Blank Maryland 503 Template

Similar forms

- Form 1040 (U.S. Individual Income Tax Return): Like the Maryland 503 form, the Form 1040 is used by individuals to report their annual income and calculate their federal tax liability. Both forms require personal information such as names, addresses, and Social Security numbers, and they include sections for exemptions and deductions. However, the Form 1040 is for federal taxes, while the Maryland 503 is specifically for state taxes.

- New York Residential Lease Agreement: A vital document that outlines the terms and conditions between landlords and tenants, ensuring protection and understanding. Familiarity with this agreement is key to preventing disputes and fostering a harmonious rental experience. For more detailed insights, you can refer to PDF Templates Online.

- Form 502 (Maryland Resident Income Tax Return): The Maryland 502 form is more comprehensive than the 503 form. Both forms serve the purpose of reporting income and calculating tax liability for Maryland residents. However, Form 502 is designed for individuals with more complex tax situations, such as those who need to report additions or subtractions to income, whereas the 503 form is a simplified version for those without such complexities.

- Form W-2 (Wage and Tax Statement): The W-2 form provides details about an employee's annual wages and the taxes withheld from their paycheck. While the Maryland 503 form uses information from W-2s to calculate taxable income and tax liability, the W-2 itself does not calculate taxes but rather reports income and withholding to the IRS and state tax authorities.

- Form 1099 (Miscellaneous Income): Similar to the W-2, the 1099 form reports income received by individuals who are not employees. This form is used for various types of income, such as freelance work or interest income. Both the 1099 and the Maryland 503 form contribute to the overall income reporting process, but the 1099 focuses on non-employment income, while the 503 is specifically for state tax calculations.

Maryland 503 - Usage Steps

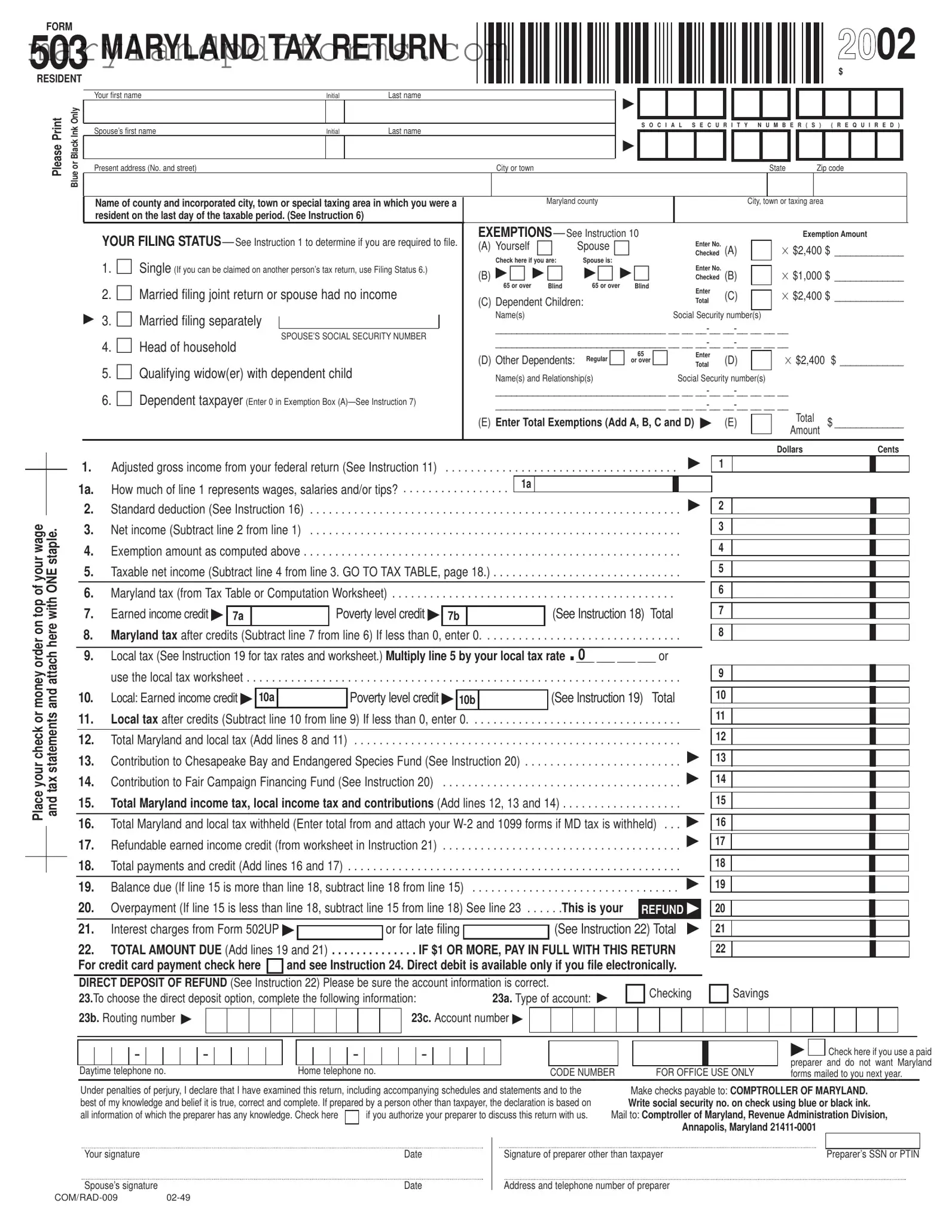

Filling out the Maryland 503 form requires attention to detail and accuracy. Follow these steps to ensure that you complete the form correctly and submit it on time.

- Begin by entering your first name, middle initial, and last name in the designated fields at the top of the form.

- Next, provide your spouse’s first name, middle initial, and last name if applicable.

- Fill in your present address, including the street number, city or town, state, and zip code.

- Indicate the county and incorporated city, town, or special taxing area where you were a resident on the last day of the taxable period.

- Select your filing status by checking the appropriate box. Refer to the instructions if you are unsure which status to choose.

- In the exemptions section, indicate the number of exemptions you are claiming. Enter the amounts in the corresponding fields.

- List the names and Social Security numbers of any dependent children and other dependents, if applicable.

- Calculate your adjusted gross income from your federal return and enter it in the designated field.

- Determine your standard deduction and enter that amount on the form.

- Subtract the standard deduction from your adjusted gross income to find your net income. Record this amount.

- Calculate the exemption amount based on the exemptions claimed and enter it on the form.

- Subtract the exemption amount from your net income to find your taxable net income.

- Consult the tax table to determine your Maryland tax based on your taxable net income and enter that amount.

- Calculate any credits, such as the earned income credit, and subtract them from your Maryland tax.

- Calculate your local tax based on your taxable net income and any applicable credits.

- Combine your Maryland tax and local tax to find the total tax owed.

- Enter any contributions to funds, if applicable, and calculate your total Maryland income tax, local income tax, and contributions.

- Record the total Maryland and local tax withheld from your W-2 and 1099 forms.

- Calculate your total payments and credits, and determine if there is a balance due or an overpayment.

- Complete the direct deposit information if you wish to receive your refund via direct deposit.

- Sign and date the form, ensuring all information is accurate before submission.

- Mail the completed form to the Comptroller of Maryland, along with any required documents.

Learn More on Maryland 503

-

What is the Maryland 503 form?

The Maryland 503 form is a tax return designed for residents of Maryland who meet specific criteria. It is a simplified form that allows eligible individuals to report their income, claim exemptions, and calculate their state tax liability. This form is typically used by those who do not have complex tax situations, such as additions or subtractions to income, and prefer not to itemize deductions.

-

Who is eligible to use the Maryland 503 form?

To use the Maryland 503 form, you must answer "NO" to all of the following questions:

- Will you have any additions or subtractions to income on your Maryland return?

- Do you want to itemize deductions?

- Did you make estimated payments or have your prior year's refund applied to your current year's estimated account?

- Are you claiming a tax credit on Maryland Form 500CR or Form 502CR?

- Were you a nonresident or part-year resident of Maryland?

- Does your return cover less than a 12-month period?

- Were you a fiscal year taxpayer?

- Do you want part or all of your refund credited to next year's estimated account?

If you answered "YES" to any of these questions, you should consider using a different form, such as the Maryland 502.

-

How do I fill out the Maryland 503 form?

Filling out the Maryland 503 form requires several key pieces of information:

- Your name and social security number.

- Your filing status (e.g., single, married filing jointly, etc.).

- Details about exemptions, including yourself, your spouse, and any dependents.

- Your adjusted gross income from your federal tax return.

- Information regarding any local taxes and credits.

Follow the instructions provided on the form carefully to ensure all sections are completed accurately.

-

Where do I send my completed Maryland 503 form?

Once you have completed the Maryland 503 form, mail it to the following address:

Comptroller of Maryland

Revenue Administration Division

Annapolis, Maryland 21411-0001Ensure that you include any required attachments, such as W-2 forms or 1099s, if applicable.

-

What if I owe taxes or am due a refund?

If your total tax liability is greater than your total payments and credits, you will owe a balance. Make sure to pay this amount in full with your return. If your total payments exceed your tax liability, you will receive a refund. You can choose to have your refund directly deposited into your bank account by providing the necessary account information on the form.

-

What should I do if I need assistance with the Maryland 503 form?

If you require help while completing the Maryland 503 form, you can contact the Maryland Comptroller’s office for guidance. Additionally, consider consulting a tax professional if your situation is complex or if you have specific questions about your tax obligations.

Additional PDF Forms

Requirements for Open Work Permit in Canada - Employers should ensure the application is complete before submission.

State of Maryland Insurance - Service date helps establish the eligibility timeline.

Documents used along the form

The Maryland 503 form is a key document for residents filing their state tax returns. However, several other forms and documents often accompany it to ensure compliance with state tax regulations. Below is a list of these forms, each serving a distinct purpose in the tax filing process.

- Maryland Form 502: This is the standard income tax return form for Maryland residents. Taxpayers who have additions or subtractions to their income, or who wish to itemize deductions, must use this form instead of the 503.

- Maryland Form 500CR: This form is used to claim various tax credits available to Maryland taxpayers. It helps reduce the overall tax liability by providing credits for specific expenses or situations.

- Maryland Form 502CR: Similar to the 500CR, this form is specifically for claiming credits related to certain contributions and investments. It is essential for those looking to maximize their tax benefits.

- Maryland Form 502E: This form is for requesting an extension of time to file the tax return. Taxpayers who need additional time to prepare their return can submit this form to avoid penalties.

- W-2 Form: Employers provide this form to employees, detailing their earnings and the taxes withheld throughout the year. It is crucial for accurately reporting income on the Maryland tax return.

- 1099 Forms: These forms report various types of income other than wages, such as freelance earnings or interest income. Taxpayers must include this income when filing their Maryland tax return.

- Maryland Form 502UP: This form is used to calculate interest charges for late payments or filings. It helps taxpayers understand any additional amounts they may owe due to delays.

- Local Tax Worksheet: This worksheet assists taxpayers in calculating local taxes owed based on their taxable income and local tax rates. It is necessary for determining the correct amount of local tax liability.

- Direct Deposit Form: If taxpayers choose to receive their refunds via direct deposit, this form collects the necessary bank account information to facilitate the transfer.

Understanding these forms and documents can significantly ease the tax filing process in Maryland. By preparing the necessary paperwork, taxpayers can ensure they comply with state laws while maximizing their potential refunds and minimizing liabilities.

Key takeaways

The Maryland 503 form is designed for residents filing their state income tax returns.

Ensure you fill out the form using black or blue ink to maintain clarity and legibility.

Provide accurate personal information, including your and your spouse's Social Security numbers, as this is a required field.

Determine your filing status carefully, as this affects your tax obligations and potential deductions.

Calculate your exemptions correctly. The form allows for exemptions based on age, blindness, and dependents.

Be aware of the standard deduction applicable to your situation, as it will reduce your taxable income.

Check the tax table provided to determine your Maryland tax based on your taxable income.

Consider any credits available, such as the earned income credit, which can lower your tax bill.

Lastly, ensure you mail your completed form to the appropriate address, along with any required payments or attachments.

Misconceptions

Understanding the Maryland 503 form is essential for residents filing their state tax returns. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- Misconception 1: The Maryland 503 form is for everyone.

- Misconception 2: You can file the 503 form if you are a nonresident.

- Misconception 3: You do not need to report any exemptions.

- Misconception 4: Filing the 503 form guarantees a refund.

This form is specifically designed for residents who meet certain criteria. If you have additions or subtractions to your income, or if you wish to itemize deductions, you should use Form 502 instead.

Only Maryland residents can use the 503 form. Nonresidents must file a different form to report their income earned in Maryland.

Exemptions play a significant role in determining your tax liability. The 503 form allows you to claim exemptions for yourself, your spouse, and dependents, which can reduce your taxable income.

A refund is not guaranteed simply by filing this form. Your refund depends on various factors, including your total income, tax credits, and withholdings. It’s essential to calculate your tax liability accurately.