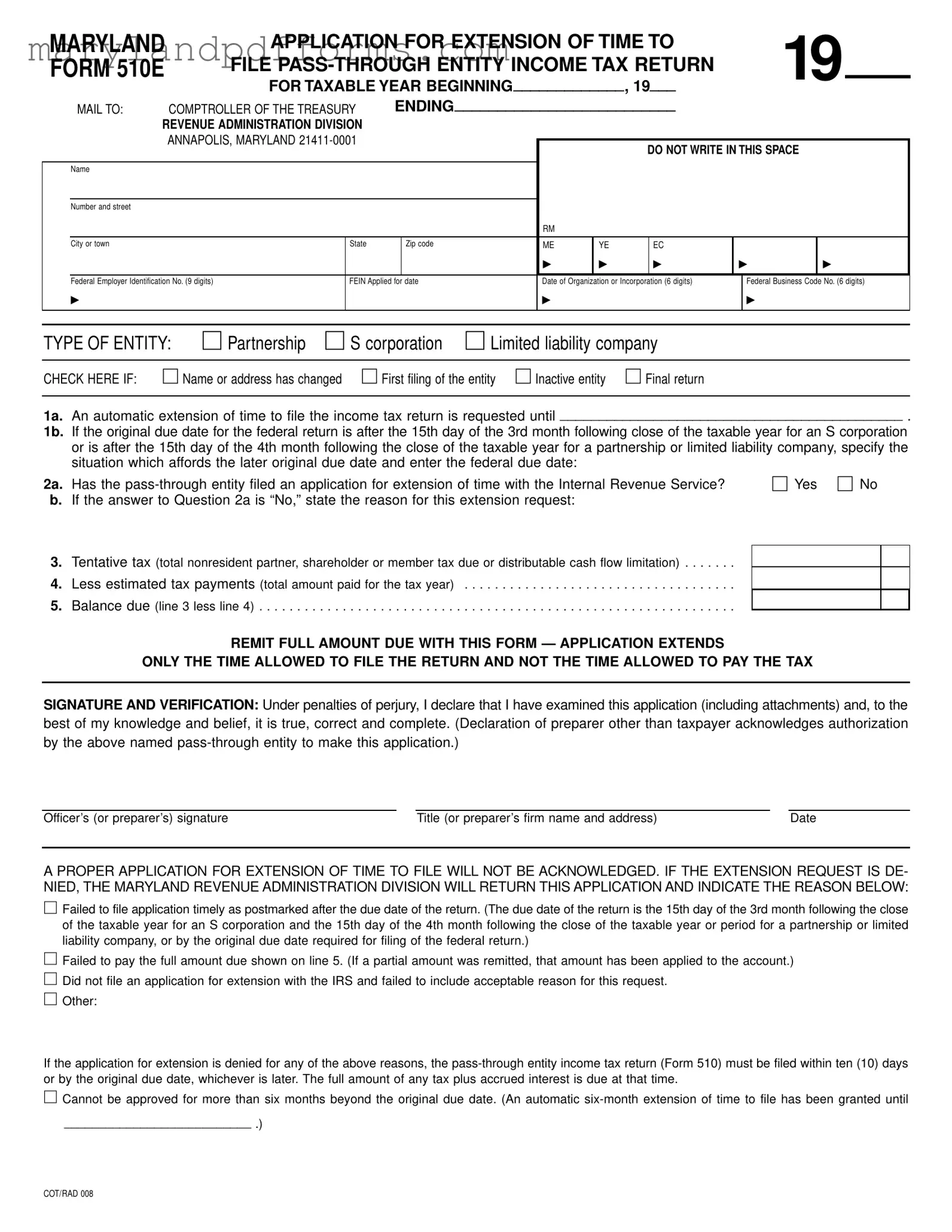

Blank Maryland 510E Template

Similar forms

- Form 500: This is the Maryland Corporation Income Tax Return. Like Form 510E, it is used by entities to report income and request extensions. However, Form 500 is specifically for corporations, while Form 510E is for pass-through entities.

- Form 510: This is the Pass-Through Entity Income Tax Return. Form 510E serves as an extension request for this return. Both forms are related and are used by the same type of entities.

- Form 1040: This is the U.S. Individual Income Tax Return. Individuals can request extensions using Form 4868, similar to how pass-through entities use Form 510E to extend their filing deadline.

- Independent Contractor Agreement: To clarify obligations in your business relationship, use the comprehensive Independent Contractor Agreement form and ensure both parties are aligned on terms.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Both Form 4868 and Form 510E allow taxpayers to request additional time to file their respective tax returns.

- Form 1120: This is the U.S. Corporation Income Tax Return. Similar to Form 500, it reports corporate income. Extensions for filing can be requested, akin to the process for Form 510E.

- Form 1065: This is the U.S. Return of Partnership Income. Partnerships use this form to report income, and they can also request an extension with Form 7004, similar to how pass-through entities use Form 510E.

- Form 7004: This is the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. It serves a similar purpose as Form 510E, allowing businesses to extend their filing deadlines.

- Form 941: This is the Employer's Quarterly Federal Tax Return. Employers can file for extensions using Form 7004, similar to how pass-through entities can use Form 510E for their tax returns.

Maryland 510E - Usage Steps

Filling out the Maryland 510E form is an important step for pass-through entities needing an extension of time to file their income tax return. To ensure your application is processed smoothly, follow these steps carefully. Make sure to provide accurate information and remit any balance due with the form.

- Begin by entering the taxable year details at the top of the form. Fill in the starting and ending dates of the taxable year.

- Provide the name and address of the pass-through entity. Type or print clearly in the designated area. Include any “Trading As” (T/A) name if applicable.

- Input the Federal Employer Identification Number (FEIN). If you have not yet secured a FEIN, write “APPLIED FOR” followed by the date of application.

- Select the type of entity by checking the appropriate box: Partnership, S Corporation, or Limited Liability Company.

- If applicable, check any of the following boxes: Name or address has changed, this is the first filing, the entity is inactive, or this is the final return.

- In line 1a, request an automatic extension by entering the date until which you are requesting the extension.

- If the original due date for the federal return is later than the standard deadlines, complete line 1b by explaining the situation and entering the federal due date.

- Answer question 2a by checking “Yes” or “No” to indicate whether the pass-through entity has filed for an extension with the IRS.

- If you answered “No” to question 2a, provide a reason for the extension request in question 2b.

- Calculate and enter the tentative tax amount on line 3. This should be the total nonresident partner, shareholder, or member tax due.

- On line 4, input the total estimated tax payments made for the tax year.

- Calculate the balance due by subtracting line 4 from line 3. Enter this amount on line 5.

- Sign and date the form in the designated area. Include the title of the officer or the name and address of the preparer's firm.

- Prepare your payment by including a check or money order for the full amount due, made payable to the Comptroller of the Treasury. Ensure to include the FEIN, type of tax, and the tax year dates on the payment.

- Mail the completed form and payment to the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland 21411-0001. Use the provided envelope and mark it appropriately.

Learn More on Maryland 510E

What is the Maryland 510E form?

The Maryland 510E form is an application used by pass-through entities, such as partnerships, S corporations, and limited liability companies, to request an extension of time to file their income tax return. This form allows these entities to extend their filing deadline while ensuring they comply with state tax laws.

Who needs to file the Maryland 510E form?

Any pass-through entity that requires additional time to file their income tax return must file the Maryland 510E form. This includes partnerships, S corporations, and limited liability companies operating in Maryland.

When is the Maryland 510E form due?

The Maryland 510E form is due by the 15th day of the 3rd month following the close of the taxable year for S corporations. For partnerships and limited liability companies, it is due by the 15th day of the 4th month following the close of their taxable year.

How long does the extension last?

An automatic extension of six months is granted for S corporations and three months for partnerships and limited liability companies. However, this extension only applies to the filing of the return and does not extend the time to pay any taxes owed.

What if I miss the deadline to file the 510E form?

If you miss the deadline, the extension request may be denied. In this case, the pass-through entity must file the income tax return within ten days of receiving notification of the denial or by the original due date, whichever is later.

What information do I need to provide on the form?

You will need to provide the following information:

- The name and address of the pass-through entity

- The Federal Employer Identification Number (FEIN)

- The type of entity (partnership, S corporation, or LLC)

- The taxable year dates

- The tentative tax amount

- Any estimated tax payments made

Do I need to pay any taxes when I file the 510E form?

Yes, you must remit the full amount due with the form. The application extends only the time allowed to file the return, not the time allowed to pay any taxes owed. Failure to pay the full amount may result in penalties and interest.

What happens if my extension request is denied?

If your request is denied, the Maryland Revenue Administration Division will notify you. You will then need to file your income tax return within ten days or by the original due date, whichever is later. Any tax due, plus accrued interest, will need to be paid at that time.

Can I get an additional extension?

Yes, a partnership or limited liability company may request an additional three-month extension for reasonable cause by filing another Maryland 510E form. However, this is not automatically granted and must be justified.

Where do I send the completed Maryland 510E form?

The completed form should be mailed to the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland 21411-0001. Ensure you use the envelope provided in the tax booklet and mark it appropriately.

Additional PDF Forms

Maryland Uniform Credentialing - Coded information helps in reporting education and specialties easily.

510d - Form 510D can be downloaded from the Maryland taxation website for convenience.

When engaging in the sale of a mobile home, it is crucial to utilize a Mobile Home Bill of Sale form, which provides legal documentation for the transaction. To assist you in creating this important document, you can refer to resources such as PDF Templates Online, ensuring that both buyers and sellers are protected throughout the process.

Maryland Credentialing Application - This form is a stepping stone to advancing your career in early childhood education.

Documents used along the form

When dealing with the Maryland 510E form, several other forms and documents may be necessary to ensure compliance with tax regulations. Each of these documents serves a specific purpose and can help streamline the filing process. Here is a list of commonly used forms and documents that accompany the Maryland 510E.

- Form 510: This is the main income tax return for pass-through entities in Maryland. It must be filed by the due date, and if an extension is granted, it should be submitted by that extended deadline.

- Form 510D: This form is used to declare estimated tax payments for nonresident partners or shareholders. It helps to report any tax obligations that may arise before filing the full return.

- IRS Form 7004: This is the application for an automatic extension of time to file certain business income tax returns with the IRS. If a pass-through entity is seeking an extension, it is crucial to file this form with the IRS as well.

- Form 120: This is the Maryland Corporate Income Tax Return. If a pass-through entity has corporate characteristics, it may need to file this form in addition to the 510E.

- Form 502: This is the Maryland Resident Income Tax Return. It may be relevant for partners or shareholders who are residents and need to report their share of the entity's income.

- ADP Pay Stub: This form provides a summary of earnings and deductions for employees, highlighting essential information such as gross pay and taxes withheld, making it crucial for financial management. For more information, visit topformsonline.com/adp-pay-stub.

- Form 504: This is the Maryland Nonresident Income Tax Return. Nonresident partners or shareholders use this form to report income earned from the pass-through entity.

- Form 1: This is the Maryland Personal Income Tax Return. Individual partners or shareholders may need to use this form to report their overall income, including income received from the pass-through entity.

Understanding these forms and their purposes is vital for ensuring timely and accurate tax compliance. Each document plays a role in the overall tax process, and missing any of them could lead to complications or penalties. It is essential to stay organized and informed throughout this process.

Key takeaways

When filling out and using the Maryland 510E form, there are several important points to keep in mind. This form is specifically designed for pass-through entities to request an extension of time to file their income tax returns. Here are key takeaways to ensure a smooth process:

- Understand the Purpose: The Maryland 510E form is used to request an extension for filing the pass-through entity income tax return (Form 510).

- Know the Deadlines: The form must be filed by specific deadlines based on the type of entity. For S corporations, the deadline is the 15th day of the 3rd month after the close of the taxable year. For partnerships and limited liability companies, it is the 15th day of the 4th month.

- Automatic Extensions: If the form is filed correctly and on time, an automatic six-month extension is granted for S corporations and three months for partnerships and limited liability companies.

- Full Payment Required: It is crucial to submit full payment of any balance due along with the form. This is necessary to obtain the extension.

- IRS Application: The pass-through entity must have filed an application for extension with the IRS. If this has not been done, an acceptable reason for the extension request must be provided.

- Signature Requirement: An authorized officer or paid preparer must sign the form. This signature verifies the accuracy of the information provided.

- Payment Instructions: Include a check or money order for the full amount due, made payable to the Comptroller of the Treasury. Always include the Federal Employer Identification Number on the payment.

- Mailing Instructions: Use the envelope provided in the tax booklet for mailing. Indicate the type of document enclosed by marking the appropriate box on the envelope.

- Be Aware of Denial Reasons: If the extension request is denied, the pass-through entity will be notified. Common reasons for denial include late filing, insufficient payment, or failure to file with the IRS.

By following these guidelines, you can effectively navigate the process of completing and submitting the Maryland 510E form. This will help ensure that your extension request is processed smoothly and that you remain compliant with state tax regulations.

Misconceptions

Understanding the Maryland 510E form is essential for pass-through entities seeking an extension to file their income tax return. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- Filing the 510E form automatically extends the payment deadline. This is not true. The 510E form only extends the time to file the return, not the time to pay any taxes owed. Payments are still due by the original deadline.

- All entities can receive a six-month extension. While S corporations can receive an automatic six-month extension, partnerships and limited liability companies are granted only a three-month extension unless an additional request is made.

- Submitting the form late is acceptable as long as it’s postmarked. This is incorrect. The form must be filed by the due date to be considered valid. Late submissions may be denied.

- There is no need to file an extension with the IRS. This is a misconception. An application for extension must be filed with the IRS, or a valid reason for not doing so must be provided with the 510E form.

- Only the entity’s name needs to be accurate on the form. In fact, all information, including the address and Federal Employer Identification Number (FEIN), must be accurate to avoid processing issues.

- Checking the box for “final return” is optional. It is crucial to check this box if the entity is indeed dissolving or liquidating. Failing to do so can lead to complications.

- Estimated tax payments can be ignored. This is false. The form requires the entity to report any estimated tax payments made, which affects the balance due.

- Signature from any officer is acceptable. Only an authorized officer or the paid preparer can sign the form. An unauthorized signature may result in denial of the extension.

- Payment methods are flexible. Payments must be made via check or money order. Cash is not accepted, which can lead to payment processing issues.

Being aware of these misconceptions can help ensure a smoother process when filing the Maryland 510E form. It is always best to read the instructions carefully and consult with a tax professional if there are any uncertainties.