Blank Maryland 510 Template

Similar forms

Form 1065: This is the U.S. Return of Partnership Income, used by partnerships to report income, deductions, and credits. Similar to the Maryland 510, it requires details about the entity, members, and income distribution.

Form 1120S: This is the U.S. Income Tax Return for an S Corporation. Like the Maryland 510, it reports income and deductions, focusing on the distribution of income to shareholders.

Form 1040: The U.S. Individual Income Tax Return, which includes schedules for reporting income from pass-through entities. It shares the focus on individual income derived from partnerships and S corporations.

Form 500: This is the Maryland Corporation Income Tax Return. It parallels the Maryland 510 in that both forms are used for reporting income to the state, though Form 500 is for corporations rather than pass-through entities.

Form 510D: This is the Maryland Pass-Through Entity Nonresident Tax Payment Form. It is directly related to the Maryland 510, as it facilitates the payment of taxes owed by nonresident members of pass-through entities.

Texas Notice to Quit: This legal document is crucial for landlords intending to reclaim rental properties. For detailed guidance on completing this form, refer to https://texasdocuments.net/printable-notice-to-quit-form/.

Form 500MC: This is the Maryland Manufacturing Corporation Income Tax Return. It is similar in that it is also a state tax form, focusing on specific industries like manufacturing, while the Maryland 510 addresses pass-through entities.

Schedule K-1 (Form 1065): This schedule reports each partner’s share of income, deductions, and credits from a partnership. It aligns with the Maryland 510's focus on individual member allocations.

Schedule K-1 (Form 1120S): Similar to the previous K-1, this one reports income for S corporation shareholders, echoing the income distribution aspect found in the Maryland 510.

Form 1041: This is the U.S. Income Tax Return for Estates and Trusts. It shares a focus on income distribution to beneficiaries, akin to how the Maryland 510 addresses income allocation among members.

Maryland 510 - Usage Steps

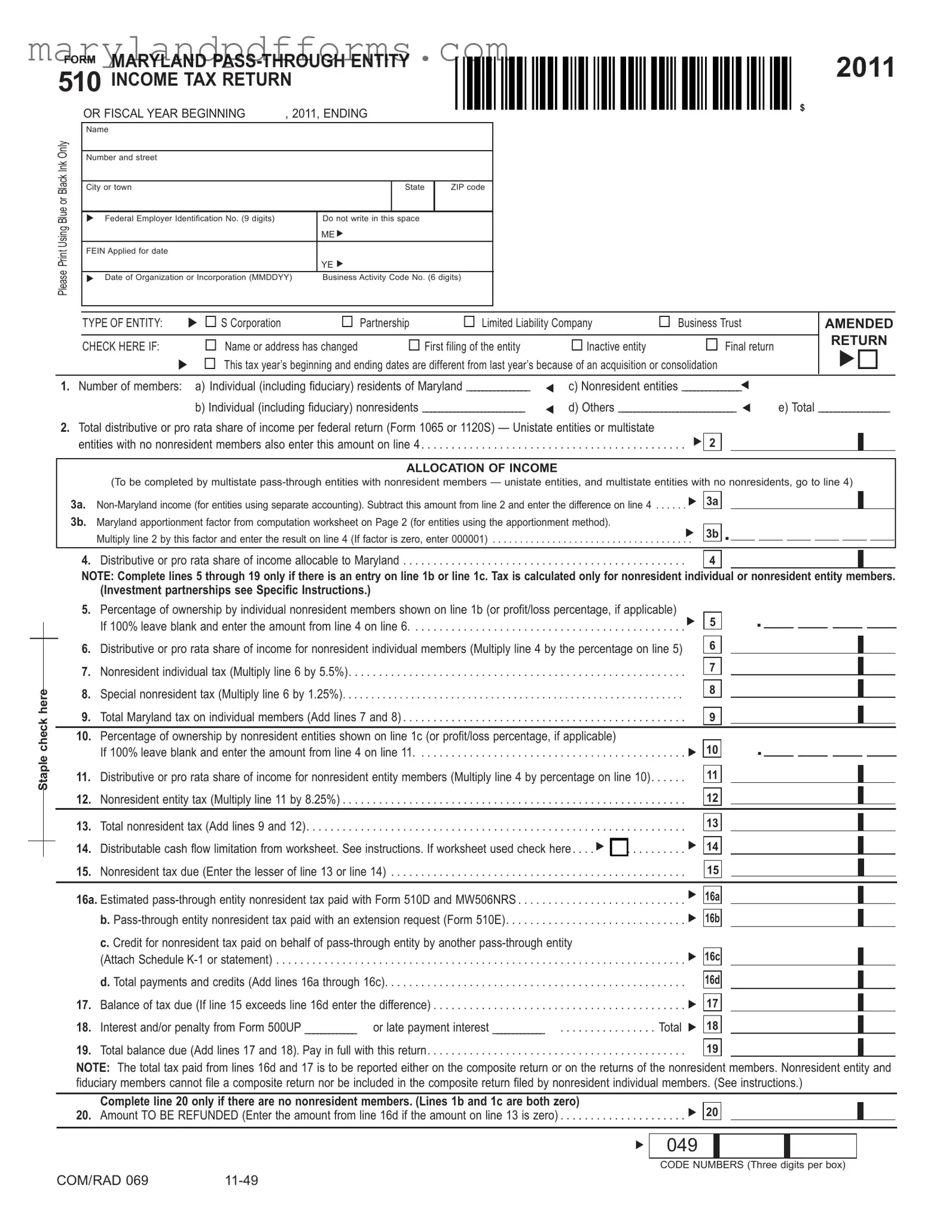

Completing the Maryland 510 form is essential for pass-through entities to report their income and taxes. Before you start, gather all necessary information, including your entity's details and financial data. Follow these steps to ensure accurate completion of the form.

- Enter Basic Information: Fill in the name, address, and federal employer identification number (FEIN) of your entity at the top of the form.

- Select Entity Type: Check the box that corresponds to your entity type: S Corporation, Partnership, Limited Liability Company, or Business Trust.

- Indicate Amended Return: If applicable, check the box for an amended return and specify the reason for the amendment.

- Complete Member Information: Fill in the number of members, including individual residents, nonresidents, and others. Calculate the total number of members.

- Report Income: Enter the total distributive or pro rata share of income as reported on your federal return.

- Allocate Income: If your entity has nonresident members, complete the allocation of income section. Calculate non-Maryland income if applicable.

- Calculate Maryland Income: Determine the distributive share of income allocable to Maryland.

- Calculate Nonresident Taxes: If there are nonresident individual or entity members, compute the taxes owed based on their shares of income.

- Determine Total Tax Due: Add up all taxes calculated for nonresident members to find the total Maryland tax owed.

- Enter Payments and Credits: List any estimated taxes paid or credits applicable to the entity.

- Calculate Balance Due: If the total tax due exceeds payments made, enter the balance owed.

- Refund Information: If applicable, enter the amount to be refunded.

- Complete Additional Information: Provide any additional details requested, such as addresses and telephone numbers for your entity.

- Signature: Have a general partner, officer, or member sign and date the form. Include the preparer's information if applicable.

Once completed, review the form for accuracy. Make sure to include any required attachments and mail it to the Comptroller of Maryland. This ensures compliance with state tax regulations and helps avoid potential issues down the line.

Learn More on Maryland 510

What is the Maryland 510 form?

The Maryland 510 form is an income tax return specifically designed for pass-through entities such as S corporations, partnerships, and limited liability companies. This form allows these entities to report income, deductions, and taxes owed for the tax year. It is essential for ensuring compliance with Maryland state tax regulations.

Who needs to file the Maryland 510 form?

Any pass-through entity operating in Maryland must file the Maryland 510 form. This includes S corporations, partnerships, limited liability companies, and business trusts. If the entity has nonresident members or owners, it is especially important to file this form to report their income and calculate the appropriate tax obligations.

What information is required to complete the Maryland 510 form?

To complete the Maryland 510 form, you will need the following information:

- Name and address of the entity.

- Federal Employer Identification Number (FEIN).

- Type of entity (e.g., S corporation, partnership).

- Dates of the tax year.

- Number of members, including residents and nonresidents.

- Income details, including distributive shares for each member.

What are the deadlines for filing the Maryland 510 form?

The Maryland 510 form is typically due on the 15th day of the fourth month following the end of the tax year. For most entities, this means the form is due by April 15. If the entity operates on a fiscal year basis, the deadline will correspond to the end of that fiscal year.

How do I calculate the tax owed on the Maryland 510 form?

Tax owed is calculated based on the distributive or pro rata share of income allocated to Maryland. For nonresident members, the tax is calculated using a percentage of their income. Individual nonresidents are taxed at a rate of 5.5%, while nonresident entities are taxed at 8.25%. Be sure to follow the specific instructions on the form for accurate calculations.

Can the Maryland 510 form be amended?

Yes, the Maryland 510 form can be amended. If there are changes to the entity's name, address, or other significant information, an amended return should be filed. Check the box for "Amended Return" on the form and provide the updated information. Be sure to file the amendment as soon as the changes are known to avoid penalties.

What happens if I miss the filing deadline?

If the Maryland 510 form is not filed by the deadline, the entity may face penalties and interest on any unpaid taxes. It is crucial to file as soon as possible, even if you cannot pay the full amount owed. Contact the Maryland Revenue Administration Division to discuss options for payment plans or other arrangements.

Is there a way to request an extension for filing the Maryland 510 form?

Yes, entities can request an extension to file the Maryland 510 form. To do this, you must submit Form 510E, which is the extension request form. This request must be filed by the original due date of the Maryland 510 form. Keep in mind that an extension to file is not an extension to pay any taxes owed.

Where do I send the completed Maryland 510 form?

Completed Maryland 510 forms should be mailed to the Comptroller of Maryland, Revenue Administration Division, at 110 Carroll Street, Annapolis, Maryland 21411-0001. Be sure to include the federal employer identification number on the check if any payment is being submitted with the form.

Additional PDF Forms

What Is a Certificate of Compliance Maryland - The form must be signed in a manner that clearly identifies each officer or member.

To ensure a smooth transaction, you can utilize the essential California Loan Agreement form found at this link, which systematically lays out the obligations of both the lender and borrower.

Must Appear in Court - The upper right corner of the citation features the citation number.

Maryland Charitable Registration - A breakdown of expenses by function aids in understanding the cost structure.

Documents used along the form

The Maryland 510 form is essential for pass-through entities in Maryland to report income and taxes. When filing this form, several other documents may be necessary to ensure compliance and accuracy. Below is a list of these commonly used forms and documents.

- Form 1065: This is the U.S. Return of Partnership Income, used by partnerships to report their income, deductions, gains, and losses. It provides the IRS with a complete picture of the partnership's financial activities.

- Form 1120S: This form is the U.S. Income Tax Return for an S Corporation. It is similar to Form 1065 but is specifically for S Corporations, reporting income, deductions, and credits.

- Form 510D: This form is used for estimated tax payments for nonresident members of a pass-through entity. It helps ensure that taxes are paid throughout the year rather than in a lump sum at the end.

- Form 500MC: This is the Maryland Corporate Income Tax Return for Multistate Corporations. It is required if the entity is a multistate corporation and needs to report income from operations in multiple states.

- Colorado ATV Bill of Sale: This legal document records the transfer of ownership for ATVs in Colorado, providing necessary details like price and date for a legitimate transaction. For more information, visit https://coloradoformpdf.com/.

- Form 510E: This form is used to request an extension for filing the Maryland Pass-Through Entity Income Tax Return. It allows additional time to prepare and submit the 510 form.

- Schedule K-1: This schedule reports each partner's or shareholder's share of income, deductions, and credits from the pass-through entity. It is crucial for individual members to report their income on their personal tax returns.

- Form MW506NRS: This is the Nonresident Pass-Through Entity Withholding Tax Return. It is used to report and pay withholding taxes for nonresident members of a pass-through entity.

These forms and documents are often interconnected, and ensuring their accuracy can help streamline the tax filing process for pass-through entities in Maryland. It is important to review each document carefully and consult with a tax professional if needed.

Key takeaways

When filling out the Maryland 510 form, there are several important points to keep in mind. Here are key takeaways to ensure a smooth process:

- Understand the Entity Types: The form is designed for various types of pass-through entities, including S Corporations, Partnerships, Limited Liability Companies, and Business Trusts. Choose the correct type to avoid complications.

- Accurate Identification: Ensure that the entity's name, address, and Federal Employer Identification Number (FEIN) are correctly entered. This information is crucial for proper identification and processing.

- Amended Returns: If you are filing an amended return, check the appropriate box. This is important if there have been changes in the entity's name, address, or status.

- Member Information: Clearly report the number of members in the entity, including both residents and non-residents. This information is vital for tax calculations.

- Income Allocation: If your entity has non-resident members, complete the allocation of income section carefully. Understanding how to apportion income correctly is key to compliance.

- Tax Calculations: Be diligent when calculating taxes for non-resident members. Different rates apply, and errors can lead to penalties.

- Documentation: Attach any necessary schedules or additional documentation as required. This includes forms like Schedule K-1 for credits or tax payments made on behalf of members.

- Signature Requirement: The return must be signed by a general partner, officer, or member of the entity. This signature verifies the accuracy of the information provided.

- Payment Instructions: If there is a balance due, ensure that payments are made to the Comptroller of Maryland, and include the FEIN on the check to avoid processing delays.

By keeping these key points in mind, you can navigate the Maryland 510 form with confidence and ensure compliance with state tax regulations.

Misconceptions

- Misconception 1: The Maryland 510 form is only for corporations.

- Misconception 2: Only Maryland residents need to file the Maryland 510 form.

- Misconception 3: The Maryland 510 form is the same as the federal tax return.

- Misconception 4: If the entity has no income, there is no need to file the Maryland 510 form.

- Misconception 5: The Maryland 510 form can be filed without any supporting documentation.

This is not true. The Maryland 510 form is designed for various types of pass-through entities, including S Corporations, Partnerships, Limited Liability Companies, and Business Trusts. Any qualifying entity should use this form to report income.

In reality, nonresident members of pass-through entities also need to be considered. If a pass-through entity has nonresident members, they must file the Maryland 510 form to report their share of income and taxes.

The Maryland 510 form is specifically for state income tax purposes and is not the same as federal forms like the 1065 or 1120S. Each form has its own requirements and calculations, so it’s important to complete the Maryland 510 form accurately for state compliance.

This is incorrect. Even if a pass-through entity has no income, it may still be required to file the Maryland 510 form. Filing ensures compliance with state regulations and avoids potential penalties.

Supporting documentation is often necessary. Entities may need to provide additional forms, such as Schedule K-1s, to report members' income and tax credits accurately. Proper documentation helps ensure that the return is complete and correct.