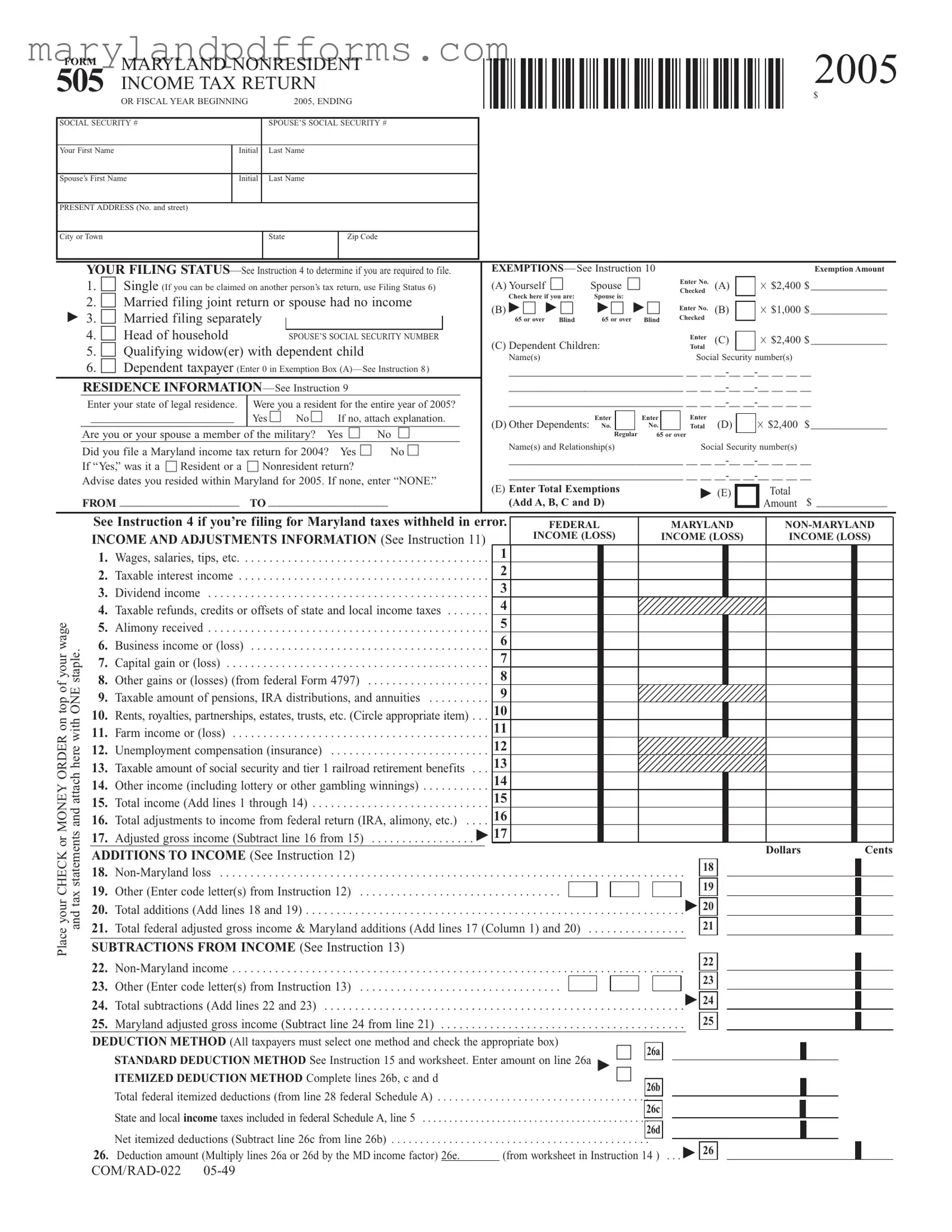

Blank Maryland 505 Template

Similar forms

- Form 1040 - This is the standard individual income tax return form used by residents to report their income, deductions, and credits to the IRS. Similar to the Maryland 505, it requires personal information, income reporting, and deduction claims.

- Texas Notice to Quit - This legal document is necessary for landlords to notify tenants of the need to vacate their rental property. For more information on how to properly utilize this form, visit https://texasdocuments.net/printable-notice-to-quit-form/.

- Form 502 - This is the Maryland resident income tax return. Like the 505, it collects information on income, exemptions, and tax calculations, but is specifically for Maryland residents rather than nonresidents.

- Form 4868 - This form is used to request an extension of time to file a federal income tax return. Similar to the Maryland 505, it requires personal identification details and indicates the taxpayer's intention to file, albeit for an extension rather than an actual return.

- Form 1099 - This form reports various types of income other than wages, salaries, and tips. It shares similarities with the Maryland 505 in that it includes income reporting, but it serves as a record of payments made to individuals rather than a tax return.

- Form W-2 - This form reports wages paid to employees and the taxes withheld from them. It is similar to the Maryland 505 in that it provides essential income information needed for tax filing, specifically for employees in the workforce.

Maryland 505 - Usage Steps

Filling out the Maryland 505 form requires careful attention to detail. Follow these steps to ensure you complete the form accurately and efficiently. After filling it out, you will need to submit it to the Comptroller of Maryland along with any necessary documents.

- Gather your personal information, including your Social Security number and your spouse's Social Security number if applicable.

- Fill in your name and address in the designated sections at the top of the form.

- Select your filing status. Check the box that applies to you and enter the exemption amounts as instructed.

- Provide details about your residence. Indicate whether you were a resident of Maryland for the entire year.

- List your income sources in the income section. Include wages, interest, dividends, and any other applicable income.

- Calculate your total income by adding all income sources together.

- Identify any adjustments to your income and subtract them to find your adjusted gross income.

- Choose your deduction method: standard or itemized. Fill in the appropriate amounts based on your choice.

- Calculate your taxable net income by subtracting your deductions from your adjusted gross income.

- Determine your Maryland tax by referring to the tax table or computation worksheet.

- List any credits you are eligible for and subtract them from your total tax.

- Calculate your total payments and credits, including any tax withheld or estimated payments made.

- Determine if you owe any balance or if you are due a refund by comparing your total tax to your total payments.

- Complete the direct deposit section if you want your refund deposited directly into your bank account.

- Sign and date the form. If someone else prepared the form, they should also sign it.

- Mail the completed form and any attachments to the Comptroller of Maryland.

Learn More on Maryland 505

What is the Maryland 505 form?

The Maryland 505 form is a tax return specifically for nonresidents who earned income in Maryland during the tax year. It allows individuals to report their income, claim exemptions, and calculate their tax liability for the state of Maryland.

Who should file the Maryland 505 form?

This form is intended for nonresidents who have earned income from Maryland sources. If you lived in Maryland for part of the year but were not a resident for the entire year, you should file this form. It's important to check your filing status to determine your requirements.

What information do I need to complete the form?

You will need the following information:

- Your Social Security number and that of your spouse, if applicable.

- Your present address, including city, state, and zip code.

- Details about your income, including wages, interest, and any other sources.

- Information about your exemptions and filing status.

How do I determine my filing status?

Your filing status can be determined based on your marital status and whether you can be claimed as a dependent. The form provides specific options to select from, such as Single, Married Filing Jointly, or Head of Household. Review the instructions carefully to choose the correct status.

What exemptions can I claim?

You may claim exemptions for yourself, your spouse, and any dependents. Each exemption has a specific dollar amount that can reduce your taxable income. Ensure you provide accurate information about each person you claim as an exemption.

What if I made no income in Maryland?

If you did not earn any income in Maryland, you may not need to file the Maryland 505 form. However, if you have had Maryland taxes withheld from your income, you might want to file to claim a refund. Always check the specific instructions to confirm your obligations.

How do I submit the Maryland 505 form?

You can submit the form either by mail or electronically. If mailing, send it to the Comptroller of Maryland, Revenue Administration Division. Make sure to include any required documents, such as W-2 forms, and ensure that your information is accurate to avoid delays.

What happens if I miss the filing deadline?

Missing the filing deadline can lead to penalties and interest on any taxes owed. If you anticipate being late, it’s best to file for an extension. However, you should still pay any estimated taxes to avoid further penalties.

Where can I find help if I have questions about the form?

If you have questions about completing the Maryland 505 form, you can contact the Comptroller of Maryland's office for assistance. Additionally, many tax professionals can provide guidance on the filing process and help ensure your return is accurate.

Additional PDF Forms

Maryland Corporate Tax Rate - Compliance with state guidelines ensures that the business remains in good standing.

To ensure a smooth borrowing experience, consider utilizing a robust Loan Agreement template that addresses key aspects of your transaction. Explore how this critical document can safeguard your interests by visiting our page on fillable loan agreements at key elements of a suitable Loan Agreement.

Sales Contract Template - Clarity around payment terms aids in financial planning for buyers.

Maryland State Department of Assessments and Taxation - There’s a mechanism to request additional information if the submitted details are found to be insufficient for evaluating the project.

Documents used along the form

The Maryland Nonresident 505 Income Tax Return form is a crucial document for individuals who earn income in Maryland but reside in another state. When completing this form, taxpayers may also need to submit several other forms and documents to ensure their tax filings are accurate and complete. Below is a list of common forms and documents that are often used alongside the Maryland 505 form.

- Form 502CR: This is the Maryland Income Tax Credit form. Taxpayers use it to claim various tax credits available in Maryland, such as the earned income credit or the credit for taxes paid to other states.

- Form 500: This is the Maryland Corporation Income Tax Return. While primarily for corporations, nonresident individuals with business income in Maryland may also need to reference this form for reporting purposes.

- Form 502: This is the Maryland Resident Income Tax Return. Nonresidents may need to refer to this form if they have filed as residents in prior years or have specific income sources that require it.

- Form 4797: This form is used to report the sale of business property. Nonresidents who have sold property in Maryland must include this form to report any gains or losses.

- Form W-2: Employers provide this form to report wages paid to employees and the taxes withheld. Nonresidents will need to attach their W-2 forms if Maryland taxes were withheld from their earnings.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Nonresidents must include 1099 forms if they received income from Maryland sources.

- Form 502E: This is the Maryland Extension Request form. If a taxpayer needs more time to file their return, they should submit this form to request an extension.

- New York Motorcycle Bill of Sale: This essential document ensures a smooth transfer of motorcycle ownership between buyer and seller. For customizable templates, visit PDF Templates Online.

- Schedule K-1: This document reports income, deductions, and credits from partnerships, S corporations, estates, and trusts. Nonresidents receiving a K-1 from a Maryland entity must include it with their tax return.

In summary, filing the Maryland Nonresident 505 form may require additional documentation to ensure compliance with state tax laws. Understanding these related forms can help taxpayers navigate their obligations more effectively and avoid potential issues with the Maryland Comptroller's office.

Key takeaways

The Maryland 505 form is specifically designed for nonresidents who need to file an income tax return for the state of Maryland.

Ensure that all personal information, including Social Security numbers and addresses, is accurately filled out to avoid processing delays.

Filing status is crucial. Choose the correct status, such as single, married filing jointly, or head of household, as it affects your tax calculations.

Exemptions can significantly reduce your taxable income. Review the exemption amounts and ensure you claim all applicable exemptions for yourself and dependents.

Report all sources of income, including wages, dividends, and unemployment compensation. Each income type must be accurately documented to ensure compliance.

Tax credits may be available. Check for eligibility on credits like the earned income credit or other specific deductions that can lower your tax liability.

Double-check the calculations for your Maryland tax owed. Use the provided tax tables or worksheets to confirm the accuracy of your tax computation.

Consider opting for direct deposit for your refund. This method is faster and more secure than receiving a check by mail.

Misconceptions

- Misconception 1: The Maryland 505 form is only for residents of Maryland.

- Misconception 2: You can use the Maryland 505 form for any year.

- Misconception 3: Filing the Maryland 505 form guarantees a tax refund.

- Misconception 4: You do not need to report income earned outside of Maryland.

- Misconception 5: You can file the Maryland 505 form without any documentation.

- Misconception 6: The exemptions listed on the form are optional.

- Misconception 7: You can file the Maryland 505 form anytime during the year.

- Misconception 8: Only individuals with high incomes need to file the Maryland 505 form.

- Misconception 9: The Maryland 505 form is the same as the federal tax return.

This is incorrect. The Maryland 505 form is specifically designed for nonresidents who have earned income in Maryland. Even if you live in another state, you may still need to file this form if you earned income from Maryland sources.

The Maryland 505 form is only applicable for the tax year specified, which in this case is 2005. Each tax year has its own form, so it is essential to use the correct version for the year you are filing.

Filing the form does not automatically mean you will receive a refund. Your refund depends on various factors, including your total income, exemptions, and any taxes withheld. The form simply allows you to report your income and calculate your tax liability.

While the Maryland 505 form focuses on income earned in Maryland, you must still report your total income, including that earned in other states. This information helps determine your overall tax liability.

It is crucial to gather all necessary documentation, such as W-2 forms and other income statements, before filing. Incomplete information can lead to errors and delays in processing your return.

Exemptions are not optional; they directly affect your taxable income. It is essential to claim all applicable exemptions to ensure you are taxed correctly.

There are specific deadlines for filing the Maryland 505 form, typically aligned with the federal tax deadline. Missing this deadline can result in penalties or interest on any taxes owed.

Any nonresident earning income in Maryland must file the form, regardless of the amount. Even if your income is low, filing may still be necessary to comply with state tax laws.

While both forms serve the purpose of reporting income and calculating tax, they are distinct documents with different requirements and instructions. It is important to complete each form accurately and according to its specific guidelines.