Blank Maryland 500E Template

Similar forms

- IRS Form 7004: Similar to the Maryland 500E, this federal form is used to request an extension of time to file certain business tax returns, including corporate returns. Both forms require basic information about the entity and the reason for the extension request.

- California Form 3537: This state-specific form allows corporations in California to request an extension for filing their corporate tax returns. Like the Maryland 500E, it also requires payment of any tax due at the time of filing.

- New York Form CT-5: This form is utilized by corporations in New York to apply for an extension of time to file their tax returns. Similar to the Maryland 500E, it allows for an automatic extension if filed on time and includes payment of any taxes owed.

- New York Operating Agreement: This essential document can be downloaded from PDF Templates Online, helping LLC owners in New York establish clear management structures and operational guidelines for their businesses.

- Texas Franchise Tax Extension: Corporations in Texas can use this extension request to delay filing their franchise tax returns. The process mirrors that of the Maryland 500E by requiring timely submission and payment.

- Florida Form F-1120: This form is for corporations in Florida to request an extension for filing their corporate income tax returns. It shares similarities with the Maryland 500E in terms of the information required and the payment of taxes.

- Virginia Form 500E: Virginia offers a similar extension form for corporations, allowing them to request additional time to file their corporate tax returns. Both forms necessitate the submission of estimated tax payments along with the extension request.

- Illinois Form CRT-1: This form is used in Illinois for corporations seeking an extension on their corporate income tax return. Like the Maryland 500E, it requires the corporation to provide details about tax liability and estimated payments.

- Pennsylvania Form REV-976: This extension request form for Pennsylvania corporations allows for an extension to file corporate tax returns. The requirements for filing and payment are similar to those of the Maryland 500E.

- Ohio Form IT 1140: This form is for corporations in Ohio to apply for an extension to file their tax returns. It aligns closely with the Maryland 500E in terms of the process and the necessity of paying any owed taxes at the time of application.

Maryland 500E - Usage Steps

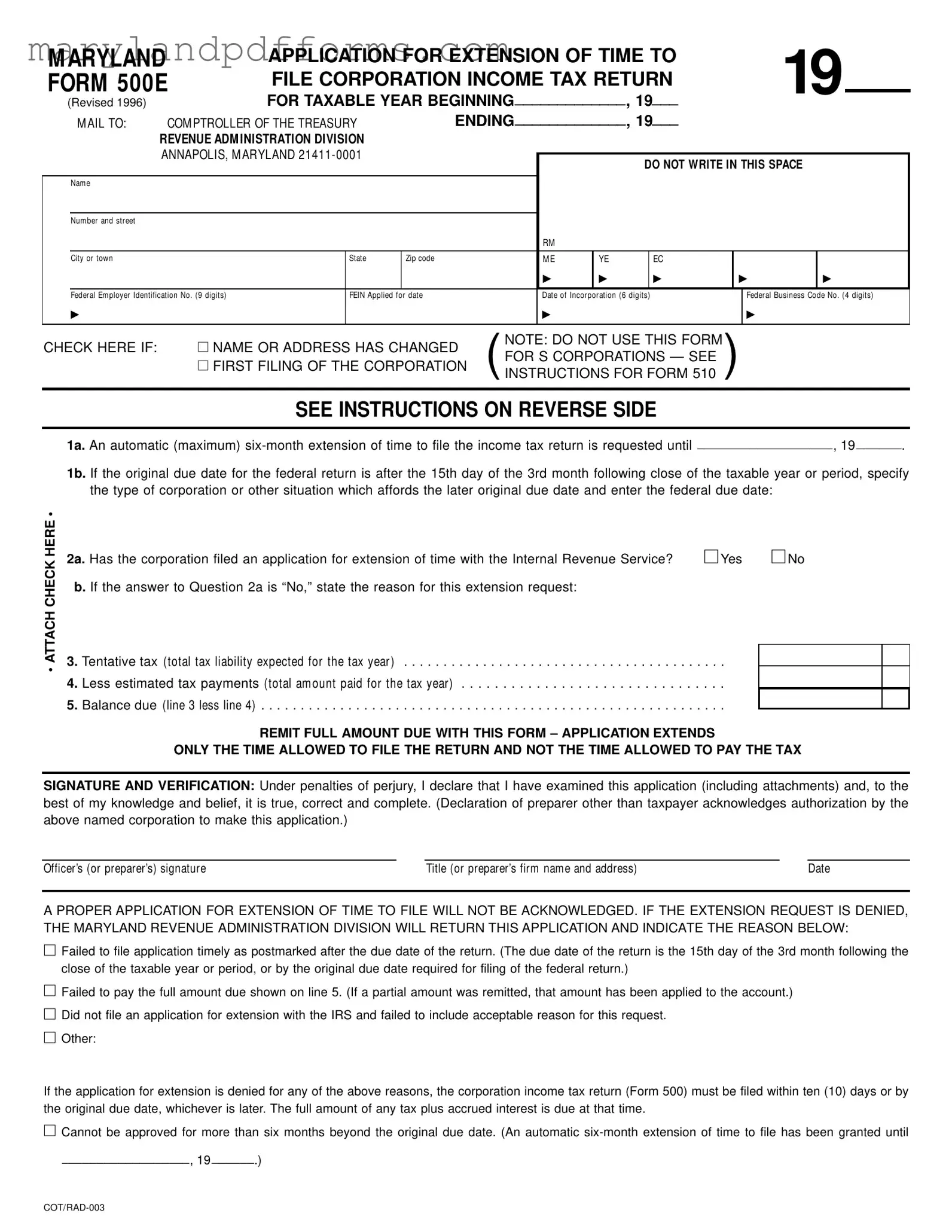

After completing the Maryland 500E form, it is crucial to ensure that all information is accurate and submitted on time. This form is essential for requesting an extension to file your corporation's income tax return. It is important to remit any balance due along with the form to avoid penalties. Follow the steps below to fill out the form correctly.

- Enter the beginning and ending dates of the taxable year in the designated spaces at the top of the form.

- Provide the corporation's name and address, ensuring it matches the Articles of Incorporation.

- Fill in the Federal Employer Identification Number (FEIN). If not yet secured, write "APPLIED FOR" along with the application date.

- If applicable, check the box for name or address changes or if this is the corporation's first filing.

- Request an automatic six-month extension by entering the new due date in line 1a.

- If the original federal return due date is after the 15th day of the 3rd month, specify the type of corporation and the federal due date in line 1b.

- Indicate whether the corporation has filed an extension application with the IRS by checking "Yes" or "No" in question 2a.

- If "No" was selected in question 2a, provide the reason for the extension request in question 2b.

- On line 3, enter the total expected tax liability for the tax year.

- On line 4, record the total estimated tax payments made for the tax year.

- Calculate the balance due by subtracting line 4 from line 3 and enter it on line 5.

- Attach a check or money order for the full amount due, made payable to the Comptroller of the Treasury.

- Sign and date the form in the designated area, indicating the title of the officer or the preparer's firm name and address.

- Mail the completed form and payment to the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland 21411-0001.

Learn More on Maryland 500E

-

What is the purpose of the Maryland 500E form?

The Maryland 500E form is used by corporations to request an extension of time to file their corporation income tax return (Form 500). It also allows corporations to remit any balance of tax due. This form is essential for ensuring that you have additional time to prepare your tax return without incurring penalties for late filing.

-

Who should use the Maryland 500E form?

This form is specifically for corporations. It is important to note that pass-through entities, such as S corporations, should not use this form. If you are filing a return for an S corporation, you will need to refer to the instructions for Form 510 instead.

-

When is the Maryland 500E form due?

The Maryland 500E form must be filed by the 15th day of the 3rd month following the close of your taxable year. Alternatively, you can file it by the original due date required for filing your federal return. Timeliness is crucial; if you miss this deadline, your request for an extension may be denied.

-

What happens if my extension request is denied?

If your application for an extension is denied, the Maryland Revenue Administration Division will notify you of the reason. Common reasons for denial include late filing, failure to pay the full amount due, or not filing an application with the IRS. If denied, you must file your corporation income tax return within ten days or by the original due date, whichever is later. Be aware that any tax owed will accrue interest and penalties if not paid on time.

-

What information do I need to provide on the form?

You will need to fill in several key pieces of information, including:

- Your corporation's name and address.

- Your Federal Employer Identification Number (FEIN).

- The beginning and ending dates of your taxable year.

- Your expected total tax liability for the year.

- Any estimated tax payments made for the year.

Make sure all information is accurate and complete to avoid complications with your application.

-

Is there a fee associated with filing the Maryland 500E form?

Additional PDF Forms

Court Forms - Different types of conveyances must be noted to ensure accurate recording by the clerk's office.

Understanding the significance of a Medical Power of Attorney form is vital for ensuring that your health care decisions are made according to your wishes. This document empowers a designated individual to act on your behalf in making crucial medical choices during times when you may not be able to express your preferences. It is a key part of your healthcare planning and should be prepared thoughtfully.

Is Maryland State Income Tax Currently Being Withheld From Your Pay? - The form requires signatures from both the taxpayer and, if applicable, the spouse to validate the submission.

Maryland State Department of Assessments and Taxation - The primary contact section captures the name and details of the individual or agency involved in the project.

Documents used along the form

The Maryland 500E form is used by corporations to request an extension of time to file their income tax return. In addition to this form, several other documents may be required to ensure compliance with tax regulations. Below is a list of related forms and documents commonly used in conjunction with the Maryland 500E form.

- Maryland Form 500: This is the standard corporation income tax return that must be filed by corporations operating in Maryland. It details the corporation's income, deductions, and tax liability for the taxable year.

- Maryland Form 500D: This form is used for the declaration of estimated corporation income tax. Corporations must file this if they expect to owe tax for the year and need to make estimated tax payments throughout the year.

- Arizona Motor Vehicle Bill of Sale: This legal document serves as proof of the transfer of ownership for a motor vehicle, providing essential information about the buyer, seller, and vehicle details. It's important for ensuring clarity and accountability in the transaction. For more information and to access a template, visit Templates Online.

- Maryland Form 500DP: This form is specifically for corporations that need to declare estimated tax payments. It helps in reporting the amount of estimated tax paid during the year and is crucial for calculating any potential balance due.

- IRS Form 7004: This federal form is used to request an automatic extension of time to file certain business tax returns, including corporate income tax returns. Filing this form with the IRS is often necessary to secure an extension for the Maryland return.

- Maryland Form 510: This form is for S corporations to file their income tax returns. While the 500E form is not applicable for S corporations, the 510 form is essential for those entities seeking to file their taxes correctly.

- Payment Voucher (Form PV): This document is used to remit payment for any taxes owed. It is important to include this voucher when sending payments to ensure proper credit to the corporation's tax account.

Understanding these documents and their purposes can facilitate a smoother tax filing process for corporations in Maryland. Properly completing and submitting the necessary forms ensures compliance with state regulations and helps avoid potential penalties.

Key takeaways

The Maryland 500E form is essential for corporations seeking an extension of time to file their income tax returns. It serves as a formal request to delay the filing of the corporation income tax return (Form 500).

To qualify for an extension, ensure that the application is submitted by the original due date, which is typically the 15th day of the 3rd month following the close of the taxable year.

Corporations must also remit any balance of tax due with the 500E form. Remember, the extension only applies to the filing date, not the payment date.

Filing the 500E does not extend the time to pay taxes owed; interest and penalties may accrue if the full amount is not paid by the due date.

Be aware that consolidated returns are not permitted under Maryland law. Each corporation within an affiliated group must file a separate extension application.

Complete all required sections accurately, including the name and address of the corporation and the Federal Employer Identification Number (FEIN). If a FEIN is not yet obtained, indicate "APPLIED FOR" with the application date.

Finally, ensure that an authorized officer or preparer signs the form, as this verification is crucial for the application to be considered valid.

Misconceptions

- Misconception 1: The Maryland 500E form can be used for S corporations.

- Misconception 2: Filing the 500E form automatically extends the payment deadline for taxes.

- Misconception 3: You can submit the 500E form after the due date for your tax return.

- Misconception 4: You don’t need to file an extension with the IRS to use the Maryland 500E form.

- Misconception 5: You can file a consolidated return for multiple corporations using the 500E form.

- Misconception 6: If the 500E form is denied, you can still file your tax return later without penalties.

- Misconception 7: The 500E form can be filed electronically.

This form is specifically for C corporations. S corporations should use Form 510 instead. Using the wrong form can lead to delays or denial of your extension request.

The 500E form only extends the time to file your return, not the time to pay any taxes owed. Taxes are still due by the original deadline.

The form must be filed by the original due date. Late submissions will not be accepted, and penalties may apply.

An application for extension with the IRS is required unless you provide an acceptable reason for not doing so. This is a key part of the process.

Maryland law does not allow consolidated returns. Each corporation must file its own extension application.

If your extension request is denied, you must file your tax return within ten days or by the original due date. Failure to do so may result in penalties and interest.