Blank Maryland 500 Template

Similar forms

- IRS Form 1120: This is the U.S. Corporation Income Tax Return. Like the Maryland 500, it reports a corporation’s income, gains, losses, deductions, and credits. Both forms require detailed financial information to calculate the tax owed.

- IRS Form 1120S: This form is for S corporations and is similar to the Maryland 500 in that it also reports income, deductions, and credits. However, S corporations pass income directly to shareholders, avoiding double taxation.

- IRS Form 1065: Used by partnerships, this form reports income and losses. Similar to the Maryland 500, it provides a comprehensive overview of financial activities, but it distributes profits to partners rather than taxing the entity itself.

- Maryland Form 510: This is the Maryland Pass-Through Entity Tax Return. Like the Maryland 500, it is designed for tax reporting but is specifically for partnerships and S corporations, reflecting their unique tax structures.

- New York Operating Agreement: Essential for LLCs, this document clarifies the management structure and responsibilities of members, enhancing operational effectiveness. For templates, visit PDF Templates Online.

- Maryland Form 502: This is the Maryland Resident Income Tax Return. It parallels the Maryland 500 in that it collects information about income and deductions, but it is focused on individual taxpayers rather than corporations.

- Maryland Form 1065: Similar to the IRS Form 1065, this Maryland form is for partnerships operating in the state. It captures income and deductions, ensuring compliance with state tax laws.

- Maryland Form 500CR: This form is used to claim business tax credits in Maryland. While it serves a different purpose than the Maryland 500, both forms are essential for corporations to navigate state tax obligations effectively.

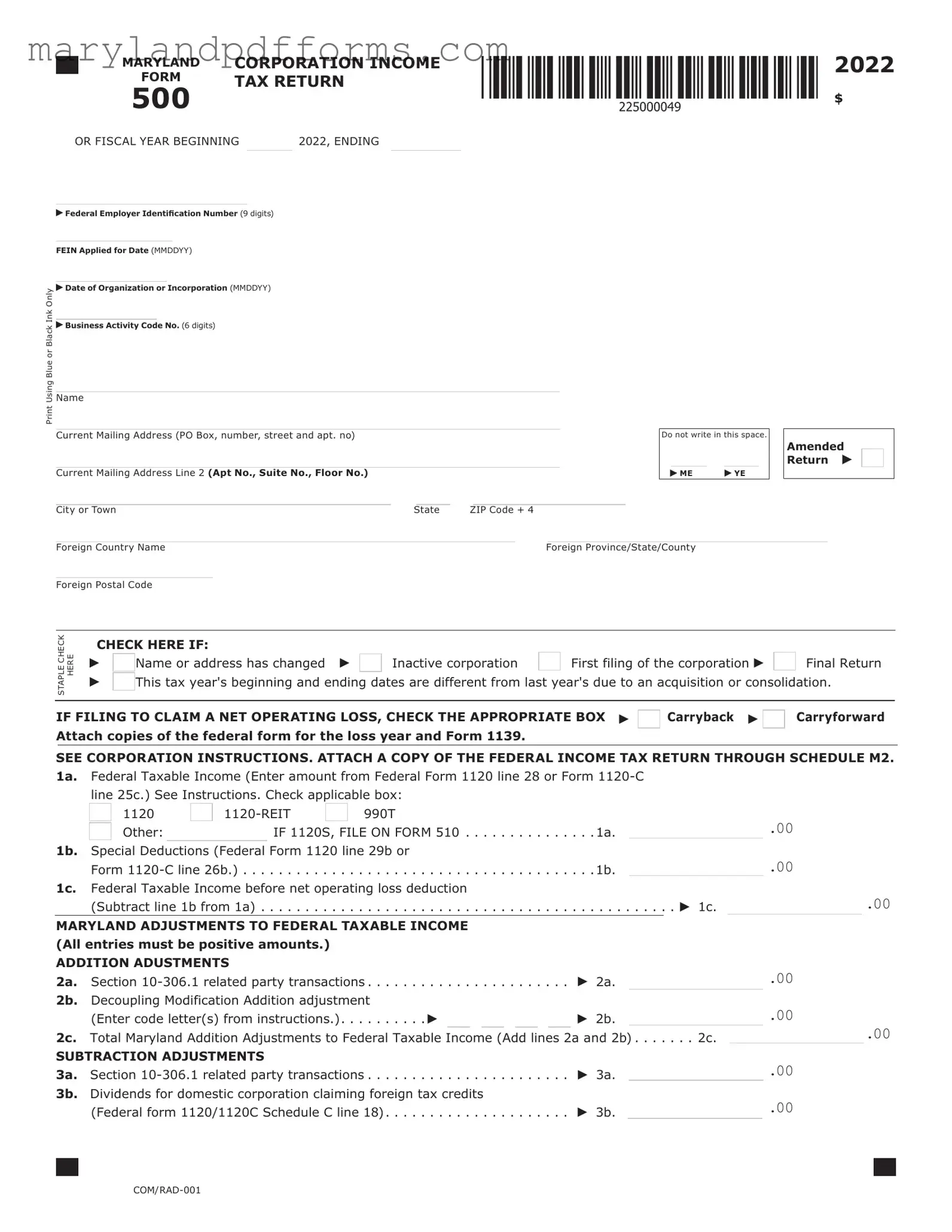

Maryland 500 - Usage Steps

Filling out the Maryland 500 form requires careful attention to detail. Follow these steps to ensure that you complete the form accurately. After filling it out, you will need to submit it to the Maryland Revenue Administration Division, along with any necessary attachments and payments.

- Obtain the Maryland 500 form and use blue or black ink to fill it out.

- Enter your Federal Employer Identification Number (FEIN) at the top of the form.

- Indicate the date you applied for the FEIN and the date of your organization or incorporation.

- Provide your Business Activity Code number.

- Fill in your corporation's name and current mailing address, including city, state, and ZIP code.

- Check any applicable boxes regarding changes in name or address, or if this is your final return or first filing.

- If claiming a net operating loss, check the appropriate box and attach the required federal forms.

- Complete the section for federal taxable income by entering the amount from the appropriate federal form.

- List any special deductions and calculate your federal taxable income before the net operating loss deduction.

- Fill out the Maryland adjustments section, including any addition and subtraction adjustments.

- Calculate your Maryland adjusted federal taxable income.

- If applicable, complete the apportionment of income section, including the Maryland apportionment factor.

- Calculate your Maryland taxable income and the tax owed based on the applicable rate.

- Enter any estimated tax payments, tax credits, and calculate the balance due or overpayment.

- Fill out the direct deposit information for any refund you may receive.

- Sign and date the form, ensuring all required fields are completed.

- Mail the completed form and any attachments to the Comptroller of Maryland.

Learn More on Maryland 500

What is the Maryland 500 form?

The Maryland 500 form is the Corporation Income Tax Return that businesses in Maryland must file annually. It is used to report the corporation's income, deductions, and tax liability for the year. This form is essential for determining how much tax a corporation owes to the state of Maryland based on its federal taxable income and any adjustments specific to Maryland tax laws.

Who needs to file the Maryland 500 form?

Any corporation that is doing business in Maryland, or has income derived from Maryland sources, is required to file the Maryland 500 form. This includes both domestic and foreign corporations. If your corporation is inactive or has undergone significant changes, such as an acquisition, you may also need to file this form. It's crucial to check your specific circumstances to ensure compliance.

What information is required to complete the Maryland 500 form?

To complete the Maryland 500 form, you will need several pieces of information:

- Your Federal Employer Identification Number (FEIN).

- The dates of your corporation's organization or incorporation.

- Your corporation's business activity code.

- Your federal taxable income, which can be found on your federal Form 1120.

- Details about any special deductions or adjustments that apply to your corporation.

- Information about any net operating losses, if applicable.

Having this information ready will facilitate a smoother filing process.

How do I file the Maryland 500 form?

The Maryland 500 form must be filed electronically. This requirement helps ensure accuracy and efficiency in processing your tax return. You can file through the Maryland Comptroller's website or use approved tax software that supports electronic filing. Be sure to keep copies of your completed form and any supporting documents for your records.

What are the deadlines for filing the Maryland 500 form?

The deadline for filing the Maryland 500 form is typically the 15th day of the fourth month following the end of your corporation's tax year. For most corporations that operate on a calendar year, this means the due date is April 15. If you require more time, you can file for an extension using Form 500E, but remember that this does not extend the time to pay any taxes owed.

What should I do if I need to amend my Maryland 500 form?

If you discover that you made an error on your Maryland 500 form after it has been filed, you can amend your return. To do this, check the box indicating that you are filing an amended return on the form and provide a detailed explanation of the changes. Attach any necessary schedules or documentation that supports your amendments. It’s important to file the amended return as soon as possible to avoid potential penalties or interest on unpaid taxes.

Additional PDF Forms

Legal Partnership Vs Marriage - Receipt of this affidavit will be processed by the Employee Benefits Division.

What's the First Thing to Do When Starting a Lab? - Indicate the reason for changes where appropriate to facilitate review.

For those looking to ensure their LLC operates smoothly and in compliance with Texas laws, it is imperative to utilize the Texas Operating Agreement form, which you can find at texasdocuments.net/printable-operating-agreement-form. This document not only provides essential guidelines for management and decision-making but also protects the interests of all members involved.

Maryland Sales Tax Exemption - Each order placed using the certificate should conform to the details provided within it.

Documents used along the form

The Maryland 500 form is a crucial document for corporations operating in Maryland, serving as the state income tax return. Alongside this form, several other documents and forms are often required to ensure compliance with state regulations. Below is a list of these commonly used forms.

- Form 500CR: This form is used to claim business tax credits. Corporations must attach it to their Maryland 500 form to receive any applicable credits.

- Form 500D: This form allows corporations to report estimated tax payments made during the year. It is essential for calculating the total tax liability.

- Form 500E: Corporations use this form to request an extension for filing their Maryland income tax return. It provides additional time to submit the necessary documentation.

- Do Not Resuscitate Order form: Ensure that your wishes regarding resuscitation are documented. For more information, visit https://coloradoformpdf.com/.

- Form MW506NRS: This form is for reporting nonresident withholding tax. It is necessary for corporations that have nonresident partners or shareholders.

- Maryland Schedule K-1: This document details each partner's share of income, deductions, and credits. It is crucial for partnerships and multi-member LLCs filing their taxes.

- Form 1139: This form is used to claim a carryback of net operating losses. It helps corporations recover taxes paid in prior years due to losses incurred in the current year.

- Form 500UP: This form is for reporting any interest and penalties owed on late payments. It is important for maintaining compliance and avoiding additional charges.

- Form 510: This is the Maryland S Corporation Income Tax Return. S Corporations must file this form instead of the Maryland 500 when applicable.

Understanding these forms and their purposes is essential for corporations operating in Maryland. Properly completing and submitting them can help ensure compliance with state tax laws and potentially reduce tax liabilities.

Key takeaways

When filling out and using the Maryland 500 form, keep these key takeaways in mind:

- Use Blue or Black Ink: Always fill out the form using blue or black ink to ensure legibility.

- File Electronically: If you wish to claim business tax credits, you must file this form electronically.

- Check Required Boxes: Indicate any changes such as a name or address change, or if this is your first filing.

- Attach Necessary Documents: Include a copy of the federal income tax return and any relevant schedules.

- Understand NOL Options: If claiming a net operating loss, make sure to check the appropriate box and attach necessary forms.

- Accurate Income Reporting: Report federal taxable income accurately, as this forms the basis for your Maryland tax calculations.

- Review Apportionment Requirements: If operating in multiple states, complete the apportionment section to determine Maryland taxable income.

- Double-Check Calculations: Ensure all calculations are correct, including tax due and any overpayments or credits.

Misconceptions

- Misconception 1: The Maryland 500 form is only for large corporations.

- Misconception 2: Only for-profit corporations need to file this form.

- Misconception 3: Filing the Maryland 500 form is optional.

- Misconception 4: The form can be filed by mail only.

- Misconception 5: The Maryland 500 form is the same as the federal tax return.

- Misconception 6: All income is taxable under Maryland law.

- Misconception 7: The due date for filing is the same every year.

- Misconception 8: Only profits are reported on the Maryland 500 form.

- Misconception 9: You cannot amend the Maryland 500 form.

- Misconception 10: The Maryland 500 form is straightforward and requires little documentation.

This form is required for all corporations operating in Maryland, regardless of size. Even small businesses must file if they meet certain income thresholds.

Non-profit corporations that engage in business activities may also be required to file the Maryland 500 form, depending on their income sources.

Corporations must file this form annually if they are doing business in Maryland. Failure to file can lead to penalties and interest.

Corporations are required to file the Maryland 500 form electronically to claim business tax credits, streamlining the process and ensuring timely submissions.

The Maryland 500 form is distinct from federal forms like the 1120. It requires specific adjustments and information pertinent to Maryland tax laws.

Some income may be exempt from state taxation. For example, certain dividends or interest from specific obligations may qualify for subtraction adjustments.

The due date can vary based on the corporation's fiscal year. Corporations must check their specific filing deadlines to avoid late penalties.

The form requires reporting of both income and deductions, including net operating losses, which can affect the overall tax liability.

Corporations can file an amended return if they discover errors or need to report changes. This is crucial for correcting any discrepancies with reported income or deductions.

In reality, the form requires detailed information and documentation, including federal tax returns and various schedules. Proper preparation is essential to ensure compliance.