Free Last Will and Testament Document for the State of Maryland

Similar forms

- Living Will: This document outlines your preferences for medical treatment in situations where you may not be able to communicate your wishes. Like a Last Will and Testament, it expresses your desires regarding your health care, but it focuses specifically on medical decisions rather than the distribution of your estate.

- Durable Power of Attorney: A Durable Power of Attorney allows you to designate someone to make financial or legal decisions on your behalf if you become incapacitated. Similar to a Last Will and Testament, it ensures your wishes are honored, but it operates while you are still alive.

- Health Care Proxy: This document names an individual to make health care decisions for you if you are unable to do so. It’s akin to a Last Will in that it addresses your preferences, but it specifically pertains to medical choices rather than asset distribution.

- Trust: A trust allows you to manage your assets during your lifetime and dictate their distribution after your death. Like a Last Will and Testament, it helps ensure your wishes are followed, but it can also provide benefits like avoiding probate.

- Codicil: A codicil is an amendment to an existing will. It serves to modify specific provisions without needing to create an entirely new Last Will and Testament, allowing for updates as your circumstances change.

- Letter of Intent: This informal document expresses your wishes regarding the distribution of your assets and can provide guidance to your executor. While not legally binding like a Last Will, it complements the will by offering additional context.

- Beneficiary Designation Forms: These forms allow you to specify who will receive certain assets, like life insurance or retirement accounts, upon your death. They function similarly to a Last Will and Testament by directing asset distribution, but they operate outside of the probate process.

- Estate Plan: An estate plan encompasses a comprehensive strategy for managing your assets during your life and after your death. It includes documents like a Last Will and Testament, but also addresses tax considerations and other financial matters.

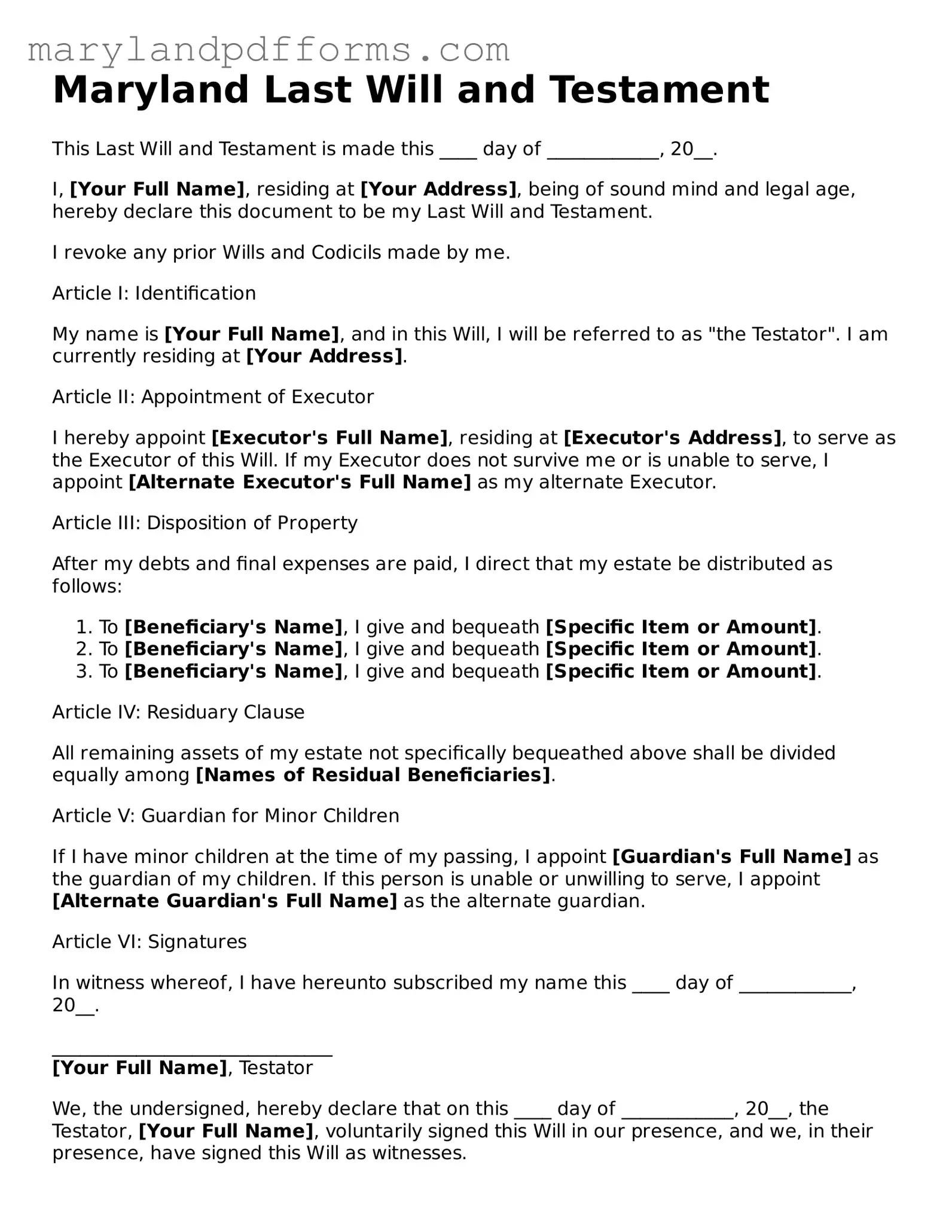

Maryland Last Will and Testament - Usage Steps

Completing the Maryland Last Will and Testament form is a straightforward process. After filling out the form, it is important to review it for accuracy and ensure that all required signatures are obtained. Following these steps will help you complete the form correctly.

- Begin by downloading the Maryland Last Will and Testament form from a reliable source.

- Fill in your full name at the top of the form.

- Provide your address in the designated section.

- State your marital status clearly (single, married, divorced, etc.).

- List your beneficiaries, including their full names and relationships to you.

- Specify the assets you wish to distribute, detailing each item and its value.

- Designate an executor who will carry out your wishes as outlined in the will.

- Include any specific instructions or wishes regarding your funeral arrangements, if desired.

- Review the completed form for any errors or omissions.

- Sign the document in the presence of two witnesses, who should also sign the form.

- Ensure that the witnesses are not beneficiaries of the will to avoid any conflicts.

- Make copies of the signed will for your records and for your executor.

Learn More on Maryland Last Will and Testament

What is a Last Will and Testament in Maryland?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Maryland, this document allows individuals to specify who will inherit their property, name guardians for minor children, and appoint an executor to manage the estate. Having a will ensures that a person's wishes are respected and can help avoid disputes among family members.

Who can create a Last Will and Testament in Maryland?

In Maryland, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. It is important that the person understands the nature of the document and the consequences of their decisions. If someone is not of sound mind, their will may be challenged in court.

What are the requirements for a valid will in Maryland?

To be considered valid in Maryland, a Last Will and Testament must meet the following criteria:

- The will must be in writing.

- The testator (the person making the will) must sign the document.

- The will must be witnessed by at least two individuals who are present at the same time.

- Witnesses must be at least 18 years old and should not be beneficiaries of the will to avoid potential conflicts of interest.

Can I change or revoke my will in Maryland?

Yes, individuals in Maryland can change or revoke their Last Will and Testament at any time while they are alive and of sound mind. Changes can be made by creating a new will that explicitly revokes the previous one or by adding a codicil, which is an amendment to the existing will. It is essential to follow the same formalities for signing and witnessing when making changes to ensure the validity of the new document.

What happens if I die without a will in Maryland?

If a person dies without a will, they are said to have died "intestate." In this case, Maryland law determines how their assets will be distributed. The distribution follows a hierarchy based on familial relationships, meaning that spouses, children, parents, and siblings may inherit in that order. However, dying intestate can lead to outcomes that may not align with the deceased's wishes, making it crucial to have a will in place.

Can I write my own will in Maryland?

Yes, individuals can write their own will in Maryland, known as a handwritten or holographic will. However, it is recommended to follow the legal requirements closely to ensure its validity. A well-drafted will can prevent confusion and disputes among heirs. Consulting with an attorney or using a reputable will template can help ensure that the document meets all necessary criteria.

What is an executor, and how do I choose one?

An executor is the person appointed in a will to carry out the instructions and manage the estate after the testator's death. When choosing an executor, consider someone who is responsible, trustworthy, and capable of handling financial matters. This person should also be willing to take on the role, as it can involve a significant time commitment and emotional strain.

How can I ensure my will is legally enforceable?

To ensure that a will is legally enforceable in Maryland, it is crucial to follow the state's requirements for creating a valid document. This includes having it in writing, signing it, and having it witnessed by at least two individuals. Additionally, storing the will in a safe place and informing the executor and family members of its location can help facilitate its enforcement when the time comes.

Discover Other Forms for Maryland

Create Promissory Note - Parties can negotiate the terms before finalizing the promissory note to ensure fairness.

Maryland Promissory Note - Clear terms can help in building a long-term lender-borrower relationship.

In addition to its essential role in the transfer of ownership, the New York Trailer Bill of Sale form can be easily accessed and downloaded through resources like PDF Templates Online, providing convenience and ensuring that both buyers and sellers have the necessary documentation to finalize their transaction effectively.

Sell Car in Maryland - This document may also help streamline the process of obtaining vehicle insurance.

Documents used along the form

When preparing a Last Will and Testament in Maryland, individuals often find it beneficial to consider additional documents that can enhance their estate planning. These documents serve various purposes, from outlining healthcare decisions to managing assets during incapacity. Below is a list of five important forms and documents commonly used alongside a Last Will and Testament.

- Durable Power of Attorney: This document allows an individual to designate someone else to make financial and legal decisions on their behalf if they become incapacitated. It ensures that someone they trust can manage their affairs without court intervention.

- Advance Medical Directive: Also known as a living will, this document outlines an individual's preferences for medical treatment in situations where they cannot communicate their wishes. It provides guidance to healthcare providers and loved ones regarding life-sustaining treatments.

- Revocable Living Trust: This legal arrangement allows an individual to place their assets into a trust during their lifetime. It can help avoid probate, provide privacy, and facilitate the management of assets if the individual becomes incapacitated.

- Beneficiary Designations: Many financial accounts and insurance policies allow individuals to name beneficiaries directly. This document ensures that assets pass directly to the named individuals upon death, bypassing the probate process.

- Letter of Intent: Although not a legally binding document, a letter of intent can accompany a will to provide additional instructions and clarify wishes regarding the distribution of assets and care of dependents.

Incorporating these documents into an estate plan can provide clarity and peace of mind. Each serves a distinct purpose, ensuring that an individual's wishes are honored and that their loved ones are supported during challenging times.

Key takeaways

Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. In Maryland, there are specific guidelines to follow when filling out this document. Here are some key takeaways to keep in mind:

- Understand the Purpose: A will outlines how your assets will be distributed and who will take care of your minor children, if applicable.

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in Maryland.

- Choose an Executor: Select a trustworthy person to manage your estate and ensure your wishes are carried out. This person is known as the executor.

- Be Clear and Specific: Clearly state your wishes regarding asset distribution. Ambiguities can lead to disputes among heirs.

- Witness Requirements: In Maryland, your will must be signed in the presence of at least two witnesses who are not beneficiaries.

- Revocation of Previous Wills: If you create a new will, it automatically revokes any prior wills unless stated otherwise.

- Consider Legal Assistance: While you can create a will on your own, consulting with an attorney can help ensure that it meets all legal requirements.

By following these guidelines, you can create a Last Will and Testament that reflects your wishes and provides peace of mind for you and your loved ones.

Misconceptions

Understanding the Maryland Last Will and Testament form can be tricky. Here are six common misconceptions that often confuse people:

-

All wills must be notarized to be valid.

Many people believe that a will must be notarized to be legally binding. In Maryland, while notarization can add an extra layer of authenticity, it is not a requirement. A handwritten will can be valid as long as it meets certain criteria.

-

You must have a lawyer to create a will.

While consulting a lawyer can be helpful, it is not mandatory. Individuals can create their own wills using templates or forms, as long as they follow Maryland's legal requirements.

-

Once a will is made, it cannot be changed.

This is a common myth. In Maryland, you can change your will at any time. You can create a new will or make amendments, known as codicils, to your existing will.

-

Only wealthy individuals need a will.

Everyone can benefit from having a will, regardless of their financial status. A will helps ensure that your wishes are followed regarding your assets, guardianship of children, and other important matters.

-

Wills are only for after death.

While wills do come into play after someone passes away, they can also serve as a guide for decisions made during your lifetime, especially in the case of incapacitation.

-

All assets automatically go to the spouse.

This is not always the case. In Maryland, if you die without a will, state laws dictate how your assets are distributed. A will allows you to specify who receives what, rather than relying on default state laws.

By clearing up these misconceptions, you can better navigate the process of creating a Last Will and Testament in Maryland.