Free Deed Document for the State of Maryland

Similar forms

- Contract: Both deeds and contracts serve as agreements between parties. They outline the terms of a transaction and require signatures for enforcement.

- Lease Agreement: Like a deed, a lease agreement transfers rights to use property, but it typically covers a limited time and includes specific terms regarding rent and responsibilities.

- Bill of Sale: A bill of sale transfers ownership of personal property, similar to how a deed transfers real property. Both documents require signatures to validate the transaction.

- Power of Attorney: This document grants authority to another person to act on one’s behalf. While a deed transfers property, a power of attorney can facilitate the execution of a deed.

- Trust Agreement: A trust agreement establishes a fiduciary relationship for managing assets. Like a deed, it can define how property is held and transferred, often for the benefit of another party.

- Loan Agreement: For those looking to formalize borrowing arrangements, the detailed California loan agreement form guidelines are essential for clear and binding terms.

- Will: A will outlines how a person's property will be distributed upon their death. Both wills and deeds involve the transfer of property, but a will takes effect after death, while a deed is effective immediately.

- Mortgage Document: A mortgage secures a loan with real property. Similar to a deed, it involves the transfer of an interest in property but is specifically tied to a loan agreement.

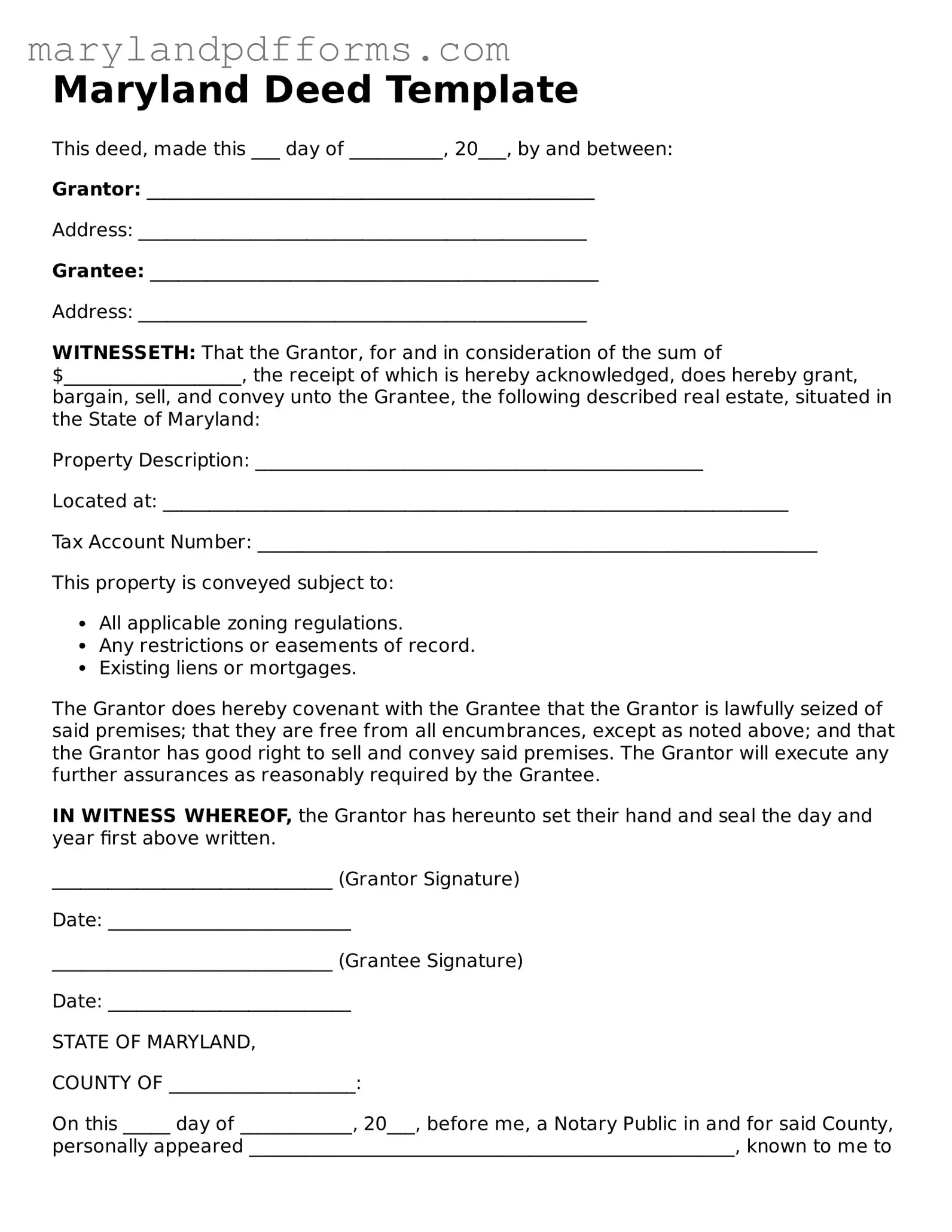

Maryland Deed - Usage Steps

Filling out the Maryland Deed form is a straightforward process. After completing the form, you will need to submit it to the appropriate local office for recording. This ensures that the transfer of property is officially recognized.

- Obtain the Maryland Deed form from a reliable source, such as a government website or a legal office.

- Fill in the names of the parties involved in the transaction, ensuring that the names are spelled correctly.

- Provide the address of the property being transferred, including the county and any relevant details.

- Indicate the type of deed being used (e.g., warranty deed, quitclaim deed) in the designated section.

- State the consideration amount, which is the value exchanged for the property.

- Include any necessary legal descriptions of the property, if required.

- Sign the form in the presence of a notary public to ensure its validity.

- Make copies of the completed deed for your records.

- Submit the original deed to the local land records office for recording, along with any required fees.

Learn More on Maryland Deed

What is a Maryland Deed form?

A Maryland Deed form is a legal document used to transfer ownership of real estate property in the state of Maryland. This form outlines the details of the property being transferred, the parties involved in the transaction, and the terms of the transfer. It serves as a public record to confirm the change in ownership and is typically recorded in the local land records office.

What types of Deed forms are available in Maryland?

In Maryland, there are several types of Deed forms, each serving a different purpose. The most common types include:

- Warranty Deed: This type guarantees that the seller has clear title to the property and has the right to sell it.

- Quitclaim Deed: This form transfers whatever interest the seller has in the property without any guarantees about the title.

- Special Warranty Deed: This offers a limited guarantee, stating that the seller has not done anything to impair the title during their ownership.

- Deed of Trust: Used in financing transactions, this deed secures a loan with the property as collateral.

How do I complete a Maryland Deed form?

Completing a Maryland Deed form involves several steps:

- Gather necessary information, including the names of the grantor (seller) and grantee (buyer), property description, and consideration (purchase price).

- Choose the appropriate type of Deed based on your situation.

- Fill out the form accurately, ensuring all details are correct and legible.

- Have the document signed by the grantor in the presence of a notary public.

- Record the completed Deed at the local land records office to make the transfer official.

Do I need an attorney to prepare a Maryland Deed form?

While it is not legally required to have an attorney prepare a Maryland Deed form, it is highly recommended. An attorney can ensure that the document is completed correctly and complies with state laws. They can also provide guidance on the implications of the transfer and help avoid potential legal issues in the future. If you choose to complete the Deed without legal assistance, make sure to double-check all information and consider consulting a professional if you have any doubts.

Discover Other Forms for Maryland

Notary Public Cost - A notary acknowledgment adds an extra layer of security and validation to important documents.

Bill of Sale Maryland - Facilitates the transfer of ownership and helps protect both parties in the transaction.

For those looking to sell or buy a motorcycle in New York, the New York Motorcycle Bill of Sale form is indispensable. It not only formalizes the transaction but also protects both parties involved by detailing the specifics of the sale. To streamline the process and ensure accuracy, you can find resources for this essential documentation at PDF Templates Online, which offers templates that simplify the complexities of motorcycle ownership transfer.

How to Register a Boat in Maryland - Ensures that all legal requirements for sale are met.

Documents used along the form

When transferring property in Maryland, the deed form is a crucial document, but it is not the only one required. Several other forms and documents may accompany the deed to ensure a smooth and legally compliant transaction. Below is a list of common documents often used alongside the Maryland Deed form.

- Property Disclosure Statement: This document provides potential buyers with information about the condition of the property. It typically includes details about any known defects, repairs, or issues that could affect the property's value.

- Transfer-on-Death Deed: This document allows property owners in Arizona to designate a beneficiary who will automatically receive the property upon the owner's death, without the need for probate. For more information on this form, you can find the details here.

- Settlement Statement (HUD-1): This form outlines all the costs and fees associated with the real estate transaction. It provides a clear breakdown of the financial aspects, including the purchase price, loan fees, and other expenses incurred during the closing process.

- Title Insurance Policy: This document protects the buyer and lender from any potential disputes regarding property ownership. It ensures that the title is clear and free from liens or encumbrances that could affect the buyer's rights to the property.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and asserts that there are no undisclosed liens or claims against it. It serves to reassure the buyer of the seller's legal right to sell the property.

- Deed of Trust or Mortgage: If the property is being financed, a deed of trust or mortgage document is necessary. This document secures the loan by placing a lien on the property, allowing the lender to take possession if the borrower defaults.

- Power of Attorney: In some cases, a seller may not be able to attend the closing in person. A power of attorney allows another individual to act on their behalf, facilitating the signing of the deed and other necessary documents.

Understanding these accompanying documents can help parties involved in a real estate transaction navigate the complexities of property transfer in Maryland. Each document serves a specific purpose and contributes to the overall legal integrity of the transaction.

Key takeaways

Filling out and using the Maryland Deed form is an important step in transferring property ownership. Here are some key takeaways to keep in mind:

- Understand the Types of Deeds: Maryland offers various types of deeds, such as warranty deeds and quitclaim deeds. Each serves a different purpose, so choose the one that best fits your needs.

- Gather Necessary Information: Before filling out the form, collect all relevant details, including the names of the grantor and grantee, property description, and any applicable tax identification numbers.

- Accurate Property Description: Ensure that the property description is precise. This includes the address and any legal descriptions, as inaccuracies can lead to complications in the transfer process.

- Record the Deed: After completing the form, it must be recorded with the local land records office. This step is essential to make the transfer official and protect the rights of the new owner.

Misconceptions

When it comes to the Maryland Deed form, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- All deeds are the same. Many people think that all deed forms are interchangeable. However, different types of deeds serve different purposes, such as warranty deeds and quitclaim deeds.

- Only a lawyer can prepare a deed. While it's helpful to have legal advice, anyone can fill out a deed form as long as they follow the required guidelines.

- A deed must be notarized to be valid. In Maryland, a deed does not need to be notarized to be valid, but having it notarized can help avoid disputes later.

- Once a deed is recorded, it cannot be changed. While it's true that a recorded deed is public, it can be amended or corrected through a new deed if necessary.

- Only property owners can sign a deed. In some cases, a property owner can authorize someone else to sign the deed on their behalf through a power of attorney.

- The deed is the same as the title. A deed transfers ownership, but the title is the legal right to own and use the property. They are related but not the same.

- All deeds need to be filed with the county. While it is common to record a deed with the county, it is not a legal requirement for all types of deeds.

- You can use a handwritten deed. While a handwritten deed may be valid, it is often better to use a standardized form to ensure all necessary information is included.

- Once a deed is signed, the transaction is complete. Signing a deed is just one step. The deed must also be delivered and accepted by the grantee to complete the transfer.

Understanding these misconceptions can help clarify the process of using the Maryland Deed form and ensure a smoother property transaction.