a mobile home in New York to familiarize themselves with the necessary documentation, specifically the Mobile Home Bill of Sale. This form not only facilitates a smooth transaction but also safeguards the interests of both parties. For those looking for reliable resources, PDF Templates Online offers a variety of options to streamline the process.

Baltimore Gun Laws - Signature areas confirm that the applicant has completed mandatory training.

Documents used along the form

The Maryland 746 form is an important document related to retirement distributions. However, several other forms and documents may be necessary to complete the process effectively. Understanding these documents can help ensure a smooth experience when managing retirement funds.

- Safe Harbor Tax Notice: This notice provides essential information about the tax implications of retirement plan distributions. It must be given to participants at least 30 days before a payment is made, helping them make informed decisions regarding their options.

- Direct Rollover Request Form: This form allows individuals to request that their retirement funds be transferred directly into another qualified retirement account. Completing this form is crucial for avoiding immediate tax liabilities.

- Retirement Account Distribution Form: This document is used to initiate the distribution of funds from a retirement account. It typically requires details about the account holder and the amount to be withdrawn.

- Notice to Quit: Understanding the process of issuing a Notice to Quit is crucial for landlords dealing with non-compliant tenants. For more details, refer to this https://texasdocuments.net/printable-notice-to-quit-form/.

- Tax Withholding Election Form: This form allows individuals to specify how much tax should be withheld from their retirement distribution. Proper completion can help avoid unexpected tax bills in the future.

- Beneficiary Designation Form: This document designates who will receive the retirement benefits upon the account holder's death. Keeping this information up to date is essential for ensuring that funds are distributed according to the holder's wishes.

- IRA Transfer Form: If transferring funds from one IRA to another, this form is necessary. It facilitates the movement of funds while maintaining the tax-deferred status of the retirement savings.

- Financial Advisor Consultation Record: While not an official form, keeping a record of consultations with a financial advisor can be beneficial. It documents advice received regarding retirement options and can guide decision-making.

Being familiar with these documents can help streamline the process of managing retirement distributions in Maryland. Each form plays a unique role in ensuring compliance with tax regulations and personal financial goals.

Key takeaways

Here are some key takeaways about filling out and using the Maryland 746 form:

- The Maryland 746 form is used to acknowledge receipt of the Safe Harbor Tax Notice.

- You must provide your name and Social Security number on the form.

- Receiving the Safe Harbor Tax Notice is essential; it informs you about your options regarding retirement plan payments.

- You can choose to make or not make a direct rollover after reviewing the notice.

- Signing the form allows the Agency to process your distribution, even if the 30-day waiting period has not passed.

- It’s advisable to consult with a tax advisor or attorney before making your decision.

- If you have questions, you can contact a retirement benefits counselor for assistance.

Misconceptions

Understanding the Maryland 746 form can be challenging for many individuals approaching retirement. Misconceptions can lead to confusion and potentially costly decisions. Here are nine common misconceptions about this form, along with clarifications to help you navigate the process more effectively.

- Misconception 1: The form is only for those who are retiring.

- Misconception 2: You must wait 30 days after receiving the Safe Harbor Tax Notice before making a decision.

- Misconception 3: The Safe Harbor Tax Notice is optional.

- Misconception 4: Signing the form means you must take a distribution.

- Misconception 5: You cannot consult with a tax advisor before signing the form.

- Misconception 6: The form is only relevant for traditional IRAs.

- Misconception 7: There are no penalties for taking an early distribution.

- Misconception 8: The Agency will automatically process your distribution without your consent.

- Misconception 9: You cannot change your mind after signing the form.

This form is relevant not just for retirees but also for anyone who may receive a distribution from their retirement account, including those who are changing jobs or withdrawing funds early.

While the form indicates a 30-day period, you can actually receive your distribution sooner if you affirmatively choose to do so by signing the form.

Receiving the Safe Harbor Tax Notice is a mandatory step. The Agency must provide this notice to ensure you are informed about the tax implications of your distribution options.

Signing the Maryland 746 form does not obligate you to take a distribution; it simply acknowledges that you have received the necessary information to make an informed choice.

You are encouraged to review the Safe Harbor Tax Notice with a tax advisor or other qualified professional to fully understand your options before making any decisions.

The Maryland 746 form applies to various retirement plans, including 401(k)s and other eligible employer plans, not just traditional IRAs.

Be aware that taking an early distribution can lead to tax penalties. Understanding your options through the Safe Harbor Tax Notice can help you avoid unnecessary costs.

The Agency requires your affirmative consent through the Maryland 746 form to process any distribution. They will not act without your explicit instructions.

While signing the form indicates your current choice, you may still have options to change your mind depending on the circumstances and timing of your request.

By dispelling these misconceptions, individuals can approach the Maryland 746 form with greater confidence and clarity, ultimately leading to more informed financial decisions regarding their retirement funds.