Blank Maryland 500D Template

Similar forms

IRS Form 1120: This is the U.S. Corporation Income Tax Return. Like the Maryland 500D, it is used by corporations to report income, gains, losses, deductions, and credits. Both forms help ensure that corporations meet their tax obligations, though Form 1120 is for annual reporting while Form 500D is for estimated payments.

IRS Form 1040-ES: This form is used by individuals to make estimated tax payments. Similar to the Maryland 500D, it allows taxpayers to estimate their tax liability for the year and make quarterly payments. Both forms aim to prevent underpayment penalties by encouraging timely tax contributions.

Maryland Form 500: This is the Maryland Corporation Income Tax Return. While Form 500D is for estimated payments, Form 500 is used for reporting the actual income and tax liability at the end of the tax year. Both forms are essential for Maryland corporations to fulfill their tax responsibilities.

IRS Form 941: This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Like the Maryland 500D, it involves tax payments but focuses on payroll taxes instead of corporate income tax.

Maryland Form 510: This is the Maryland Pass-Through Entity Income Tax Return. While it serves a different type of business entity, it also requires tax payments and reporting similar to the Maryland 500D, although it is specifically for pass-through entities.

IRS Form 1065: This form is used by partnerships to report income, deductions, gains, and losses. Like the Maryland 500D, it requires the entity to report financial information, although it pertains to partnerships rather than corporations.

Maryland Form 502: This is the Maryland Resident Income Tax Return. While it is designed for individual taxpayers, it shares the purpose of reporting income and paying taxes, much like the Maryland 500D does for corporations.

California Marital Separation Agreement: For those navigating divorce proceedings, the comprehensive California marital separation agreement provides essential guidelines to formalize terms of separation.

IRS Form 8862: This form is used to claim the Earned Income Credit after disallowance. Similar to the Maryland 500D in that it requires a declaration and submission for tax benefits, it focuses on individual tax credits rather than corporate income tax.

Maryland Form 1: This is the Maryland Non-Resident Income Tax Return. Like the Maryland 500D, it involves tax payments, but it is specifically for non-residents earning income in Maryland.

IRS Form 720: This form is used to report and pay federal excise taxes. While it serves a different purpose, it shares the commonality of being a tax payment form, similar to the Maryland 500D.

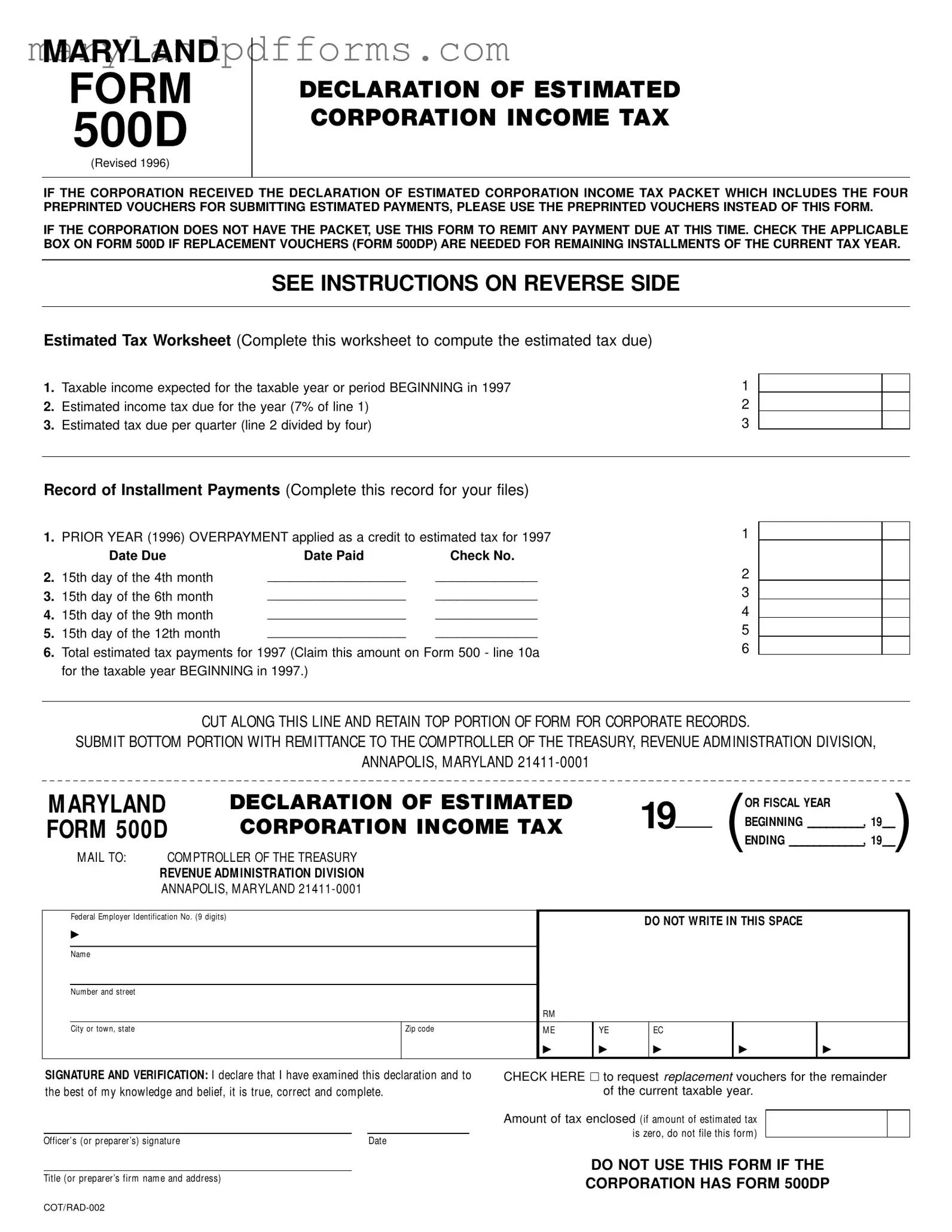

Maryland 500D - Usage Steps

Filling out the Maryland Form 500D is a straightforward process, designed to help corporations declare and remit their estimated income tax. It is essential to ensure accuracy and completeness to avoid any potential penalties. Follow the steps below to complete the form correctly.

- Obtain the Form: Download or print the Maryland Form 500D from the official website or obtain it from your tax booklet.

- Enter Corporation Information: Type or print the corporation's name exactly as it appears in the Articles of Incorporation. Include any "Trading As" (T/A) name if applicable.

- Provide Address: Fill in the complete address, including the number and street, city or town, state, and zip code.

- Federal Employer Identification Number: Enter the nine-digit Federal Employer Identification Number (FEIN). If you have not secured one, write "APPLIED FOR" and the date of application.

- Check for Replacement Vouchers: If you need replacement vouchers for the current taxable year, check the appropriate box on the form.

- Taxable Year: Clearly indicate the beginning and ending dates of the taxable year in the designated area on the form.

- Calculate Estimated Tax: Complete the Estimated Tax Worksheet included in the form. Calculate the taxable income expected and the estimated income tax due.

- Record Installment Payments: Fill in the record of installment payments for the previous year, if applicable, including due dates and amounts paid.

- Enter Amount of Tax Enclosed: Write the total amount of tax due in the space provided. If the estimated tax is zero, do not file the form.

- Signature and Verification: An authorized officer or the paid preparer must sign and date the form, including their title or preparer firm name and address.

- Prepare Payment: Include a check or money order made payable to the Comptroller of the Treasury for the total amount due. Ensure it indicates the FEIN, type of tax, and the beginning and ending dates of the tax year.

- Mail the Form: Use the envelope provided in the tax booklet. Mark the appropriate box in the lower left corner to indicate the type of document enclosed. Send the completed form and payment to the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland 21411-0001.

Learn More on Maryland 500D

What is the Maryland Form 500D?

The Maryland Form 500D is a declaration of estimated corporation income tax. Corporations use this form to report and remit estimated tax payments when they do not have the preprinted Declaration of Estimated Corporation Income Tax Packet, which includes Form 500DP vouchers. This form is essential for corporations expecting to owe more than $1,000 in taxes for the year.

Who needs to file Form 500D?

Any corporation with Maryland taxable income that anticipates a tax liability exceeding $1,000 for the taxable year must file Form 500D. This includes corporations that have not received the preprinted vouchers. It is important to note that pass-through entities, such as S corporations, do not use this form.

When should Form 500D be filed?

Form 500D should be filed on or before the 15th day of the 4th, 6th, 9th, and 12th months following the beginning of the taxable year. Timely filing helps avoid penalties and interest on unpaid taxes.

How do I calculate the estimated tax due?

To calculate the estimated tax due, complete the Estimated Tax Worksheet included with Form 500D. You will need to:

- Estimate your taxable income for the year.

- Multiply that amount by the tax rate (7% for Maryland).

- Divide the total estimated tax by four to determine the quarterly payment amount.

What if I need replacement vouchers?

If you need replacement vouchers for the remaining installments of the current taxable year, check the appropriate box on Form 500D. This request will ensure you receive the necessary vouchers to facilitate your future payments.

Where do I send Form 500D?

Mail Form 500D, along with your payment, to the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland 21411-0001. Ensure that your payment includes your Federal Employer Identification Number and the tax year information to avoid processing delays.

What happens if I do not file or pay on time?

Failure to file or pay on time can result in penalties and interest accruing on the unpaid tax. Maryland law mandates that corporations make estimated tax payments to avoid these consequences. It is crucial to stay on top of your tax obligations to maintain compliance and avoid unnecessary fees.

Additional PDF Forms

Boat Registration Maryland - This document can facilitate the resolution of any future boat-related issues.

For those looking to navigate the intricacies of motorcycle ownership transfers, the New York Motorcycle Bill of Sale form is invaluable. Utilizing resources like PDF Templates Online can help ensure that all necessary details are properly documented, ultimately safeguarding the interests of both the seller and buyer throughout the transaction process.

Maryland Medicaid Application - Identifying any behavior-related issues is part of the assessment process.

Documents used along the form

The Maryland 500D form is an important document for corporations to declare and remit their estimated income tax. Alongside this form, several other documents may be required to ensure compliance with tax obligations. Below is a list of common forms and documents that are often used in conjunction with the Maryland 500D form.

- Maryland Form 500DP: This is the preprinted voucher that corporations should use for submitting estimated payments. It contains taxpayer information and is designed for easier processing of payments.

- Estimated Tax Worksheet: This worksheet helps corporations calculate their estimated tax due. It includes sections for taxable income and the estimated tax amount, making it easier to determine quarterly payments.

- Maryland Form 500: This is the final corporation income tax return that corporations must file at the end of the tax year. It summarizes the total income and tax liability for the year.

- Hold Harmless Agreement: Ensuring that all parties are protected from liability during activities can be crucial; refer to the Templates Online for a reliable template.

- Record of Installment Payments: This document is used to keep track of the estimated tax payments made throughout the year. It is important for maintaining accurate records and ensuring compliance with tax obligations.

- Tax Payment Check: When submitting the 500D form, a check or money order must accompany it. This payment should be made out to the Comptroller of the Treasury for the total amount due.

- Request for Replacement Vouchers: If a corporation needs additional vouchers for future payments, they can check the box on the 500D form to request replacement vouchers.

- Mailing Instructions: This includes guidelines for properly mailing the completed forms and payments to ensure they are received by the Comptroller of the Treasury.

Understanding these documents is crucial for corporations to meet their tax obligations effectively. Properly completing and submitting the Maryland 500D form, along with the associated documents, helps ensure compliance and avoids potential penalties. If there are any questions or uncertainties, it is advisable to consult with a tax professional for guidance.

Key takeaways

Filling out and using the Maryland Form 500D requires attention to detail and adherence to specific guidelines. Here are four key takeaways to consider:

- Use the Correct Form: Form 500D is intended for corporations that do not have the Declaration of Estimated Corporation Income Tax Packet. If the packet is available, utilize the preprinted vouchers instead.

- Calculate Estimated Tax Accurately: Complete the Estimated Tax Worksheet to determine the taxable income and the estimated tax due. Ensure that the estimated payments meet the minimum requirements set by Maryland law.

- Timely Submission is Crucial: File Form 500D by the 15th day of the 4th, 6th, 9th, and 12th months following the beginning of the taxable year. Late payments may incur penalties and interest.

- Signature Requirement: An authorized officer or paid preparer must sign and date the form. This verification confirms that the information provided is accurate and complete.

Misconceptions

Misconception 1: The Maryland 500D form is only for large corporations.

This form applies to any corporation that expects to owe more than $1,000 in taxes for the year. Size doesn't matter; if you meet the income threshold, you need to file.

Misconception 2: You can use the 500D form even if you received the preprinted vouchers.

If your corporation received the Declaration of Estimated Corporation Income Tax Packet, you should use the preprinted vouchers instead of the 500D form. Using the correct form ensures accurate processing.

Misconception 3: You don't need to make payments if you think you’ll have a loss.

Even if you anticipate a loss, if you expect to owe any tax, you must still make estimated payments. Not filing can lead to penalties.

Misconception 4: The 500D form can be used for pass-through entities.

This form is not applicable for pass-through entities like S corporations. They have different filing requirements.

Misconception 5: You can submit the form anytime during the year.

The 500D form must be filed by specific due dates: the 15th day of the 4th, 6th, 9th, and 12th months after your tax year begins. Late submissions can incur penalties.

Misconception 6: You don’t need to sign the form if you’re submitting it electronically.

An authorized officer or preparer must sign the form, regardless of how it’s submitted. This verifies the accuracy of the information provided.

Misconception 7: You can send cash with the form.

Cash payments are not allowed. Always include a check or money order made out to the Comptroller of the Treasury.

Misconception 8: You can file the 500D form without entering the Federal Employer Identification Number (FEIN).

Entering the FEIN is mandatory. If you don’t have one, you must apply for it immediately before filing the form.