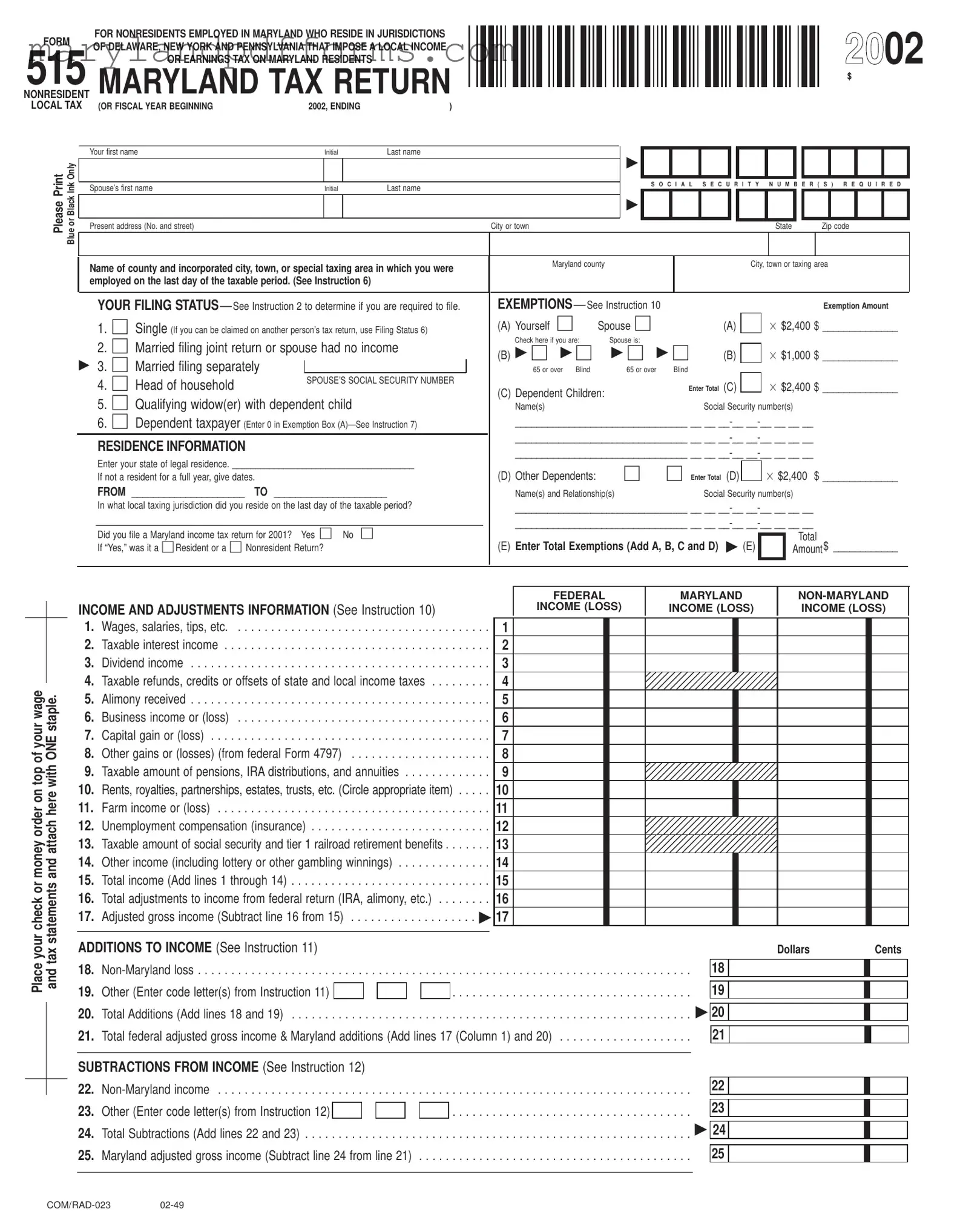

Blank Maryland 515 Template

Similar forms

The Maryland 515 form is designed for nonresidents employed in Maryland who reside in jurisdictions of Delaware, New York, and Pennsylvania that impose a local income or earnings tax on Maryland residents. Several other tax forms share similarities with the Maryland 515 form, each catering to specific situations regarding income tax filings. Below is a list of nine documents that are similar to the Maryland 515 form, along with explanations of their similarities:

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. Like the Maryland 515, it collects information about income, deductions, and credits, but it is used for federal tax purposes rather than state-specific requirements.

- Form 1040-NR: This form is for nonresident aliens who earn income in the U.S. It parallels the Maryland 515 in that it addresses the tax obligations of individuals who are not residents but have income sourced from within the jurisdiction.

- Form 502: This is Maryland's resident income tax return. It is similar to the Maryland 515 in that it captures income, exemptions, and credits, but it is for residents rather than nonresidents.

- Form 505: This Maryland form is used for nonresidents with non-wage income. It complements the Maryland 515 by allowing individuals to report income from sources other than employment, similar to how the 515 addresses employment income.

- Form W-2: This is the wage and tax statement provided by employers to report an employee's annual wages and the taxes withheld. The Maryland 515 relies on W-2 information for reporting income and tax withholding, making them closely related.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Similar to the W-2, it provides necessary information for completing the Maryland 515, especially for non-wage income.

- Do Not Resuscitate Order form: This legal document allows individuals to specify their wishes regarding resuscitation efforts. Similar to various tax forms, it is crucial for ensuring that medical personnel honor the patient's intent, much like how tax forms ensure compliance with financial obligations. More information can be found at https://coloradoformpdf.com/.

- Form 8862: This form is used to claim the Earned Income Credit after it has been disallowed in previous years. It relates to the Maryland 515 in that both documents may involve tax credits that reduce overall tax liability.

- Form 1040X: This is the amended U.S. individual income tax return. Similar to the Maryland 515, it allows taxpayers to correct errors in previously filed returns, ensuring accurate reporting of income and tax obligations.

- State-Specific Local Tax Forms: Many states have local tax forms for residents of specific jurisdictions. These forms are similar to the Maryland 515 as they address local tax obligations for individuals working in a specific area while residing elsewhere.

Maryland 515 - Usage Steps

Filling out the Maryland 515 form can seem daunting, but with a clear step-by-step approach, it becomes manageable. This form is specifically for nonresidents employed in Maryland who live in Delaware, New York, or Pennsylvania and are subject to local income taxes. Follow these steps carefully to ensure that your form is completed accurately.

- Gather necessary documents such as your federal income tax return, W-2 forms, and any other income statements.

- Use blue or black ink to fill out the form; avoid using pencil or red ink.

- Complete the "Name" and "Address" sections at the top of the form, including your Social Security number.

- Indicate the county and city where you were employed on the last day of the taxable period.

- Select your filing status by checking the appropriate box. Refer to the instructions to determine the correct status.

- Provide your state of legal residence and the dates if you were not a resident for the full year.

- Fill in the exemptions section by checking the boxes that apply to you and your spouse, if applicable.

- Enter your income information in the appropriate columns: Federal Income, Maryland Income, and Non-Maryland Income.

- Calculate any additions to income and enter the amounts on the designated lines.

- Determine any subtractions from income and complete those sections as well.

- Choose your deduction method (standard or itemized) and enter the amount accordingly.

- Calculate your Maryland tax and any local tax based on the provided worksheets and tables.

- Complete the payment section, entering any amounts withheld and credits you are eligible for.

- Sign and date the form, and include your spouse's signature if applicable.

- Mail the completed form to the Comptroller of Maryland, along with any required attachments.

Learn More on Maryland 515

1. What is the Maryland 515 form?

The Maryland 515 form is specifically designed for nonresidents who are employed in Maryland but reside in certain jurisdictions of Delaware, New York, and Pennsylvania. These jurisdictions impose a local income or earnings tax on Maryland residents. The form allows these nonresidents to report their Maryland income and claim any applicable exemptions or credits.

2. Who is required to file the Maryland 515 form?

You must file the Maryland 515 form if you meet several criteria. First, you should be a nonresident of Maryland. This means you do not have a permanent home in Maryland and did not live there for more than six months during the tax year. Additionally, you need to have received salary, wages, or other compensation for services performed in Maryland. If you reside in a jurisdiction that imposes a local income tax on Maryland residents and are required to file a federal return, you will need to file the Maryland 515 form.

3. What income is taxable under the Maryland 515 form?

If you are required to file the Maryland 515 form, you will be subject to local income tax on the portion of your federal adjusted gross income that comes from salary, wages, or other compensation for personal services performed in Maryland. This includes any income you earn while working in Maryland, even if you live in another state that also imposes its own income tax.

4. How do I determine my filing status on the Maryland 515 form?

Your filing status on the Maryland 515 form should match the status you used on your federal tax return. Common statuses include Single, Married Filing Jointly, or Head of Household. If you are a dependent taxpayer, you will need to check a specific box indicating that status. It's important to select the correct status as it affects your tax calculations and exemptions.

5. What are the penalties for not filing the Maryland 515 form?

Failing to file the Maryland 515 form can result in severe penalties. These may include criminal fines and even imprisonment for filing a false or fraudulent return. Additionally, interest will accrue on any unpaid taxes. The Comptroller of Maryland can also place liens against your wages or property to collect any delinquent taxes. Therefore, it is crucial to file accurately and on time.

6. How can I claim a refund if Maryland tax was withheld in error?

If Maryland tax was withheld from your income in error, you can claim a refund by filing the Maryland 515 form. You will need to complete the relevant sections of the form, including your federal adjusted gross income and details about the Maryland tax withheld. Attach any withholding statements, such as W-2 or 1099 forms, that show the amount withheld. It is important to file for a refund within three years of the original due date to ensure you receive it.

Additional PDF Forms

Maryland Medicaid Application - Any adaptive devices used by the patient should be noted.

For those looking to establish an LLC in Texas, it's crucial to have a comprehensive understanding of how to complete the Texas Operating Agreement form, as it contains vital details about management and operations. To access this important resource, you can find the complete form at https://texasdocuments.net/printable-operating-agreement-form, which will help ensure that your company's governance is clear and structured from the outset.

How to Create Job Application Form - Job duties, reasons for leaving each position, and supervisor contact information must be included.

Documents used along the form

The Maryland 515 form is essential for nonresidents employed in Maryland who live in Delaware, New York, or Pennsylvania. Along with this form, several other documents are often required to ensure accurate tax filing. Here’s a brief overview of these additional forms and documents.

- Form 502: This is the Maryland Resident Income Tax Return. It is used by residents of Maryland to report their income and calculate their tax liability.

- Form 505: The Maryland Nonresident Income Tax Return. This form is for nonresidents who have income from Maryland sources other than wages, such as business income or rental income.

- Form W-2: This form reports an employee's annual wages and the taxes withheld from their paycheck. It's essential for verifying income and tax withholdings.

- Form 1099: Used to report various types of income other than wages, salaries, and tips. This form is crucial for reporting freelance or contract work income.

- Form 502CR: This is the Maryland Personal Income Tax Credits form. Taxpayers use it to claim various tax credits that can reduce their overall tax liability.

- Form 502UP: This form is used to calculate interest on unpaid taxes. If there are any late payments, this form is necessary for determining the interest owed.

- Editable Affidavit of Service: This form is crucial for proving the delivery of legal papers in court cases. To access it, you can find the document here.

- Form 500CR: This is the Business Tax Credit form. Businesses use it to claim various credits available under Maryland tax law.

- Federal Form 1040: This is the U.S. Individual Income Tax Return. It provides the basis for reporting income to the IRS and is often referenced when completing state forms.

- Local Tax Worksheet: This worksheet helps calculate local tax obligations based on income earned in Maryland, which is essential for completing the Maryland 515 form accurately.

These documents work together to provide a comprehensive view of your tax situation, ensuring compliance with Maryland tax laws. Having them ready can simplify the filing process and help avoid potential issues with tax authorities.

Key takeaways

Understand Your Eligibility: The Maryland 515 form is specifically for nonresidents who work in Maryland but reside in Delaware, New York, or Pennsylvania. Ensure that you meet these criteria before filling out the form.

Filing Status Matters: Your filing status on the Maryland 515 form should match your federal return unless you are a dependent taxpayer. Familiarize yourself with the different statuses to select the appropriate one.

Accurate Information is Key: Complete all sections of the form with accurate information, including your name, address, and Social Security number. Use blue or black ink and avoid using pencil or red ink.

Know Your Deadlines: The Maryland 515 form is due by April 15 of the following year. Be mindful of this deadline to avoid penalties or interest on unpaid taxes.

Misconceptions

Understanding the Maryland Form 515 can be challenging, and several misconceptions can lead to confusion. Here are seven common misconceptions about this form:

- Only Maryland residents need to file Form 515. This is incorrect. Nonresidents employed in Maryland who live in certain jurisdictions of Delaware, New York, and Pennsylvania must file this form if they owe local income taxes.

- Form 515 is only for individuals who have lived in Maryland. This is a misconception. Nonresidents who work in Maryland but reside in specific neighboring states are required to file Form 515.

- Filing Form 515 means you have to pay Maryland state income tax. Not necessarily. The form is primarily for those who need to report local taxes, and if your local jurisdiction does not impose a tax on Maryland residents, you may not owe any Maryland state tax.

- All income must be reported on Form 515. This is misleading. Only income derived from services performed in Maryland is reported on this form. Non-Maryland income should be reported separately, if applicable.

- You can file Form 515 without completing your federal tax return first. This is false. You need to complete your federal return before filling out Form 515, as it requires information from your federal return.

- There are no penalties for late filing of Form 515. This is incorrect. There are significant penalties for failing to file on time, which can include fines and interest on unpaid taxes.

- Once filed, you cannot amend Form 515. This is not true. If you need to make changes after filing, you can amend the form, but it is crucial to do so within the designated time frame to avoid penalties.

By clarifying these misconceptions, individuals can better navigate the filing process and ensure compliance with Maryland tax laws.