Blank Maryland 4A Template

Similar forms

- Balance Sheet: Similar to the Maryland 4A form, a standard balance sheet provides a snapshot of a company's financial position at a specific point in time. It includes assets, liabilities, and equity, allowing for a clear view of the business's financial health.

- Income Statement: While the Maryland 4A focuses on assets and liabilities, an income statement summarizes revenue and expenses over a period. Both documents are essential for assessing a business's overall financial performance.

- Cash Flow Statement: This document tracks the flow of cash in and out of a business. Like the Maryland 4A, it provides insights into the company's financial stability, though it emphasizes liquidity rather than overall financial position.

- Statement of Changes in Equity: This statement outlines changes in equity over a reporting period. It complements the Maryland 4A by detailing how retained earnings and other equity components evolve, providing a fuller picture of financial health.

- Tax Return Forms: Business tax return forms, such as the IRS Form 1120 for corporations, share similarities with the Maryland 4A in that they require detailed reporting of financial information. Both documents are used for tax assessment and compliance.

- Financial Projections: These documents estimate future financial performance based on historical data. Like the Maryland 4A, they rely on accurate financial data to inform stakeholders about potential growth and stability.

- Personal Property Tax Returns: These returns are often required by local jurisdictions and share a focus on reporting assets and liabilities. They serve a similar purpose to the Maryland 4A in determining tax obligations for personal property.

- Operating Agreement: A crucial document for LLCs, the Operating Agreement sets forth the management structure and operational guidelines essential for compliance and governance. For detailed instructions and to fill out the form, visit https://texasdocuments.net/printable-operating-agreement-form.

- Corporate Annual Reports: Annual reports provide a comprehensive overview of a company's financial performance over the year. They include balance sheets, income statements, and other key financial information, paralleling the purpose of the Maryland 4A.

Maryland 4A - Usage Steps

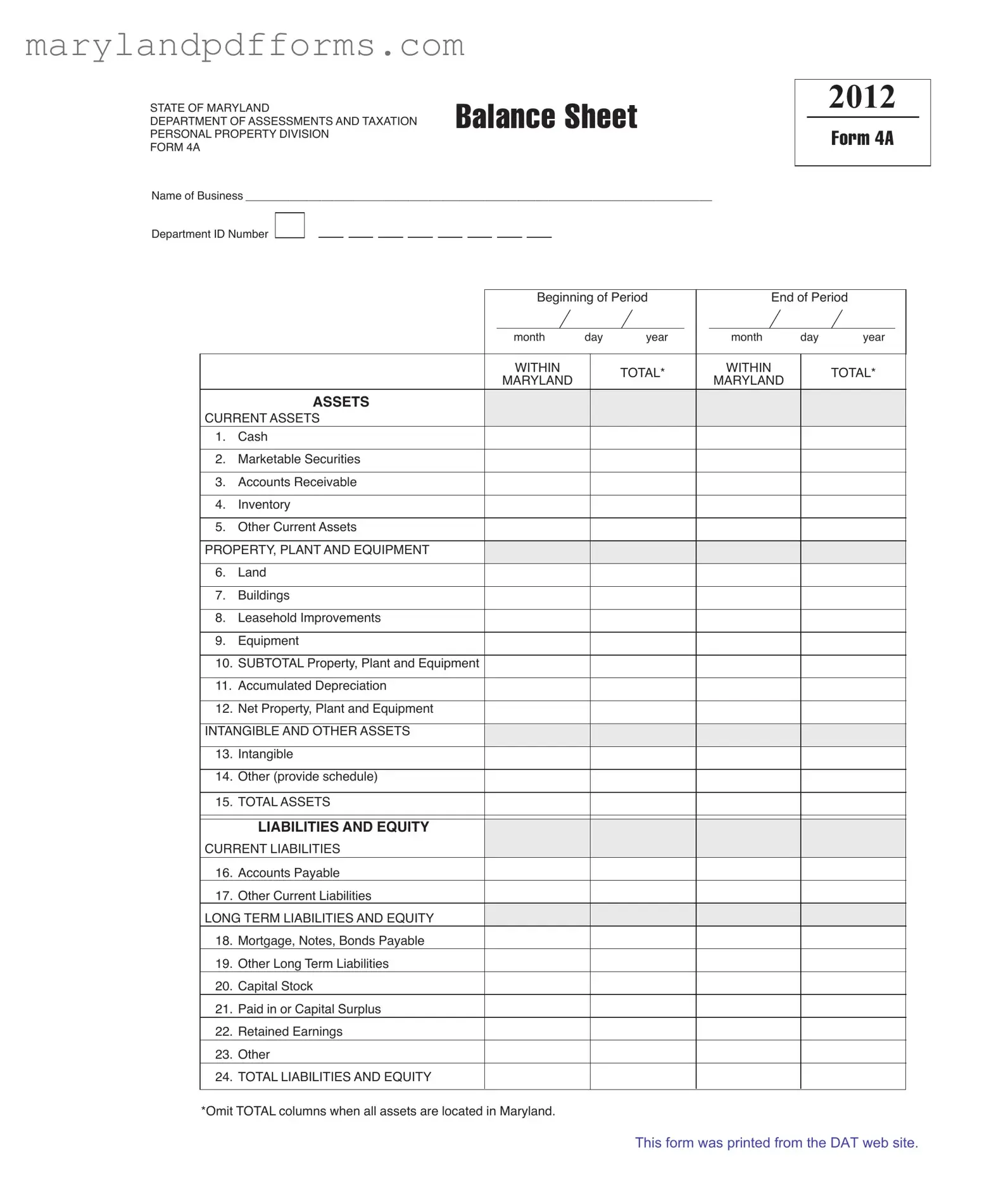

Completing the Maryland 4A form involves providing detailed information about your business's financial status at the beginning and end of a specific period. This information will be used for assessment and tax purposes. Follow these steps to ensure accurate completion of the form.

- Begin by entering the Name of Business at the top of the form.

- Fill in the Department ID Number associated with your business.

- Specify the Beginning of Period date by entering the month, day, and year.

- Specify the End of Period date by entering the month, day, and year.

- In the ASSETS section, list the following under CURRENT ASSETS:

- 1. Cash

- 2. Marketable Securities

- 3. Accounts Receivable

- 4. Inventory

- 5. Other Current Assets

- Next, under PROPERTY, PLANT AND EQUIPMENT, provide the following:

- 6. Land

- 7. Buildings

- 8. Leasehold Improvements

- 9. Equipment

- 10. SUBTOTAL Property, Plant and Equipment

- Indicate the Accumulated Depreciation and calculate the Net Property, Plant and Equipment as follows:

- 11. Accumulated Depreciation

- 12. Net Property, Plant and Equipment

- Under INTANGIBLE AND OTHER ASSETS, provide the following:

- 13. Intangible

- 14. Other (provide schedule)

- Calculate and enter the TOTAL ASSETS.

- In the LIABILITIES AND EQUITY section, list the following under CURRENT LIABILITIES:

- 16. Accounts Payable

- 17. Other Current Liabilities

- Next, under LONG TERM LIABILITIES AND EQUITY, include the following:

- 18. Mortgage, Notes, Bonds Payable

- 19. Other Long Term Liabilities

- 20. Capital Stock

- 21. Paid in or Capital Surplus

- 22. Retained Earnings

- 23. Other

- Finally, calculate and enter the TOTAL LIABILITIES AND EQUITY.

Once you have completed the form, review all entries for accuracy. Ensure that you omit the TOTAL columns if all assets are located in Maryland. Submit the form according to the instructions provided by the Department of Assessments and Taxation.

Learn More on Maryland 4A

What is the Maryland 4A form?

The Maryland 4A form is a balance sheet used by businesses to report their financial position to the Department of Assessments and Taxation. It includes detailed information about a business's assets, liabilities, and equity as of a specific date.

Who needs to file the Maryland 4A form?

Any business entity operating in Maryland that has personal property must file the Maryland 4A form. This includes corporations, partnerships, and sole proprietorships that own or lease personal property in the state.

What information is required on the Maryland 4A form?

The form requires information about:

- Current Assets, such as cash, accounts receivable, and inventory.

- Property, Plant, and Equipment, including land, buildings, and equipment.

- Intangible and Other Assets.

- Current Liabilities, such as accounts payable.

- Long-term Liabilities and Equity, including capital stock and retained earnings.

When is the Maryland 4A form due?

The Maryland 4A form is typically due on April 15th of each year. However, businesses should verify any specific deadlines or extensions that may apply to their situation.

What happens if I do not file the Maryland 4A form?

Failing to file the Maryland 4A form can result in penalties and interest on any unpaid taxes. Additionally, the business may face difficulties in maintaining good standing with the state.

Can I file the Maryland 4A form online?

Yes, businesses can file the Maryland 4A form online through the Maryland Department of Assessments and Taxation's website. This option may streamline the process and ensure timely submission.

What is the purpose of the TOTAL columns in the form?

The TOTAL columns on the Maryland 4A form summarize the total assets and liabilities of the business. However, if all assets are located within Maryland, businesses can omit these columns.

How do I determine the value of my assets?

To determine the value of assets, businesses should assess the fair market value of each item. This may involve reviewing purchase prices, current market conditions, and depreciation schedules for property and equipment.

Where can I find additional resources or assistance with the Maryland 4A form?

Additional resources, including instructions and guidelines for completing the Maryland 4A form, can be found on the Maryland Department of Assessments and Taxation's website. For personalized assistance, consider reaching out to a tax professional or legal advisor.

Additional PDF Forms

Maryland State Compliance Application - Be sure to refer to the checklist on the last page before submitting your application.

The Aaa International Driving Permit Application form is a crucial document for travelers who wish to drive legally in foreign countries. This form allows individuals to obtain an International Driving Permit (IDP), which translates their driver's license into multiple languages. Completing the application accurately ensures a smooth process for obtaining the permit, enabling safe and legal driving abroad. For more information, you can visit the official application page at documentonline.org/blank-aaa-international-driving-permit-application/.

Masonic Charities of Maryland - Students are reminded to submit all materials by the deadline to ensure consideration for the scholarship.

Documents used along the form

The Maryland 4A form serves as a crucial document for businesses to report their financial status, specifically regarding their balance sheet. Along with this form, several other documents are often required to provide a complete picture of a business's financial health. Below is a list of related forms and documents that may be necessary.

- Personal Property Tax Return (Form 1): This document is used to report the value of personal property owned by a business. It details the assets that are subject to taxation and is typically submitted annually to the local tax authority.

- Income Statement: Also known as a profit and loss statement, this document summarizes the revenues, costs, and expenses incurred during a specific period. It provides insight into the company's operational performance and profitability.

- Statement of Cash Flows: This document outlines the cash inflows and outflows from operating, investing, and financing activities. It helps stakeholders understand how cash is generated and used over a given period.

- Balance Sheet (Form 4B): Similar to the 4A form, this balance sheet provides a snapshot of a business's financial position, detailing its assets, liabilities, and equity. It may be required for specific types of businesses or industries.

- New York Operating Agreement: This document is crucial for LLCs in New York, defining the management structure and operational guidelines. For templates, you can refer to PDF Templates Online.

- Business License Application: This document is essential for businesses to legally operate within Maryland. It ensures compliance with local regulations and may need to be renewed periodically.

These documents work in tandem with the Maryland 4A form to ensure that businesses maintain transparency and comply with state regulations. Having all necessary paperwork prepared and submitted accurately is vital for smooth operations and to avoid potential legal issues.

Key takeaways

Filling out the Maryland 4A form can seem daunting, but it’s essential for accurately reporting your business's financial position. Here are some key takeaways to keep in mind:

- Know Your Business Details: Make sure to include your business name and Department ID number at the top of the form. This information is crucial for proper identification.

- Accurate Dates: Fill in the beginning and end dates for the reporting period. This helps in tracking your financial performance over time.

- List All Assets: Break down your assets into categories like current assets, property, plant, and equipment, and intangible assets. Each category has specific items that need to be reported.

- Calculate Depreciation: If you have property, plant, and equipment, don’t forget to account for accumulated depreciation. This affects the net value of your assets.

- Report Liabilities Clearly: Distinguish between current liabilities and long-term liabilities. This will give a clearer picture of your business's financial obligations.

- Omit Total Columns If Necessary: If all your assets are located in Maryland, you can skip the total columns. This simplifies the reporting process.

By keeping these points in mind, you can fill out the Maryland 4A form accurately and efficiently. It’s an important step in managing your business’s financial health.

Misconceptions

Many people have misunderstandings about the Maryland 4A form. Here are some common misconceptions:

- Only large businesses need to file the 4A form. This is not true. Any business with personal property in Maryland must file, regardless of size.

- The 4A form is only for corporations. This form is for any business entity, including sole proprietorships and partnerships.

- Filing the 4A form is optional. Actually, it is mandatory for businesses that meet certain criteria. Failing to file can lead to penalties.

- All assets must be reported on the form. If all assets are located in Maryland, you can omit the total columns. However, you still need to report the assets.

- Depreciation is not important for the 4A form. In fact, accumulated depreciation must be included to accurately reflect net property values.

- The 4A form is only for tangible assets. This form also requires reporting of intangible assets, which are just as important.

- You can file the 4A form anytime during the year. There are specific deadlines for filing, typically aligned with the state’s tax calendar.

- It’s easy to complete the form without help. While it may seem straightforward, many find it beneficial to consult with a tax professional.

- Once filed, you don’t need to update the form. Businesses must update their 4A form annually to reflect any changes in assets or liabilities.