Blank Maryland 4B Template

Similar forms

- Maryland Form 4A: This form serves as the Balance Sheet for businesses in Maryland. It complements Form 4B by providing a comprehensive view of the organization’s financial position, including total assets, liabilities, and equity. Both forms are crucial for accurately reporting property and financial information to the state.

- IRS Form 990: Nonprofit organizations use this form to report their financial information to the IRS. Like Form 4B, it requires detailed disclosures about assets and liabilities, helping ensure transparency and compliance with tax regulations.

- New York Motorcycle Bill of Sale: This form includes critical details about the sale and is essential for protecting both the buyer and seller. For templates and guidance, you can refer to PDF Templates Online.

- Maryland Personal Property Return: This document is similar in purpose, as it requires businesses to report personal property to the state. It includes details about property types and values, similar to the categories outlined in Form 4B.

- Depreciation Schedule (Federal Form 4562): This federal form is used to report depreciation and amortization. Like Form 4B, it helps businesses track the depreciation of assets over time, ensuring accurate financial reporting.

- Form 1065 (U.S. Return of Partnership Income): Partnerships use this form to report income, deductions, and credits. It parallels Form 4B in that both require detailed information about assets and how they contribute to the overall financial picture of the entity.

- Form 1120 (U.S. Corporation Income Tax Return): Corporations utilize this form for tax reporting. It shares similarities with Form 4B, as both necessitate a breakdown of property and asset values, which are essential for determining tax liabilities.

- State Property Tax Returns: Various states require property tax returns that report the value of owned property. This is akin to Form 4B, which documents property values for taxation purposes, ensuring compliance with local tax laws.

Maryland 4B - Usage Steps

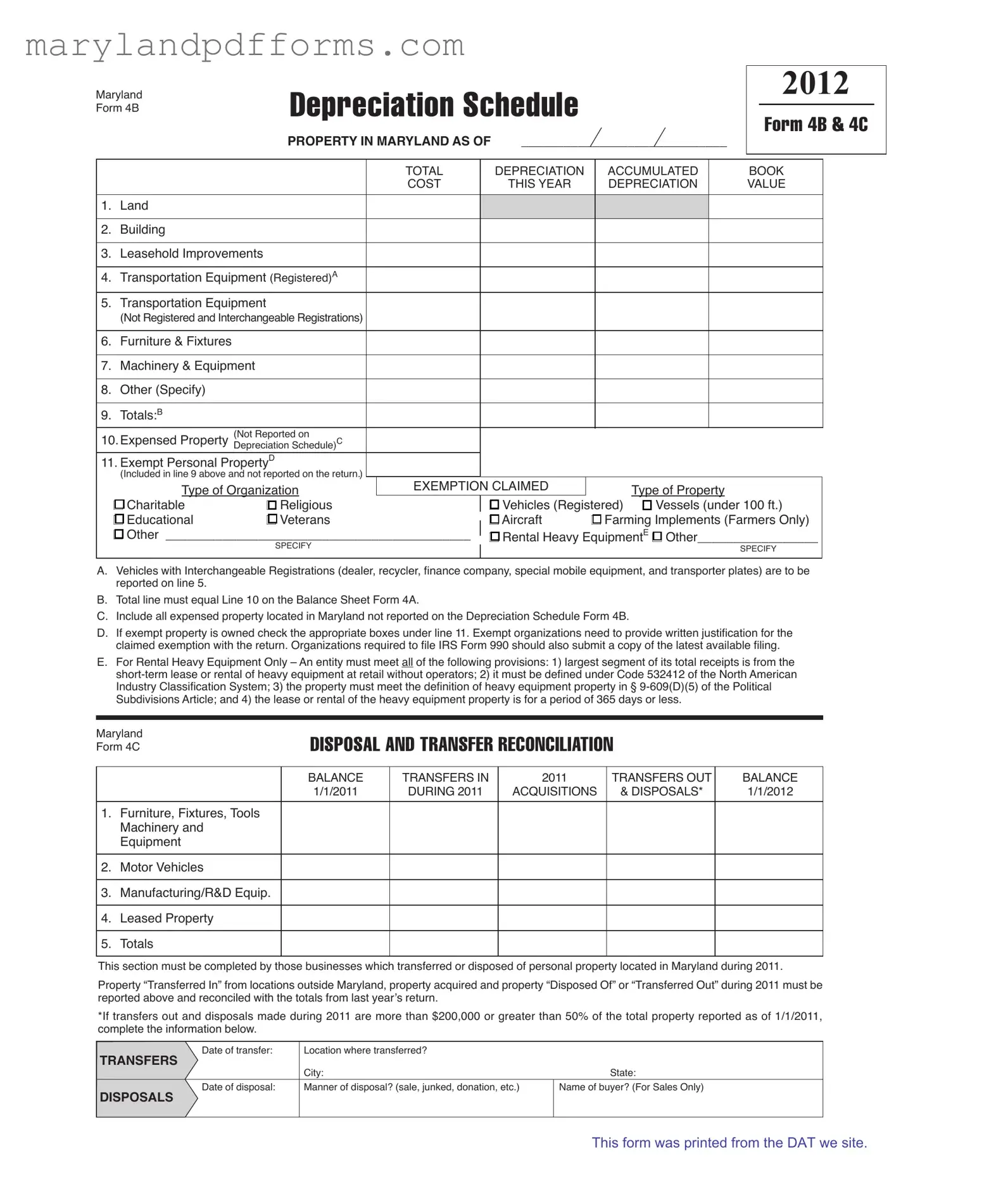

Completing the Maryland 4B form requires careful attention to detail. This form is essential for reporting property and depreciation information to the state. After filling it out, ensure that all required documentation is attached, especially if claiming exemptions.

- Gather Required Information: Collect details about all property owned in Maryland, including land, buildings, equipment, and any other relevant assets.

- Enter Property Information: In the designated fields, list each type of property. Include land, buildings, leasehold improvements, transportation equipment, furniture, fixtures, machinery, and any other specified assets.

- Calculate Depreciation: For each property type, calculate the total depreciation accumulated and the book cost for the current year. Fill in these amounts in the corresponding columns.

- Complete Totals: Add up the values in the depreciation and book cost columns. Ensure that the total in line 9 matches the total reported on line 10 of the Balance Sheet Form 4A.

- Report Expensed Property: If there is any property that has been expensed but not reported on the depreciation schedule, list it under line 10.

- Claim Exemptions: If applicable, check the appropriate boxes under line 11 to claim any exemptions. Provide written justification for the claimed exemption.

- Review and Verify: Carefully review all entries for accuracy. Ensure that all required information is complete and correct before submission.

- Submit the Form: Once verified, submit the completed Maryland 4B form along with any necessary documentation to the appropriate state agency.

Learn More on Maryland 4B

What is the purpose of the Maryland 4B form?

The Maryland 4B form is used to report the depreciation of personal property owned by businesses in Maryland. It helps organizations detail the accumulated depreciation on various types of property, such as land, buildings, machinery, and equipment. Accurate reporting is essential for tax purposes and ensures compliance with state regulations.

Who needs to file the Maryland 4B form?

Any business entity that owns personal property located in Maryland must file the Maryland 4B form. This includes corporations, partnerships, and sole proprietorships. If the organization has property that is subject to depreciation, it is required to complete and submit this form as part of its annual tax return. Additionally, exempt organizations claiming property exemptions must also file this form.

What information is required on the Maryland 4B form?

The Maryland 4B form requires detailed information about various categories of property, including:

- Land

- Buildings

- Leasehold improvements

- Transportation equipment (registered and not registered)

- Furniture and fixtures

- Machinery and equipment

- Other specified property

Additionally, businesses must report total depreciation, expensed property, and any claimed exemptions. Accurate and complete information is crucial to avoid potential penalties.

What exemptions can be claimed on the Maryland 4B form?

Organizations may claim exemptions for certain types of property on the Maryland 4B form. Common exemptions include:

- Charitable organizations

- Religious institutions

- Educational entities

- Vehicles and vessels under specific conditions

- Farming implements for farmers

- Rental heavy equipment meeting specific criteria

To claim an exemption, the organization must check the appropriate boxes on the form and provide written justification along with the return. For those required to file IRS Form 990, a copy of the latest filing should also be submitted.

Additional PDF Forms

How to Prepare for Polygraph Test - Clear communication about all aspects of one’s background fosters trust with the police department.

For individuals seeking clarity in their separation process, the California Marital Separation Agreement form serves as a critical tool to ensure that all aspects of the separation are properly defined and documented.

Tax Id Number Lookup Maryland - Providing the date wages were first paid is essential for unemployment insurance registration.

Documents used along the form

The Maryland 4B form is an important document for reporting depreciation on property located in Maryland. When filing this form, there are several other documents that may be required or beneficial to include. Below is a list of commonly used forms and documents that often accompany the Maryland 4B form, along with brief descriptions of each.

- Maryland Form 4C: This form is used for reporting the disposal and transfer reconciliation of personal property. It tracks acquisitions and disposals during the year, ensuring accurate reporting of property changes.

- IRS Form 990: Non-profit organizations must file this form to report their financial information. A copy of the latest available filing may be required when claiming exemptions on the Maryland 4B form.

- Maryland Balance Sheet Form 4A: This form provides a comprehensive view of the organization’s financial position. It is essential for reconciling totals reported on the Maryland 4B form.

- Texas Notice to Quit: For landlords in Texas looking to inform tenants of the need to vacate the rental property, utilizing the https://texasdocuments.net/printable-notice-to-quit-form/ can be crucial for compliance with local rental laws.

- Property Exemption Application: Organizations claiming exemptions for certain types of property may need to submit an application detailing the justification for the exemption claimed on the Maryland 4B form.

- Depreciation Schedule: This document outlines the depreciation for various assets. It can provide additional details that support the figures reported on the Maryland 4B form.

- Sales Receipts: If property has been sold, receipts may be required to substantiate the amounts reported as disposals on the Maryland 4C form.

- Inventory List: A detailed inventory of all personal property may be necessary to verify the assets reported on the Maryland 4B form, especially if there are significant changes in property values.

- Lease Agreements: For leased property, copies of lease agreements may be required to confirm terms and conditions, particularly for reporting leased equipment on the Maryland 4C form.

Understanding the additional documents that may be required alongside the Maryland 4B form can help ensure a smoother filing process. Each document serves a specific purpose and can provide necessary support for the information reported, aiding in compliance with Maryland's property tax regulations.

Key takeaways

When filling out the Maryland Form 4B, consider the following key takeaways:

- Accurate Information: Ensure all property values are accurately reported as of the specified date.

- Categories of Property: Familiarize yourself with the different categories listed, such as land, buildings, and machinery.

- Depreciation Calculation: Calculate total depreciation accumulated correctly for each category to reflect the current value.

- Expensed Property: Report any expensed property not included in the depreciation schedule on Line 10.

- Exemptions: Identify any exemptions that apply to your organization and check the appropriate boxes on Line 11.

- Documentation: Keep written justification for claimed exemptions ready for submission with the return.

- IRS Form 990: If applicable, include a copy of the latest IRS Form 990 with your filing.

- Rental Heavy Equipment: Ensure your organization meets all criteria to claim rental heavy equipment exemptions.

- Transfer and Disposal Reporting: Complete the disposal and transfer reconciliation section if applicable, including all necessary details.

- Review and Verify: Thoroughly review the completed form for accuracy before submission to avoid delays or penalties.

Misconceptions

Understanding the Maryland Form 4B can be challenging due to several misconceptions. Here are nine common misunderstandings about this form, along with clarifications to help you navigate it more easily.

- Form 4B is only for businesses. Many people think this form is exclusively for businesses. However, it is also applicable to non-profit organizations and other entities that own property in Maryland.

- Only registered vehicles need to be reported. Some individuals believe that only registered vehicles are included in Form 4B. In reality, both registered and non-registered vehicles must be reported, particularly under the interchangeable registrations section.

- Depreciation is only for buildings. A common misconception is that depreciation applies solely to buildings. In fact, depreciation can be claimed on various types of property, including machinery, equipment, and leasehold improvements.

- Exemptions are automatic. Many assume that if their organization qualifies for an exemption, it will be automatically granted. This is not the case; organizations must provide written justification for any claimed exemptions when filing.

- Form 4B can be submitted without supporting documentation. Some believe they can submit Form 4B without any additional documents. However, if you are claiming exemptions, you must include the latest IRS Form 990 and other relevant paperwork.

- All personal property is reported on Form 4B. There is a misconception that all personal property should be reported on Form 4B. In fact, certain expensed properties that are not reported on the depreciation schedule must be included separately on the form.

- Only new acquisitions need to be reported. Some people think they only need to report new acquisitions. However, any transfers or disposals of property during the year must also be reconciled and reported on Form 4B.

- Heavy equipment is not subject to specific definitions. It is often misunderstood that heavy equipment can be classified without adhering to specific definitions. In reality, to qualify for certain exemptions, the equipment must meet detailed criteria set forth in the Maryland regulations.

- Filing Form 4B is optional for small businesses. Some small business owners believe that filing Form 4B is optional if their property value is low. This is incorrect; all businesses with property in Maryland are required to file, regardless of the property’s value.

By understanding these misconceptions, individuals and organizations can better navigate the requirements of the Maryland Form 4B and ensure compliance.