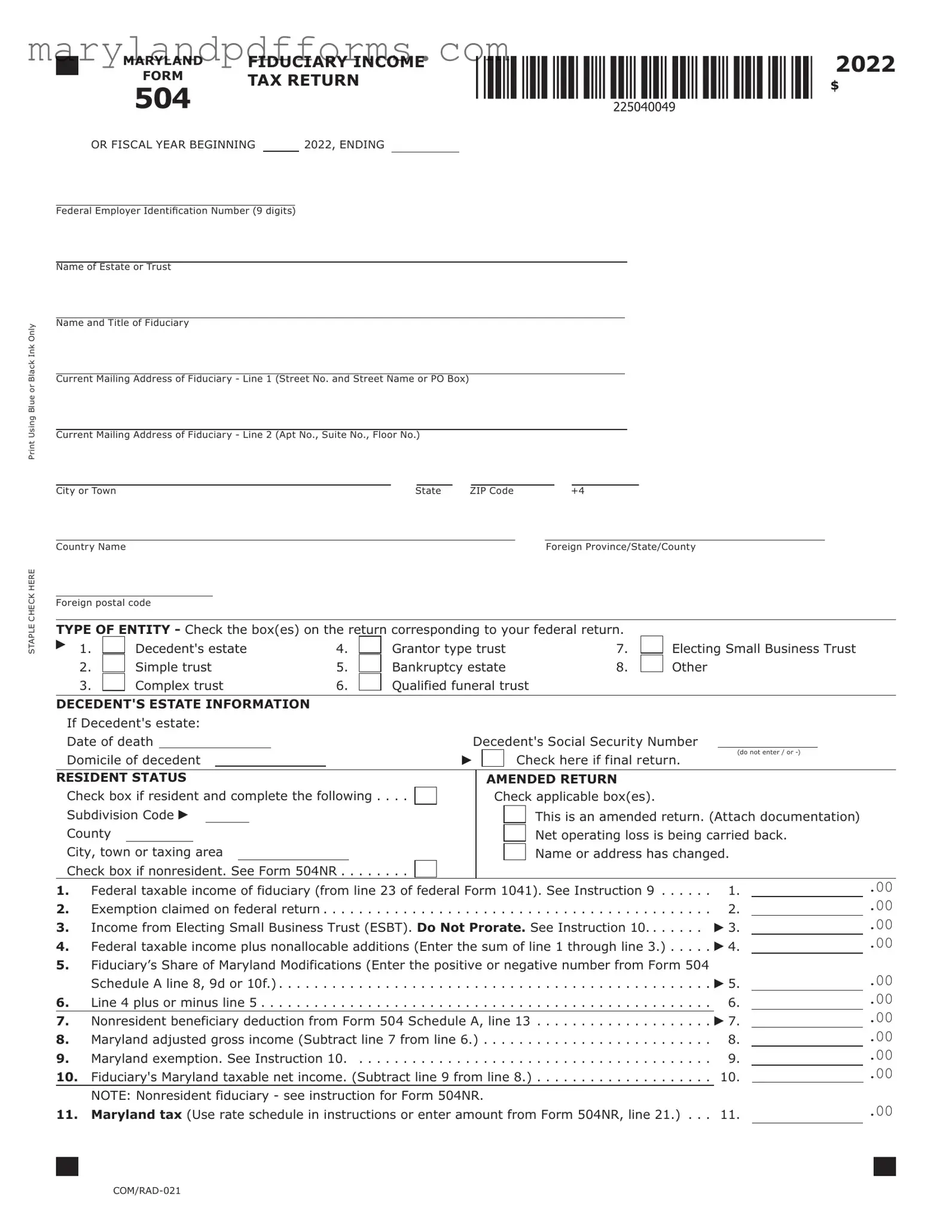

Blank Maryland 504 Template

Similar forms

The Maryland 504 form, which is used for fiduciary income tax returns, shares similarities with several other important documents in the realm of tax reporting and fiduciary responsibilities. Below is a list of nine documents that are comparable to the Maryland 504 form, along with explanations of how they are alike:

- Form 1041 - U.S. Income Tax Return for Estates and Trusts: Like the Maryland 504, this federal form is used to report income, deductions, and credits for estates and trusts. Both forms require detailed information about the fiduciary's share of income and tax calculations.

- Form 1040 - U.S. Individual Income Tax Return: While primarily for individuals, the Form 1040 also includes sections for reporting income from estates and trusts. Both forms necessitate accurate reporting of income and tax liabilities.

- Form 706 - United States Estate (and Generation-Skipping Transfer) Tax Return: This form is used to report estate taxes, similar to how the Maryland 504 reports fiduciary income. Both documents involve the management of estate-related financial responsibilities.

- Form 990 - Return of Organization Exempt from Income Tax: Nonprofit organizations use this form to report their income and expenses. Like the Maryland 504, it requires detailed financial disclosures and is crucial for maintaining compliance with tax regulations.

- New York Operating Agreement: Similar to the Maryland 504 form, the New York Operating Agreement is essential for outlining the governance of a limited liability company (LLC). For more details, you can refer to PDF Templates Online.

- Form 5500 - Annual Return/Report of Employee Benefit Plan: This form is relevant for employee benefit plans and requires reporting of financial information. Both forms focus on fiduciary responsibilities and financial transparency.

- Form 1040NR - U.S. Nonresident Alien Income Tax Return: This form is for nonresident aliens who need to report income. Similar to the Maryland 504, it requires specific information regarding income sources and tax obligations.

- Form 541 - California Fiduciary Income Tax Return: This state-level form serves a similar purpose as the Maryland 504 but is specific to California. Both forms report income, deductions, and tax liabilities for trusts and estates.

- Form 8822 - Change of Address: While not a tax return, this form is used to update the IRS about changes in address, similar to how the Maryland 504 requires accurate address information for fiduciaries.

- Form 4868 - Application for Automatic Extension of Time to File U.S. Individual Income Tax Return: This form allows for an extension on filing, akin to how the Maryland 504 includes provisions for amended returns and extensions for fiduciaries.

Each of these forms plays a vital role in the broader context of tax compliance and fiduciary responsibilities, ensuring that all relevant information is reported accurately and timely.

Maryland 504 - Usage Steps

Completing the Maryland 504 form is a straightforward process, but it requires careful attention to detail. This form is essential for fiduciaries managing estates or trusts in Maryland, as it helps ensure compliance with state tax regulations. Follow the steps below to accurately fill out the form.

- Begin by entering the federal employer identification number at the top of the form.

- Fill in the name of the estate or trust and the name and title of the fiduciary.

- Provide the address of the fiduciary, including the number and street, city or town, state, and zip code.

- Indicate the type of entity by checking the appropriate box, such as decedent’s estate, simple trust, complex trust, etc.

- If applicable, enter the date of death, domicile of the decedent, and decedent’s Social Security number. Check the box if this is the final return.

- Mark the resident status by checking the box for resident or nonresident as appropriate. If this is an amended return, check the corresponding box and provide the necessary details.

- Complete the income details by filling in the federal taxable income of fiduciary (line 21) and the exemption claimed on federal return (line 22).

- Calculate the total by adding lines 21 and 22, and enter the result on line 23.

- Report the fiduciary’s share of Maryland modifications on line 24 and perform the necessary calculations to complete lines 25 through 29.

- Determine the Maryland tax using the appropriate rate schedule and enter it on line 30.

- If applicable, calculate the local or special nonresident tax on line 31.

- Add lines 30 and 31 to find the total Maryland and local tax and enter this amount on line 32.

- Complete the sections for contributions and payments, filling in lines 33 through 42 as necessary.

- Determine if there is a balance due or an overpayment and fill out lines 43 through 46 accordingly.

- If you choose direct deposit for any refund, complete the required account information on line 49.

- Finally, sign and date the form in the designated areas, ensuring all information is accurate and complete.

After completing the form, it’s essential to double-check all entries for accuracy. Once verified, mail the form to the Comptroller of Maryland, ensuring that it reaches the appropriate division by the tax deadline. This careful preparation helps to avoid potential issues with your tax filings.

Learn More on Maryland 504

What is the Maryland 504 Form?

The Maryland 504 Form is a tax return specifically designed for fiduciaries, such as executors of estates or trustees of trusts. It is used to report the income earned by the estate or trust during the tax year. This form is essential for calculating the fiduciary income tax owed to the state of Maryland. It includes various sections that require detailed information about the estate or trust, its income, and any deductions or credits that may apply.

Who needs to file the Maryland 504 Form?

The Maryland 504 Form must be filed by fiduciaries managing estates or trusts that have generated income during the tax year. This includes:

- Decedent's estates

- Simple trusts

- Complex trusts

- Grantor-type trusts

- Bankruptcy estates

- Qualified funeral trusts

- Other types of trusts or estates as applicable

If the estate or trust has a federal employer identification number and meets the income thresholds, filing is required.

What information is needed to complete the Maryland 504 Form?

To accurately complete the Maryland 504 Form, fiduciaries need to gather several pieces of information, including:

- Federal employer identification number (FEIN)

- Name and address of the estate or trust

- Name and title of the fiduciary

- Type of entity (e.g., decedent’s estate, simple trust, etc.)

- Date of death of the decedent (if applicable)

- Domicile of the decedent

- Social Security number of the decedent (if applicable)

- Income details from federal Form 1041

Having this information ready will streamline the filing process and help ensure accuracy.

How is the Maryland 504 Form filed?

The Maryland 504 Form can be filed either by mail or electronically. If filing by mail, the completed form should be sent to the Comptroller of Maryland, Revenue Administration Division, at the designated address. If filing electronically, fiduciaries can use the Maryland Comptroller's online services. Ensure that all required documentation, such as federal Form 1041 and any supporting schedules, is attached if necessary.

What are the deadlines for filing the Maryland 504 Form?

The deadline for filing the Maryland 504 Form generally aligns with the federal tax return deadlines. For estates and trusts, this is typically April 15 of the following year for calendar year filers. If the fiduciary needs additional time, an extension can be requested, but it is crucial to file the extension form before the original deadline to avoid penalties.

What happens if I need to amend my Maryland 504 Form?

If there are errors or changes that need to be made after the Maryland 504 Form has been filed, an amended return must be submitted. To do this, check the appropriate box indicating that it is an amended return, and provide a detailed explanation of the changes. It's also essential to attach any revised federal forms if applicable. This ensures that the state has the most accurate and updated information.

Are there any credits or deductions available on the Maryland 504 Form?

Yes, the Maryland 504 Form allows for various deductions and credits that can reduce the overall tax liability. Some common deductions include:

- Nonresident beneficiary deductions for income earned by nonresidents

- Credits for taxes paid to other states

- Contributions to specific state funds, such as the Chesapeake Bay and Endangered Species Fund

Fiduciaries should review the instructions carefully to determine eligibility for these credits and ensure they are claimed appropriately.

Additional PDF Forms

What Items Are Exempt From Sales Tax in Maryland - The form is a safeguard against unnecessary taxation for resellers.

Understanding the significance of a Colorado Do Not Resuscitate Order form is essential for ensuring that medical personnel and caregivers are aware of a patient's wishes. For those seeking more information, you can find resources at https://coloradoformpdf.com, which provides guidance on how to properly complete and implement this important legal document.

Is Maryland State Income Tax Currently Being Withheld From Your Pay? - The Maryland 505 form is used for nonresident individuals to report their state income tax obligations.

Haccp Plan Example - Procedures for thawing frozen foods must be provided in the plan.

Documents used along the form

The Maryland 504 form is essential for fiduciaries managing estates or trusts in Maryland. When filing this form, you may need to complete additional documents to ensure compliance with state tax regulations. Below is a list of other forms and documents that are often used alongside the Maryland 504 form.

- Form 504NR: This form is for nonresident fiduciaries. It helps report income and deductions for fiduciaries who do not reside in Maryland but have taxable income from Maryland sources.

- Schedule K-1: This document is used to report each beneficiary's share of income, deductions, and credits from the estate or trust. It is essential for beneficiaries to accurately report their income on their tax returns.

- Form 500CR: This form is for claiming business and heritage structure rehabilitation tax credits. It can help reduce the overall tax liability for the estate or trust.

- Form 502H: This form is used to report credits for heritage structure rehabilitation. It must be attached to the Maryland fiduciary income tax return if applicable.

- Texas Operating Agreement Form: Essential for LLCs in Texas to outline management structures and operational procedures. For more information, visit texasdocuments.net/printable-operating-agreement-form/.

- Form 504UP: This is used to report interest charges for late filing or underpayment of taxes. It helps calculate any penalties that may apply.

- Form MW506NRS: This form is for making estimated tax payments for nonresident fiduciaries. It ensures compliance with Maryland tax laws regarding estimated payments.

- Form 502: This is the Maryland resident income tax return. If a fiduciary is also a resident, this form may be necessary for reporting personal income.

- Form 1041: This is the federal income tax return for estates and trusts. It is required for reporting income, deductions, and tax liability at the federal level.

Using these forms and documents in conjunction with the Maryland 504 form will help ensure accurate and complete tax reporting for fiduciaries. Always review the specific requirements for each document to avoid any issues during the filing process.

Key takeaways

The Maryland 504 form is used for filing fiduciary income tax returns for estates and trusts. It is essential to determine the correct type of entity before filling out the form, as this affects tax obligations.

When completing the form, ensure that all relevant information, such as the federal employer identification number and the fiduciary's details, is accurate. This information is crucial for processing the return without delays.

If the decedent's estate is involved, specific information like the date of death and the decedent's domicile must be included. Checking the box for a final return is also important if applicable.

For nonresident beneficiaries, it is necessary to complete the nonresident beneficiary deduction section. This ensures that any income derived from Maryland sources is accurately reported and taxed.

Finally, if filing an amended return, it is important to check the appropriate boxes and provide a clear explanation of the changes. This helps the tax authorities understand the adjustments being made.

Misconceptions

- Misconception 1: The Maryland 504 form is only for decedent's estates.

- Misconception 2: Filing the Maryland 504 form is optional.

- Misconception 3: Only the fiduciary needs to sign the form.

- Misconception 4: The form cannot be amended once submitted.

- Misconception 5: All income must be distributed to beneficiaries to avoid taxes.

This form can be used for various entities, including simple trusts, complex trusts, grantor-type trusts, bankruptcy estates, and qualified funeral trusts. It is not limited to decedent's estates.

If you are managing an estate or trust that generates income, filing the Maryland 504 form is mandatory. This ensures compliance with state tax laws.