Blank Maryland 504E Template

Similar forms

- Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return): Similar to the Maryland 504E, this form allows individuals to request an automatic extension to file their federal income tax returns. Both forms require timely submission and payment of any taxes owed to avoid penalties.

- Form 7004 (Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns): This form is used by businesses to request an extension for filing various tax returns. Like the 504E, it provides an extension but does not extend the time to pay taxes due.

- Form 1040-ES (Estimated Tax for Individuals): This form is used to estimate and pay quarterly taxes. While not an extension form, it shares the purpose of ensuring tax obligations are met, similar to the payment requirements in the 504E.

- Form 1120 (U.S. Corporation Income Tax Return): Corporations use this form to report their income. The filing process parallels the 504E in that timely filing and payment are critical to avoid penalties.

- Form 1065 (U.S. Return of Partnership Income): Partnerships file this form to report income, deductions, and other tax information. The need for timely filing and accurate reporting mirrors the requirements of the 504E.

- Form 1041 (U.S. Income Tax Return for Estates and Trusts): This form is specifically for estates and trusts to report income. Like the 504E, it requires fiduciaries to manage tax obligations responsibly.

- Form 941 (Employer's Quarterly Federal Tax Return): Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. The emphasis on accurate reporting and timely payment connects it to the 504E.

- California Loan Agreement Form: For individuals considering borrowing or lending money, it's important to understand the necessary California loan agreement documentation that details the terms and conditions of the transaction.

- Form 990 (Return of Organization Exempt from Income Tax): Nonprofits file this form to report their financial information. Similar to the 504E, it involves deadlines and the importance of timely submission.

- Form W-2 (Wage and Tax Statement): Employers use this form to report wages paid to employees and taxes withheld. Although it serves a different purpose, the focus on accurate tax reporting aligns with the principles of the 504E.

- Form 1099 (Miscellaneous Income): This form is used to report various types of income other than wages. It shares the requirement of accurate reporting and adherence to deadlines, similar to the 504E's filing process.

Maryland 504E - Usage Steps

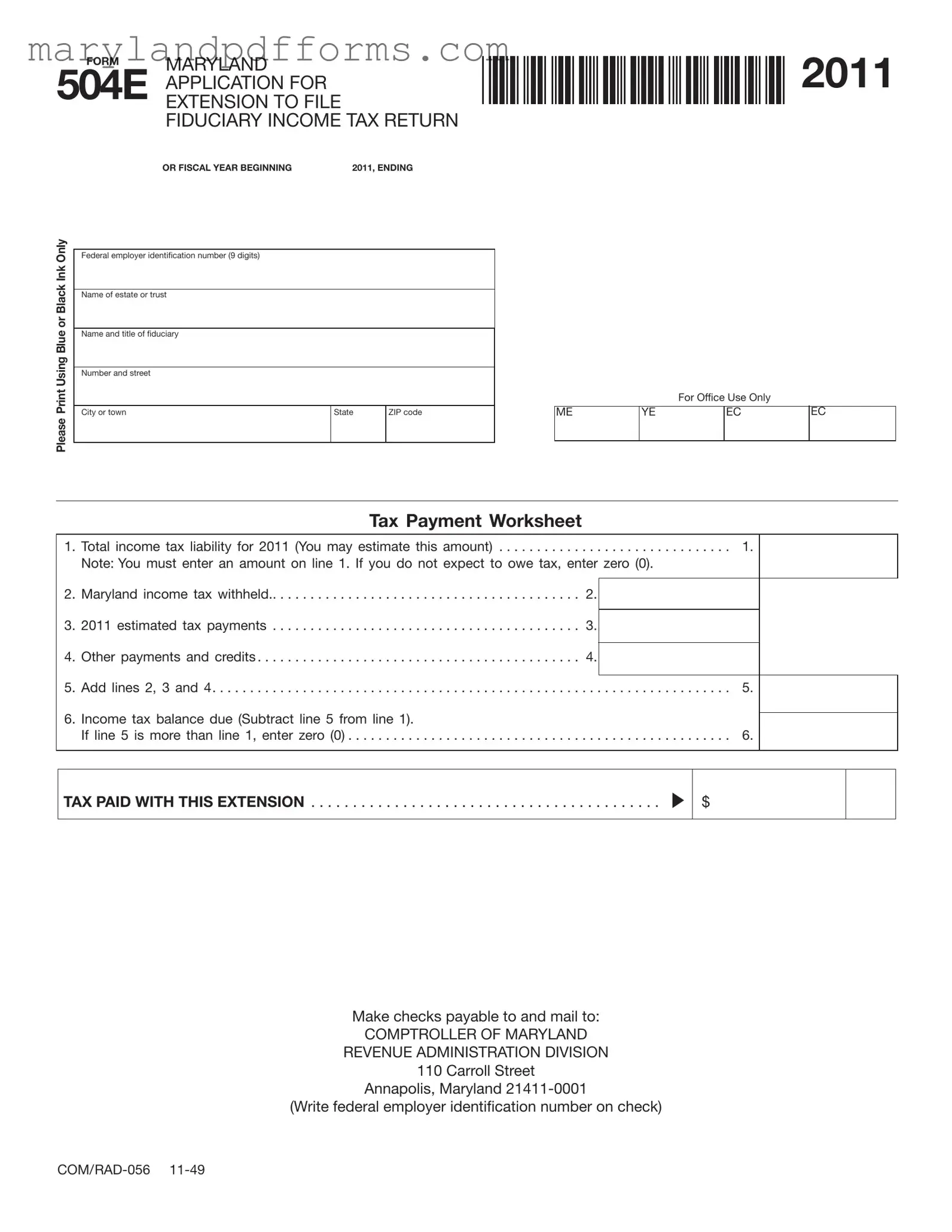

Filling out the Maryland 504E form is a straightforward process that requires careful attention to detail. This form is used to request an extension for filing a fiduciary income tax return. To ensure your application is processed smoothly, follow the steps outlined below.

- Obtain the Form: Download or print the Maryland 504E form from the Maryland Comptroller's website or request a physical copy.

- Enter Identification Information: Fill in the federal employer identification number (EIN) in the designated space. This is a nine-digit number.

- Provide Name Details: Write the name of the estate or trust in the appropriate field.

- Fiduciary Information: Input the name and title of the fiduciary responsible for the estate or trust.

- Address Information: Complete the address section with the number and street, city or town, state, and ZIP code.

- Calculate Total Income Tax Liability: On line 1, enter the total income tax liability for the year. If you expect to owe no tax, enter zero (0).

- Record Maryland Income Tax Withheld: Fill in the amount of Maryland income tax that was withheld on line 2.

- List Estimated Tax Payments: Enter any estimated tax payments made on line 3.

- Include Other Payments and Credits: Write any other payments or credits on line 4.

- Add Payments: Calculate the total of lines 2, 3, and 4, and write the result on line 5.

- Determine Balance Due: Subtract line 5 from line 1 to find the income tax balance due on line 6. If line 5 exceeds line 1, enter zero (0).

- Payment Section: If applicable, enter the amount of tax paid with this extension in the designated area.

- Mailing Instructions: Make checks payable to the "Comptroller of Maryland" and mail the completed form to the Maryland Revenue Administration Division at 110 Carroll Street, Annapolis, MD 21411-0001.

After submitting the form, remember that it grants you an automatic six-month extension to file your fiduciary income tax return. However, it is crucial to pay any tax due by the original deadline to avoid penalties and interest.

Learn More on Maryland 504E

What is the Maryland 504E form used for?

The Maryland 504E form is an application for an automatic six-month extension to file the fiduciary income tax return, specifically Form 504. This form is essential for fiduciaries managing estates or trusts that require additional time to prepare their tax returns.

Who needs to file Form 504E?

Any fiduciary responsible for filing a fiduciary income tax return in Maryland may need to file Form 504E. This includes individuals managing estates or trusts who require an extension beyond the standard filing deadline.

When is the deadline to file Form 504E?

Form 504E must be filed by April 15 of the year following the tax year in question. For fiscal year filers, the form should be submitted by the regular due date of their return. It’s crucial to meet this deadline to ensure the extension is granted.

What information is required on the form?

When completing Form 504E, you will need to provide:

- Your federal employer identification number.

- The name of the estate or trust.

- The name and title of the fiduciary.

- Your address, including city, state, and ZIP code.

- Your estimated total income tax liability for the year.

- Any Maryland income tax withheld, estimated tax payments, and other payments or credits.

What happens if I miss the deadline to file Form 504E?

If you miss the deadline to file Form 504E, you will not receive the automatic extension. This could result in penalties and interest on any unpaid taxes. It’s important to file on time to avoid these additional costs.

Does filing Form 504E extend the time to pay taxes?

No, filing Form 504E only extends the time to file your return. It does not extend the time to pay any taxes owed. If you do not pay the amount due by the original deadline, you will incur interest and potential penalties.

What if I need more than a six-month extension?

Generally, extensions longer than six months are not granted. However, if you are a fiduciary who is out of the United States, you may request a longer extension by providing a reason on your application. Keep in mind that no extension can exceed one year from the original due date.

How do I claim credit for a payment made with Form 504E?

When you file your fiduciary income tax return (Form 504), you should report any payment made with Form 504E on line 31 of your return. This ensures that the payment is properly credited to your account.

Where do I send Form 504E?

Mail Form 504E to the Maryland Revenue Administration Division at the following address: 110 Carroll Street, Annapolis, MD 21411-0001. Make sure to include your federal employer identification number on any checks you send with the form.

Additional PDF Forms

How to Create Job Application Form - Important contact details for the State Employment Center are provided within the form.

The ADP Pay Stub form is a crucial document that provides employees with a comprehensive overview of their earnings and deductions for a specific pay period. This form includes essential details such as gross pay, net pay, and taxes withheld, which helps employees to manage their finances effectively. For further information on how to understand your pay stub better, you can visit https://topformsonline.com/adp-pay-stub.

Addendum Meaning in Real Estate - If a buyer intends to use the property for purposes beyond its designated use, additional provisions may be necessary.

Documents used along the form

The Maryland 504E form is an important document for fiduciaries seeking an extension to file their fiduciary income tax return. Alongside this form, several other documents may be required or beneficial for a comprehensive filing process. Below is a list of related forms and documents that are commonly used in conjunction with the Maryland 504E form.

- Form 504: This is the actual fiduciary income tax return that must be filed after the extension granted by the 504E form. It details the income, deductions, and tax liability of the estate or trust.

- Form 502: This is the Maryland resident income tax return, which may be necessary if the fiduciary is also required to report personal income in conjunction with the estate or trust.

- Form 503: This form is used for the Maryland non-resident income tax return. It is applicable if the fiduciary or beneficiaries are non-residents of Maryland but have income sourced from the state.

- Payment Voucher (Form PV): This document is used to submit any tax payments due along with the filing of the 504E or 504 forms. It ensures that payments are properly credited to the account.

- New York Motorcycle Bill of Sale: This important document serves to ensure both the buyer and seller are protected during the transaction, detailing essential information about the sale. For templates, visit PDF Templates Online.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. It may be relevant for fiduciaries to report income distributions to beneficiaries.

- Form 1041: The federal income tax return for estates and trusts. This form is often filed alongside the Maryland forms to report income to the IRS.

- Form 2848: This is a Power of Attorney form that allows a fiduciary to designate someone to represent them before the IRS or state tax authorities.

- Supporting Documentation: This may include financial statements, tax payment receipts, and other records that substantiate the information reported in the tax returns.

Understanding these additional forms and documents is crucial for a smooth tax filing process. Ensuring that all necessary paperwork is completed and submitted on time can help avoid penalties and interest, providing peace of mind during what can be a complex financial period.

Key takeaways

Filling out the Maryland 504E form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways to guide you:

- Purpose of the Form: The Maryland 504E form is used to request an automatic six-month extension for filing the fiduciary income tax return, Form 504.

- Timely Submission: To receive the extension, it is crucial to fill out the form correctly and submit it by the due date of your return.

- Payment Requirement: You must pay the total tax balance due as indicated on line 6 of the form. Failure to do so may result in penalties.

- Fiduciary Information: Ensure that the name and title of the fiduciary, as well as the estate or trust name, are accurately filled out to avoid processing delays.

- Fiscal Year Filers: If your fiduciary return operates on a fiscal year, submit the form by the regular due date of that return.

- Interest Accrual: Be aware that if taxes are not paid by the original due date, interest will accumulate until payment is made.

- Extension Limitations: Extensions cannot exceed six months unless there are specific circumstances, such as being out of the country.

- Filing Location: Mail the completed form to the Maryland Revenue Administration Division at the specified address to ensure it is processed correctly.

- Credit for Payments: When filing your return, remember to report any payment made with Form 504E on line 31 of your return.

By keeping these points in mind, you can navigate the process of filing the Maryland 504E form with greater confidence and clarity.

Misconceptions

- Misconception 1: Form 504E automatically eliminates tax payments.

- Misconception 2: You can file Form 504E at any time without consequences.

- Misconception 3: An extension granted through Form 504E lasts indefinitely.

- Misconception 4: You can ignore estimated tax payments.

- Misconception 5: Filing Form 504E means you can delay filing Form 504 without repercussions.

- Misconception 6: You do not need to pay anything when submitting Form 504E.

- Misconception 7: Filing Form 504E is optional for all fiduciaries.

This form provides an extension to file your fiduciary income tax return, but it does not extend the time to pay any taxes owed. If you do not pay by the due date, interest and penalties will apply.

Form 504E must be filed by the due date of your return. If it is submitted late, you may lose the extension and face penalties.

The extension provided by Form 504E is limited to six months. Extensions beyond this period require a specific reason and are not guaranteed.

While Form 504E allows you to extend the filing deadline, it does not change the due date for tax payments. Delaying payment can lead to additional charges.

You must pay the amount shown on line 6 of Form 504E when you file. If you do not pay, you may incur interest and penalties.

If you need more time to file your fiduciary income tax return, using Form 504E is essential. It provides the necessary extension and should not be overlooked.