Blank Maryland 505Nr Template

Similar forms

The Maryland 505NR form is similar to several other tax documents used for reporting income and calculating taxes. Below is a list of these documents and a brief explanation of how they are similar:

- Form 505: This is the primary Maryland income tax form for residents. Both forms require similar calculations for taxable income and tax owed, but the 505NR is specifically for nonresidents.

- Form 515: This form is used by nonresidents who earn income in Maryland. Like the 505NR, it focuses on nonresident income but includes additional local tax calculations.

- Form 502: This is the Maryland resident income tax return. It shares similar income reporting requirements with the 505NR, but is designed for residents rather than nonresidents.

- Form 1040: The federal income tax return is used by all U.S. taxpayers. Both the 1040 and 505NR require reporting of adjusted gross income and tax calculations, although they apply different tax rates and rules.

- Form 1099: This form reports various types of income other than wages. Like the 505NR, it is used to report income that may be subject to tax, but the 505NR is specifically for Maryland nonresidents.

- Form W-2: This form reports wages earned by employees. Both the W-2 and 505NR require accurate reporting of income, but the W-2 is focused on employee earnings while the 505NR is for nonresident tax calculation.

- Arizona Hold Harmless Agreement: This legal document is crucial for ensuring one party is not liable for damages during activities. For templates and further details, visit Templates Online.

- Form 8862: This form is used to claim the Earned Income Credit after a disallowance. Similar to the 505NR, it requires detailed income reporting and calculations related to credits and deductions.

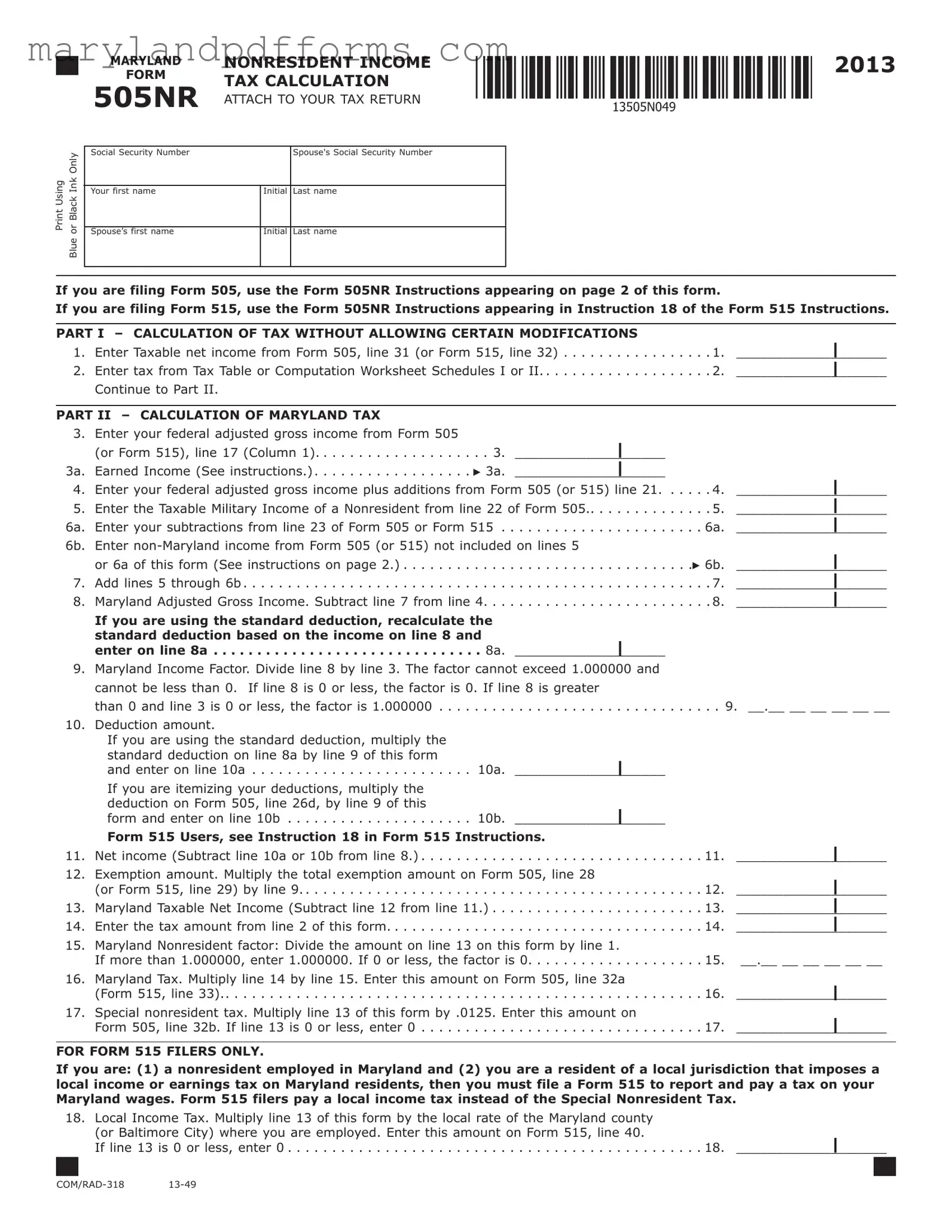

Maryland 505Nr - Usage Steps

Completing the Maryland 505NR form involves several steps to ensure accurate reporting of your nonresident income. After filling out the form, it will need to be attached to your tax return. Be sure to double-check all entries for accuracy before submission.

- Begin by entering your Social Security Number and your spouse's Social Security Number, if applicable.

- Print your first name, middle initial, and last name, followed by your spouse’s information.

- In Part I, line 1, input your taxable net income from Form 505, line 31 (or Form 515, line 32).

- For line 2, refer to the tax table or computation worksheet to find the tax amount corresponding to the income reported on line 1. Enter this amount.

- Proceed to Part II. On line 3, enter your federal adjusted gross income from Form 505, line 17 (Column 1).

- If claiming a federal earned income credit, enter the earned income on line 3a.

- On line 4, enter your federal adjusted gross income plus any additions from Form 505, line 21.

- For line 5, enter any taxable military income from line 22 of Form 505.

- On line 6a, input your subtractions from line 23 of Form 505.

- For line 6b, enter any non-Maryland income not included on lines 5 or 6a.

- Add the amounts from lines 5 through 6b and enter the total on line 7.

- Calculate your Maryland Adjusted Gross Income by subtracting line 7 from line 4. Enter this on line 8.

- If using the standard deduction, recalculate it based on the income on line 8 and enter it on line 8a.

- On line 9, divide line 8 by line 3 to determine your Maryland income factor. Ensure this factor does not exceed 1.000000 or fall below 0.

- If using the standard deduction, multiply the standard deduction on line 8a by the Maryland income factor (line 9) and enter it on line 10a. If itemizing deductions, multiply the deduction on Form 505, line 26d, by line 9 and enter it on line 10b.

- Subtract line 10a or 10b from line 8 and enter the result on line 11.

- Multiply the total exemption amount on Form 505, line 28, by line 9 and enter this on line 12.

- Subtract line 12 from line 11 to find your Maryland Taxable Net Income. Enter this on line 13.

- Enter the tax amount from line 2 on line 14.

- Calculate the Maryland nonresident factor by dividing line 13 by line 1. Enter this on line 15, ensuring it adheres to the specified limits.

- Multiply line 14 by line 15 to find your Maryland tax, and enter this on line 16.

- For line 17, multiply line 13 by .0125 and enter the amount. If line 13 is 0 or less, enter 0.

- Finally, if applicable, add the amounts from lines 32a and 32b on Form 505 and enter the total on line 32c.

Learn More on Maryland 505Nr

-

What is the Maryland 505NR form?

The Maryland 505NR form is a tax calculation form specifically designed for nonresidents who earn income in Maryland. It is used to determine the amount of Maryland state tax owed based on the income earned within the state. Nonresidents must attach this form to their Maryland tax return, either Form 505 or Form 515, depending on their filing status.

-

Who needs to file the 505NR form?

Nonresidents who earn income in Maryland must file the 505NR form. This includes individuals who work in Maryland but reside in another state. If you are a nonresident employed in Maryland and your home jurisdiction imposes a local income tax, you will need to file Form 515 instead.

-

How do I calculate my Maryland taxable net income using the 505NR form?

To calculate your Maryland taxable net income, follow these steps:

- Start with your federal adjusted gross income from Form 505 or Form 515.

- Subtract any non-Maryland income and applicable deductions.

- Calculate the Maryland income factor by dividing your Maryland adjusted gross income by your federal adjusted gross income.

- Finally, subtract the exemption amount from your net income to determine your Maryland taxable net income.

-

What information do I need to complete the 505NR form?

You will need the following information to complete the 505NR form:

- Your Social Security Number and your spouse's, if applicable.

- Your federal adjusted gross income from Form 505 or Form 515.

- Details on any deductions, exemptions, and non-Maryland income.

- Taxable military income, if applicable.

-

What is the Maryland income factor and how is it calculated?

The Maryland income factor is a percentage that determines how much of your income is subject to Maryland tax. It is calculated by dividing your Maryland adjusted gross income by your federal adjusted gross income. This factor can range from 0 to 1, where a factor of 0 indicates no Maryland income and a factor of 1 indicates all income is taxable by Maryland.

-

What happens if I do not file the 505NR form?

Failing to file the 505NR form can result in penalties and interest on any unpaid taxes owed to the state of Maryland. It is important to accurately report your income and file all necessary forms to avoid these consequences.

-

Can I use the standard deduction when filing the 505NR form?

Yes, you can use the standard deduction when filing the 505NR form. However, you will need to recalculate the standard deduction based on your Maryland adjusted gross income. This recalculated amount should be entered on the appropriate line of the form.

-

Where can I find the tax tables needed for the 505NR form?

The tax tables needed for the 505NR form can be found in the Maryland tax booklet or on the Maryland Comptroller's website. These tables will help you determine the tax amount based on your taxable net income.

-

Is there a special nonresident tax for Maryland nonresidents?

Yes, there is a special nonresident tax for individuals who earn income in Maryland. This tax is calculated as a percentage of your Maryland taxable net income. If your taxable income is zero or less, the special nonresident tax will also be zero.

Additional PDF Forms

Sales Contract Template - Signatories are advised to keep copies for their records post-agreement.

Utilizing the New York Operating Agreement form is essential for LLCs, as it not only clarifies management and operational guidelines but also protects the interests of its members. For those seeking a structured approach to drafting this important document, resources like PDF Templates Online can provide valuable templates to streamline the process and ensure compliance with New York laws.

Maryland Late Filing Penalty - Ensure your federal tax year aligns with the taxable year entered on Form 500D.

Documents used along the form

The Maryland 505NR form is an essential document for nonresidents who need to report their income earned in Maryland. However, several other forms and documents are often used in conjunction with the 505NR to ensure accurate tax reporting. Below is a list of these forms, along with brief descriptions of their purposes.

- Form 505: This is the main Maryland income tax return form for residents. Nonresidents often need to refer to this form for their federal adjusted gross income and other calculations related to their Maryland tax obligations.

- Form 515: This form is specifically for nonresidents who have Maryland-source income and are required to report and pay taxes on their Maryland wages. It is often used in conjunction with the 505NR for those who also need to report local income taxes.

- Form 502: This is the Maryland resident income tax return. Nonresidents may need to reference this form if they are also required to file as residents in another state or if they have income that is subject to tax in Maryland.

- Form 505A: This is the Maryland Nonresident Income Tax Return for individuals who are claiming a credit for taxes paid to another state. It can be helpful for nonresidents who earn income in multiple states.

- Form 504: This form is used to claim a refund for Maryland taxes withheld. Nonresidents who have had taxes withheld from their Maryland income may need this form to recover any overpayment.

- Texas Operating Agreement Form: This form is crucial for managing the operations and organizational structure of an LLC in Texas. To begin the process, consult the document available at texasdocuments.net/printable-operating-agreement-form/.

- Form 502CR: This is the Maryland Credit for Income Taxes Paid to Other States form. Nonresidents who pay taxes to another state on income earned in Maryland may use this form to claim a credit against their Maryland tax liability.

- Form 510: This form is used for pass-through entities, such as partnerships and S corporations, to report income earned in Maryland. Nonresidents who are part of these entities may need this form for their tax calculations.

Understanding these forms can help nonresidents navigate their tax obligations more effectively. Each document plays a specific role in ensuring that individuals report their income accurately and take advantage of available credits and deductions. Being familiar with these forms can simplify the tax filing process and minimize the risk of errors.

Key takeaways

Filing the Maryland 505NR form requires careful attention to detail. Here are key takeaways to ensure a smooth process:

- Ensure you have the correct Social Security numbers for both you and your spouse, if applicable.

- Use the Form 505NR Instructions for guidance, especially if filing alongside Form 505 or Form 515.

- Start with your taxable net income from the appropriate line of Form 505 or Form 515.

- Consult the tax table to find the corresponding tax amount based on your taxable income.

- Accurately report your federal adjusted gross income (FAGI) as it is critical for calculating your Maryland tax.

- Be diligent when entering any non-Maryland income to avoid discrepancies.

- Calculate your Maryland adjusted gross income by subtracting specified amounts from your total income.

- Understand the importance of the Maryland income factor, which is derived from your adjusted gross income.

- Finally, ensure all calculations are double-checked before submission to avoid delays or errors in processing.

Misconceptions

- Misconception 1: The 505NR form is only for Maryland residents.

- Misconception 2: You can use the 505NR form if you are a resident of a reciprocal state.

- Misconception 3: You do not need to report non-Maryland income on the 505NR form.

- Misconception 4: The 505NR form is the same as the 505 form.

- Misconception 5: You can ignore the instructions on line 6b.

- Misconception 6: If you earn less than $50,000, you do not need to use the tax table.

- Misconception 7: You do not need to calculate your Maryland income factor if your income is zero.

- Misconception 8: Filing the 505NR form guarantees a refund.

This is incorrect. The 505NR form is specifically designed for nonresidents who earn income in Maryland.

This is misleading. If you are a resident of a reciprocal state, you should file a different form, typically Form 502, instead of the 505NR.

This is false. You must report any non-Maryland income that is not included in other lines of the form.

This is incorrect. While both forms are related to income tax, the 505NR is specifically for nonresidents, while the 505 is for Maryland residents.

This is a mistake. Following the instructions on line 6b is crucial for accurately reporting your non-Maryland income.

This is misleading. Even if your taxable income is below $50,000, you still need to refer to the tax table for the correct tax amount.

This is false. If your income is zero, you still need to calculate the Maryland income factor, which will be zero in that case.

This is not true. Filing the form does not automatically result in a refund; it depends on your overall tax situation and payments.