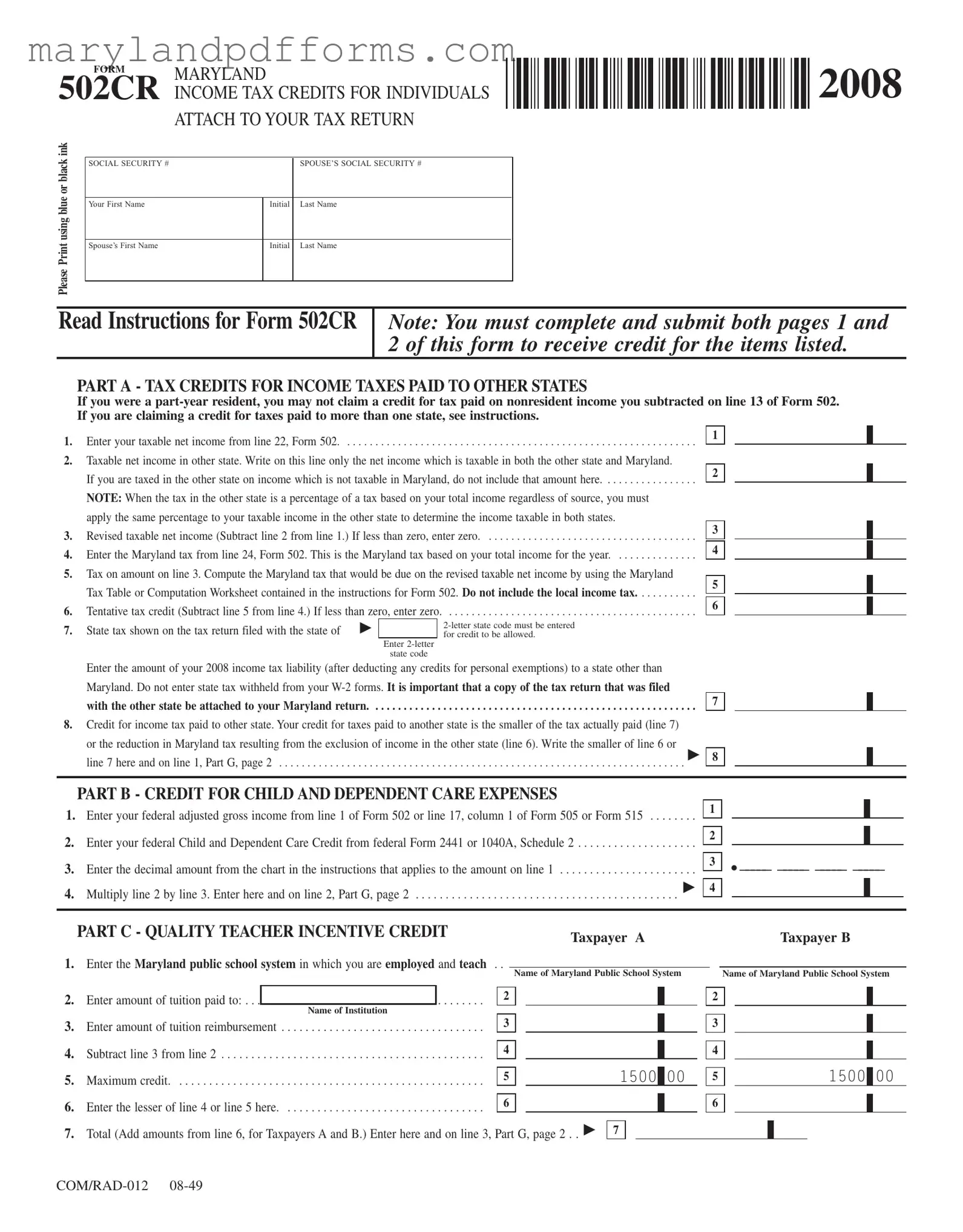

Blank Maryland 502Cr Template

Similar forms

- Form 502: This is the main Maryland income tax return form. Like the 502CR, it is used to report income and calculate tax owed, but it does not specifically focus on tax credits. The 502CR is an attachment that provides details about various credits that can reduce the tax calculated on Form 502.

- Form 505: This form is for nonresidents and part-year residents of Maryland. Similar to the 502CR, it requires additional documentation for claiming tax credits, including those for taxes paid to other states. Both forms require careful calculations to determine tax liability.

- Form 515: This form is for fiduciaries, such as estates and trusts. Like the 502CR, it allows for the reporting of income and tax credits but is specifically designed for non-individual entities. Both forms share a need for accurate income reporting and credit claims.

- California Medical Power of Attorney Form: To ensure your healthcare preferences are respected, consider filling out the comprehensive Medical Power of Attorney resources to designate someone to make medical decisions on your behalf.

- Form 2441: This federal form is used to claim the Child and Dependent Care Credit. Similar to the credit claimed on the 502CR, it requires proof of eligible expenses and income limits. Both forms aim to provide tax relief for families with dependent care costs.

- Form 500CR: This form is used to claim business income tax credits in Maryland. Like the 502CR, it is designed to provide tax relief but focuses on businesses rather than individuals. Both forms require detailed reporting and can significantly affect tax liability.

- Form 1040: This is the standard federal income tax return. Similar to the 502CR, it allows taxpayers to claim various credits, including those for child and dependent care. Both forms require a comprehensive view of income and credits to determine tax obligations.

- Form 1040A: A simplified version of the 1040, this form also allows for claiming certain credits, including the Child and Dependent Care Credit. Like the 502CR, it provides a streamlined approach for taxpayers with straightforward tax situations.

- Form 500: This is the Maryland corporate income tax return. Similar to the 502CR, it allows for the reporting of income and claiming of credits, but it is specifically for corporations. Both forms require accurate income reporting and can lead to reduced tax liability through credits.

Maryland 502Cr - Usage Steps

Completing the Maryland 502Cr form requires careful attention to detail, as it is essential for claiming various tax credits. Make sure to gather all necessary documentation before you start. Each section of the form corresponds to specific credits, and you must provide accurate information to ensure you receive the credits you are entitled to. Below are the steps to fill out the form effectively.

- Personal Information: At the top of the form, enter your name and Social Security number. If applicable, include your spouse's information as well.

- Part A - Tax Credits for Income Taxes Paid to Other States:

- Line 1: Enter your taxable net income from line 22 of Form 502.

- Line 2: Report the taxable net income in the other state that is also taxable in Maryland.

- Line 3: Subtract line 2 from line 1. If the result is less than zero, enter zero.

- Line 4: Enter the Maryland tax from line 24 of Form 502.

- Line 5: Calculate the Maryland tax on the amount from line 3 using the Maryland Tax Table or Computation Worksheet. Do not include local income tax.

- Line 6: Subtract line 5 from line 4. If the result is less than zero, enter zero.

- Line 7: Enter the amount of your income tax liability from the other state and the two-letter state code.

- Line 8: Write the smaller amount between line 6 or line 7 here.

- Part B - Credit for Child and Dependent Care Expenses:

- Line 1: Enter your federal adjusted gross income from Form 502 or Form 505.

- Line 2: Enter your federal Child and Dependent Care Credit from federal Form 2441 or 1040A, Schedule 2.

- Line 3: Enter the decimal amount from the chart in the instructions that applies to your income.

- Line 4: Multiply line 2 by line 3 and enter the result.

- Part C - Quality Teacher Incentive Credit:

- Line 1: Enter the name of the Maryland public school system where you teach.

- Line 2: Enter the amount of tuition paid for graduate-level courses.

- Line 3: Enter the amount of tuition reimbursement received.

- Line 4: Subtract line 3 from line 2.

- Line 5: Maximum credit is $1,500. Enter this amount.

- Line 6: Enter the lesser of line 4 or line 5.

- Line 7: Total the amounts from line 6 for both taxpayers.

- Part D - Credit for Aquaculture Oyster Floats:

- Line 1: Enter the amount paid to purchase aquaculture oyster floats.

- Part E - Long-Term Care Insurance Credit:

- Answer the questions regarding eligibility for the credit.

- Complete Columns A through D for each qualifying insured individual.

- Column E: Enter the lesser of the premium paid or the maximum allowable amount based on age.

- Add the amounts in Column E and enter the total on line 5.

- Part F - Credit for Preservation and Conservation Easements:

- Line 1: Enter the total current year donation amount and any carryover from prior years.

- Line 2: Enter any payment received for the easement during the tax year.

- Line 3: Subtract line 2 from line 1.

- Line 4: Enter the lesser of line 3 or $5,000.

- Line 5: Enter the result on line 6 of Part G.

- Part G - Income Tax Credit Summary:

- Enter the amounts from Parts A through F in the corresponding lines.

- Add lines 1 through 7 and enter the total on the appropriate line of your tax return.

- Part H - Refundable Income Tax Credits:

- Complete the lines for any refundable credits you are claiming.

- Add lines 1 through 5 and enter the total on the appropriate line of your tax return.

After completing the Maryland 502Cr form, ensure that you attach it to your Maryland tax return. Double-check all entries for accuracy and completeness. If you are claiming credits for taxes paid to other states, remember to include copies of the relevant state tax returns. Submitting a well-prepared form will help streamline the processing of your tax credits.

Learn More on Maryland 502Cr

What is the purpose of the Maryland 502Cr form?

The Maryland 502Cr form is used to claim personal income tax credits for individuals. It allows taxpayers to report various credits, including those for income taxes paid to other states, child and dependent care expenses, and several other specific credits. This form must be attached to your annual tax return.

Who is eligible to use the Maryland 502Cr form?

Eligibility for the Maryland 502Cr form primarily applies to Maryland residents who have incurred qualifying expenses or paid taxes to other states. Non-residents filing Form 505 or Form 515 are not eligible for the credits claimed on this form. Taxpayers must also meet specific criteria for each type of credit claimed.

How do I claim a credit for income taxes paid to other states?

To claim a credit for income taxes paid to other states, complete Part A of the 502Cr form. You will need to provide details such as your taxable net income, the taxable income in the other state, and the tax liability from the other state's return. Attach a copy of the tax return filed with the other state to your Maryland return. If you paid taxes to more than one state, a separate 502Cr form must be completed for each state.

What documentation do I need to submit with the Maryland 502Cr form?

When submitting the Maryland 502Cr form, you must include the following documentation:

- A completed and signed copy of your tax return filed with the other state for any credits claimed for taxes paid to other states.

- For the Child and Dependent Care Credit, attach the federal Form 2441 or 1040A, Schedule 2.

- Documentation supporting any other specific credits claimed, such as tuition receipts for the Quality Teacher Incentive Credit.

Can I carry forward any unused credits from the Maryland 502Cr form?

Yes, certain credits may be carried forward to future tax years. For example, excess credits for preservation and conservation easements can be carried forward for up to 15 years. However, most other credits cannot be carried forward. Be sure to check the specific rules for each credit to understand your options.

What is the deadline for filing the Maryland 502Cr form?

The Maryland 502Cr form must be filed along with your annual tax return, which is typically due on April 15th. If you need additional time, you may file for an extension, but ensure that the 502Cr form is still attached to your completed return by the extended deadline.

Is there a maximum limit on the credits I can claim using the Maryland 502Cr form?

Yes, there are limits on certain credits. For instance, the maximum credit for the Quality Teacher Incentive Credit is $1,500 per qualifying individual. The Credit for Preservation and Conservation Easements is limited to $5,000 per owner. It’s essential to review the instructions for each credit to understand the specific limits and conditions that apply.

Additional PDF Forms

Haccp Plan Example - Maintaining equipment is vital for ensuring food safety measures.

For anyone looking to buy or sell a vehicle, utilizing the Arizona Motor Vehicle Bill of Sale is essential. This document not only details vital information about the buyer, seller, and vehicle, but it also helps prevent any misunderstandings during the transaction. By following the guidelines outlined, parties can safeguard their interests and ensure a seamless transfer of ownership; additional resources can be found at Templates Online.

Mva Temporary Registration Renewal - Detailed instructions for mailing titles to alternate addresses are included in the online application.

Maryland State Police Accident Report - Include all relevant safety equipment details for every vehicle.

Documents used along the form

The Maryland 502Cr form is essential for individuals claiming various income tax credits in Maryland. When completing this form, several other documents may be necessary to support your claims. Below are four commonly used forms and documents that often accompany the Maryland 502Cr form.

- Form 502: This is the primary income tax return form for Maryland residents. It reports total income, deductions, and tax liability. The 502Cr form must be attached to this return to claim any credits.

- Form 505: Used by nonresidents and part-year residents, this form calculates Maryland income tax based on income earned in the state. Similar to Form 502, the 502Cr must accompany this return for credit claims.

- New York Operating Agreement form: This important document outlines the management structure of an LLC in New York, helping define members' responsibilities. For more information, visit PDF Templates Online.

- Form 2441: This federal form is used to claim the Child and Dependent Care Credit. If you are claiming this credit on your Maryland return, you must provide details from Form 2441 along with the 502Cr.

- Form 500CR: This form is for claiming refundable business income tax credits. If you are eligible for credits related to business activities, you will need to attach this form to your Maryland tax return.

Including the necessary forms and documentation ensures a smooth filing process and maximizes your eligibility for tax credits. Always review each form's requirements to confirm all information is accurate and complete before submission.

Key takeaways

Filling out the Maryland 502Cr form can seem daunting, but understanding a few key points can simplify the process. Here are some important takeaways to keep in mind:

- Complete Both Pages: Ensure that you fill out and submit both pages of the Maryland 502Cr form. Missing either page can delay your credit.

- Eligibility for Credits: The form allows you to claim various tax credits, including those for income taxes paid to other states, child and dependent care expenses, and long-term care insurance. Review each section to determine which credits you qualify for.

- Attach Required Documentation: If you are claiming a credit for taxes paid to another state, you must attach a copy of the tax return filed with that state. This is essential for the Maryland tax authorities to process your claim.

- Calculate Carefully: Pay close attention to the calculations required in Part A. You need to determine your taxable net income in both Maryland and the other state to accurately compute your tax credit.

- Understand the Limits: Some credits have limits. For instance, the credit for long-term care insurance is capped based on the age of the insured. Make sure to check these limits to avoid errors.

- Separate Forms for Multiple States: If you paid taxes to more than one state, you must complete a separate 502Cr form for each state. Combine the totals on the summary section of the form.

- Filing Deadline: Don’t forget to file your Maryland 502Cr form with your annual tax return. Missing the deadline can result in losing out on potential credits.

By keeping these key points in mind, you can navigate the Maryland 502Cr form with greater confidence and ease.

Misconceptions

Understanding the Maryland 502Cr form is essential for individuals seeking to claim income tax credits. However, several misconceptions may lead to confusion. Here are five common misconceptions, along with clarifications for each:

- Misconception 1: The Maryland 502Cr form can be submitted without completing both pages.

- Misconception 2: Any tax paid to another state qualifies for a credit on the Maryland return.

- Misconception 3: Local taxes paid in another state can be included when calculating the credit.

- Misconception 4: The credits claimed on the Maryland 502Cr form can exceed the state income tax liability.

- Misconception 5: Only individuals with children can claim credits for child and dependent care expenses.

In reality, it is mandatory to complete and submit both pages of the form to receive credit for the items listed. Omitting one page may result in delays or denials of credits.

This is not true. Only taxes paid on income that is also taxable in Maryland can be claimed. If you were a part-year resident, you cannot claim a credit for nonresident income that you subtracted on your Maryland tax return.

Local taxes are not eligible for credit. The Maryland 502Cr form only allows for credit on state income taxes paid, not local or municipal taxes.

This is incorrect. The total amount of credits claimed cannot exceed the state income tax owed. Any excess credits may not be refunded or carried forward.

This is misleading. While the credit is often associated with families, any taxpayer who qualifies based on their federal adjusted gross income and meets other criteria can claim the credit, regardless of whether they have children.