Free Loan Agreement Document for the State of Maryland

Similar forms

Promissory Note: This document outlines the borrower's promise to repay a loan. Like a Loan Agreement, it specifies the amount borrowed, interest rate, and repayment terms.

Mortgage Agreement: This document secures a loan with property as collateral. Similar to a Loan Agreement, it details the loan amount, interest, and terms of repayment, but also includes provisions related to the property.

Medical Power of Attorney: To ensure your healthcare decisions are honored, consider the comprehensive Medical Power of Attorney guidelines that facilitate appointing a trusted individual for medical choices.

Credit Agreement: This document governs the terms of a line of credit. It shares similarities with a Loan Agreement by detailing the credit limit, interest rates, and repayment obligations.

Lease Agreement: While primarily used for renting property, a Lease Agreement can resemble a Loan Agreement in that it outlines payment terms and responsibilities of both parties. It includes details about the duration of the lease and payment amounts.

Maryland Loan Agreement - Usage Steps

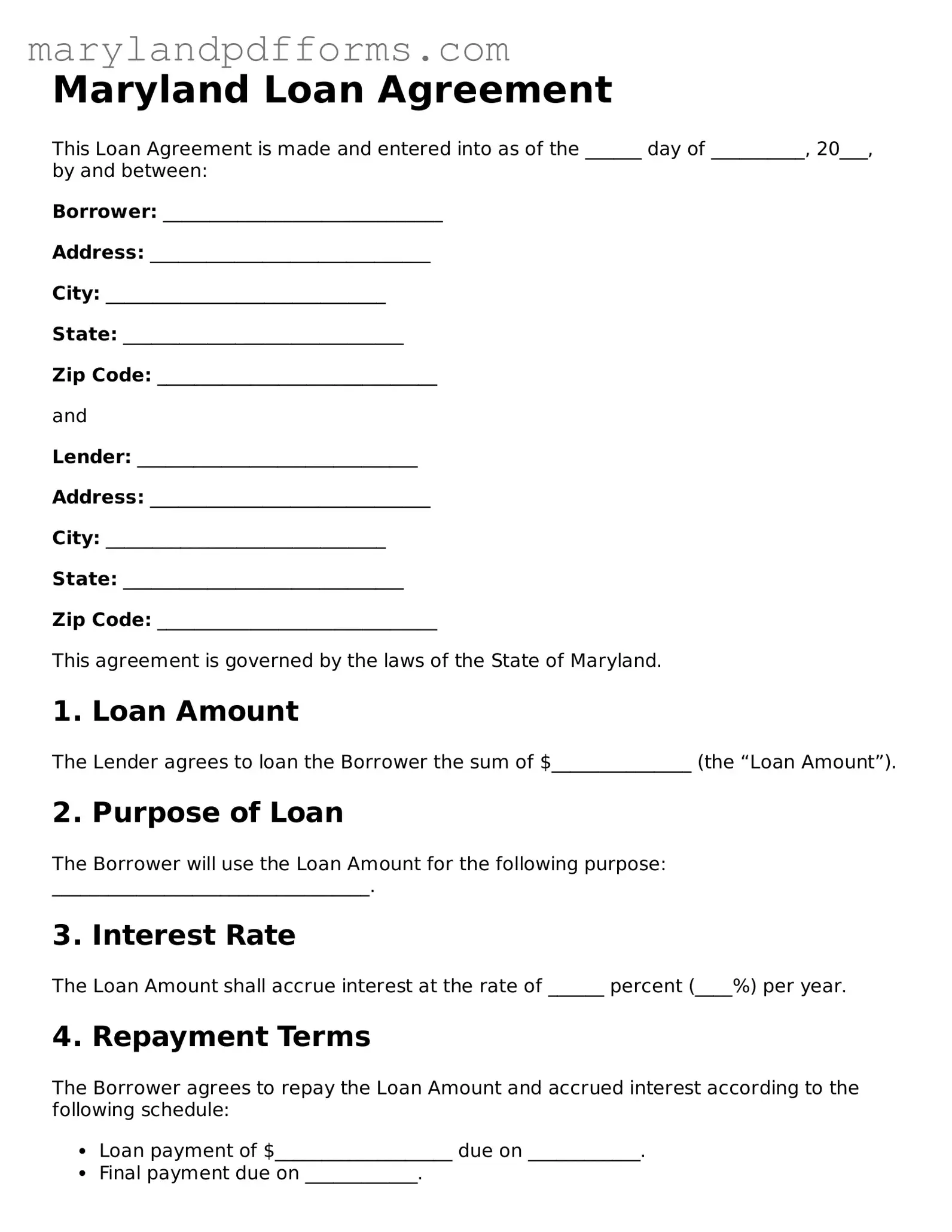

Filling out the Maryland Loan Agreement form requires careful attention to detail. Each section of the form must be completed accurately to ensure that the agreement is legally binding and reflects the intentions of both parties involved in the loan transaction. The following steps outline the process for completing the form effectively.

- Begin by entering the date at the top of the form. This date marks when the agreement is being executed.

- Provide the full names and addresses of both the lender and the borrower. Ensure that all information is current and correct.

- Specify the loan amount. Clearly state the total sum being borrowed.

- Indicate the interest rate applicable to the loan. This should be expressed as a percentage.

- Detail the repayment terms. Include the frequency of payments (monthly, quarterly, etc.) and the total duration of the loan.

- Outline any collateral that secures the loan, if applicable. Describe the collateral in sufficient detail.

- Include any additional terms or conditions that both parties agree upon. This may cover late fees, prepayment options, or other relevant stipulations.

- Sign and date the form at the designated spaces. Both the lender and borrower must provide their signatures.

- Make copies of the completed form for both parties to retain for their records.

After completing the form, both parties should review it carefully to ensure all information is accurate and reflects their agreement. It is advisable to consult a legal professional if any uncertainties arise regarding the terms outlined in the agreement.

Learn More on Maryland Loan Agreement

What is a Maryland Loan Agreement form?

A Maryland Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Maryland. This form serves to protect the interests of both parties by clearly defining the repayment terms, interest rates, and any collateral involved in the loan.

Who should use a Maryland Loan Agreement form?

This form is suitable for anyone who is lending or borrowing money in Maryland. Individuals, businesses, and organizations can all benefit from using this agreement to ensure that their financial transactions are documented and legally binding.

What are the key components of a Maryland Loan Agreement?

A comprehensive Maryland Loan Agreement typically includes the following components:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Schedule: Details on how and when the borrower will repay the loan.

- Collateral: Any assets pledged by the borrower to secure the loan.

- Default Terms: Conditions under which the borrower would be considered in default.

Is the Maryland Loan Agreement form legally binding?

Yes, when properly executed, a Maryland Loan Agreement is legally binding. Both parties must sign the document, and it should be clear and comprehensive to ensure enforceability in a court of law. It is advisable to have the agreement reviewed by a legal professional to confirm its validity.

Can the terms of the loan be modified after the agreement is signed?

Yes, the terms of the loan can be modified, but both parties must agree to any changes. It is essential to document any modifications in writing and have both parties sign the amended agreement to maintain clarity and enforceability.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to pursue various remedies as outlined in the Loan Agreement. This may include demanding immediate repayment, taking possession of collateral, or pursuing legal action to recover the owed amount. The specific consequences of default should be clearly stated in the agreement.

Do I need a lawyer to draft a Maryland Loan Agreement?

While it is not legally required to have a lawyer draft a Loan Agreement, consulting with one is highly recommended. A legal professional can help ensure that the agreement complies with Maryland laws and adequately protects the interests of both parties involved.

Are there any specific laws governing loan agreements in Maryland?

Yes, loan agreements in Maryland are subject to both state and federal regulations. The Maryland Credit Grantor Closed End Credit Provisions and the Maryland Consumer Loan Law are examples of state laws that may apply. It is crucial to be aware of these regulations to ensure compliance.

Can I use a Maryland Loan Agreement form for personal loans?

Absolutely. A Maryland Loan Agreement can be used for personal loans between friends, family, or acquaintances. Having a written agreement helps prevent misunderstandings and provides a clear record of the terms agreed upon.

Where can I obtain a Maryland Loan Agreement form?

You can find Maryland Loan Agreement forms online through legal document websites, or you may choose to draft one from scratch using templates available in legal resources. It is important to ensure that any form you use meets the specific requirements of Maryland law.

Discover Other Forms for Maryland

Molst Form Md - Patients should consider how changes in health status might influence their preferences regarding a DNR over time.

Maryland Operation Agreement - It details the financial and operational procedures for the LLC.

In addition to understanding the general principles of liability protection, individuals and organizations should consider utilizing a well-drafted template for their specific needs, such as the one provided by Templates Online, which can help ensure that all necessary provisions are included in their Hold Harmless Agreement.

Register of Wills Maryland - Guides the administration of your estate according to personal beliefs and values.

Documents used along the form

When entering into a loan agreement in Maryland, several other documents may accompany the primary agreement to ensure clarity and protection for all parties involved. Each of these documents serves a specific purpose in the loan process.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, and repayment schedule.

- Security Agreement: If the loan is secured by collateral, this document describes the collateral and the rights of the lender in case of default.

- Loan Application: This form is completed by the borrower and provides the lender with necessary information to assess creditworthiness and loan eligibility.

- Credit Report Authorization: Borrowers often need to authorize lenders to obtain their credit reports. This document allows lenders to check the borrower's credit history.

- Operating Agreement: This document is essential for LLCs as it outlines the management structure and operational guidelines, ensuring clarity among members. For more information, refer to PDF Templates Online.

- Disclosure Statement: This document provides important information about the terms of the loan, including fees, interest rates, and other costs associated with borrowing.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party, ensuring that the loan will be repaid even if the borrower defaults.

- Amortization Schedule: This schedule outlines each payment over the life of the loan, showing how much goes towards interest and how much goes towards the principal.

- Loan Closing Statement: This document summarizes the final terms of the loan, including the total amount financed, closing costs, and any adjustments made before the loan is finalized.

- Release of Lien: Once the loan is paid off, this document is issued to confirm that the lender has released any claim on the collateral used to secure the loan.

These documents work together to create a comprehensive framework for the loan agreement, protecting both the lender and the borrower throughout the lending process. Understanding each document helps ensure a smoother transaction and clearer expectations for everyone involved.

Key takeaways

When filling out and using the Maryland Loan Agreement form, several key points are essential to ensure clarity and legal compliance. Below are important takeaways to consider:

- Understand the Purpose: The loan agreement serves as a formal document outlining the terms of the loan between the lender and borrower.

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower to avoid confusion.

- Specify the Loan Amount: Clearly indicate the total amount being loaned. This figure should be precise and unambiguous.

- Detail the Interest Rate: Include the interest rate being charged on the loan. Specify whether it is fixed or variable.

- Outline Repayment Terms: Clearly define the repayment schedule, including due dates and the method of payment.

- Include Default Provisions: Specify what happens if the borrower defaults on the loan. This may include late fees or other penalties.

- Consider Collateral: If applicable, describe any collateral being offered to secure the loan. This provides additional protection for the lender.

- Review State Laws: Be aware of Maryland's specific laws regarding loan agreements, as they can impact the enforceability of the contract.

- Seek Legal Advice: If unsure about any terms or conditions, consulting with a legal professional can provide valuable guidance.

By keeping these points in mind, both lenders and borrowers can navigate the loan agreement process more effectively, fostering a clearer understanding and reducing the likelihood of disputes.

Misconceptions

Understanding the Maryland Loan Agreement form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- The form is the same for all types of loans. This is not true. Different loans, such as personal loans, mortgages, or business loans, may require different terms and conditions. Always ensure you are using the correct form for your specific loan type.

- Signing the form means you automatically receive the loan. Not necessarily. Signing the agreement is just one step in the process. Lenders typically review your financial information and creditworthiness before finalizing the loan.

- Once signed, the terms cannot be changed. While it is true that the agreement is binding, parties can negotiate changes before signing. It’s important to discuss any concerns or desired modifications with the lender beforehand.

- The Maryland Loan Agreement form protects only the lender. This is a misconception. The form is designed to protect both parties. It outlines the rights and responsibilities of the borrower as well as the lender, ensuring transparency in the loan process.

- All loan agreements are the same across states. Each state has its own laws governing loan agreements. The Maryland Loan Agreement form includes specific provisions that comply with Maryland's laws, which may differ from those in other states.

- You don’t need legal advice to fill out the form. While it is possible to complete the form without legal assistance, seeking advice can be beneficial. A legal professional can help clarify terms and ensure that your rights are protected.

By addressing these misconceptions, individuals can approach the Maryland Loan Agreement form with a clearer understanding, leading to more informed financial decisions.