Blank Maryland 505X Template

Similar forms

The Maryland 505X form is specifically designed for nonresidents who need to amend their tax returns. There are several other tax documents that serve similar purposes, each tailored to different situations or types of taxpayers. Below is a list of seven documents that share similarities with the Maryland 505X form:

- Form 1040X - This is the U.S. Individual Income Tax Return Amended Form. Like the 505X, it allows taxpayers to correct errors on their original federal tax returns, including changes to income, deductions, or credits.

- ADP Pay Stub - The https://topformsonline.com/adp-pay-stub/ form provides a detailed summary of employee earnings and deductions, essential for accurate financial management, much like the 505X form provides important tax adjustments for individuals.

- Form 502X - This is the Maryland Resident Amended Income Tax Return. Similar to the 505X, it is used by Maryland residents to amend their state tax returns for changes in income or deductions.

- Form 1045 - This form is for Application for Tentative Refund. It allows taxpayers to apply for a quick refund due to a net operating loss, akin to how the 505X addresses changes in income for nonresidents.

- Form 8862 - This form is used to Claim Earned Income Credit After Disallowance. If a taxpayer has had their earned income credit disallowed in the past, they can use this form to amend their claim, similar to how the 505X allows amendments to claims for tax credits.

- Form 8888 - This form is used to Allocate Your Refund. Taxpayers can use it to direct their refunds into multiple accounts. Like the 505X, it helps in managing how tax returns are processed and refunds issued.

- Form 1040-ES - This is the Estimated Tax for Individuals form. While primarily for estimating taxes owed, it can be used to amend payment estimates, similar to how the 505X allows for adjustments to tax liabilities.

- Form 1120X - This is the Amended U.S. Corporation Income Tax Return. Corporations use it to amend their tax returns, similar to how individuals use the 505X to make corrections to their nonresident returns.

Maryland 505X - Usage Steps

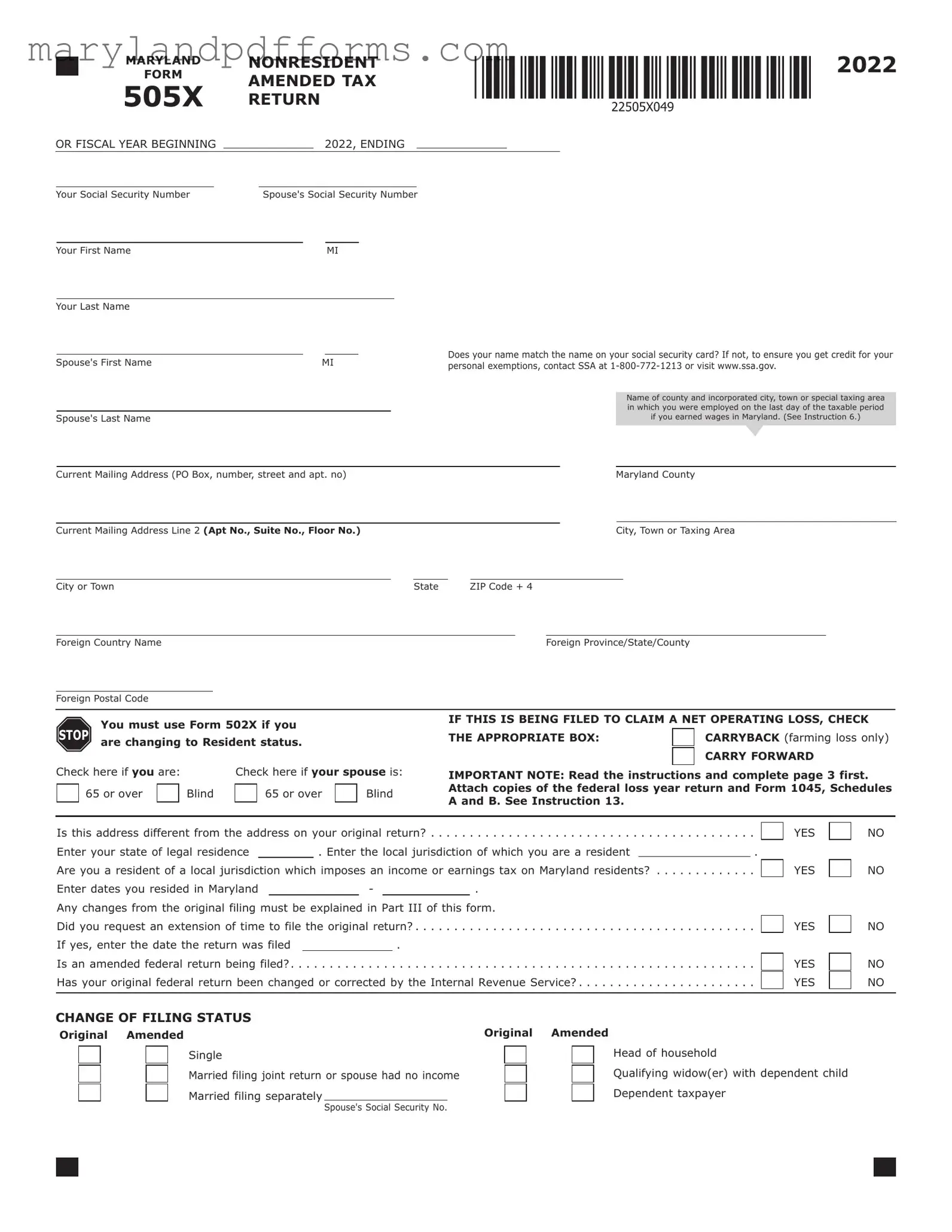

Filling out the Maryland 505X form is an essential step for those who need to amend their nonresident tax return. This process requires careful attention to detail to ensure that all necessary information is accurately reported. Below are the steps to guide you through completing the form.

- Begin by entering your Social Security Number and your spouse's Social Security Number if applicable.

- Fill in your first name, middle initial, and last name. Confirm that your name matches the name on your Social Security card.

- Provide the name of the county and the city, town, or special taxing area where you were employed on the last day of the taxable period.

- Input your current mailing address, including PO Box, street number, apartment number, city, state, and ZIP code.

- Indicate your state of legal residence and the local jurisdiction of which you are a resident.

- Answer whether you are a resident of a local jurisdiction that imposes an income or earnings tax on Maryland residents.

- Enter the dates you resided in Maryland during the taxable period.

- Check the appropriate box if you requested an extension of time to file the original return and enter the date it was filed.

- Indicate if an amended federal return is being filed and whether your original federal return has been changed or corrected by the IRS.

- Choose your filing status by checking the appropriate box (e.g., Single, Married filing jointly, etc.).

- Complete the income and adjustments section using amounts from your federal income tax return, including any supporting schedules.

- Calculate your total income and adjusted gross income and carry the amount to the appropriate lines.

- Choose between the standard deduction method or the itemized deduction method and enter the necessary amounts.

- Complete the tax calculation section by following the prompts to determine your taxable net income and total Maryland tax.

- Input any credits and calculate your Maryland tax after credits.

- Determine if you have a balance due or an overpayment and complete the respective sections.

- Sign and date the form, and ensure your spouse does the same if applicable.

- Mail your completed form to the Comptroller of Maryland, ensuring to include your Social Security Number on the check if applicable.

After completing these steps, double-check your entries for accuracy. If you need to make any changes or have additional documentation, ensure those are included before mailing your form. This will help facilitate a smoother processing experience for your amended return.

Learn More on Maryland 505X

What is the Maryland 505X form?

The Maryland 505X form is used for filing an amended tax return for nonresidents who need to make changes to their original Maryland tax return. It allows taxpayers to correct any errors or omissions, update their income, or adjust deductions and credits that may have been reported incorrectly.

Who should use the 505X form?

This form is specifically for nonresidents who have previously filed a Maryland tax return and need to amend it. If you initially filed as a resident and are now changing your status, you should use Form 502X instead. It’s important to ensure that you’re using the correct form based on your residency status.

What information do I need to complete the 505X form?

To fill out the 505X form, you will need:

- Your Social Security Number

- Your spouse’s Social Security Number, if applicable

- Details about your income, deductions, and any changes from your original return

- Supporting documents, such as copies of your federal return and any relevant schedules

How do I report changes on the 505X form?

When reporting changes, you will need to explain each modification in Part III of the form. Make sure to specify the line number from your original return that you are changing and provide a clear reason for each change. This helps the tax authorities understand your adjustments and ensures your amended return is processed smoothly.

Can I claim a refund using the 505X form?

Yes, if your amended return results in an overpayment of taxes, you can claim a refund. The form includes a section where you can calculate any refund due. Ensure that you complete the necessary calculations accurately to avoid delays in receiving your refund.

What if I owe additional taxes after filing the 505X?

If your amended return indicates that you owe more taxes, you must pay the balance due when you submit the form. The 505X form includes a section for calculating the total amount you owe, including any interest or penalties that may apply. It's crucial to pay this amount promptly to avoid further penalties.

Is there a deadline for submitting the 505X form?

Yes, the deadline for submitting an amended return using the 505X form is typically three years from the original due date of your return. It’s essential to file your amendment within this timeframe to ensure that any changes are accepted and processed by the Maryland tax authorities.

What should I do if I need assistance with the 505X form?

If you need help with completing the 505X form, consider reaching out to a tax professional or a certified public accountant (CPA). They can provide guidance tailored to your specific situation and ensure that your amended return is filed correctly. Additionally, the Maryland Comptroller’s office offers resources and support for taxpayers.

Where do I send my completed 505X form?

Your completed 505X form should be mailed to the Comptroller of Maryland, Revenue Administration Division, at the address provided on the form. It's advisable to send your return via certified mail or another traceable method to ensure it is received and processed without issues.

Additional PDF Forms

Maryland 502 - The form simplifies the process of claiming personal exemptions related to dependents.

The California Release of Liability form is a legal document that individuals sign to waive their right to sue another party for possible injuries, damages, or losses. This form is commonly used in activities or events that might carry a risk, such as sports or community events. By signing this form, a person acknowledges they are participating voluntarily and agree not to hold the other party accountable for any harm that may arise. For more information, visit holdharmlessletter.com/.

Maryland State Compliance Application - Prospective laboratory owners should gather all necessary supporting documents prior to submission.

Mdnewhire - Use the Federal Employer ID Number as it appears on your wage reports.

Documents used along the form

The Maryland 505X form is an essential document for nonresidents who need to amend their tax returns. However, there are several other forms and documents that often accompany this form to ensure accurate reporting and compliance. Below is a list of commonly used forms that may be relevant.

- Form 502X: This form is used by Maryland residents to amend their state income tax returns. If you change your residency status while filing, this form is necessary.

- Form 1045: This federal form allows taxpayers to apply for a carryback of a net operating loss. It is often required when amending state returns that involve losses.

- Mobile Home Bill of Sale: This legal document is crucial for the sale or transfer of ownership of a mobile home in New York. It provides proof of the transaction and safeguards the rights of both parties. For more information and resources, visit PDF Templates Online.

- Schedule A: Used for itemizing deductions on federal tax returns, this schedule may be necessary if you are itemizing deductions for your Maryland return as well.

- Schedule B: This schedule is for reporting interest and dividend income. If these sources of income are amended, it must be included with your Maryland 505X form.

- Form 502CR: This is the Maryland Credit for Income Taxes Paid to Other States. If you qualify for this credit, you'll need to attach this form when submitting your amended return.

- Form 502UP: Used to report any unpaid tax and related interest or penalties. This form may be required if you owe additional tax after amending your return.

- Form MW506NRS: This form is for reporting nonresident tax withheld. It can be useful if you are claiming a refund or credit for taxes withheld while working in Maryland.

- Form 505NR: This is the Nonresident Income Tax Return. If you are amending your nonresident return, this form provides the necessary information about your income earned in Maryland.

Each of these forms plays a vital role in the tax amendment process. Ensure you have all the necessary documents completed and submitted to avoid any issues with your tax filings. Accurate and timely submissions can help you navigate the complexities of tax regulations smoothly.

Key takeaways

- Form Purpose: The Maryland 505X form is used to amend a previously filed nonresident tax return for the state of Maryland.

- Eligibility: Only individuals who initially filed a nonresident return can use this form to make corrections or updates.

- Filing Instructions: Read the instructions thoroughly before filling out the form, especially the guidance provided on page 3.

- Supporting Documents: Attach copies of your federal return and any relevant schedules, particularly if claiming a net operating loss.

- Changes Explanation: Any changes from your original filing must be clearly explained in Part III of the form.

- Tax Credits: Ensure to account for any applicable tax credits on the form to reduce your total tax liability.

- Mailing Address: Send the completed form to the Comptroller of Maryland, ensuring your Social Security Number is included on any checks.

Misconceptions

1. The 505X form is only for residents. Many believe that the Maryland 505X form is exclusively for residents. In reality, it is specifically designed for nonresidents who need to amend their tax returns.

2. You can use 505X for any tax year. Some assume that the 505X form can be used for any tax year. However, it is only applicable for the specific tax year indicated on the form.

3. Filing 505X means you will always get a refund. A common misconception is that filing the 505X guarantees a refund. While it can result in a refund, it may also lead to a balance due if additional taxes are owed.

4. You don't need to attach documents when filing 505X. Many think that supporting documents are unnecessary. In fact, it is crucial to attach any required forms, such as the federal loss year return and Form 1045.

5. You can ignore changes made by the IRS. Some individuals believe that if the IRS adjusts their federal return, they do not need to address it on the 505X. This is incorrect; any changes must be reflected on the Maryland form.

6. You can file 505X without an explanation of changes. It's a misconception that you can submit the form without detailing the changes. You must provide a clear explanation for any modifications made to your original return.

7. The 505X form is the same as the original return. Many people confuse the 505X with their original return. The 505X is an amended return and requires different information and calculations.

8. Filing 505X is a quick process. Some assume that amending a return is straightforward and quick. While it can be, the process may take time, especially if you need to gather supporting documents or if there are complex changes.