Blank Maryland 129 Template

Similar forms

- Form 548 - Maryland Power of Attorney: This form allows a taxpayer to designate another person to act on their behalf. Similar to Form 129, it requires specific taxpayer information and can be used to request copies of tax returns without needing to submit Form 129 separately.

- Form 548P - Reporting Agent Authorization: This document grants authority to a reporting agent to handle tax matters for a taxpayer. Like Form 129, it requires signatures and can streamline the process of obtaining tax information.

- Form 130 - Maryland Tax Return Request: This form is used to request a copy of a Maryland tax return for a specific year. It shares similarities with Form 129 in that it requires taxpayer identification and can be submitted by mail or in person.

- California Medical Power of Attorney: This important document enables you to appoint someone to make medical decisions on your behalf, as detailed in our comprehensive Medical Power of Attorney form guide.

- Form 1040 - U.S. Individual Income Tax Return: While this federal form is for filing taxes, it is similar in that it requires personal information and can be referenced when requesting state tax returns through Form 129.

- Form W-2 - Wage and Tax Statement: This document reports annual wages and taxes withheld. Form 129 allows for the request of W-2s, making it similar in purpose as it pertains to tax documentation.

- Form 1099 - Miscellaneous Income: Like the W-2, this form reports income received from sources other than employment. Both forms can be requested through Form 129 if needed for tax purposes.

- Form 1040X - Amended U.S. Individual Income Tax Return: This form is used to correct previously filed tax returns. Similar to Form 129, it requires detailed information about the taxpayer and their previous filings.

- Form 8862 - Information to Claim Earned Income Credit After Disallowance: This form is submitted to claim the Earned Income Credit again after it was previously denied. It requires taxpayer information similar to that on Form 129.

- Form 4506 - Request for Copy of Tax Return: This federal form requests a copy of a tax return from the IRS. It is similar to Form 129 in that it serves the same purpose for obtaining tax records but is used at the federal level.

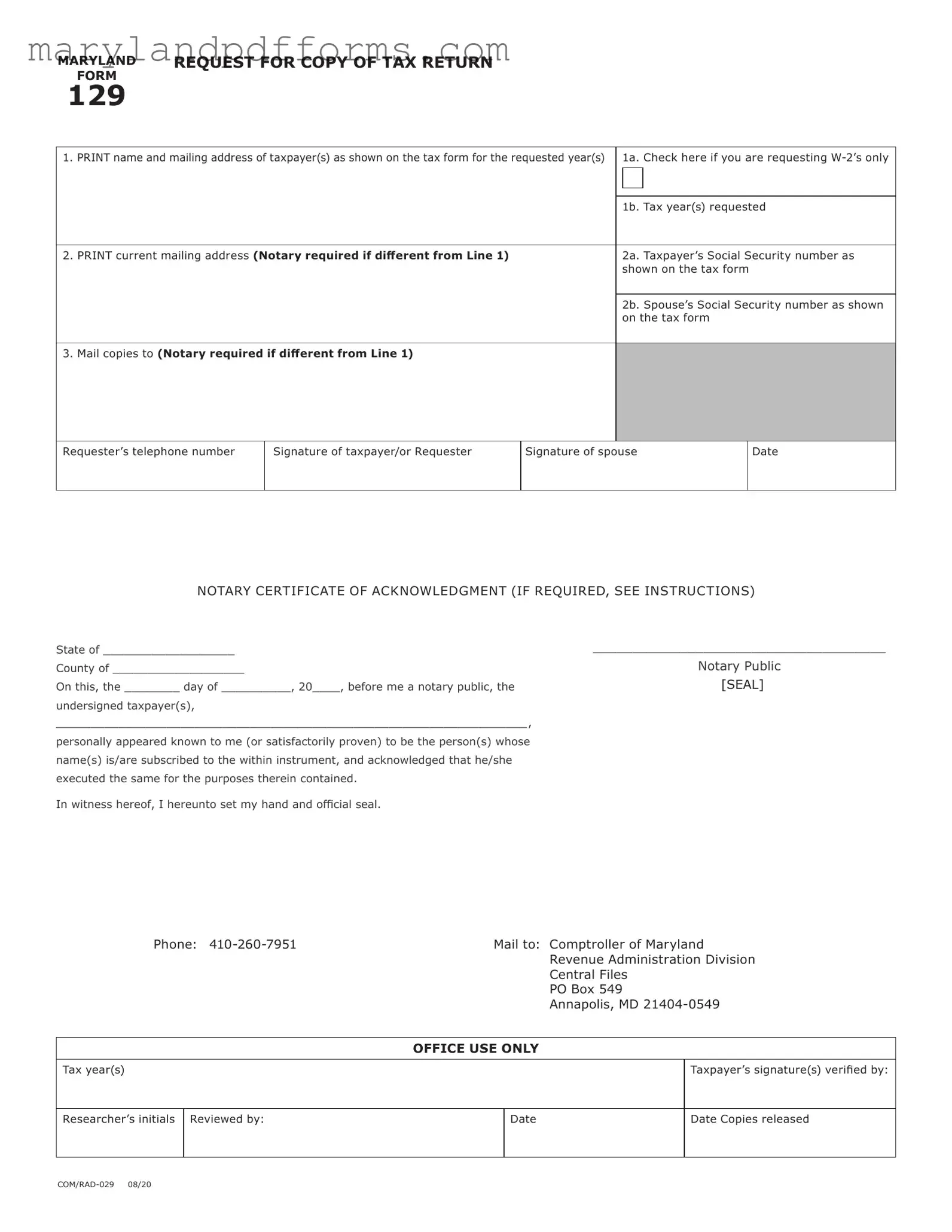

Maryland 129 - Usage Steps

Once you have gathered all necessary information, you can begin filling out the Maryland 129 form. This form is essential for requesting copies of tax returns or W-2s from the state. Ensure that you have all required details on hand to complete the form accurately.

- Print your name and mailing address as shown on your tax return for the requested year(s) in Line 1.

- If you are requesting W-2s only, check the box in Line 1a.

- Enter the tax year(s) you are requesting in Line 1b.

- In Line 2, print your current mailing address. If this address is different from Line 1, a notary is required.

- Enter your Social Security number as shown on your tax return in Line 2a.

- If applicable, enter your spouse’s Social Security number in Line 2b.

- In Line 3, provide the name, address, and phone number of the person to whom the copies should be mailed, if different from the taxpayer.

- Sign and date the form where indicated. Make sure to sign exactly as your name appears on your original tax return.

- If notarization is required (when the address in Line 2 is different from Line 1), complete the Notary Certificate section.

- Mail the completed and signed form to the Comptroller of Maryland at the address provided, or submit it in person at a branch office.

Learn More on Maryland 129

What is the purpose of the Maryland 129 form?

The Maryland 129 form is used to request a copy of a Maryland tax return and/or W-2 forms as originally filed with the Comptroller of Maryland. Completing the form in full is necessary for processing your request.

Who can submit a Maryland 129 form?

The form can be submitted by the taxpayer, a personal representative, or a taxpayer’s representative. If a joint tax return was filed, either spouse may request a copy of the return.

How do I fill out the Maryland 129 form?

To fill out the form, you need to provide the following information:

- Your name and mailing address as shown on the original tax return.

- Check if you are requesting W-2 forms only.

- Enter the tax year(s) requested.

- Your current mailing address.

- Your Social Security number and, if applicable, your spouse's Social Security number.

- Specify where to send the copies if different from your address.

Do I need to notarize the Maryland 129 form?

Notarization is required if the current mailing address (Line 2) is different from the address on Line 1. If the addresses match, notarization is not necessary.

Where do I send the completed Maryland 129 form?

You can mail the completed form to:

Comptroller of MarylandRevenue Administration Division

Central Files

PO Box 549

Annapolis, MD 21404-0549

You may also submit the form in person at any branch office of the Comptroller of Maryland during business hours.

What if I am requesting a copy for a deceased taxpayer?

A personal representative of the deceased taxpayer's estate can sign the Maryland 129 form. When doing so, include a copy of the letter of administration with the request.

Can I request a copy of a tax return by email or fax?

No, copies of tax returns will not be emailed, scanned, or faxed. They will be sent via U.S. Postal Service or can be picked up in person at a branch office.

What should I do if I have a Power of Attorney?

If you have a valid Maryland Power of Attorney (Form 548) on file, you do not need to submit the Maryland 129 form to request a copy of a Maryland tax return.

What are the office hours for submitting the Maryland 129 form in person?

The branch offices are open Monday through Friday from 8:30 a.m. to 4:30 p.m. Make sure to visit during these hours for in-person submissions.

Additional PDF Forms

How Do I Donate My Body to Science When I Die - In case of questions, contact the Anatomy Board directly for guidance.

The Asurion F-017-08 MEN form is a document used for specific service requests and claims related to warranty coverage. It is designed to facilitate communication between customers and the service provider. For more details on the form, you can visit https://topformsonline.com/asurion-f-017-08-men. Proper completion of this form ensures a smoother resolution process for any issues that may arise.

Boat Registration Maryland - The bill of sale includes details about the boat's make, model, and year.

Documents used along the form

The Maryland 129 form is essential for individuals seeking copies of their tax returns or W-2 forms from the Comptroller of Maryland. In conjunction with this form, several other documents may be required or helpful in the process. Below is a list of related forms and documents that are commonly used alongside the Maryland 129 form.

- Maryland Power of Attorney (Form 548): This document allows an individual to designate someone else to act on their behalf in tax matters. If a valid Form 548 is on file, it eliminates the need to submit a Maryland 129 form to request tax return copies.

- Notary Certificate of Acknowledgment: If the taxpayer's current mailing address differs from the address listed on the tax return, a notary must certify the request. This document verifies the identity of the signer and confirms that they are who they claim to be.

- New York Operating Agreement: To ensure clarity in your LLC's management structure and operational guidelines, you may want to consider obtaining the PDF Templates Online for the New York Operating Agreement form.

- Letter of Administration: In cases where a deceased taxpayer's tax return is requested, a personal representative must include this document. It proves their authority to act on behalf of the deceased individual.

- Maryland Form 548P: This form is used to delegate authority to a reporting agent. If a reporting agent is signing the Maryland 129 form, a copy of this form must accompany the request to confirm their authority.

- Employer Identification Number (EIN): If requesting W-2 forms, providing the EIN of the employer can expedite the process. This number uniquely identifies the employer and helps in locating the correct documents.

Understanding these accompanying documents can streamline the process of obtaining tax return copies in Maryland. Ensure that all necessary forms are completed accurately to avoid delays in your request.

Key takeaways

1. The Maryland 129 form is used to request a copy of your Maryland tax return or W-2 forms.

2. Fill out the form completely. Missing information can delay your request.

3. Provide your name and mailing address exactly as it appears on your original tax return.

4. If you’re requesting W-2 forms only, check the appropriate box on the form.

5. Notarization is required unless your current mailing address matches the address on your tax return.

6. You can submit the form either in person or by mail. If mailing, ensure it is signed and notarized.

7. Copies of tax returns will not be emailed or faxed. They will be sent via U.S. Postal Service.

8. If you are a personal representative for a deceased taxpayer, include the letter of administration with your request.

9. For assistance, visit the Maryland tax website or contact their customer service.

Misconceptions

- Form 129 is only for tax returns. Many believe that the Maryland 129 form is solely for tax returns. However, it can also be used to request W-2 forms.

- Notarization is always required. A common misconception is that notarization is mandatory for all requests. If the current mailing address matches the address on the tax return, notarization is not needed.

- You can submit the form via email or fax. Some think they can send the form electronically. The Comptroller of Maryland only accepts the form via U.S. Postal Service or in person.

- Only the taxpayer can request copies. While the taxpayer typically requests copies, a personal representative can also submit the form for deceased taxpayers, provided they include the necessary documentation.

- Form 129 can be signed before submission. It’s important to note that you should not sign the form until instructed by a representative from the Comptroller's office.

- All tax years can be requested at once. Some believe they can request multiple years in one submission. While you can request several years, you must specify each year on the form.

- The form is only for Maryland residents. Although it’s called the Maryland 129 form, anyone who filed a Maryland tax return can use it, regardless of their current residency.

- W-2 requests require additional forms. Many think that requesting W-2 forms necessitates extra paperwork. In fact, you can indicate your request for W-2s directly on Form 129.