Blank Maryland 500Dm Template

Similar forms

The Maryland 500DM form is utilized to report modifications related to federal tax provisions that Maryland has decoupled from. Several other forms serve similar purposes in various contexts, particularly regarding tax modifications and adjustments. Below is a list of seven documents that share similarities with the Maryland 500DM form:

- Form 502 - This is the Maryland Individual Income Tax Return. It is used to report personal income tax and includes modifications similar to those on the 500DM form, such as adjustments for deductions and credits.

- Form 510 - This form is for Pass-Through Entities. It allows partnerships and S-corporations to report income and modifications, including those related to decoupling, akin to what is required on the 500DM form.

- Form 502CR - This form is used to claim a credit for taxes paid to another state. Similar to the 500DM, it requires modifications based on federal adjustments that may affect state tax liabilities.

- Form 500X - This is the Maryland Amended Income Tax Return. It is similar in that it allows taxpayers to correct previous returns, including adjustments that align with decoupling provisions outlined in the 500DM.

- Form 1040 - This is the federal individual income tax return. It also includes sections for reporting various deductions and modifications, paralleling the adjustments reported on the Maryland 500DM form.

- Affidavit of Service - This is the document used to establish that legal papers have been delivered to a party, ensuring compliance with legal protocols, as detailed in this.

- Form 1120 - This form is for corporate income tax returns at the federal level. It contains sections for reporting modifications similar to those found in the Maryland 500DM, especially concerning depreciation and NOLs.

- Form 1065 - This is the federal return for partnerships. It includes provisions for reporting income, deductions, and modifications, similar to the requirements of the Maryland 500DM for pass-through entities.

Maryland 500Dm - Usage Steps

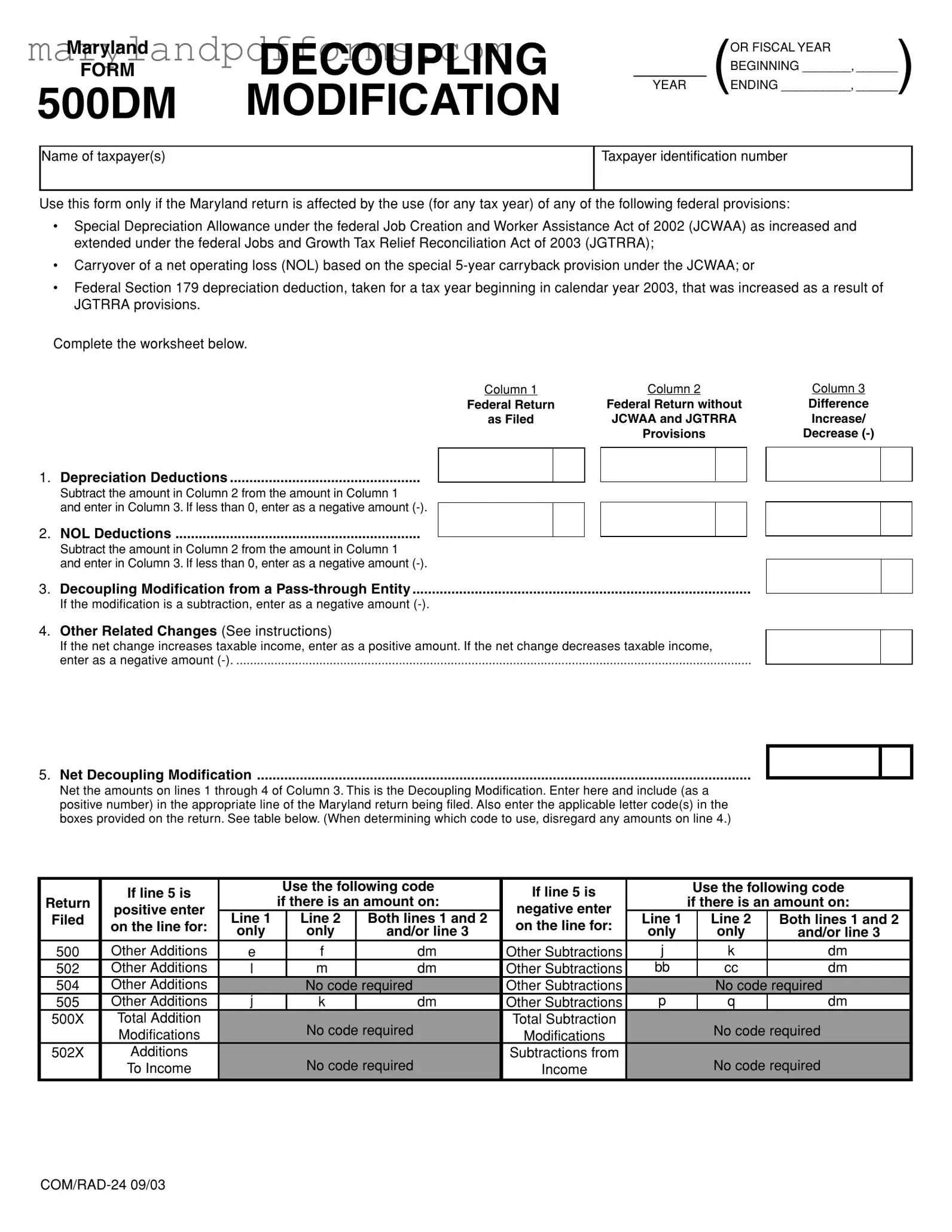

Completing the Maryland 500DM form is essential for taxpayers whose Maryland return is impacted by specific federal provisions. This process involves gathering relevant financial information and accurately entering it into the designated sections of the form. Follow the steps below to fill out the Maryland 500DM form correctly.

- Obtain the Maryland 500DM form and ensure you have the necessary financial documents, including your federal tax return.

- In the top section, fill in the name of the taxpayer(s) and the taxpayer identification number.

- Indicate the beginning and ending dates of the fiscal year for which you are filing.

- For Column 1, enter the amounts from your federal return as filed, specifically for depreciation deductions and NOL deductions.

- In Column 2, input the amounts from your federal return without the JCWAA and JGTRRA provisions.

- Calculate the difference for each line (1 and 2) by subtracting the amount in Column 2 from the amount in Column 1. Enter this result in Column 3.

- If applicable, enter any modifications from a pass-through entity in line 3, noting whether it is an addition or subtraction.

- For line 4, report any other related changes that affect taxable income, indicating whether this change is an increase or decrease.

- Sum the amounts from lines 1 through 4 in Column 3 and enter the total on line 5. This is your Decoupling Modification.

- Refer to the table provided at the bottom of the form to determine the appropriate code(s) to enter based on the result from line 5.

- Attach the completed Maryland 500DM form to your Maryland income tax return. Keep pro forma returns for your records but do not submit them.

Learn More on Maryland 500Dm

What is the Maryland 500DM form?

The Maryland 500DM form is used to report decoupling modifications from certain federal tax provisions. These provisions include special depreciation allowances and net operating loss carrybacks. The form helps determine the necessary adjustments to your Maryland income tax return, ensuring that the impact of federal changes is eliminated for state tax purposes.

Who needs to file the Maryland 500DM form?

If your Maryland return is affected by federal provisions such as the Job Creation and Worker Assistance Act of 2002 or the Jobs and Growth Tax Relief Reconciliation Act of 2003, you must file the 500DM form. This includes individuals and entities that have taken advantage of special depreciation allowances or have net operating losses that need to be adjusted.

How do I complete the Maryland 500DM form?

To complete the form, you will need to fill out a worksheet that compares your federal return as filed with a pro forma return that excludes the federal provisions. You'll list depreciation deductions, NOL deductions, and any other related changes. The differences between these amounts will help you determine your decoupling modification.

What information is required on the form?

You will need to provide the following information on the 500DM form:

- Name of taxpayer(s)

- Taxpayer identification number

- Details of depreciation deductions and NOL deductions

- Any modifications from pass-through entities

- Other related changes that affect taxable income

What should I do with the completed form?

Once you complete the Maryland 500DM form, attach it to your Maryland income tax return. If you are filing an amended return, include the 500DM form along with any necessary schedules and pro forma returns. Keep copies of all documents for your records.

Are there any specific instructions for pass-through entities?

Yes, if you are a partner, shareholder, or member of a pass-through entity, you must report your share of the decoupling modification on line 3 of the 500DM form. You should also ensure that the pass-through entity provides you with a statement of your share of the modification.

What if I have questions about the Maryland 500DM form?

If you have questions regarding the 500DM form, you can contact the Revenue Administration Division in Annapolis, Maryland. They can be reached at 410-260-7980 or toll-free at 1-800-MDTAXES. More information is also available on the Maryland taxes website.

What happens if I don’t file the Maryland 500DM form?

Failing to file the Maryland 500DM form when required may result in incorrect tax calculations. This could lead to penalties, interest, or additional tax liabilities. It’s important to ensure that your Maryland return accurately reflects any necessary adjustments due to federal provisions.

Additional PDF Forms

Maryland Late Filing Penalty - Estimated tax due is calculated at 7% of the expected taxable income.

In order to create a comprehensive understanding of the divorce process, it is essential to utilize resources that assist in drafting the necessary documents, such as the coloradoformpdf.com, which provides templates and guidance for completing the Colorado Divorce Settlement Agreement form accurately.

Maryland State Sales Tax - The Maryland Sales and Use Tax Form 202FR is specific to businesses in Maryland.

Maryland Medicaid Application - The Maryland Medicaid form 3871 is crucial for evaluating medical eligibility for assistance.

Documents used along the form

The Maryland 500DM form is utilized by taxpayers to report modifications related to federal tax provisions that Maryland has decoupled from. This form is essential for accurately calculating state tax liabilities when specific federal tax benefits are not applicable. In conjunction with the 500DM form, several other documents may be required to ensure compliance with state tax regulations. Below is a list of relevant forms and documents commonly used alongside the Maryland 500DM form.

- Maryland Form 500: This is the primary income tax return form for individuals and businesses in Maryland. Taxpayers use it to report their income, claim deductions, and calculate their tax liability.

- California Marital Separation Agreement: For those navigating separation, it’s important to utilize the detailed California marital separation agreement resources to ensure clarity and legal compliance.

- Maryland Form 502: This form is specifically for residents who need to report their income and calculate their tax liability. It is often used in conjunction with the 500DM for adjustments related to decoupling.

- Maryland Form 502CR: This form is used to claim a credit for taxes paid to another state. If taxpayers are affected by changes in federal provisions, they may need to adjust their credit calculations accordingly.

- Maryland Form 510: This form is designated for pass-through entities, such as partnerships and S-corporations. It allows these entities to report income and modifications, including those affecting their partners or shareholders.

- Maryland Form 1045: This form is used to apply for a carryback of a net operating loss (NOL). Taxpayers may need to complete this form if they are affected by the NOL provisions outlined in the 500DM.

- Maryland Form 500X: This is the amended income tax return form. If a taxpayer needs to correct errors on their original return, this form must be filed along with any relevant modifications.

- Maryland Form 548: This form is used to report the Maryland estate tax. While not directly related to the 500DM, it may be necessary for taxpayers with estate-related issues.

- Maryland Form 15: This form is for claiming a refund of Maryland income tax. Taxpayers who have overpaid their taxes may need to use this form in conjunction with their 500DM modifications.

- Maryland Administrative Release 38: This document provides guidance on the decoupling modifications and is essential for understanding how to complete the 500DM form accurately.

- Pro Forma Returns: These are not official forms but rather calculations made to determine tax liability without the federal provisions affecting Maryland tax. They are used to assist in completing the 500DM form.

Understanding these additional forms and documents is crucial for ensuring compliance with Maryland tax laws. Taxpayers should be diligent in gathering all necessary paperwork to accurately report their income and modifications, thereby avoiding potential issues with tax liabilities.

Key takeaways

Filling out the Maryland 500DM form can be straightforward if you understand its purpose and requirements. Here are key takeaways to guide you through the process:

- Purpose of the Form: The Maryland 500DM form is used to report modifications that decouple Maryland taxes from certain federal tax provisions.

- Eligibility: Use this form if your Maryland return is impacted by the Special Depreciation Allowance, net operating loss (NOL) carryback, or Section 179 depreciation deductions as specified in the form.

- Pro Forma Returns: Prepare separate pro forma federal and Maryland returns to complete the 500DM form accurately. These help calculate deductions without federal benefits.

- Column Breakdown: Column 1 captures the federal return as filed, while Column 2 shows the return without the federal provisions. Column 3 reflects the difference between the two.

- Calculating Modifications: Follow the worksheet to calculate depreciation deductions, NOL deductions, and any other related changes that impact taxable income.

- Net Decoupling Modification: The total from lines 1 through 4 in Column 3 will give you the net decoupling modification, which you must report on your Maryland tax return.

- Pass-Through Entities: If you receive income from a pass-through entity, you must report your share of the decoupling modification on line 3 of the 500DM form.

- Attachment Requirements: Always attach the completed 500DM form to your Maryland income tax return. For amended returns, include the form along with any schedules and pro forma returns.

- Seek Assistance: If you have questions about the form or its requirements, contact the Revenue Administration Division or visit the Maryland tax website for more information.

Misconceptions

-

Misconception 1: The Maryland 500DM form is only for businesses.

This form is applicable to both individuals and businesses. Any taxpayer who has taken advantage of specific federal provisions affecting their Maryland tax return may need to use this form, regardless of their business status.

-

Misconception 2: The 500DM form is only needed for current tax years.

Taxpayers may need to file the 500DM form for any tax year affected by the federal provisions listed. This includes past tax years where modifications may impact current tax calculations.

-

Misconception 3: Completing the 500DM form is optional.

For taxpayers affected by the decoupling provisions, filing the 500DM form is mandatory. It ensures compliance with Maryland tax laws and accurately reflects any necessary modifications to taxable income.

-

Misconception 4: The form only addresses depreciation deductions.

While depreciation is a significant aspect, the 500DM form also addresses net operating loss deductions and other related changes. Taxpayers must consider all applicable modifications to ensure accurate reporting.