Blank Maryland 510D Template

Similar forms

The Maryland 510D form serves a specific purpose for pass-through entities to declare and remit estimated income tax. Several other documents share similarities with the 510D form, primarily in their function of estimating and reporting tax liabilities. Here’s a list of seven such documents:

- IRS Form 1040-ES: This form is used by individuals to calculate and pay estimated taxes. Like the Maryland 510D, it helps taxpayers determine their estimated tax liability for the year and make quarterly payments to avoid penalties.

- IRS Form 1120-W: Corporations use this form to estimate their tax liability and make quarterly payments. Similar to the 510D, it requires corporations to project their income and expenses for the year.

- Maryland Form 500: This is the individual income tax return for Maryland residents. While it is filed annually, it incorporates the estimated taxes paid throughout the year, similar to how the 510D tracks estimated payments for pass-through entities.

- Maryland Form 505: This form is for nonresidents and part-year residents to report their income and taxes owed. It reflects the estimated taxes paid on behalf of nonresident members, paralleling the purpose of the 510D.

- IRS Form 1065: Partnerships use this form to report income, deductions, gains, and losses. While it does not focus on estimated payments, it shares the requirement of reporting income that may impact estimated tax calculations, much like the 510D.

- Mobile Home Bill of Sale: Essential for the transfer of ownership of a mobile home in New York, this document provides proof of transaction and protects both parties involved. For more information, you can visit PDF Templates Online.

- Maryland Form 510: This form is used by pass-through entities to report their income and tax liabilities. It is closely related to the 510D, as both forms are essential for compliance with Maryland tax laws regarding pass-through entities.

- IRS Form 941: Employers use this form to report payroll taxes, including withholding and FICA taxes. While it serves a different purpose, it also requires accurate estimates of tax liabilities based on payroll, similar to how the 510D estimates tax for pass-through entities.

Each of these forms plays a vital role in tax reporting and compliance, ensuring that taxpayers fulfill their obligations accurately and on time.

Maryland 510D - Usage Steps

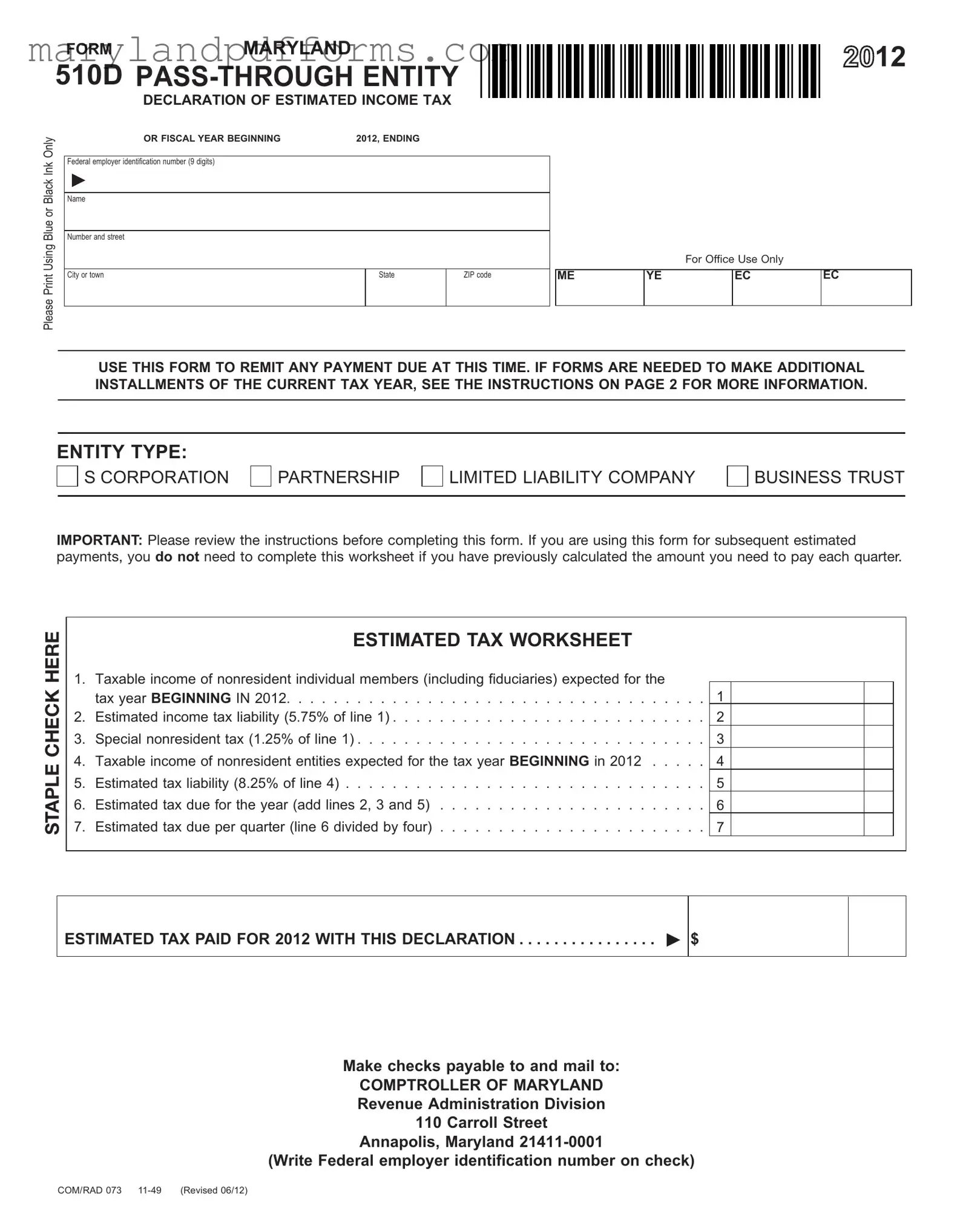

Completing the Maryland 510D form is essential for pass-through entities to declare and remit estimated income tax. Follow these steps carefully to ensure accuracy and compliance.

- Obtain the Maryland 510D form from the Maryland state tax website or your tax professional.

- At the top of the form, enter the federal employer identification number (FEIN) in the designated area.

- Provide the name of the pass-through entity and any applicable “Trading As” (T/A) name.

- Fill in the address of the entity, including the number and street, city or town, state, and ZIP code.

- Indicate the entity type by checking the appropriate box for S Corporation, Partnership, Limited Liability Company, or Business Trust.

- Complete the Estimated Tax Worksheet by filling in the taxable income of nonresident individual members on line 1.

- Calculate the estimated income tax liability (5.75% of line 1) and enter it on line 2.

- Calculate the special nonresident tax (1.25% of line 1) and enter it on line 3.

- Enter the taxable income of nonresident entities on line 4.

- Calculate the estimated tax liability for nonresident entities (8.25% of line 4) and enter it on line 5.

- Add lines 2, 3, and 5 together to find the total estimated tax due for the year and enter it on line 6.

- Divide the amount on line 6 by four to determine the estimated tax due per quarter and enter it on line 7.

- Include the estimated tax paid for the year with this declaration in the designated area.

- Attach a check or money order made payable to the Comptroller of Maryland, ensuring the FEIN is written on the check.

- Mail the completed form and payment to the address: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001.

After submitting the form, keep a copy for your records. Ensure to monitor any changes in tax rates or requirements from the Maryland tax authority, as these can affect future filings.

Learn More on Maryland 510D

What is the purpose of the Maryland 510D form?

The Maryland 510D form is designed for pass-through entities (PTEs) to declare and remit estimated income tax on behalf of their nonresident members. This includes individuals, fiduciaries, and entities that are not registered to do business in Maryland. By using this form, PTEs ensure that they comply with state tax obligations and facilitate tax payments for their members.

Who needs to file the Maryland 510D form?

Any pass-through entity, such as an S corporation, partnership, limited liability company (LLC), or business trust, must file the Maryland 510D form if they have nonresident members. These entities are responsible for paying estimated taxes on behalf of their nonresident members, which includes individuals and entities not formed under Maryland law.

What are the tax rates applicable to nonresident members?

The tax rates for nonresident members vary based on their classification:

- For nonresident individual members and fiduciaries, the tax rate is 5.75% of their distributive or pro rata share of income.

- For nonresident entity members, the tax rate is 8.25% of their distributive or pro rata share of income.

It is essential to stay updated, as these rates may change with new legislation.

When should the Maryland 510D form be filed?

The form must be filed on specific due dates, which vary depending on the type of entity. For S corporations, the form is due on or before the 15th day of the 4th, 6th, 9th, and 12th months following the start of the tax year. For partnerships, LLCs, and business trusts, the due dates are the 4th, 6th, 9th, and 13th months after the tax year begins.

What happens if the estimated tax exceeds $1,000?

If the estimated tax for the year is expected to exceed $1,000, the PTE is required to make quarterly estimated payments. To avoid penalties and interest, the total estimated payments must be at least 90% of the current year’s tax or 110% of the prior year’s tax. This ensures that the entity meets its tax obligations in a timely manner.

How can a PTE amend its estimated tax payment?

If a PTE needs to amend its estimated tax, it should recalculate the required amount using the provided worksheet. The next installment should reflect any adjustments for previous underpayments or overpayments. Remaining installments must be at least 25% of the amended estimated tax due for the year, ensuring that the entity remains compliant.

What information is required to complete the Maryland 510D form?

When completing the form, the PTE must provide specific information, including:

- The entity's name and address.

- The federal employer identification number (FEIN).

- The tax year beginning and ending dates.

Accurate and complete information is crucial for proper processing and compliance with state tax laws.

Where should the completed Maryland 510D form be sent?

The completed form, along with any payment, should be mailed to:

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, MD 21411-0001

Ensure that the FEIN and relevant tax information are included on the payment to avoid any processing delays.

Additional PDF Forms

Maryland Charitable Registration - Organizations must report their total assets and total liabilities on the balance sheet.

Md 502cr - To claim child care credits, individuals must refer to the federal adjusted gross income reported in their federal return.

When considering the implications of liability in various activities, it is essential to understand the importance of a Hold Harmless Agreement. This document not only alleviates concerns for parties involved but also clarifies responsibilities and risks. For those looking for a comprehensive format, exploring resources such as Templates Online can provide useful templates and guidance to ensure that all necessary elements are included in the agreement.

Boat Registration Maryland - It aids in establishing a clear timeline for the transfer of ownership.

Documents used along the form

When dealing with the Maryland 510D form, several other documents and forms may come into play. Each of these documents serves a specific purpose and can help ensure compliance with Maryland tax regulations. Below is a list of commonly used forms alongside the Maryland 510D form, along with brief descriptions of their functions.

- Form 500: This is the Maryland Resident Income Tax Return. It is used by residents to report their income and calculate their tax liability. Nonresident members must include a statement of taxes paid on their behalf when filing this form.

- California Living Will Form: To ensure your healthcare preferences are respected, utilize our comprehensive California Living Will resources for clear guidance on medical decisions.

- Form 504: This form is the Maryland Nonresident Income Tax Return. Nonresidents use it to report income earned in Maryland and to claim any credits for taxes paid on their behalf by pass-through entities.

- Form 505: This is the Maryland Composite Nonresident Income Tax Return. It allows pass-through entities to file a single return on behalf of their nonresident members, simplifying the process for those members.

- Form 510: The Maryland Pass-Through Entity Income Tax Return is used by pass-through entities to report income, deductions, and credits. This form is essential for entities that need to report their overall tax obligations.

- Distributable Cash Flow Limitation Worksheet: This worksheet helps pass-through entities determine the limitations on distributable cash flow for tax purposes. It is an important tool for ensuring compliance with tax regulations.

- Estimated Tax Worksheet: This worksheet assists in calculating the estimated tax liability for the current tax year. It is crucial for ensuring that the estimated payments made align with the actual tax obligations.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Pass-through entities may need to issue 1099 forms to members or contractors for income distributions.

- Form 1120S: This is the U.S. Income Tax Return for an S Corporation. If the pass-through entity is an S corporation, this form must be filed to report income, deductions, and credits at the federal level.

- Form 1065: This is the U.S. Return of Partnership Income. Partnerships use this form to report income, deductions, gains, and losses from their operations. It is essential for compliance at the federal level.

Understanding these forms and how they relate to the Maryland 510D can help ensure that you meet your tax obligations effectively. Always consider consulting with a tax professional for personalized guidance tailored to your specific situation.

Key takeaways

1. Purpose of the Form: The Maryland 510D form is designed for pass-through entities (PTEs) to declare and remit estimated income tax on behalf of their nonresident members.

2. Tax Rates: The tax rates vary based on the type of nonresident member. Individual members are taxed at 5.75%, while nonresident entities face an 8.25% tax rate on their distributive shares of income.

3. Filing Deadlines: Form 510D must be filed by specific deadlines. For S corporations, it is due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year. For partnerships, LLCs, and business trusts, it is due on the 4th, 6th, 9th, and 13th months.

4. Payment Requirements: If the estimated tax for the year is expected to exceed $1,000, quarterly payments are necessary. The total payments must meet at least 90% of the current year’s tax or 110% of the previous year’s tax to avoid penalties.

5. Record Keeping: PTEs must provide a statement to each nonresident member indicating the amount of tax paid on their behalf. Members should retain this statement for their income tax filings to claim credits for taxes paid.

Misconceptions

Misconceptions about the Maryland 510D form can lead to confusion among pass-through entities. Here are four common misconceptions clarified:

- Misconception 1: The Maryland 510D form is only for S corporations.

- Misconception 2: Estimated tax payments are optional.

- Misconception 3: The tax rates are fixed and do not change.

- Misconception 4: Filing electronically means you do not need to keep records.

This form is applicable to various types of pass-through entities, including partnerships, limited liability companies, and business trusts. It is not limited to S corporations alone.

In fact, if the expected tax liability exceeds $1,000 for the year, pass-through entities must make quarterly estimated payments. This requirement helps avoid interest and penalties.

The tax rates for nonresident members can change. For example, the rate for nonresident individual members was 5.75% in 2012, but future legislative changes may alter this rate. It is advisable to check the Maryland tax website for updates.

While electronic filing is encouraged, entities must retain a copy of the filed Form 510D with their records. This is essential for future reference and compliance.