Blank Maryland 193 Template

Similar forms

The Maryland 193 form serves as a trustee-to-trustee distribution form for rollovers, primarily used for retirement accounts. Similar forms exist in other contexts, each designed to facilitate the transfer of funds or benefits. Here are nine documents that share similarities with the Maryland 193 form:

- IRS Form 5305-RA: This form is used to establish a traditional Individual Retirement Account (IRA). Like the Maryland 193, it outlines the necessary information for transferring retirement funds into an IRA.

- Texas Notice to Quit form: This legal document informs tenants they must vacate the rental property. For more details, visit the official page: https://texasdocuments.net/printable-notice-to-quit-form/

- IRS Form 1099-R: This document reports distributions from pensions, annuities, and retirement plans. It is similar to the Maryland 193 in that both deal with the movement of retirement funds, but the 1099-R focuses on reporting rather than initiating a rollover.

- IRS Form 8606: This form is used to report nondeductible contributions to traditional IRAs and distributions from Roth IRAs. It parallels the Maryland 193 form in that it addresses the tax implications of retirement account distributions.

- Form W-4P: This form is used for withholding on pensions and annuities. While the Maryland 193 form is about directing distributions, the W-4P focuses on tax withholding preferences for those distributions.

- Form 8854: This form is for expatriates to report their expatriation and ensure compliance with tax obligations. It is similar to the Maryland 193 in that both documents deal with financial transitions, albeit in different contexts.

- Plan Distribution Request Form: Many retirement plans have their own distribution request forms. These forms are akin to the Maryland 193 as they request the release of funds from retirement accounts.

- Transfer Request Form: Used by financial institutions to facilitate the transfer of assets between accounts, this form shares the purpose of the Maryland 193 by enabling the movement of retirement funds.

- Qualified Domestic Relations Order (QDRO): This legal order recognizes a spouse's right to receive a portion of a retirement plan. It is similar to the Maryland 193 in that both involve the distribution of retirement assets, but the QDRO specifically addresses divorce settlements.

- Beneficiary Designation Form: This document allows account holders to designate beneficiaries for their retirement accounts. While it does not directly initiate a distribution, it is related to the management of retirement funds, similar to the Maryland 193.

Each of these forms plays a vital role in managing retirement assets and ensuring that distributions are handled appropriately. Understanding their similarities can help individuals navigate their financial options more effectively.

Maryland 193 - Usage Steps

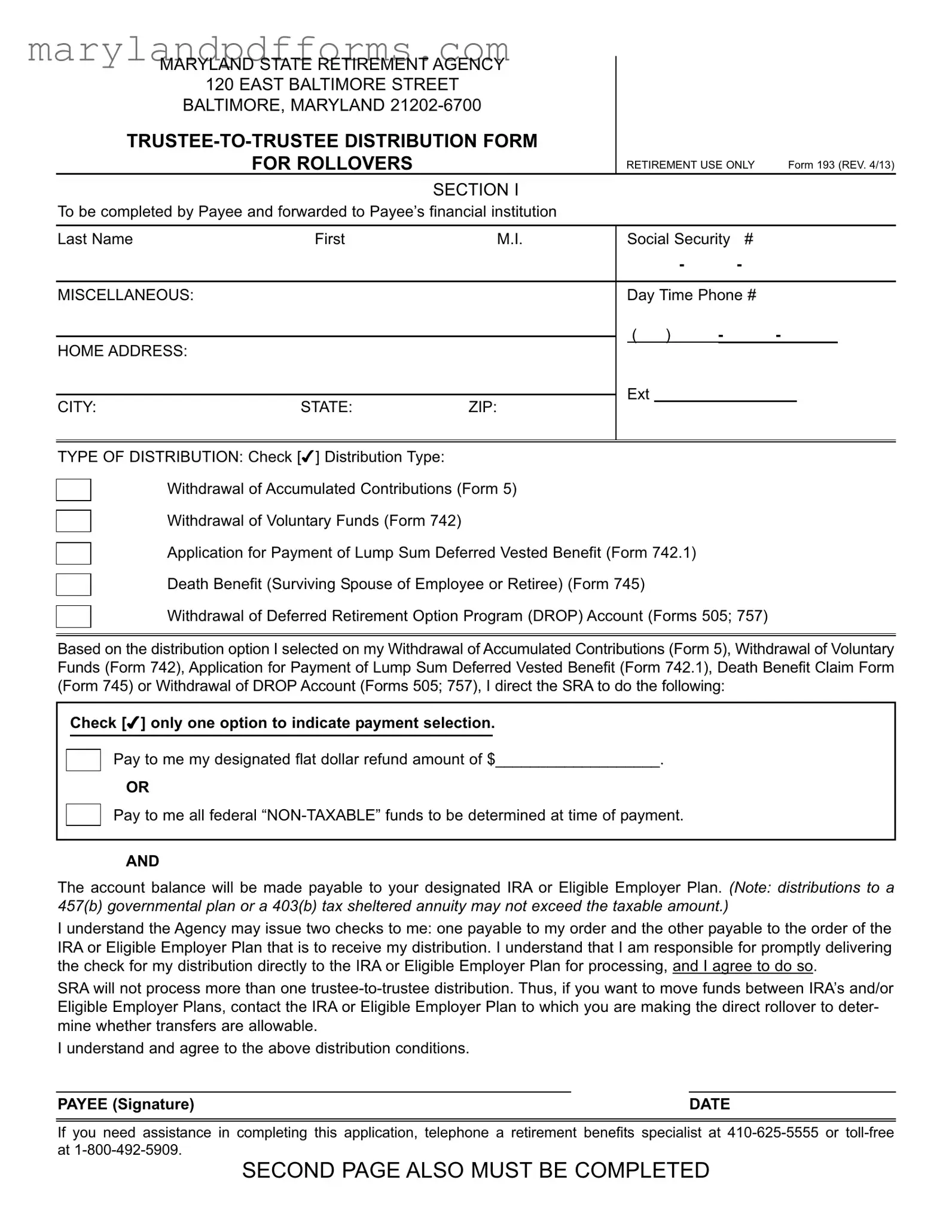

Completing the Maryland 193 form requires careful attention to detail. This process involves providing personal information, selecting the type of distribution, and ensuring that the designated financial institution is accurately noted. Following these steps will help ensure a smooth submission and processing of the form.

- Begin by filling out Section I. Enter your last name, first name, and middle initial.

- Provide your Social Security number in the format of XXX-XX-XXXX.

- Include your daytime phone number, ensuring the area code is correct.

- Fill in your home address, including city, state, and ZIP code.

- Select the type of distribution by checking the appropriate box. Options include withdrawal of accumulated contributions, voluntary funds, or other specified benefits.

- Specify your payment selection. Indicate either a flat dollar refund amount or all federal “NON-TAXABLE” funds.

- Sign and date the form in the designated area to confirm your understanding of the distribution conditions.

- Proceed to Section II, which must be completed by the financial institution. Ensure that the institution verifies your information from Section I.

- Provide the name and address of the financial institution where the funds will be directed.

- Specify the depositor account title, ensuring it is clear and accurate for proper check preparation.

- Optionally, enter the payee’s account number.

- Check the appropriate box to affirm the type of plan (e.g., Traditional IRA, Roth IRA, etc.) that will receive the funds.

- Have a representative from the financial institution print or type their name, sign, and date the form.

- Finally, ensure all required information is complete before submitting the form to the State Retirement Agency at the specified address.

Learn More on Maryland 193

-

What is the Maryland 193 form?

The Maryland 193 form is a Trustee-to-Trustee Distribution Form used for rollovers of retirement funds. It allows individuals to request the transfer of their retirement account balances directly to another financial institution, such as an IRA or an eligible employer plan.

-

Who needs to complete the Maryland 193 form?

This form must be completed by the payee, who is the individual receiving the distribution. The payee needs to provide their personal information and indicate the type of distribution they are requesting.

-

What types of distributions can be requested using this form?

The form allows for several types of distributions, including:

- Withdrawal of Accumulated Contributions

- Withdrawal of Voluntary Funds

- Application for Payment of Lump Sum Deferred Vested Benefit

- Death Benefit for Surviving Spouse

- Withdrawal of Deferred Retirement Option Program (DROP) Account

-

How should the completed form be submitted?

The completed Maryland 193 form should be sent to the State Retirement Agency at 120 East Baltimore Street, Baltimore, Maryland 21202-6700. It is important to ensure that all sections of the form are filled out correctly before submission.

-

Can I receive my funds in multiple checks?

Yes, the State Retirement Agency may issue two checks. One check will be payable to the payee, and the other will be made out to the designated IRA or Eligible Employer Plan. It is the payee's responsibility to deliver the check for the distribution to the receiving institution.

-

What should I do if I have questions about completing the form?

If you have questions or need assistance, you can contact a retirement benefits specialist at 410-625-5555 or toll-free at 1-800-492-5909. They can provide guidance on how to complete the form correctly.

-

What happens if I provide incorrect information on the form?

Providing incorrect information can delay the processing of your distribution. It is crucial to double-check all details, including your social security number and financial institution information, to avoid any issues.

-

Is the information I provide on the form confidential?

Yes, all information provided on the Maryland 193 form is confidential. It will only be used to process payment data between the Maryland State Retirement Agency and the financial institution.

-

Are there any restrictions on the types of accounts that can receive a rollover?

Yes, not all accounts can accept rollovers. The form specifies that distributions to a 457(b) governmental plan or a 403(b) tax-sheltered annuity may not exceed the taxable amount. It is important to verify whether the receiving account can accept the funds.

-

What should I do if I need to transfer funds between multiple accounts?

If you wish to move funds between multiple IRAs or Eligible Employer Plans, you should contact the receiving institution first. They can inform you about any specific requirements or restrictions regarding transfers.

Additional PDF Forms

Md Tax Forms - Part II of the form focuses on calculating your Maryland tax specifically.

Maryland Credentialing Application - List your primary language and county to ensure effective communication and service delivery.

When engaging in the sale of a motorcycle, utilizing the New York Motorcycle Bill of Sale form is imperative for both parties involved. This document not only details the transaction but also serves to protect the rights of the buyer and seller. For those looking for a reliable source to obtain such forms, PDF Templates Online offers convenient access to the necessary paperwork, ensuring a seamless transfer of ownership and minimizing the risk of future disputes.

Maryland Income Tax Forms - Corporations must use Form 500E to extend their tax return filing deadline if necessary.

Documents used along the form

The Maryland 193 form is essential for individuals looking to execute a trustee-to-trustee distribution for rollovers within the Maryland State Retirement Agency. Alongside this form, several other documents may be necessary to facilitate various aspects of retirement distributions. Below is a list of commonly used forms and documents that often accompany the Maryland 193 form.

- Withdrawal of Accumulated Contributions (Form 5): This form allows members to withdraw their accumulated contributions upon termination of employment or retirement.

- Withdrawal of Voluntary Funds (Form 742): Members use this form to withdraw any voluntary contributions made to their retirement accounts.

- Application for Payment of Lump Sum Deferred Vested Benefit (Form 742.1): This application is for individuals who have a deferred vested benefit and wish to receive a lump sum payment.

- Death Benefit Claim Form (Form 745): This form is used by surviving spouses or beneficiaries to claim death benefits from the retirement system.

- Withdrawal of Deferred Retirement Option Program (DROP) Account (Forms 505; 757): These forms facilitate the withdrawal of funds from a DROP account, which allows members to accumulate retirement benefits while still employed.

- Direct Rollover Request Form: This document is necessary for initiating a direct rollover from one retirement account to another, ensuring tax advantages are preserved.

- Beneficiary Designation Form: Members use this form to designate beneficiaries for their retirement accounts, ensuring that benefits are distributed according to their wishes.

- Marital Separation Agreement Form: To navigate the complexities of separation, individuals can utilize the important Marital Separation Agreement essentials to ensure all legal aspects are adequately addressed.

- Transfer Request Form: This form is utilized to request the transfer of retirement funds between different financial institutions or plans.

- Tax Withholding Election Form: This document allows members to specify their tax withholding preferences for any distributions taken from their retirement accounts.

Each of these forms plays a vital role in managing retirement benefits and ensuring compliance with regulations. Properly completing and submitting the necessary documents can help streamline the process and avoid potential delays in accessing retirement funds.

Key takeaways

Understanding the Maryland 193 Form is essential for anyone looking to manage their retirement funds effectively. Here are four key takeaways regarding the form and its usage:

- Complete All Required Sections: Ensure that both Section I and Section II are filled out completely. Section I requires personal information from the payee, while Section II must be completed by the financial institution. Incomplete forms may delay processing.

- Select the Correct Distribution Type: Carefully choose the appropriate distribution type from the options provided. Options include withdrawals of accumulated contributions, voluntary funds, and various benefits. Each selection may have different implications for your retirement account.

- Understand Payment Options: You can choose to receive a flat dollar refund or all federal non-taxable funds. Be aware that the agency may issue two checks—one to you and another to your designated IRA or employer plan. Promptly deliver the check to the appropriate institution for processing.

- Consult with a Specialist if Needed: If you encounter any difficulties while completing the form, do not hesitate to reach out to a retirement benefits specialist. Assistance is available via phone, ensuring that you can navigate the process smoothly.

Misconceptions

- Misconception 1: The Maryland 193 form can be used for any type of retirement account rollover.

- Misconception 2: Completing the Maryland 193 form guarantees immediate access to funds.

- Misconception 3: Only the account holder needs to sign the Maryland 193 form.

- Misconception 4: The Maryland 193 form allows for multiple trustee-to-trustee distributions at once.

- Misconception 5: After completing the Maryland 193 form, there is no need to contact the receiving financial institution.

- Misconception 6: The Maryland 193 form can be submitted without verifying personal information.

- Misconception 7: The Maryland 193 form is only for retirement account withdrawals.

This form is specifically designed for trustee-to-trustee distributions related to Maryland state retirement accounts. It is not valid for all retirement accounts.

Filling out the form does not ensure instant access. The processing time depends on the financial institution and the specifics of the rollover.

Both the payee and a representative from the financial institution must complete and sign the form to ensure proper processing.

The form permits only one trustee-to-trustee distribution at a time. Additional distributions require separate forms.

It is essential to communicate with the receiving institution to confirm they accept the rollover and understand their specific requirements.

Accurate personal information is crucial. Incomplete or incorrect details can delay the processing of the rollover.

While it includes withdrawal options, it also facilitates transfers to other eligible employer plans and IRAs.