Free Durable Power of Attorney Document for the State of Maryland

Similar forms

- General Power of Attorney: This document allows someone to act on your behalf in a broad range of matters, similar to a Durable Power of Attorney. However, it usually becomes invalid if you become incapacitated.

- Medical Power of Attorney: This form specifically grants someone the authority to make healthcare decisions for you if you are unable to do so. It focuses solely on medical matters.

- Living Will: While not the same as a Durable Power of Attorney, a Living Will outlines your wishes regarding medical treatment. It complements the Medical Power of Attorney by providing guidance on your preferences.

- Advance Healthcare Directive: This combines a Medical Power of Attorney and a Living Will. It allows you to appoint someone to make healthcare decisions and provides instructions about your medical care.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document allows someone to manage your financial affairs. It may be limited to specific tasks or accounts.

- Trust: A trust can manage your assets and provide for your beneficiaries. Like a Durable Power of Attorney, it helps ensure your wishes are followed, but it typically involves more complex arrangements.

- Guardianship Documents: These documents appoint someone to make decisions for a minor or incapacitated adult. They serve a similar purpose in protecting someone's interests when they cannot do so themselves.

- Will: A Will outlines how your assets will be distributed after your death. While it does not grant authority during your lifetime like a Durable Power of Attorney, both documents are essential for planning your affairs.

Maryland Durable Power of Attorney - Usage Steps

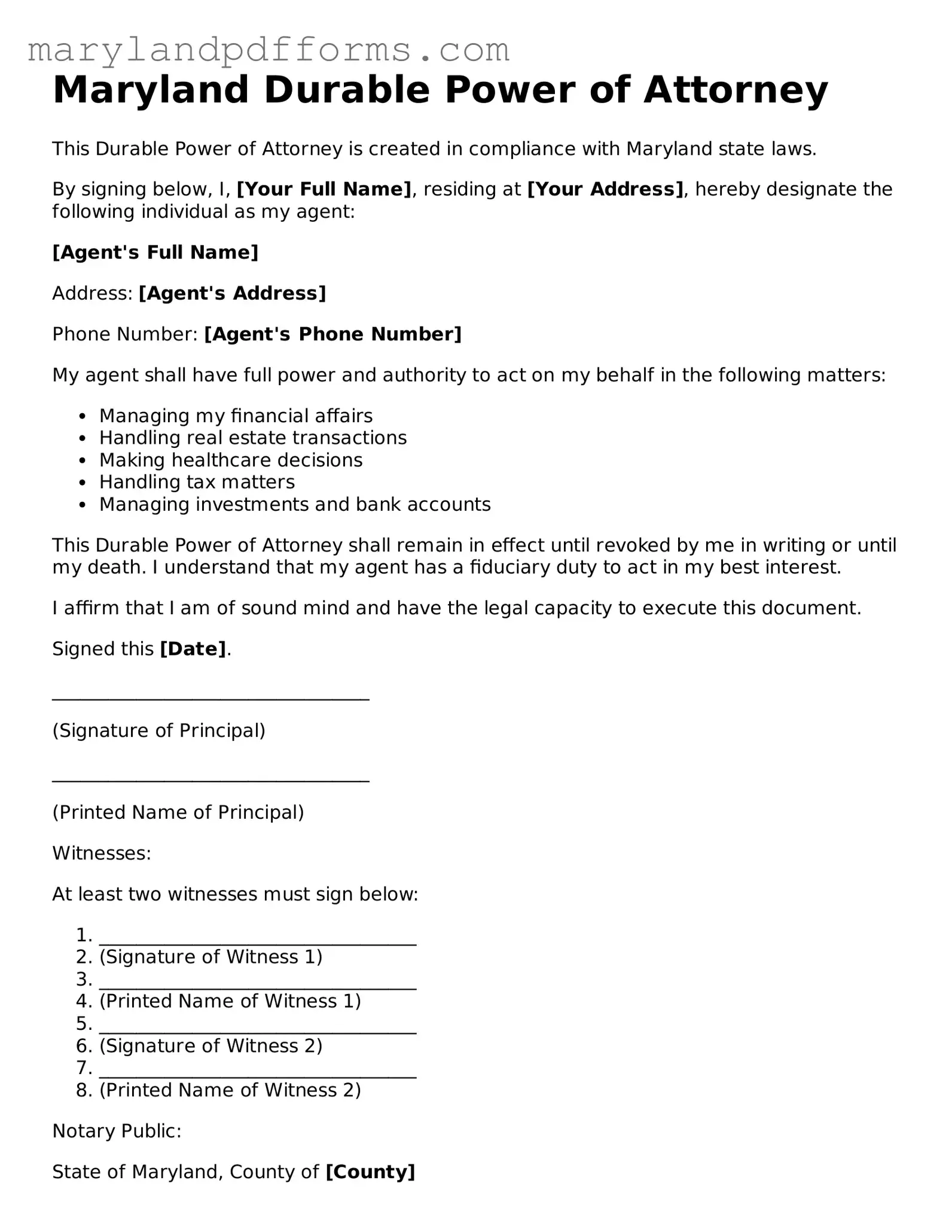

Once you have the Maryland Durable Power of Attorney form, you are ready to fill it out. This document allows you to designate someone to make decisions on your behalf if you become unable to do so. Follow the steps below to complete the form accurately.

- Begin by entering your full name at the top of the form.

- Provide your address, including city, state, and zip code.

- Identify the person you are appointing as your agent. Write their full name and address.

- Specify the powers you are granting to your agent. You can choose general powers or limit them to specific areas.

- Include any special instructions or limitations, if applicable.

- Sign and date the form in the designated area.

- Have the form witnessed by at least two individuals who are not related to you or your agent.

- If necessary, consider having the form notarized for added validity.

After completing the form, keep a copy for your records. Provide copies to your agent and any relevant parties. This ensures that your wishes are clear and accessible when needed.

Learn More on Maryland Durable Power of Attorney

What is a Maryland Durable Power of Attorney?

A Maryland Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to manage their financial and legal affairs. This document remains effective even if the principal becomes incapacitated. It is crucial for ensuring that someone you trust can make decisions on your behalf when you are unable to do so.

How do I create a Durable Power of Attorney in Maryland?

To create a Durable Power of Attorney in Maryland, follow these steps:

- Choose a trusted individual to act as your agent.

- Obtain the Maryland Durable Power of Attorney form, which can be found online or through legal resources.

- Complete the form by providing the necessary information, including your name, the agent's name, and the powers you wish to grant.

- Sign the document in the presence of a notary public to ensure its validity.

- Provide copies to your agent and any relevant institutions, such as banks or healthcare providers.

What powers can I grant to my agent?

In Maryland, you can grant a wide range of powers to your agent, including but not limited to:

- Managing bank accounts and financial transactions.

- Making investment decisions.

- Buying or selling real estate.

- Handling tax matters.

- Making healthcare decisions, if specified in the document.

It is essential to clearly outline the powers you wish to grant to avoid any confusion in the future.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do so, you should create a written revocation document that explicitly states your intent to revoke the previous power of attorney. Once completed, provide copies of the revocation to your agent and any institutions that may have a copy of the original document.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your family may need to go through a court process to have a guardian or conservator appointed to manage your affairs. This process can be time-consuming, costly, and may not reflect your wishes. Establishing a Durable Power of Attorney can prevent these complications and ensure that your preferences are honored.

Discover Other Forms for Maryland

Maryland Prenup Agreement - A Prenuptial Agreement allows you to define marital property clearly.

Sell Car in Maryland - The form can vary in format, but all must include key information relevant to the vehicle sale.

Documents used along the form

When establishing a Maryland Durable Power of Attorney, several other forms and documents may be beneficial to ensure comprehensive legal coverage. These documents work in conjunction with the Durable Power of Attorney to address various aspects of personal and financial decision-making. Below is a list of commonly associated documents.

- Advance Healthcare Directive: This document outlines an individual's healthcare preferences in case they become unable to communicate their wishes. It often includes a living will and a medical power of attorney, specifying who can make medical decisions on behalf of the individual.

- Living Will: A living will details the types of medical treatment an individual wishes to receive or avoid in end-of-life situations. It serves as a guide for healthcare providers and family members regarding the individual's preferences.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document specifically grants authority to an agent to manage financial matters. It can be limited to specific transactions or be broad in scope.

- Will: A will outlines how an individual's assets and affairs should be handled after their death. It designates beneficiaries and can appoint guardians for minor children, ensuring that personal wishes are respected.

- New York Trailer Bill of Sale: This form is essential for transferring ownership of a trailer, providing clear evidence of the transaction between the seller and buyer. For more information, you can visit PDF Templates Online.

- Trust Document: A trust is a legal arrangement that allows a person to transfer assets to a trustee for the benefit of designated beneficiaries. This can help with estate planning and may avoid probate, providing a smoother transition of assets.

Incorporating these documents along with the Maryland Durable Power of Attorney can provide clarity and security in managing personal and financial affairs. It is advisable to consult with a legal professional to ensure that all documents align with individual needs and state requirements.

Key takeaways

Filling out and utilizing a Maryland Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes, especially in the event that you become incapacitated. Here are some key takeaways to consider:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone you trust to make decisions on your behalf if you are unable to do so.

- Choose Your Agent Wisely: Select an agent who is responsible, trustworthy, and understands your values and preferences. This person will have significant authority over your financial matters.

- Be Specific: Clearly outline the powers you are granting to your agent. This can include managing bank accounts, real estate transactions, and other financial decisions.

- Consider Legal Requirements: In Maryland, the form must be signed in the presence of a notary public. Ensure that you follow the state's requirements to make the document valid.

- Review Regularly: Life circumstances change, so it’s important to review and update your Durable Power of Attorney periodically to reflect your current wishes and situation.

By keeping these points in mind, you can effectively use the Maryland Durable Power of Attorney form to safeguard your interests and ensure that your affairs are handled according to your preferences.

Misconceptions

Understanding the Maryland Durable Power of Attorney form can be challenging. Many people hold misconceptions that can lead to confusion. Here are eight common misconceptions about this important legal document:

- It only applies to financial decisions. Many believe that a Durable Power of Attorney only allows someone to make financial choices. However, it can also grant authority over health care decisions if specified.

- It is only for the elderly. Some think this form is only necessary for older individuals. In reality, anyone can benefit from having a Durable Power of Attorney, regardless of age.

- It becomes invalid if the principal becomes incapacitated. This is not true. A Durable Power of Attorney remains effective even if the person who created it becomes unable to make decisions.

- All powers of attorney are the same. Not all powers of attorney are durable. A standard power of attorney may become invalid if the principal becomes incapacitated, while a durable one does not.

- It can be created verbally. Some people think they can create a Durable Power of Attorney through a verbal agreement. In Maryland, it must be in writing and signed to be valid.

- It must be notarized to be valid. While notarization is recommended for a Durable Power of Attorney in Maryland, it is not strictly required. Witness signatures can suffice.

- Once signed, it cannot be changed. Many believe that a Durable Power of Attorney is permanent. In fact, you can revoke or change it at any time, as long as you are still capable of making decisions.

- It only takes effect immediately. Some think that a Durable Power of Attorney must take effect as soon as it is signed. However, you can specify that it takes effect only under certain conditions, such as incapacitation.

By clarifying these misconceptions, individuals can better understand the Maryland Durable Power of Attorney form and its importance in planning for the future.