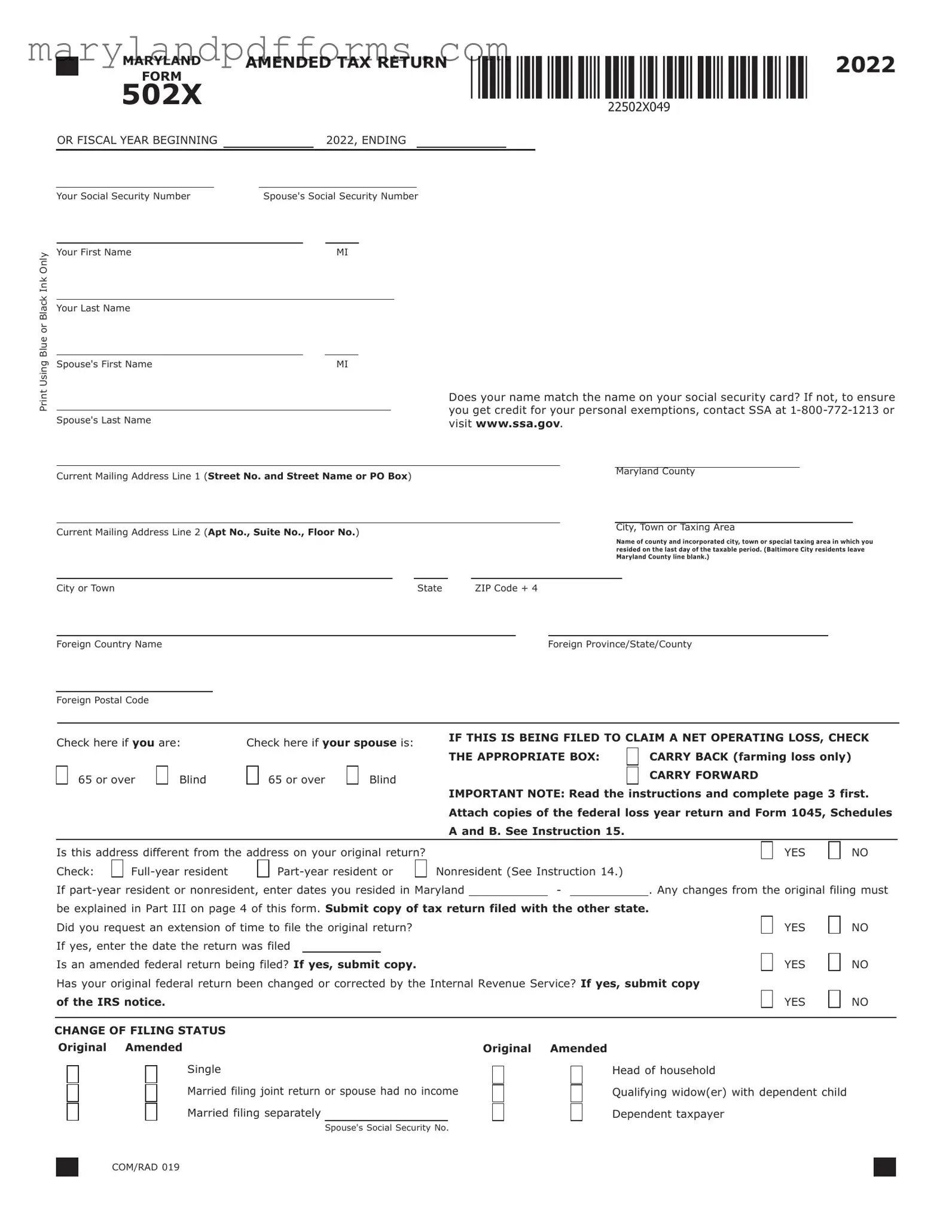

Blank Maryland 502X Template

Similar forms

- IRS Form 1040X: This is the U.S. Individual Income Tax Return Amended Form. Like the Maryland 502X, it allows taxpayers to correct errors or make changes to their original federal tax returns. Both forms require detailed explanations of the changes made and may involve attaching supporting documents.

- Colorado Do Not Resuscitate Order Form: This legal document specifies an individual's wish not to be resuscitated in case of a medical emergency. It is essential for ensuring that medical personnel respect a patient's decisions. More information can be found at coloradoformpdf.com.

- State Amended Tax Return Forms: Similar to the Maryland 502X, other states have their own amended tax return forms. These forms serve the same purpose: to correct previous filings. Each state form typically requires information from the original return and an explanation of the amendments.

- Form 1045: This is the Application for Tentative Refund, used to claim a refund based on a carryback of a net operating loss. Like the 502X, it requires detailed financial information and can be filed to amend a previous return, specifically for loss claims.

- Form 8862: This is the Information to Claim Certain Credits After Disallowance. If a taxpayer's claim for certain credits was denied in a previous year, this form allows them to reapply. Similar to the 502X, it involves providing information to support the claim and may require changes to prior returns.

Maryland 502X - Usage Steps

Completing the Maryland 502X form requires careful attention to detail. This form is used for filing an amended tax return in Maryland. To ensure accuracy and compliance, follow the steps outlined below. Gather all necessary documents, including your original tax return, and proceed with filling out the form accurately.

- Use blue or black ink to fill out the form.

- Enter your Social Security Number, first name, and last name in the designated fields.

- If applicable, provide your spouse's first name, last name, and Social Security Number.

- Confirm whether your name matches the name on your Social Security card. If not, contact the SSA.

- Fill in your current mailing address, including street number, street name, and ZIP code.

- Indicate your Maryland county and city or town of residence as of the last day of the taxable period.

- Check the appropriate boxes if you or your spouse are 65 or older or blind.

- If claiming a net operating loss, check the appropriate box for carry back or carry forward.

- Indicate if your address has changed since your original return.

- Specify your residency status: full-year resident, part-year resident, or nonresident.

- If you are a part-year resident or nonresident, enter the dates you resided in Maryland.

- Answer whether you requested an extension for filing your original return and provide the date it was filed.

- Indicate if you are filing an amended federal return and attach a copy if applicable.

- Check if your original federal return has been changed by the IRS and attach any relevant notices.

- Change your filing status if necessary, selecting from the options provided.

- Complete the income and adjustments section using figures from your federal return.

- Fill out the itemized deductions section if applicable, ensuring to report any changes.

- Provide explanations for any changes made in Part III of the form.

- Sign and date the form, including your spouse’s signature if filing jointly.

- Make your check payable to the Comptroller of Maryland and include your Social Security number on it.

- Mail the completed form to the Comptroller of Maryland at the specified address.

Learn More on Maryland 502X

-

What is the Maryland 502X form?

The Maryland 502X form is an amended tax return used by residents and non-residents to correct errors or make changes to a previously filed Maryland income tax return. This form allows taxpayers to adjust their reported income, deductions, and credits based on new information or corrections.

-

When should I file the Maryland 502X form?

You should file the Maryland 502X form within three years from the original return's due date, including any extensions. However, there are exceptions for claims related to federal net operating losses or credits for taxes paid to another state, which have specific timeframes for filing.

-

How do I complete the Maryland 502X form?

To complete the form, start by entering your personal information, including your Social Security number and current address. Then, follow the instructions to report any changes to your federal adjusted gross income, deductions, and credits. Be sure to explain any changes in Part III of the form and attach any necessary supporting documents.

-

What if I need to change my filing status?

If you need to change your filing status, you can do so on the Maryland 502X form. Indicate your original and amended filing status, such as switching from married filing jointly to married filing separately. Ensure that any changes are clearly explained in the appropriate section of the form.

-

Can I file the Maryland 502X form electronically?

Yes, the Maryland 502X form must be filed electronically if you are claiming or changing information related to business income tax credits. For other amendments, you can file electronically or submit a paper form to the Comptroller of Maryland.

-

What happens if I file an amended return after the deadline?

If you file an amended return after the deadline, your claim may be limited. Generally, you will only receive a refund for amounts paid within the two years prior to filing the claim. Be mindful of the specific exceptions that apply to your situation.

-

Are there penalties for filing an amended return?

Yes, there can be penalties for failing to file a tax return or for filing false information. Penalties may include fines, interest on unpaid taxes, and potential criminal charges. It is crucial to ensure that all information provided on the amended return is accurate and complete.

-

What supporting documents do I need to include?

When filing the Maryland 502X form, you may need to attach supporting documents such as copies of your federal amended return, IRS notices, or any other relevant forms that support the changes you are making. Check the instructions for specific requirements.

-

How will I receive my refund?

If your amended return results in a refund, it will be processed by the Comptroller of Maryland. The refund will be issued by check or direct deposit, depending on how you filed your return. Note that refunds less than $1.00 will not be issued.

Additional PDF Forms

Maryland Personal Property Tax - Other assets should be detailed in a schedule if applicable.

The California Affidavit of Service form is a crucial document used to prove the delivery of legal papers to a party involved in a court case. It serves as a formal declaration, usually made by a process server, to verify that they have served documents in accordance with the law. Ensuring accuracy and completeness of this affidavit is vital for the smooth progression of legal proceedings. If you're seeking further clarification or details, you can learn more about the document.

Is Maryland State Income Tax Currently Being Withheld From Your Pay? - The form includes a section for specifying any contributions to state funds or organizations as part of tax payments.

Documents used along the form

The Maryland 502X form is used to file an amended tax return for individuals who need to correct their original Maryland tax return. When submitting this form, there are several other documents that may be required or helpful to include. Below is a list of forms and documents commonly used alongside the Maryland 502X form.

- Federal Form 1040X: This form is used to amend an individual’s federal tax return. It provides a summary of changes made to the original return and must be submitted if the federal return is also being amended.

- Form 502CR: This is the Maryland Credit for Income Tax Paid to Another State form. It is necessary if a taxpayer is claiming a credit for taxes paid to another state, which may affect the Maryland tax liability.

- Form 1045: This form is used to apply for a quick refund of taxes due to a net operating loss. It should be included if the amended return involves a net operating loss carryback.

- Texas Operating Agreement Form: For LLCs in Texas, completing the texasdocuments.net/printable-operating-agreement-form/ is crucial for outlining management structures and operational procedures, ensuring clarity in governance and member responsibilities.

- Schedule A: This is the itemized deductions form used for federal taxes. If itemized deductions are being amended, a copy of this schedule may need to be attached.

- IRS Notice: If the IRS has issued a notice regarding changes to the federal return, a copy of this notice must be included with the Maryland 502X to explain any adjustments made.

- Supporting Documentation: Any additional documents that support the changes being made should be attached. This can include W-2s, 1099s, or receipts for deductions.

- Form MW506NRS: This form is used for nonresident withholding. If applicable, it should be included to report any taxes withheld for nonresidents.

- Tax Payment Receipt: If any additional tax is owed as a result of the amendments, including a receipt for payment can help confirm that the tax has been settled.

Each of these documents plays a vital role in ensuring that the amended tax return is processed smoothly. By providing the necessary forms and supporting information, taxpayers can help facilitate a more efficient review by the Maryland Comptroller's Office.

Key takeaways

1. The Maryland 502X form is specifically designed for amending your Maryland tax return. Ensure you have the correct version for the year you are amending.

2. Use blue or black ink when filling out the form. This ensures clarity and legibility for processing.

3. Confirm that your name matches the name on your Social Security card. If there are discrepancies, contact the Social Security Administration to rectify the issue.

4. Be aware of the filing deadlines. Generally, the form must be submitted within three years from the date the original return was due or filed.

5. If claiming a net operating loss, indicate whether you are carrying it back or forward. Attach necessary documentation, such as copies of the federal loss year return.

6. You must explain any changes from the original filing in Part III of the form. This is crucial for clarity and for the processing of your amendment.

7. If you are amending your federal return, attach a copy of the amended federal return along with your 502X form. This helps ensure consistency between state and federal filings.

8. Any tax credits or deductions claimed on the original return must be reported accurately on the amended form. Changes may affect your tax liability.

9. After completing the form, mail it to the Comptroller of Maryland at the specified address. Ensure you include your Social Security number on any checks if payment is due.

Misconceptions

- Misconception 1: The 502X form is only for large businesses.

- Misconception 2: You can file the 502X form anytime.

- Misconception 3: The 502X form is the same as the original tax return.

- Misconception 4: You do not need to explain changes on the 502X form.

- Misconception 5: You can submit the 502X form by mail or electronically.

- Misconception 6: You will automatically receive a refund after filing the 502X form.

- Misconception 7: You do not need to attach any documents with the 502X form.

This form is actually intended for individuals and small businesses alike. Anyone who needs to amend their Maryland tax return can use it, regardless of their income level or business size.

There are specific time limits for filing this form. Generally, you must submit it within three years of the original return's due date. Failing to meet this deadline may result in the loss of your right to amend.

While it may seem similar, the 502X form is specifically designed for amendments. It requires you to indicate what changes you are making to your original return, rather than simply resubmitting the same information.

In fact, any changes from your original filing must be clearly explained in Part III of the form. This helps the tax authorities understand why you are amending your return.

For most taxpayers, the 502X form must be filed electronically. This requirement ensures faster processing and helps reduce errors.

Filing an amended return does not guarantee a refund. Your amended return will be reviewed, and any refund will depend on the changes made and the overall tax situation.

When filing the 502X, you may need to attach supporting documents, such as copies of the original return or any relevant schedules. This helps validate the changes you are making.